Mid-week market update: Last Friday’s Omicron surprise left a lot of bulls off-guard when the markets suddenly went risk-off on the news of a new variant emerging from South Africa. Stocks became oversold and I observed that “To be bearish here means you are betting on another COVID Crash.” (see COVID Crash 2.0?). Even as the market staged a relief rally Monday, my alarm grew when it appeared that the consensus opinion was the bottom was in. It was a sign of excessive complacency.

Stock prices were sideswiped Tuesday by the news that existing vaccines may be of limited utility against Omicron and Powell’s hawkish turn. At a Senate hearing, Powell called for the retirement of the “transitory” term as a way to describe inflation, “It’s probably a good time to retire that word and explain more clearly what we mean.” As well, Powell stated that it was time for the FOMC to consider accelerating the pace of QE taper at its December meeting. The S&P 500 tanked and undercut its lows set on Friday.

Can the market still manage a year-end Santa Claus rally?

Ryan Detrick of LPL Financial argues that history is still on the bulls’ side.

When the S&P 500 is up >20% for the year going into December, the final month of the year is actually stronger than normal.

What about you? Do you believe in Santa?

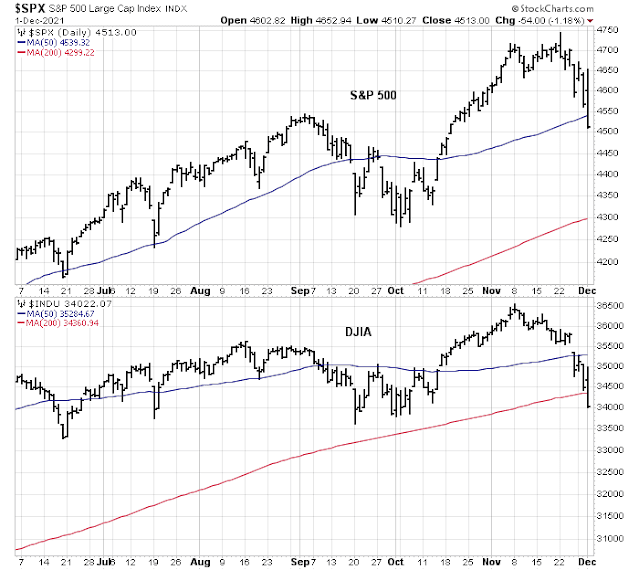

The bear case is easy to make. Much technical damage has been done by the market action in the past week. Even though the S&P 500 stages an initial test of its 50 dma, the Dow fell below its 50 dma several days ago and violated its 200 dma today.

Equally disconcerting is the downward trajectory of NYSE highs-lows and NASDAQ highs-lows. The deteriorating in the NASDAQ is especially concerning as NASDAQ stocks have been the market leaders.

Even as the market became oversold, there has been a lack of panic in many quarters. The equity-only put/call ratio rose to only 0.48 on Tuesday, but the reading was below Friday’s level and well below panic levels seen in recent short-term bottoms.

Moreover, sentiment remains jittery. The market tried to stage a relief rally today, only to be derailed by the news that the Omicron variant had landed on American shores.

The bull case

The bulls will argue that the recent market action was only a hiccup. The relative performance of defensive sectors are all in downtrends, indicating that the bears haven’t seized control of the tape.

All four of my bottoming models had flashed oversold signals. In addition, TRIN spiked above 2 Tuesday, which is an indication of market clerk liquidation and price-insensitive selling that often marks short-term bottoms.

Waiting for the rebound

What’s the verdict? Bull or bear?

The jury is still out on that score. The market is obviously very oversold. Today’s market action indicates that stock prices are poised for a relief rally. Any trader who initiates short positions at current levels risks getting his head ripped off.

I am waiting to see how the market behaves in the next few days to pass judgment. The S&P 500 should find downside support at the current level, which is its 50 dma, and could encounter overhead resistance at its 20 dma at about 4660.

Stay tuned.

Disclosure: Long SPXL

I think a relief rally Starts when one of the two (or both) of these happens in the next few weeks:

1) vaccines are shown to be less effective at getting Covid, but still offer good protection while having a huge positive impact towards preventing the worse outcomes

2) Omicron is shown to have a more mild impact, even if it is more contagious

I think that we will see continued protection against severe covid from the vaccine, hopefully even better after boosters.

