As the stock market looks forward to another exciting week of volatility, the technical damage suffered by the market is quite severe. Nevertheless, investors need to take a deep breath and ask, “What’s the market pricing in?”

The three major factors I consider in my analysis are:

- Earnings and valuation;

- Fed policy; and

- Geopolitical risk.

A valuation reset?

As we proceed through Q4 earnings season, the market hasn’t mostly reacted well to earnings announcements, headlined by the -20% air pocket suffered by Netflix. Nevertheless, the macro summary from The Transcript, which monitors earnings calls, is relatively benign.

Omicron continues to sweep through the US and it’s causing some disruptions, but consumer spending continues to be strong. Inflation is also strong and inflation expectations are rising. The Fed is expected to raise rates four times this year and that is spooking investors.

Forward earnings estimates have been steadily rising across all market cap bands.

As stock prices pulled back, stock prices are undergoing a valuation reset. While all eyes have been on the large-cap S&P 500, the valuation reset has been evident in mid and small-cap stocks,

I can make two observations from this analysis. Valuation resets are a feature and not a bug of mid-cycle expansions (see

How small caps are foreshadowing the 2022 market). As well, the forward P/E for the S&P 400 and S&P 600 are arguably quite attractive relative to their own history.

Goldman Sachs studied the history of S&P 500 forward P/E ratio around the time of the first Fed rate hike. It found that forward P/E is typically flat ahead of the first rate hike and then falls afterwards. Equity price gains are dependent on the evolution of forward EPS estimates, which have been rising so far.

While major earnings misses like the one suffered by Netflix have received the headlines, FactSet reported that the 5-year average EPS beat rate is 76% and the average sales beat rate is 68%. As more companies report in the coming weeks, the market will react on a daily basis to reports and there should be more better reactions than the Netflix debacle.

In light of the recent market weakness, earnings expectations may have become too low/

How hawkish will the Fed be?

A potential major market event will be the FOMC meeting on Wednesday. While no interest rate changes are expected, both the FOMC statement and Powell’s subsequent press conference remarks will be closely scrutinized to the direction of Fed policy. (The Bank of Canada will also announce its interest rate decision Wednesday and it is expected to chart a more hawkish course by raising rates, but that won’t be the same global market-moving implications as the Fed announcement.)

Recent Fedspeak has made it clear that there are no doves left on the FOMC. How hawkish will the Fed be?

Market expectations for the rate hike path is already very hawkish. Fed Funds futures are discounting five rate hikes this year, with liftoff in March.

Bloomberg recently conducted a survey of economists and here’s what they said. While no rate announcement is expected at the January meeting, most expect a signal of a rate hike. Respondents were split between the language of whether the Fed would explicitly signal a March rate hike or a rate hike “soon”.

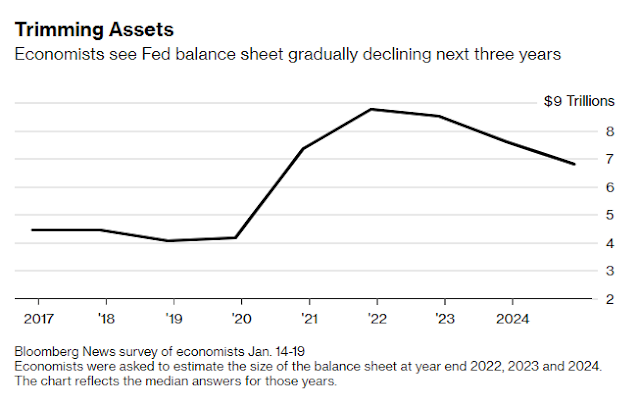

As for the Fed’s balance sheet, survey respondents expect quantitative tightening to begin in the April to June period.

Economists expect the runoff of maturing securities to commence this year, with 29% looking for a start from April to June and 40% expecting July to September. The median economist estimate looked for monthly reductions between $40 billion and $59.9 billion. The runoff would bring the size of the balance sheet down to $8.5 trillion at the end of this year and $7.6 trillion at the end of 2023, still far above pre-pandemic levels.

In short, market expectations are already very hawkish. While the Fed is set on a course of tightening monetary policy, it may have to exceed hawkish expectations to spark a further risk-off episode. Morgan Stanley recently highlighted analysis which showed 10 year real yields are up by over 50 bps in the last three weeks, while 10-year breakevens are down by more than 25 bps. This is an event that has only happened before at or near major market bottoms, in October 2008, March 2009, June 2013, and March 2020.

The drumbeats of war?

