Stock markets were recently sideswiped by the dual threat of a new Omicron strain of COVID-19 and Jerome Powell’s hawkish pivot. Global markets adopted a risk-on tone and the S&P 500 pulled back to test its 50-day moving average.

This week, I assess the damage that these developments have done to the investment climate from several perspectives:

- Fundamental and macro;

- Omicron and Federal Reserve monetary policy; and

- Technical analysis.

Fundamental momentum still positive

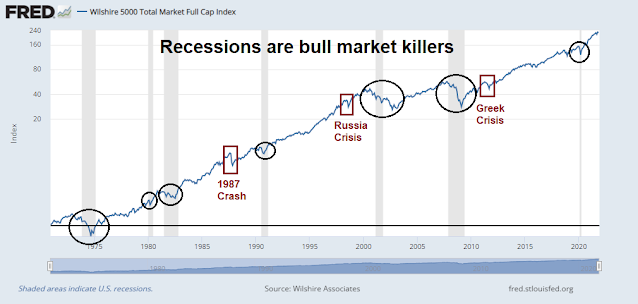

Let’s start with the good news. Recessions are bull market killers and there is no recession in sight. New Deal democrat maintains a dashboard of coincident, short-leading, and long-leading indicators. His

latest update concluded that the “underlying indicators for the economy in all timeframes remain generally positive”.

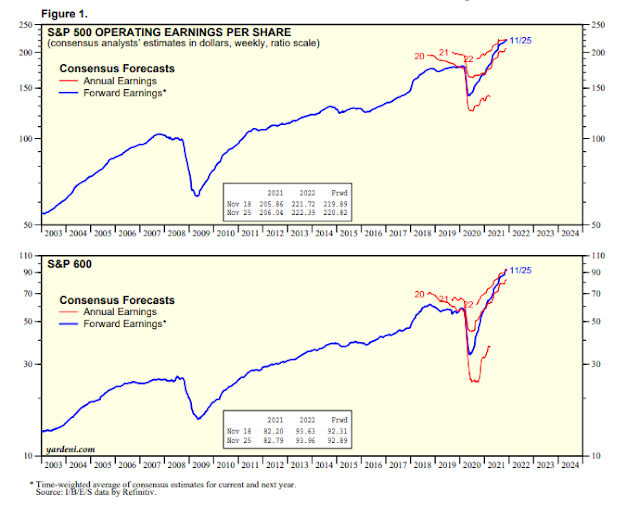

Fundamental momentum is still strong. Forward 12-month EPS estimates for both large and small-cap stocks are still rising.

CEO confidence is on fire. So is the employment and capital spending outlook.

Omicron and the Fed

There is much we don’t know about the Omicron variant of the virus. Some very preliminary data indicate that it is spreading more quickly than previous variants. The data from South Africa’s Gauteng province, which includes Johannesburg, indicates that Omicron related caseloads are rising faster than Delta. Early anecdotal evidence also suggests that infections are mild as hospitalization rates are similar or lower than other waves. On the other hand, early reports indicate that the current generation of vaccines are not as protective against Omicron infection, though they are still effective against serious illness.

There are two ways of interpreting this preliminary data. A benign scenario of a fast spreading but less deadly virus is equity bullish. Lockdowns measures would be minimal and there would be few supply chain disruptions. As well, a lower mortality wave would have the additional benefit of endowing the infected with some natural immunity. Such an outcome would be bullish for the cyclical and value stocks and beneficial to high-beta small-caps.

The cautious view came from the Fed’s Jerome Powell, whose

testimony to Congress was initially interpreted by the markets as dovish but turned out to be hawkish [emphasis added]:

The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.

Here is the reasoning behind’s Powell’s phrase, “time to retire the word transitory”. The Fed recently rolled out its Flexible Average Inflation Targeting framework (FAIT) as a way of addressing criticism that it was chronically undershooting its inflation target. FAIT also served as a way of allowing the Fed to pay more attention to its full employment mandate.