I don’t believe Powell. I think this is all a game to look serious about all of this. If they raise rates the economy will tank, we did this with Yellen and tapering, are things so much better now? If they don’t buy treasury debt, who will? How will all this fiscal stimulus be possible? All those companies with cheap debt have to refi at some point, and if mortgage rates go up and loan rates go up, do people spend more or less?

What I don’t know is how far he will play chicken with the market. There is a lot of counterparts risk built in. A bit like playing Jenga.

All the trillions tossed out have not been spent, that’s why the economy is “good”, but eventually they will be.

Yeah, at some point things will get ugly, only when?

First the Junk Bond crapped out.

Second on 11/22 we had one of the biggest day intra -day reversal a very bearish sign.

Third on a day after Thanksgiving which is normally a Bullish Day we had a decline for the records.

Fourth Powell has changed his tune. Now he talks about aggressively tapering.

Marty Zweig said long ago “don’t fight the fed”.

So in my mind the question should be not do you believe in Santa Claus but do you believe Powell?

Sure the market is oversold and due for a rally. The $65,000 question is going further do you by the dip or do you sell the rallies?

The small caps are nearing the bottom of the multi month range. Interesting to see what happens at that point.

1. There are a lot of newbie traders/investors (of video game generation) who are trigger happy.

2. Professional managers need to protect gains.

3. Mechanical flows (algos) deleverage due to high vix levels.

4. ARK funds are suffering from outright redemption and bear attacks arising from short- ARK funds.

5. Media is feeding the flame.

All of these are reinforcing each other to the downside. But We are probably near or at a bottom.

6. Fear and greed is at 19, a crisis level reading.

5. NYSE and NASDAQ stocks above 50/200 MA ratios are at bear market level.

So obviously most of the average stocks are in bear markets even the indices are not.

What to monitor: SMH, ITB, TSLA. If these are holding up, then buying dips are more favorable statistically.

Now Powell is on a mission and not worrying about second term anymore. We need to monitor whether he is aspiring to be Volcker 2 and leaving a legacy. Th logic is quite simple: Would you like to be remembered as the Fed Chair who lost control of inflation or the opposite? I suspect a good portion of the selling are related to this thinking, and complicated by the Democrats’ tax proposal.

As of today, the 2s10s is at 0.87. A few hikes and we will be dealing with an inversion. If that happens 2022 will be a year to remember for Democrats during the election. I am afraid Powell is tightening into a slow-down. CRB has been declining rapidly, and small/micro caps are not telling us about a robust economy.

Jay Powell is only nominated and not yet confirmed for the 2nd term.

I think his unusually aggressive posturing in regards to tapering maybe a result of his consultation (or negotiation for a 2nd term) with the President. Dems do not want to lose mid-term election because of inflation worries.

I think inflation will moderate in 2022 (easing supply-chain and production issues, less pent-up demand, uncertain consumer, etc.). Oil that feeds into many aspects of the economy has already cooled down. Maybe even some workers will return once their stimmy checks and savings deplete.

The markets have been going down for the entire month of Nov. Powell turned hawkish only today. Omicron was nowhere to be found a few weeks ago.

Was it the fear of rising inflation (and therefore subsequent rise in interest rates) that cratered the market?

Consumers may be less naive than we think and their confidence is low, both in Europe and in the US. They are concerned about inflation and here in Europe we have realized that Covid is going to be with us and is going to impact our life at least during winter for the foreseeable future. This is emphasizing the current imbalances in the economy. Retail sales in Europe have been missing estimates and trending down for consecutive months now, there is a probability of the US consumer cutting back on spending due to similar worries as well. Even more important for financial markets is that the Fed has pivoted to taking inflation serious, also because it has realized that worries about inflation are a top priority for consumers.

I wonder if the supply will exceed the demand sometime next year as consumers retrench after gorging on goods during the pandemic (at least in the US) while producers expand production in anticipation of continued demand and as the supply-chain issues ease.

The SPX is below prior high and 50 dma around the same level. It’s a challenge to hold on to bullish view. The best would be a sideways market to calm the nerves.

Today’s selling in the last couple of hours was ‘emotional’ so to speak. Many traders may be short in the hole!!