The headlines from Ukraine are alarming. The White House warned that an invasion could happen at any time, but there will be dire consequences for Russia if it undertakes military action. The US ordered the evacuation of families of embassy staff from the Kyiv mission. The UK has also withdrawn some embassy staff. Germany will help embassy staff family leave Ukraine.

British intelligence accused the Russians of hatching a plot to install Ukrainian parliamentarian Yevgeniy Murayev to be the leader of a Russian-friendly government in Kyiv. Russia has accused Ukraine of building up forces on the border of Donbas, a separtist region, and called the threat of a Ukrainian invasion very high. The US is considering sending troops to eastern Europe and various other NATO members are mobiling and sending military assets to the region.

Even as the drumbeats of war sound, the tail-risk of an immediate invasion may be receding. While the Blinken-Lavrov meeting in Geneva broke up last Friday with no breakthrough, both sides agreed to continue a dialogue next week and there is the possibility of a direct Biden-Putin meeting in February. As well, the back channels are active on all fronts.

Reuters reported that political advisers from Russia, Ukraine, France, and Germany will hold talks on Ukraine in Paris on January 25. If they’re talking, there will be no invasion, at least for now.

Moreover, a

Bloomberg article speculated that the Beijing Olympics may restrain Putin’s maneuvering room in an invasion.

As the U.S. and Europe mount increasingly frantic efforts to deter Russia from any invasion of Ukraine, it’s Chinese President Xi Jinping who may have the biggest influence on Vladimir Putin’s timetable.

The Russian president has said he will join Xi at the opening ceremony Feb. 4 of the Beijing Winter Olympics, where the Chinese leader has lavished billions of dollars to showcase his nation’s superpower status to the world.

The last thing Xi needs is for Putin to overshadow China’s big moment by triggering a global security crisis with the U.S. and Europe. That’s especially the case given Xi is looking to bolster his prestige at home as he seeks endorsement for an unprecedented third term later this year.

Xi called Putin an “old friend” when they chatted in mid December, while the Russian leader hailed what he said was a “responsible joint approach to solving urgent global issues.”

But kicking off an invasion of Ukraine in the middle of Xi’s Olympic moment would throw a wrench into such warmth, and risk drawing China into the diplomatic fray. It’s possible Xi asked Putin in their recent call not to invade Ukraine during the Games, according to one diplomat in Beijing who asked not to be identified talking about such scenarios. Putin has repeatedly denied he currently intends to attack Ukraine.

While an immediate invasion is always possible, the more likely time frame is mid or late February. The closing date of the Beijing games is February 20.

Putin and China have been here before. Russia’s 2008 war with Georgia erupted on the day of the opening ceremony of the Beijing Summer Olympics, to the chagrin of Chinese leaders, prompting Putin to fly home to direct military operations.

Days after Putin hosted the closing ceremony of the 2014 Winter Olympics in Sochi, on which he’d spent a record $50 billion to stage the Games, Russian forces began their operation to annex Crimea from Ukraine.

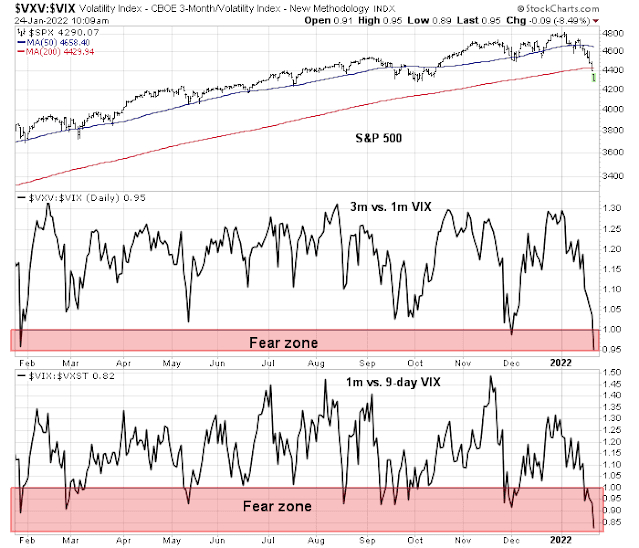

During moment of crisis, even developments that appear to kick the can down the road, such as a Biden-Putin meeting in February or the staging of an Olympic games that delay the onset of conflict, can spark a risk-on episode. Today’s market action where everything is falling except for safe haven assets has the hallmark of a panic liquidation event. The term structure of the VIX has fully inverted, which is another indication of high anxiety.

In conclusion, the balance of short-term risks is tilted to the upside. Expectations have been ratcheted down too much and the chances of positive surprises from earnings season, Fed policy, and Ukrainian developments appear to be higher than what’s in the price. Being bearish here amounts to betting on outcomes of catastrophic proportions. While that’s not impossible, the odds of rip your face off rally in light of the market’s severely oversold condition are high.

