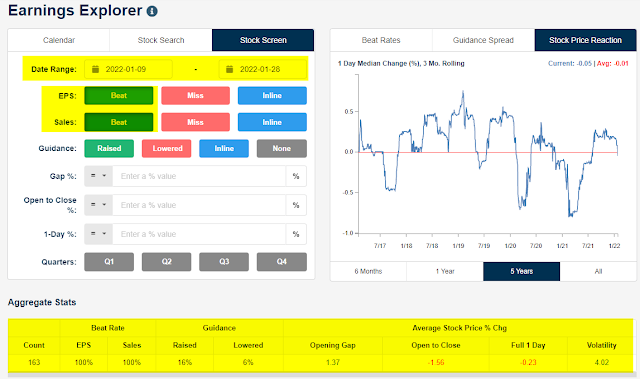

You can tell a lot about the character of a market by the way it reacts to the news. Bespoke reported a downbeat market reaction to earnings and sales beats, which is disappointing, “The 163 companies that have beaten both top and bottom line estimates this earnings season have averaged a one-day decline of 0.23% on their earnings reaction days.”

While this may seem like the dirty little secret of Q4 earnings season, there’s another one that buried that you may not be aware of.

A difficult market

While the tone of the market has been difficult in the past few weeks, negative market reactions to positive surprises aren’t necessarily bearish signals.

FactSet reported that the market is punishing stocks with both positive and negative earnings surprises. At first glance, that sounds bearish. However, the slope of the earnings reaction (dotted red line) is positively sloping, indicating that positive surprises are still being rewarded. Earnings beats are still outperforming earnings misses. It’s the overall market conditions that are challenging.

Mid-cycle expansion challenges

The market’s risk-off tone can be mainly attributed to two factors, fears over a Russia-Ukraine confrontation and a hawkish pivot by the Federal Reserve. The geopolitical risk premium seems to be facing, as measured by a stabilization in the Ruble exchange rate.

So has the relative performance of Russian stocks to the EURO STOXX 50.

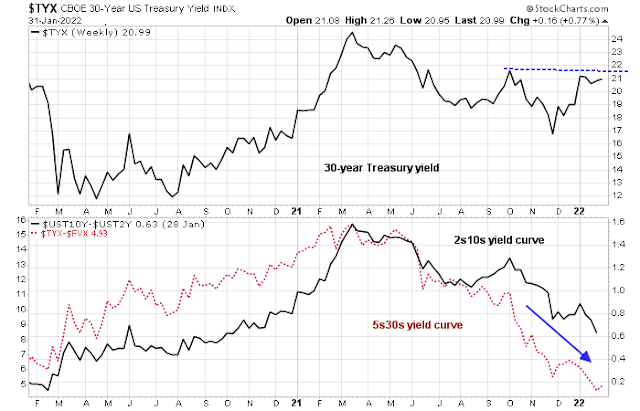

However, the market reacted to the Fed’s hawkish pivot by flattening the 2s10s and 5s30s yield curves, indicating expectations of slower economic growth.

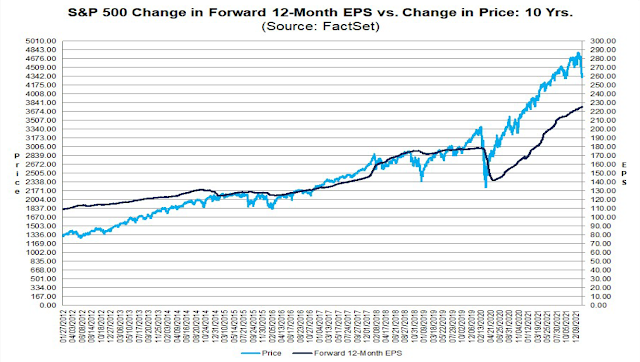

As a consequence, the S&P 500 forward P/E ratio fell…

…even as forward 12-month EPS estimates continued to rise.

P/E ratio compression during a period that the Fed shifts from easy to tight money is a normal characteristic of a mid-cycle expansion. Investors deflate P/E ratios because of the expectation of higher interest rates. In order for stock prices to advance, earnings growth will have to do the heavy lifting to overcome falling P/Es.