Here is a thread where the author argues that some hedge fund managers who have outperformed the indices by a substantial amount may sell their holdings to book their outsized gains and their performance incentive fees.

https://twitter.com/hkuppy/status/1466094188190175237

The other side of the coin is that very few money managers are really outperforming the index unless they hold an excess of TSLA, APPL and NVDA stocks. So, there might be incentive for them to rush into equities into year-end to narrow the gap with indices.

What do you guys think?

Nice move on the calls. I think your plan was to close the positions at/near the open, which turned out to be prescient.

Thanks! Yes, that was the plan. I also got lucky as news about the 1st Omicron case in the US came in the afternoon.

Satya Nadella sold half his holdings ($300M) in MSFT to avoid paying the WA state capital gains tax of 7% effective next year.

Or, was that just an excuse to book his gains?

One thing I know for certain is that it’s never easy.

It’s always entertaining to listen to CNBC commentators who have all the answers (what else would qualify them to be TV commentators). For traders with skin in the game who are down in the trenches each day – those types of ‘answers’ are rarely helpful.

My own debriefing:

(a) My early morning comments re the bull/bear battle contained a little too much hubris and undoubtedly offended the market gods 😉 I was actually ahead by +1.5% at that point but opted not to lock in my gains. Why? I don’t really know – my sense was that the market was headed even higher.

(b) I had an opportunity to exit at breakeven in the final hour. I failed to act on it.

(c) Sellers appear to be in control.

(d) I foresee further downside. And I backed up that view by moving to cash after hours.

Not unlike heading out confidently in the morning and predicting victory, only to find yourself outmaneuvered or outgunned by smarter adversaries.

One reason I find it easy (or at least easier) to admit defeat and/or take losses quickly is that I’m always acutely aware of the risk/reward aspect of the markets. I don’t take gains for granted – the market owes me nothing and I’m certainly not entitled to always make money.

Meanwhile, SPX futures are up +0.5%. That kind of day.

A very senior executive at a leading investment bank admitted that they are very good in explaining the market action after it had already happened.

It is hard to predict the future – for anyone. Least of all, for entertainers at CNBC.

Remember, how many sell-side shops were calling for a 10% correction back in Sep?

It was actually a very orderly price action today if you pay attention to the VWAPs. They sold emini ES S&P futures at VWAP (from 11/29) of 4649 at 13:00 and covered at VWAP (from 10/19) of 4504 into the close. Trading VWAPs can be very boring when the market is inching along but a day like today was a great day for the VWAP traders.

The yellow dash lines on chart below are the unfilled VWAP lines extending back to their origins.

https://i.imgur.com/svPovdb.png

Failure to hold 4550 would be a bad sign, futures just tested that from below and got rejected. QQQ also broke the neckline of head & should pattern from early November and got rejected at the attempt to reclaim the necklin in early European trading.

SPX futures +0.7%.

I’ve been struggling with ST market timing. Failures outnumber successes, and not by a small amount.

Now off ~-4% from all time highs.

All traders struggle with difficult periods. The good ones are somehow able to distance themselves from the bad calls (at least in public). I’m not built that way. A couple of traders I have followed through the years include John Hussman and Todd Harrison. Both were highly successful at one point – and both have in recent years fallen from grace in spectacular fashion. They’re likely insulated from the financial impact via earlier wealth accumulation – but that’s not the case for most of us. Were I to make a similarly long series of bad calls with my portfolio, the fallout in terms of financial security would be very real and maybe even irreversible. I can’t afford to let that happen.

I perform self-assessments frequently. There’s been a noticeable deterioration either in my skills or in the applicability of my skills to a market that has changed considerably. Most likely the latter. What would Darwin have to say? Learn to adapt or retire from the game.

BABA closed yesterday @ 122? Unbelievable. A great example of the need to reexamine one’s conviction in a trade on a daily basis.

I made two trades yesterday. Made money on the first one. Thought the rally was going to continue lost more on the second one. C’est La Vie. At turning points in the market, it gets very choppy. Intra-day rallies fade quickly. Buying dips don’t work. It helps to know if trends have changed. That is why I posed the question – should we buying dips or selling rallies?

All corrections/ crashes begin with the first decline. In the back of my mind is the thought that there are so many traders looking for a seasonal rally that it’s bound to fail. Even further in the back is the thought that perhaps we’re about to see the first correction of 2021 – and we’ll hear from more than one CNBC analyst just how well-telegraphed the correction was in retrospect.