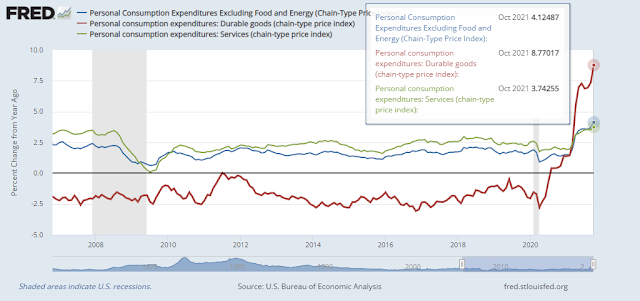

The Fed’s response to the pandemic was a test of FAIT. The downturn in 2020 was highly unusual inasmuch as demand for goods rose while demand for services fell. At the same time, the global economy shut down in response to the pandemic and sparked a supply shock in goods production. As a consequence, durable goods PCE shot up while services PCE was relatively tame. Over time, supply chain bottlenecks should ease and inflation should fall, which was the reasoning behind the “transitory” narrative.

The emergence of Omicron poses “increased uncertainty for inflation”. Further COVID-19 disruptions to the supply chain mean that the inflation spike is more enduring and less transitory. In effect, the Fed risks being caught behind the inflation-fighting curve by allowing inflation expectations to rise and become unanchored. In other words, the Fed’s nightmare scenario is stagflation caused by slow growth from COVID-19 induced bottlenecks and rising inflation expectations.

Stalling price momentum

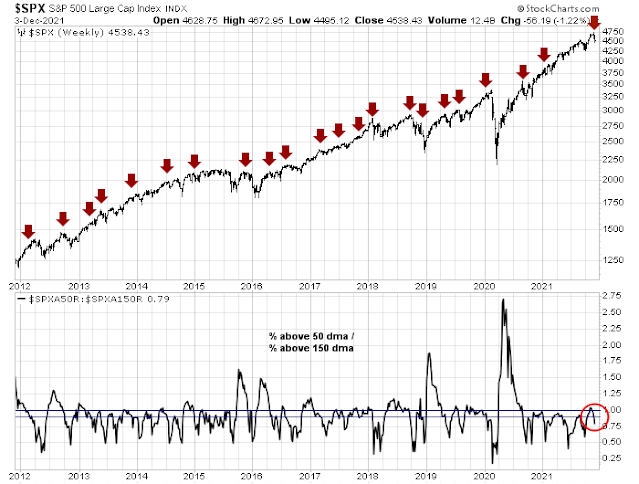

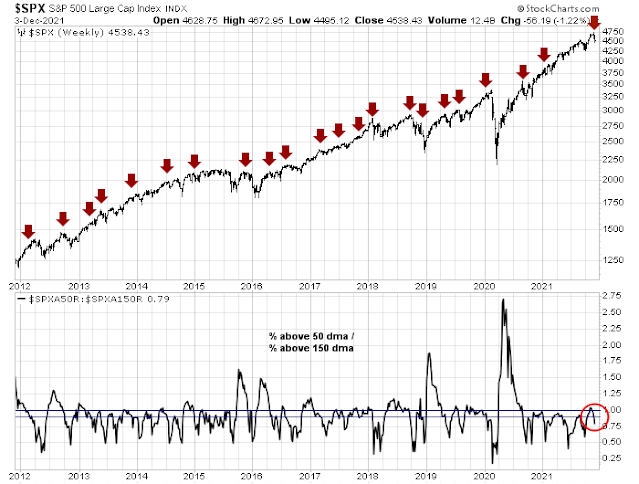

Even though fundamental momentum remains positive, the combination of the Omicron news and the Fed’s hawkish pivot has turned price momentum negative. The S&P 500 had been held up during most of 2021 by the presence of positive price momentum, but momentum has turned. My momentum indicator, defined as the percentage of S&P 500 stocks above their 50 dma to percentage above 150 dma, rose above 1 and recycled below 0.9. Historically, this has been an intermediate-term cautionary signal to de-risk equity portfolios.