However, intermediate-term challenges remain. Technical conditions are deteriorating and the macro backdrop of a mid-cycle expansion will be headwinds for risk assets. I continue to expect stock prices to chart a choppy to down course for the first half of 2022. The recent lows set by the S&P 500 may not be the ultimate low of the latest downdraft.

Disclosure: Long SPXL

As a trader I have the luxury of either being long, short or flat. I am flat. Looking for a rally to short again.

Of some interest is that all metals are breaking out:

SLV, GLD, PALL and PPLT. If people were looking for Bitcoin to be a refuge and a store of value, it shore did not make it. A 50% haircut from the highs does hurt. Maybe, that is the reason metals are attractive now as an alternate asset class.

One thing I have heard about currencies is the importance of confidence. The crypto guys have faith in it, but when confidence is lost you get a run on the currency. So far it seems bitcoin is just following the market, it makes me wonder though what kind of move would happen if confidence in cryptos were to be lost.

dipped my toe in longs down here.

my toe was temporarily severed below 4250 but was shortly reattached.

LOL

But I find it interesting how they talk about a rate hike, oh maybe all the way to 1.25%. We aren’t talking 10%, go a few years back and 1% would be cheap, so I have a hard time buying the narrative. I know it’s all relative and there is debt to consider

As an investor reading Cam’s insights, I took his advice and trimmed in Dec. that turned out to be pretty good advice. 🙂

Now that we are in correction territory, I’m thinking of what has been hit the most. Growth looks attractive. I don’t think inflation sticks around and like yodoc2003 I believe interest rate hikes to 1.25% are not a “run for the hills” moment. Reminds me of Cam’s advice in 2015 to relax and have a glass of wine (this evening of course!).

I think that for the zombie companies refinancing at higher rates will hurt them, but! first of all if they are truly zombies why would people lend to them in the first place? So if the rates are higher, what really matters is if those lenders are still willing to lend for a refi. But this is not something that will happen tomorrow.

In 2008 there was the GFC and there was fear that things would totally freeze….I’m not sure how bad that would really be tbh, after all the world does not end every weekend and the markets are closed ie frozen…and ofc they scared the cr@p out of us….covid and lockdowns were unprecedented so again massive panic as we hoarded toilet paper and worried what tomorrow would bring.

This is something that has been telegraphed really a lot…is the market taken by surprise? Yeah, I think we have some serious tree shaking going on….qui bono? why would they shake the tree if they thought this was the end? So maybe this is the dip I should have bought…well I bought a few cheapo uvxy puts and wrote a put on ccj…

Good volume is often a sign of a washout so I have fingers crossed

A thought on CCJ, the uranium story is good. Kazakhstan news, the Russian influence makes CCJ look safer. The eurozone will at some point finally say uranium and NG are compatible with interim green…so then funds can invest in URA or CCJ if their mandates had prevented them. I just wonder how much geopolitical risk is seen for Kazatomprom compared to Cameco? Even if the Fed hikes rates, they aren’t turning off the electricity…if that happens sell your bitcoins now!

Reposting here for continuity. Didn’t realize Cam had added a new post in the interim.

rxchen2 says:

January 24, 2022 at 10:56 am

Really brutal, but to the point where I’m embracing the selloff as the pause that refreshes.

SPY 420? I’m able to sound calm and collected about that number right now, but to be honest I’m not sure how I would have handled that in real time. My wife and I were in the midst of our annual exams when that number hit – and it may head even lower before the close.

I have one position in the green – IWM.

I’m long down here, but skeptical of how well it will pay out.

well… it paid out. The ramp took me completely surprised.

potential H&S bottom on the 5 minute chart…neckline around 4330 which would target 4460, which would be awesome were it to happen

neckline is broken…looks like we get a nice hammer…fingers crossed ofc….the good volume bodes well….those sharp bottoms have high vols…crazy

Indexes are now likely to gap and run on Tuesday – making it difficult to board or reboard.

It’s unlikely that we revisit SPY 420 anytime soon. Just my opinion. We’re more likely to see SPY 500 first.

A +1200-point reversal in the DJIA? That’s as bullish as it gets.

Maybe not the final bottom in this current correction, but sure felt like one

No one that I follow foresaw 4222. The average call was for 4300 or 4400 – there may have been one call for 4250.

Nor did anyone foresee a green close. (I was about to make that call at one point ~2 pm pst – but the markets quickly reversed and I canceled the post. It only counts if I follow through with the post.)