So far, the results are not encouraging. While it’s important to consider the earnings beat and miss rate, the magnitude of the beat and miss rates have been subpar. While FactSet reported that the Q4 earnings beat rate is above its 5-year average, the magnitude of the beats is lower.

At this point in time, more companies are beating EPS estimates than average, but they are beating estimates by a smaller margin than average…Overall, 33% of the companies in the S&P 500 have reported actual results for Q4 2021 to date. Of these companies, 77% have reported actual EPS above estimates, which is above the 5-year average of 76%. In aggregate, companies are reporting earnings that are 4.0% above estimates, which is below the 5-year average of 8.6%.

That’s the true dirty little secret of Q4 earnings season. Even though earnings beats are above average, the magnitude of the beats have been subpar.

About one-third of the S&P 500 has reported earnings so far and individual stocks have been the source of significant daily volatility. Earnings season continues and significant FANG+ names such as GOOGL, FB, and AMZN report this week.

Stay tuned and keep an open mind.

Cam, since the geopolitical risk premium seems to be fading, would you suggest putting some money in Russian stocks (RSX of individual stocks)?

RSX is down 1/3rd from its recent peak.

I have no special insight to offer. Your guess is as good as mine.

I have looked at RSX myself. Long term we get a market crash….some day…when that happens RSX goes down like everything else. Short term there is political risk, sabre rattling and what does RSX do?

RSX is at support line which is good, also there is a divergence on RSI (daily) which suggests a bounce is possible, only is the correction done? Looking at the RSX chart, those drops are really sharp, and if you chart RSX:SPY , then you can see RSX has been underperforming the SPY which makes me feel SPY is a better place , with the caveat that oversold means a bounce is possible. SPY, aren’t we all nervous about it?

Also, if you look at charts of XYZ:SPY what I see is that outperformance or underperformance often goes on for years, so it makes sense to me to take long positions on the outperformers, and short or puts (or just avoid )on the underperformers

Yodoc, thanks for your insights.

https://www.marketwatch.com/story/russian-stocks-have-35-upside-when-the-ukraine-crisis-de-escalates-these-2-etfs-give-you-a-way-to-play-11643729093

=> However, the market reacted to the Fed’s hawkish pivot by flattening the 2s10s and 5s30s yield curves, indicating expectations of slower economic growth.

I don’t understand why the Fed officials and the Sell-side analysts are in a race to one-up one-another in terms of rate hikes when the yield curves are flattening.

Forget about 7 rate hikes; we may not even have 3 in 2022 if the economy continues to slow and the inflation moderates in coming months.

This is called jawboning. Fed understands rate hikes and QT will cause a lot of slowdown, even a recession. So by jawboning the markets correct themselves and tighten financial conditions. This would have given some time for Fed. But obviously the path forward is data-dependent.

Gaslighting, or something along those lines. We are given so much information and opinions that we get confused. We are near all time highs even if it does not feel that way because of the recent drop. Prices are crazy unstable, one minute the ES mini is up 10 then it’s down 5 etc etc. We are told over and over prices are way too high etc etc….where’s the euphoria? Is it in the rear view mirror along with a peak and we are in the negotiating phase of fading optimism?

I think they are fooling us, there is no euphoria out there, there is fear. I’m looking for it to go higher, and then hey markets going higher in spite of the Fed doing what it does, and hey Covid is going away and then we get the euphoria of the unstoppable bull. Will this happen? Don’t know.

I remember in 1980/81 when gold spiked and the hunt bros were trying to corner silver, and remember oil in 2007 or so when it went to 147, or more recently when it went negative? Peaks and bottoms are not ambivalent. When oil went negative, or mar 2009 it was like the world would end. Dotcom people were quitting jobs to day trade….ok we had reddit, but this was while in lockdowns and people being paid not to work. It does not feel like a top, but I have to confess my timing sucks.

The Fed is between a rock and a hard place. They at least need to be perceived to be doing something about the inflation because of political imperatives and impending mid-terms. But they also know that a highly leveraged and decelerating economy – still emerging from the virus – cannot bear higher interest rates.

So, I agree. They are trying to jawbone and hoping the market will do the job for them without the Fed raising a finger.