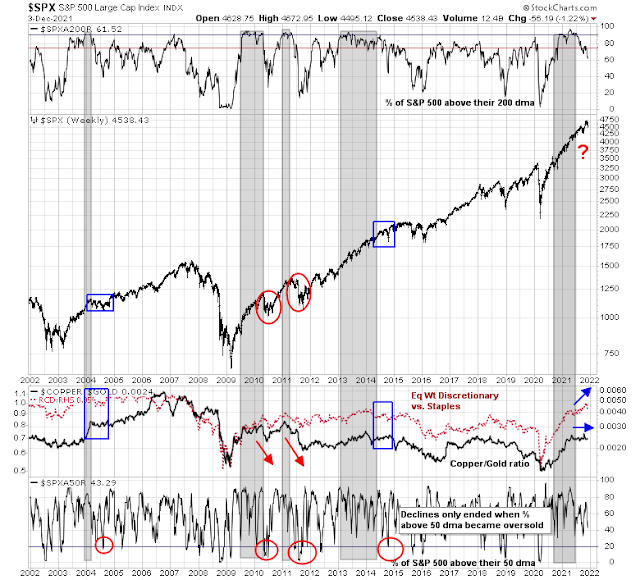

A longer time horizon price momentum model focuses on the percentage of stocks above their 200 dma. In the last 20 years, there has only been five episodes when this indicator reached 90% and stayed there, indicating a “good overbought” market advance (grey shaded periods). This indicator has also stalled and recycled downwards. Even though macro indicators, such as the copper/gold ratio and the equal-weighted consumer discretionary/staples ratios, appear benign, past stalls have not ended until the percentage of stocks above their 50 dma has reached the oversold levels of 20.

Investment implications

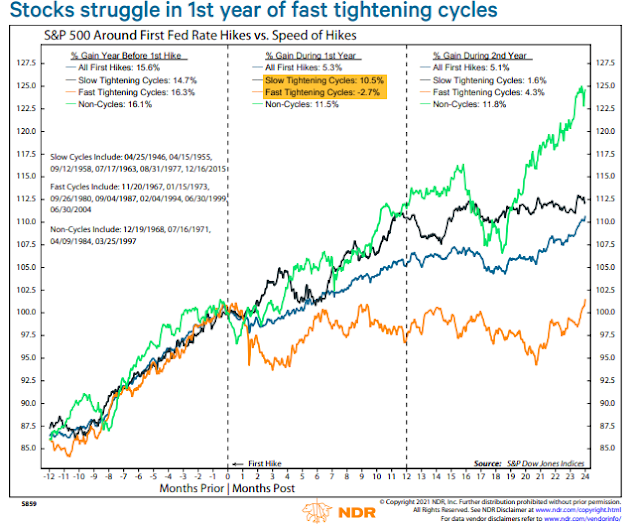

What does this mean for the stock market? The intermediate-term outlook depends on the path of the Omicron wave and the Fed’s reaction function. Ned Davis Research found that stock prices especially struggle if the Fed undergoes a fast tightening cycle.

What will the Fed do? Powell testified the FOMC will consider speeding up the taper of its QE program at the December meeting, but nothing is set in stone. Expect the Fed to pivot to the narrative that “tapering does not mean rate hike”. The Fed will remain data-dependent and its reaction function will depend on progress towards economic recovery and the wildcard posed by the Omicron variant.

It is appropriate, I think, for us to discuss at our next meeting, which is in a couple of weeks, whether it will be appropriate to wrap up our purchases a few months earlier. In those two weeks we are going to get more data and learn more about the new variant.

Investor reaction function will also be dependent on time horizon. I have been calling for a sloppy range-bound market in H1 2022 (see How small caps are foreshadowing the 2022 market and Time for a mid-cycle swoon?). The latest risk-off episode is probably just a shot off the bow of equity investors.

Under these conditions, investment-oriented accounts should practice some scenario planning and risk mitigation. In the coming months, gradually de-risk portfolios by reducing equity risk and raising fixed-income allocations. My Trend Asset Allocation Model remains at a risk-on signal. The model is based on trend following principles and it will not buy in at the bottom and sell at the top. While I am not inclined to front-run model readings, I expect the Trend Model signal will be downgraded from risk-on to neutral in the next few weeks.

I would favor a barbell portfolio of FANG+ growth and small-cap value stocks as a way of risk mitigation and scenario analysis. If the Fed’s stagflation fears were to materialize, high-quality FANG+ stocks will outperform in a growth-scarce world. Make sure to focus on quality growth names with strong cash flows and competitive positions. Speculative growth stocks, such as meme stocks and unprofitable but promising growth companies such as the ones held by ARKK, are underperforming.

