Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

COVID panic!

Global markets took a risk-off tone on Friday when news of a heavily mutated coronavirus variant labeled B.1.1.529, or Omicron, emerged from Southern Africa.

Nature reports that South African scientists recently identified a new strain.

Researchers in South Africa are racing to track the concerning rise of a new variant of the coronavirus that causes COVID-19. The variant harbours a large number of mutations found in other variants, including Delta, and it seems to be spreading quickly across South Africa.

A top priority is to follow the variant more closely as it spreads: it was first identified in Botswana this month and has turned up in travellers to Hong Kong from South Africa. Scientists are also trying to understand the variant’s properties, such as whether it can evade immune responses triggered by vaccines and whether it causes more or less severe disease than other variants do.

“We’re flying at warp speed,” says Penny Moore, a virologist at the University of Witwatersrand in Johannesburg, whose lab is gauging the variant’s potential to dodge immunity from vaccines and previous infections. There are anecdotal reports of reinfections and cases in vaccinated individuals, but “at this stage it’s too early to tell anything,” Moore adds.

“There’s a lot we don’t understand about this variant,” Richard Lessells, an infectious disease physician at the University of KwaZulu-Natal in Durban, South Africa, said at a press briefing organized by South Africa’s health department on 25 November. “The mutation profile gives us concern, but now we need to do the work to understand the significance of this variant and what it means for the response to the pandemic.”

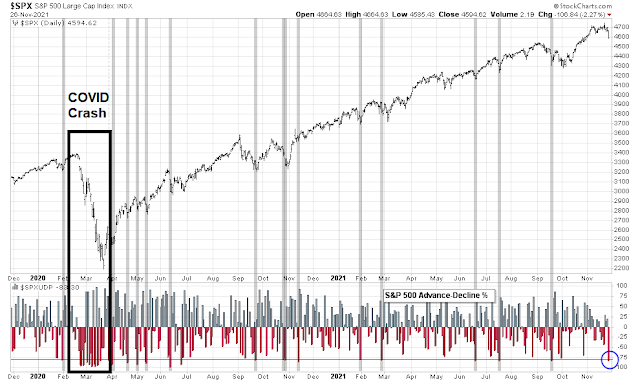

When COVID-19 first came out of nowhere in early 2020, the global economy shut down and the markets crashed. Could we be seeing the start of COVID Crash 2.0?

2020 parallels

There are some parallels to the 2020 experience. The stock market was already exhibiting technical stress even before the onset of COVID-19.

The standard technique for calculating a Bollinger Band (BB) is to put a two standard deviation band around a 20-day moving average (dma). As a demonstration of how strong the recent advance has been, the S&P 500 approached the top of the 200 dma BB and stalled. In the last five years, there have been six episodes of 200 dma BB rides. In five of the instances, the top was signaled by a negative RSI divergence, which is the case today. Half of them resolved with significant downdrafts (circled in red) and the other half ended with a sideways consolidation.

If the latest round of market weakness is a just plain vanilla pullback, the latest stall is likely to be benign. That’s because the market saw an initial bottom when the NYSE McClellan Oscillator (NYMO) has already reached an oversold level. The caveat is oversold markets can become more oversold. During the COVID Crash, market internals blew past oversold conditions to reach extreme levels very quickly.

In fact, three of the four components of my bottoming models have flashed buy signals. The VIX Index has spiked above its upper Bollinger Band, NYMO is oversold, and so is the 5-day RSI. Only the term structure of the VIX hasn’t inverted, but it’s very close. However, the COVID Crash was an exception to the rule for these buy signals,

Another breadth indicator, the percentage of advancing-declining volumes, fell to an oversold extreme on Friday. This has usually led to short-term bounces. To be bearish here means you are betting on another COVID Crash.

2020 differences

Here are some key differences between today and 2020. Global healthcare systems were completely unprepared when COVID-19 first appeared in early 2020. China reacted by completely shutting down its economy. Hospitals in northern Italy, which is the wealthiest part of the country in a G-7 nation, were overwhelmed and the death rates were horrific. There were no treatments available. The only solution was a lockdown in order to reduce the transmission rates (remember “flatten the curve”) in order to buy time for researchers to find vaccines and treatments.

Fast forward to 2021. Vaccines and treatments are available. Any lockdowns are likely to be relatively temporary. However, there are some key unanswered questions about the new Omicron variant.

- How transmissible is it compared to other COVID-19 strains? Higher transmission rates mean greater virulence and ability to spread through the population.