According to Marketwatch:

‘It’s a Wall Street comeback for the history books, one that would make the National Football League’s Tampa Bay Buccaneers signal caller Tom Brady green with envy.

‘The Nasdaq Composite Index COMP, +0.63% just finished in positive territory, up 0.6% in a whipsaw session, after being down by as much as 4.9% at Monday’s nadir, with that turnaround marking the largest comeback to end in positive territory since Oct. 10, 2008, according to Dow Jones Market Data.

‘And the S&P 500 index SPX, +0.28%, which was down 3.99% on Monday, finished up 0.3%, to mark the sharpest snapback after being down to end positive since Oct. 23, 2008.’

Retest of today’s lows? That would be painful.

I had a plan as outlined in yesterday’s post. But didn’t have the guts to pull the trigger to go long around 4280. So much for plans.

I did buy puts for VIX to revert to below 28. Defined risk/reward.

Morgan Stanley is out with a note today expecting a 10% correction in next 3-4 weeks! Reinforcing skittishness. JPMORGAN said today that sell off was overdone.

I was completely wrong about a gap and run open.

Not much else to say. I remain ahead of the SPX ytd by a few percentage points, but so what? Still down for the year.

If there’s one positive, it’s the fact that almost everyone is expecting a continuation of the decline. That may in fact be an accurate take, but from a contrarian point of view it’s reassuring.

Deja vu. I remember these numbers so clearly from watching Monday’s action.

Deja vu all over again? The volume seems lower so far. Usually when you have those horrific waterfall drops the vols keep rising. Of course they could ramp up in a few minutes…it will all be obvious after the fact, just like bubbles. Speaking of bubbles, what defines a bubble? Maybe it is when it pops. Think of BTC, when it went from 5 cents to say 20 bucks, if it imploded then, people would have said 5 cents to 20 bucks is 40,000%, it was a bubble. Only it didn’t pop, so the rise to 20 bucks was not a bubble. Disclosure, I am seriously crypto skeptic, so even if BTC goes to a million I think at some point it will pop and be labelled a bubble, only not yet. This applies to the market also I think. What if the market is right? Central banks will print until it no longer works and the S&P will just keep going up, in which case this will not be called a bubble, but we are getting less able to live off our savings. Running a pension fund must be a nightmare if one has a conscience.

This is a market guaranteed to wear you down if you’re watching every tick.

Are we making a cup and handle? with a target around 4600?

Adam and Eve bottom on the 15 minute chart?

Human nature. Do public figures like being blamed? So if they come out hard on rates tomorrow what will happen? They will equivocate is my guess and then perhaps we get a rally based on “the market was expecting more hawkish” We find out tomorrow

I’m treating the minor positive reaction to news after hours as a selling opp.

I’m out.

One thing that stood out for me personally today was the emotional toll that fighting a bear market is taking. At this stage in my life (or any stage for that matter), I don’t need it.

Now the markets are ready to rally on Wednesday 🙂

Here it is! The rally 🙂

On a more serious note. My wife and I discussed the markets over dinner last night – basically wondering why we’re invested at all in a bear market. But the real takeaways from the conversation:

(a) Why are we (I should say why am I) still trading? Good question. Continuing to play when one has already won the (lifetime) game really isn’t that smart – it adds unnecessary risk.

(b) Do I enjoy trading? Up to a point, yes. But the fact that the past two weeks have taken an emotional toll tells me I’ve exceeded that point.

(c) What needs to change? We’re tilted strongly toward capital preservation right now. Partly due to age, and partly due to having achieved critical mass. For over thirty years I’ve scaled into positions based on percentages. 6% -> 12% ->24% ->48% ->60% or more of the portfolio. That no longer works.

(d) We settled on two changes. In a bull market, we’ll invest no more than 50% of the portfolio in stocks. In a bear market, no more than 20%. (We also maintain substantial cash accounts for emergencies that in the Bay Area would include catastrophic earthquakes or the possibility that one of our kids loses their job or needs help.) And of course, the plan is to keep buying I Bonds over the remainder of our lives.

(e) I need to update my position sizing percentages – at a minimum, cut the numbers in half. 6% isn’t what it used to be. To keep emotions on an even keel, starting at 2% or 3% makes more sense.

So the rally has arrived! But hey – with new rules about limiting exposure to 20% in a bear and position sizing – it’s just another countertrend rally to manage. Personally, I plan to avoid the FOMC run-up and post-announcement whipsaws. It’s probably even advisable to take some time off to reflect on the entire idea of trading.