On the other hand, if the benign scenario of the Omicron wave is correct, high-beta and cyclically sensitive small-cap value stocks would have the greatest leverage to a recovery.

Positioning for short-term traders is a different matter. The market is wildly oversold and there are numerous short-term studies that call for a relief rally. Instead of de-risking, traders should be buying the dip.

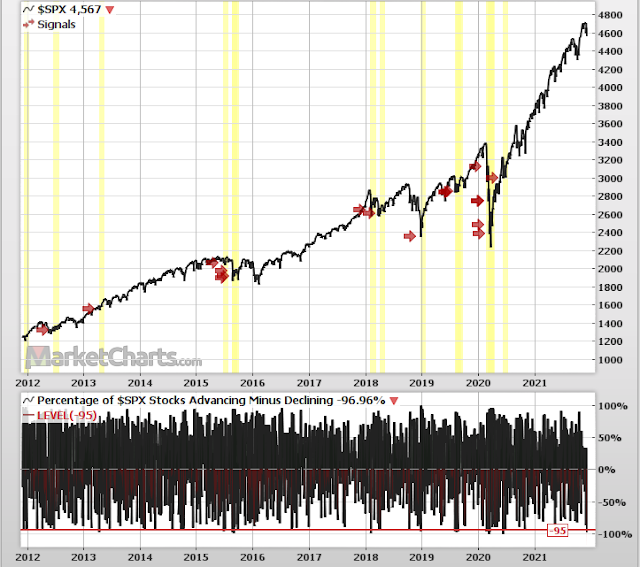

As one of many examples, 95% of S&P 500 stocks closed down on November 30, 2021. There were 19 similar episodes in the last 10 years and the S&P 500 was higher within 20 trading days every time.

In conclusion, I have been calling for a transition from an early cycle market to a mid-cycle market marked by more choppiness. The recent air pocket encountered by global stock markets may just be the prelude to such a scenario. Investment-oriented accounts should gradually de-risk portfolios by reducing equity weights and adding fixed income positions. Focus on a barbell portfolio of FANG+ growth and small-cap value stocks as a way of risk mitigation.

Traders, on the other hand, are faced with a market that is extremely oversold. The short-term risk/reward is tilted to the upside. Buy the dip in anticipation of gains over the next few weeks.

https://www.yahoo.com/news/americans-seem-to-have-become-numb-to-delta-omicron-is-coming-but-older-variant-is-still-driving-infections-203546167.html

Interesting?

Did we have a near global shut down circa April 2021 when Delta started to become the dominant strain?

So, in a few months, Omicron may be in the rear view window and a new virus may take over. Would we get another shut down?

The pendulum never stays in the middle. Last year, we had a lasizze faire attitude and now politicians want to be seen to be doing something.

The real solution is immediate, global vaccinations funded by G7 nations. Heard anything on this front? Any politician front running this idea?

Powell seems to like causing the market to wildly overreact. Eg. End 2018 and April 2020. An overreaction seems possible here particularly with crypto crashing over the weekend. There is every reason to go to cash in investment accounts because as you say intermediate outlook is not favourable. Adds up to lots of sellers no convicted buyers. Plus lots of new retail no doubt being liquidated.

Confirmation bias, says humans construct ideas that confirm what they want to happen. With Omicron, we want it to be mild and solvable. I’m there too. But there are very nasty things happening around it. Cases in the key region in South Africa recently doubled from 2000 to 4000 in 24 hours. That wasn’t 20 to 40. That could mean it is wildly more transmissible. They say it is breaking through previous vaccinated people at three times the Delta rate. Not good. They say 10% of cases are children. That is new and nasty. The disease from it is milder they find but the average age of the South African population is very young and that could account be why. So older folks could have severe outcomes when it gets to developed countries with older populations. There are also a huge number of new variations on the virus itself which may cause any number of new outcomes.

This is super early days. On a daily basis we could see it spread exponentially or not. In a worst case, the markets might crash further than 2020. This time round, the gridlock in Washington will not see helicopter money sent out to people and interest rates are near zero.

In situations where there are many unknowns and judgement is impossible, and risks are high, I think it important to use objective methods to minimize risk and maximize profits. I use moving average lines to exit and reenter unemotionally. If you are anxious to get in close to a dip low, use a 10 day or even a 5 day moving average. But commit yourself to selling if it goes back below the line. Longer term players can use 20 day or 50 day. For core portfolio holdings, I would use the 200 day. That means you would be out of equities entirely if the pandemic went out of control.