- Are its symptoms more severe than previous variants?

- How effective are current vaccines and treatments against Omicron?

- If current vaccines and treatments are ineffective, which is a big if, mRNA technology allows researchers to react quickly to new variants. How quickly can a new vaccine be tested and approved?

Equally important is the policy reaction. Prior to the emergence of Omicron, Fedspeak had turned hawkish. Two Fed governors and San Francisco Fed President Mary Daly, who is considered to be a dove, all supported a faster taper of QE purchases. In addition,

Reuters reported that when Biden announced the re-nomination of Jerome Powell as Fed Chair and Lael Brainard as Vice-Chair, both turned their focus to inflation.

“We know that high inflation takes a toll on families, especially those less able to meet the higher costs of essentials, like food, housing and transportation,” Powell said in comments alongside Biden and Brainard. “We will use our tools both to support the economy – a strong labor market – and to prevent higher inflation from becoming entrenched.”

Brainard added she too was committed to putting working Americans at the centre of her agenda. “This means getting inflation down at a time when people are focused on their jobs and how far their paychecks will go,” Brainard said.

The

November FOMC minutes, which were released last Wednesday, also contained some surprises. It seems that the Fed is reacting to market pressures on inflation, even though the official view remains in the transitory camp.

Participants generally saw the current elevated level of inflation as largely reflecting factors that were likely to be transitory but judged that inflation pressures could take longer to subside than they had previously assessed.

Last week’s hawkish Fedspeak was confirmed by the minutes, which is signaling an acceleration in the pace of taper.

Some participants suggested that reducing the pace of net asset purchases by more than $15 billion each month could be warranted so that the Committee would be in a better position to make adjustments to the target range for the federal funds rate….

In the wake of the Omicron news, the

WSJ reported a dramatic shift in Fed Funds expectations.

Federal funds futures, a proxy for market expectations of interest rate changes, shifted downward Friday, with the market anticipating that the Federal Reserve will keep interest rates low for longer. CME Group data showed the majority of investors are now pricing in two or three, quarter percentage-point rate increases by the end of 2022, compared with three or four on Wednesday. Equivalent measures of interest-rate expectations for the eurozone and the U.K. also shifted downward.

Market anomalies

As the markets reacted to the news of the new variant on Friday, some market anomalies have appeared signaling that the latest risk-off episode is a buying opportunity rather than COVID Crash 2.0. Friday’s market action is indicative of an irrational panic rather than reasoned reaction to events.

Treasury yields understandably fell dramatically during this risk-off episode. But if the B.1.1.529 is truly a threat to the global economy, expect the Fed to downgrade its hawkish views in light of the downside threats to growth. If that’s the case, why did the yield curve initially experience a parallel shift downwards in the 2-10 year range (though it did flatten later in the day)?

A survey of case counts shows that the situation had deteriorated badly in Europe compared to other regions. When global markets took a risk-off tone, why did EURUSD surge? The USD is normally a safe haven during periods of crisis. Instead, the greenback weakened.

Sentiment vs. data

Notwithstanding the latest panic, high frequency economic data had been improving. The Economic Surprise Index, which measures whether economic releases are beating or missing expectations, has been rising.

Similarly, the San Francisco Fed’s daily news sentiment index, which tracks the tone of economic news, has recovered after a brief dip.

In 2021, every variant sell-off has turned out to be a buying opportunity. The latest sell-off is likely to be another.

Take a deep breath and relax. The latest mRNA technology is well-positioned to react to new variants should current vaccines and treatments fail. Central bankers are poised to ease should growth disappoint. The latest risk-off episode represents a washout panic and a probable near-term bottom.

Buy the dip.

Disclosure: Long SPXL

Anyone sees NDX as a good alternative to SPX at this moment?

I’m always early, not only in the markets but in most of life’s activities. To paraphrase Kevin Marder – I prefer to arrive when the drinks and hors d’oeuvres are fresh, and slip out the door during peak celebration.

I’ve often commented about the unnoticed bear markets in emerging markets/commodities or the near misses when SPX pulls back -19.8% as sufficient reason to rally further. Now I’m back to zooming out for a wider view and in terms of consumer/investor behavior I’m beginning to notice the same excesses we saw in 2007. Rather than brand-new SUVs it’s now new Teslas jamming the freeways. Betting on second homes that have yet to be built it’s now bets on cryptocurrency. And CALPERS is once again preparing to up their bets on alternative investments.