In retrospect, the best play YTD was to have bought last week’s negativity – and hold. It remains to be seen whether the countertrend rally that ensued continues to the point where it’s no longer a countertrend rally.

Despite profiting from the trade, I made several mistakes.

(a) Began averaging in too early.

(b) At the point of maximum despair (which IMO occurred in the overnight futures market prior to market open last Friday) – that would have been the time to aggressively add to positions. That was the one correct move I made – I did in fact add to positions to the point of being 80% long at one point prior to Friday’s reversal – which may seem to have been the ‘right’ thing to do, yet resulted in taking gains quickly due to position size. I reduced near the close on Friday – then ‘re-upped’ on Monday. I didn’t have the guts to post those kinds of percentages (nor do I feel compelled to do so until the after the fact).

(c) On the heels of Friday’s reversal – I sensed the possibility of a multi-day +8% rally. I even posted the possibility as a reminder to myself.

(d) Instead, I ended up cashing out early on Monday based on the assumption that the rally was a short-squeeze – again due to position size.

(e) I had two additional opportunities to reenter – during Monday’s pullback, and then again during this morning’s pullback. I had plenty of time to digest the pros/cons each time, but opted instead to wait for a better pitch – and paid the price both times.

How I would handle the same scenario next time:

(a) Exercise more patience – both in taking on and cutting exposure. Average down in smaller increments and capping exposure prior to reversal. Paring back in increments and maintaining a core position as the market rallies.

(b) Have a little more faith in my take. Sometimes it’s easier to turn off the media and take a walk instead.

I’m probably more emotionally engaged in the markets and in my trades than most – yet in many ways that is often the source of contrarian takes that result in winning trades. We each bring a unique set of personality traits, perspectives and skill sets to the playing field – which is why price movements in aggregate are so unpredictable.

As a trader it is good to be introspective and hopefully learn from our past trades and experiences. I can fully relate to what you are going through. In my case the fear of losing and the volatility of the last month has impaired my trading. I made 6 trades, 4 longs and 2 shorts. I was right on 5 out 6. However, even though I am up for the year, the profits are not substantial for being so right. What did I do wrong? Simple, I did not give any position much room to go against me. I was scared of the volatility. Going forward till the volatility comes down I am going to reduce my trade size and use a trailing stop. The fact is that even if I had lost on more trades I would have come out more profitable if I had left my wining trades more room to run.

Another lesson to be learned.

I am looking for more upside today and tomorrow…UPS and GOOG both popped after earnings, and AMZN reports tomorrow. It’s possible that it underwhelms, but seeing how the first 2 did well, the anticipation of a pop by AMZN should help keep the market afloat.

Besides, all this talk about the Fed is leading us astray.

we are near the low on jan 10 and the high of jan 20 for spx….good s/r line it will grind here but if it breaks through then we can go to 4650 or better

do we get a zbt in the next week? how would the shorts react? time to ponder self fulfilling prophecies. It has gone from .35 to .53 in 3 days, and given all this angst over rate hikes, a lot of traders could be standing on the wrong side. FOMO is a B@@@@ and I am imagining what those who bailed in the last month would be going through if it pops to new highs

we are also at the 61.8 retrace to the high, if we get to 4670 ish then we are past that 78.6 or whatever fib retrace

The market has transitioned from vastly oversold to strongly overbought in two days.

Opinions are all over the map. Ultimately, we make decisions based on our own judgments.

There are no trades for me here. Currently green ytd and after a volatile January I’m starting with a clean slate.

Back in the Nineties Fidelity launched a series of radio ads which quoted Peter Lynch making the distinction between gambling and investing. I disagreed with that distinction. Both pursuits are based on probabilities and it’s impossible to make a clear distinction. Lynch invested OPM (other people’s money) via the Fidelity Magellan fund by making bets on companies – and pocketed fees whether he was right or wrong.

Right now I’m considering the possibility that we retest last week’s lows. But also the possibility that we revisit former highs before we retest the lows. I’m also cognizant that all bear markets begin with the kind of volatility seen in January.

We use indicators and risk management to navigate the markets as best we can. My best guess is that reverse to the downside, but that was also my best guess on Monday morning and all day Tuesday. The market will do whatever it wants, and I’m the one who needs to adjust my expectations.