You have raised many philosophical questions and each person has to find their own sweet spot. As a personal background I have been trading since before 1987 and have gone through a lot. I have battle wounds to show for it. Like you, I don’t need to trade but I enjoy trading. Some people like to play golf, I like to trade. Fortunately, I am good at what I do. I make money just about every month but definitely every year. But I have learnt to respect risk. Therefore, my capital allocated to trading is a function of what will not adversely affect my life style. I trade on average 15,000 to 35,000 shares in very liquid markets. The size does not affect my emotional equilibrium, Anything bigger and I would not make sound decisions. I won’t sleep well at night.

In my earlier notes I had mentioned the importance of trade size and Maximum Adverse Excursion. Here is the link:

https://therobusttrader.com/maximum-adverse-excursion/

Most people don’t understand risk and its many permutations. E.g. in order to trade you need money. However, all trades are not going to be profitable. Therefore, if one has three trades going against them, they should not be so large that they get thrown out of the game for monetary or emotional reasons. Hence, using stops (not mental stops but paper stops) is advisable. Also, the size of the trade should factor in the extreme unknown -crash of 1987, LTCM or markets going against them for 8 to 10 days up or down. In these case most traders including me have sold or bought at the bottom or top.

Finally, in my case I have learnt the hard way not to try to call tops and bottoms. It does give psychological satisfaction but in the realm of things it is just one trade in many. Here is a clip you might enjoy by Bruce Lee:

https://www.youtube.com/watch?v=cJMwBwFj5nQ

i.e.trade with the trend -don’t fight it.

The legendary Bruce Lee.

I’ve always believed that it’s better to succeed as a celebrity/ be recognized after age forty when we’ve suffered enough to have the right perspective. Early success just seems to ruin so many talented people.

Yes, I’ve had periods where dancing to the rhythm of the markets seemed effortless. But I always know they’re going to end. Trading is in many ways the ultimate challenge – no one masters the art, they simply manage the wins/losses as they come.

Adding an addendum.

It’s unlikely that we achieved critical mass due to any trading acumen on my part. There is a great deal of luck involved when investing and/or trading. And we were fortunate to have participated in the 1982-2000 bull, the 2003-2007 bull, the 2009-2020 bull, and the post-pandemic bull. We somehow managed to skirt a great deal of the intervening bears. If there is a secret to success in trading, it comes down to staying invested in bull markets and staying away from bear markets. If we pay close attention, it’s usually not that hard to spot a bear market in the early stages.

I believe in market timing. I’ve seen too many people hit with ‘sequence risk’ when retiring to have any faith in buy-and-hold.

Depends on what you mean by buy and hold. But I think that if you buy something that is out of favor, but is long term important that holding can pay off, so long as if there has been a really good gain, take some off the table. Recent examples are uranium, oil, silver (back around 2016). If an asset class is down 80% and is necessary for our economies, at some point it goes up, it has to. Yeah there are some stocks that go crazy like NVDA or AMD but this is outside of my knowledge base.

We have been in a secular bull since 1982 in my opinion and this has totally altered our perceptions of things. Wait till we get a spell like 1966 to 1982, or 1929 to 1950, things will be different.

It is addictive, like gambling, but we believe we can get an edge. The house almost always wins, but it is like poker where some players win, some lose even though the house takes it’s cut.

WE live in uncertain times. There is no way to know how expensive life will get, so I view trading as a skill that might provide income in the future. But trade only a small position. It’s also a mental exercise maybe it’s good for us.

Personally I have been mostly in cash, waiting for the bear since literally forever. In march 2020 I stayed frozen in my position. Not like one could anticipate the spraying of money courtesy of central banks….will there be repeats?

I am still waiting for the bear, hoping to get in at good prices on stocks like XOM or Chevron, silver, reload on uranium (provided I am smart enough to get out this year on a high). We need oil, electronics, silver, copper etc

The hype about the FOMC is just there to mess with our heads. If they could keep us off balance on a daily basis they would.

I trade small which means not much emotion which helps, and maybe I have just been lucky, but with small size you don’t think about life altering home runs and so you take a profit and move on to something else.

Who knows? If they decide to totally trash the dollar to support pensions, federal deficits, state budgets etc etc then stocks may keep being inflated even though there will be times where they pretend to want fiscal responsibility. One reason to own a home and have a 30 year fixed mortgage if you still have one, it’s an inflation hedge. Home prices might decline if rates go up, but rental costs would go up, your 30 year fixed won’t.

Anyways, I am thinking we aren’t ready for the UZA where Z is Zimbabwes, so for now I have mostly cash.

More tree shaking to come until this afternoon

Exactly the kind of whipsaw I wanted to avoid.