Personally, I’ve been waiting for a correction for over a year. Now that I’ve given up on the idea – that’s why it’s sitting in the back of my mind.

In trading I judge myself not by the money I make which of course is important but whether I followed the rules and had the discipline to take my loss quickly and cleaning. No regrets no remorse.

The same position if I had held it today the loss would be substantially higher. I would love to be right on all my trades. Unfortunately, in life that does not happen.

should read cleanly. Not the last typo.

There is a divergence opening up between the more economically sensitive indices and the Nasdaq 100. I’m trying a long German DAX vs short Nasdaq 100 trade.

Same opinion of Cam. Not really clear where market is going next. On one hand, Fed hasn’t raised rates. On the other, countries closing borders all isn’t bullish.

I think it’s safe to say that we’re trading an unusually turbulent market right now. Conventional interpretations of market action aren’t playing out well – the market seems ‘off.’

Nasdaq breaks down again.

Hopefully some kind of rotation has already started. Big tech into small caps. If so, it is healthy pullback.

November would still look like a valid top structure for the NDX.

“So our view has been that almost all of these U.S.-listed tech companies will relist either Hong Kong or the mainland,” he told CNBC’s “Street Signs Asia.”

https://www.cnbc.com/2021/12/03/didi-on-delisting-from-us-and-list-in-hong-kong.html

Usually it is not what you believe but what other large traders believe that matters. This chart can be titiled ‘What happens when All Time Highs (ATH) meets $52WLND’. $52WLND is the 52 week Nasdaq100 (ND) new lows that is rising- a divergence of breadth when you have ATH highs in the indexes.

Normally you would see this on a daily chart but traders are obviously trading this on shorter time frames and when you see it, you come to see what you probably haven’t seen before. The chart simply shows the indicator lavender crosses on top of bars when the closing price is within 2.5% of all time high with $52WLND>4 and how price action reacts to the indicator with strong selling.

But bulls should take comfort that the bears don’t have conviction for now and are astute enough to cover, usually at the end of the day as prices recovered the following day. Those who are students of market structure should look to Oct and Nov 2017 for similar divergences and how the markets got resolved.

https://i.imgur.com/Doc1pmj.png

And the Naz breaks down again. Just not the kind of thing that keeps happening in a healthy market.

One of my tells has been BABA. Now 111. When investors want out, the declines can be precipitous.

This cat is obviously dead, will it do what dead cats usually do and bounce again?

At some point the dip-buyers get burned. Buying the fallout – whether intraday or the following day – may be the next best buying opp.

Tom McClellan had been bullish for 10+ years. He changed narrative a few weeks ago. Saying the major top is in. Market will trend down. Major crash in 2024 if I remember correctly. So I capitulated last week

But dead cat bounce inc.

https://www.financialsense.com/podcast/20122/tom-mcclellan-warns-major-stock-market-peak-says-indicators-are-flashing-red

The current market action is very similar to the 2007 top, if that analog continues we should see a one week relief rally. This would be consistent with traders front-running the late December seasonal strength which may eventually not materialize this year.

Elevated inflation (even though probably slowing but still elevated), a tightening Fed and a still raging pandemic combined with trouble in China are non-trivial headwinds.

Cam, some people are raising concerns about the enormous debt held by the corporations and the governments (incl. pension, debt, healthcare liabilities).

What’s the impact of Powell raising (or forced to raise because of inflation) interest rates? Could we see major bankruptcies and contagion that spreads to the banking sector like back in 2008?

Thank you.

SPX 4470 might be a support zone from which to try timing a bounce.

And I’m almost certain that as soon as I post a target like that – the market will begin rallying hard.

10% down from highs? Maybe I’m too bearish.

There it is. We rally hard in the final minutes…

Personally, I think the last-minute ramp was a skillfully executed bull trap. My bet would be a gap down on Monday.

One major disadvantage in 2021 was the number of times that market action defied conventional wisdom. For instance, ‘markets rarely bottom on a Friday.’ An observation seared into the minds of an entire generation of traders on Black Monday.

The only consistent behaviour this week was the constant number of traps that the market set up for traders. This culminated in the last 2 days where the market did the exact opposite of what futures did just before the open. So whatever gap we get on Monday, I wouldn’t neccesarily trust it.