When you get out on a moving average violation and later back in, you lose one or two percent or so. Not bad for insurance against a big decline. Later, you get in and profit handsomely when others are frozen in fear.

In Israel and the UK there is evidence of beneficial effects of increased dosing intervals. Especially in Israel, where in the summer of 2021 the majority of hospitalizations were due to delta, so they gave boosters to around 3 million people and after 2 weeks post booster the reduction of hospitalization in those with a booster was around 95%. So boosters seem to work well for delta.

Powell is playing a game to look good….they know that shite will happen at some point. Running huge trade deficits just doesn’t create wealth, I mean, if I buy way more from you than you buy from me, who will end up poorer? Being able to print money delays the final reckoning. So if they keep with easing and low rates they get in trouble because the critics are getting noisier and if shite happens, it’s their fault, so they play this game of tapering and rate hikes. What is the chance of a balanced budget? The treasury will want trillions in 2022 and who will buy those bonds? They could mandate that 60% of IRAs are in treasury bonds, but to do that they will need a good crisis, umm maybe in 5 to 10 years. This is a redo of 2017 or whenever it was with Yellen. In the meanwhile this makes for shakes in the market. Mind you, a shake could unleash a tsunami of unwinding.

Rates, some 20% of the S&P are zombies, how will they refi at higher rates? How many of their bonds will fall into junk? Mortgage rates are low, but then the Fed is buying MBS, doing CDOs is so 2006 when you don’t even have to slice, dice and repackage because the Fed just takes them. How much is that worth? Who wants to hold those mortgages, on properties in a bubble? I haven’t seen that the Fed was unable to buy MBS because of lack of supply, somebody else buying them all. It makes no sense to me that if you remove a buyer of 35 billion a month that prices of MBS won’t go down and hence rates go up for mortgages.

Supply chains get fixed.

Demographics…look at Europe and Japan….we won’t get inflation because of Covid, but at some point rising energy costs will get us, because everything we do has energy at the core

What is the success rate for market timers? And what about taxes one has to pay?

Anything is possible in the markets.

I remember one newsletter writer – who had recommended moving to 100% cash in 1995 and resolutely stayed with that call – briefly topping the rankings at the depth of the 2009 Crash.

One guy I follow who waited patiently for Alibaba to drop from 300+ to 150 – and then began buying – is now -25% underwater on the trade. Others made actionable calls on any number of names/sectors last week, only to stop out.

Can we see SPX 4000 next week? Sure. In the highly emotional/ news-based market we have right now, the SPX could just as easily rally to 4700 next week.

None of this week’s action was predictable. I misjudged and/or badly timed market action and was thrown off several times for losses.

I have no idea what will happen on Monday, but I prefer to pivot from a position in cash.

Russian troop build up @ Ukraine border. China bash democracy/US political risk over this weekend. So may see more selling next week, before the big bounce.

Just read cases in South Africa quadrupled in four days. Be careful on your health front and portfolio.

Roughly 25% of the population is vaccinated in South Africa. The delta variant is still strong in the world. Over 99.9% of the cases in US, for example, are from Delta. Data on the vulnerability of vaccinated people to Omicron is very preliminary. Data on vulnerability of people who have had Covid to Omicron is sparse. Do people get seriously ill and die from Omicron infection?

So, there is a lot that is not known. Hysteria will not make the situation better. Science will.

They believe most people in this area of South Africa have had Covid and hence should have similar immunity as getting vaccinated. So the 25% vaccinated number is not such a comfort.

It is again speculative in two respects. Most people have had Covid and that immunities from vaccinations is same as from infections. If that was the case, would it not make sense to not vaccinate people who have had Covid in North America?

Let Science inform our policies and actions. Otherwise it will be Trumpian all over again.

Regarding the suggestiong to look at “raising fixed-income allocations”, if the Fed starts tightening, isn’t that likely to result in fixed-income positions falling also?

I imagine it’s betting on the equity would drop more and/or the risk-off sentiment would pull bond prices up.

Ie, TLT or GOVT vs SPY, summer 2015 to spring 2016.