My current take (aside from a ST reflex bounce) is a decent pullback into the following year followed by a rally to new highs. That might be the time to sell ahead of a protracted multiyear bear. In any case, I plan to continuing looking for alternatives to the stock market over the longer-term.

We spent our first Thanksgiving in Vegas this year – our first destination vacation since Hawaii last June. The crowds were back to pre-pandemic levels. Lots of mask-wearing but little attention to social distancing. I was actually waiting in line for a dinner reservation when the news of a new variant hit the futures market. I was able to wake early on Friday and unload all three positions for an average exit of 105.5x, which allowed me to enjoy the rest of our time there. Hopefully we dodged a bullet in terms of exposure to Omicron (if Hong Kong has recorded 1-2 cases it’s almost a certainty to have arrived in Las Vegas over the holidays).

I think the timing of Thanksgiving is suspicious. How come with their knowing about this virus the news only came out on Black Friday? If they know it has already arrived in Hong Kong, and I think there was a case in the UK also….then they have known about this variant for at least a week or 2. So why a day that is known to be quiet?

I think the reason the euro went up, as did the yen is because until the dust settles the Fed will back off on it’s tightening and this had been a tailwind for the dollar.

We don’t know about this new variant, maybe it will be less severe but more contagious. This also is consistent with evolution, but we have to see what happens.

The other thing that they are not saying is that many vaccinations seem to depend on the delayed booster…think of the Hep B protocol. The Pfizer vaccine, the first 2 doss were 3 weeks apart, the moderna was 4 weeks, this would be expected to work better, but best is the 6 month later one. 2022 will tell us how those who have had the 6 month booster fare. Hopefully there will be many less breakthroughs.

The other thing is that the credit markets had been tightening since 2018. True that after the dec 2018 freakout, the spreads had been improving, but they were still higher in jan 2020 than in sept 2018, now the spreads are way lower. Same thing happened with LTCM in 1998, spreads went up and even though they would narrow at times, they never got back to the lows of pre-LTCM until 2007! They are still higher than in 2007, but since Mar 2020 in a steep decline. Looking at the prior blowups the most common pattern after a prolonged sharp decline is some choppy consolidation before the big rise. So my guess is that this is not the real one and the Fed will take any excuse not to tighten, buuuuut even though this could be a head fake, it could be a nail biter

If you really want to go down the conspiracy theory rabbit hole, try this 🙂

https://twitter.com/Zieleds/status/1464596691194052613

now that’s a rabbit hole!

I do vanilla conspiracy…you know…people will exploit a situation…new variant, holiday might equal a quick dip, or a kick start to a bigger dip…the dip buyers are in for now, I’m curious to see how things evolve.

it’s also a time when funds distribute, so this could mean more selling required.

ES mini up 36 atm

Reports about the variant were pretty much public during Thursday which was a normal business day here in Europe – so European stock futures had several hours to respond but did not react at all until Friday night. I noticed several times before that US markets tend to ignore bad news and go with a positive note into holidays like Thanksgiving or 4th of July, so I would rather blame the modus operandi of US stock markets which do not have to be rational all the time.

What has largely been ignored for several weeks is the current Covid situation in Europe and the likely next wave that is going to git the US after thanksgiving and into December, this is a new kind of dire seasonality that is possibly going to stay with us for several years to come.

Also remember how US markets pretty much ignored the initial Covid wave in February 2020 while it was very much obvious for anyone reading Chinese and/or Italian news what was going to happen. This is really not intended to be an anti-American post, but the positions and money flows of major US based investors tend to dominate global markets and may not reflect the economic sentiment in other parts of the world. What the weak breadth numbers of US markets however may seem to foreshadow is that all is not well in major parts of the rest of the world.

I think that they come up with whatever reason is convenient. Delta has been around and what did the market do? It went up. They are shaking the tree to get nervous hands to let go. I say this, I have nervous hands even though I am mostly in cash. Most market tops are not like steeples although the nasdaq in 2000 was like that, so this could be another time. Most of the time the credit markets show some stress before the whole thing blows up, but not always. My impression even though I am mostly a spectator is that it’s not over yet. I also don’t believe the Fed. If they raise rates this will be very heavy on the market. If they stop buying MBS what will happen to mortgage rates? Housing prices?

If bond rates go up, buy bonds because at some point the Fed will be buying them again en masse, until things really break.

What I don’t get is how the $ is so strong in the face of huge trade deficits, that cannot last forever.

The action on Friday just tells me that markets don’t have a solid base. More money poured into the markets this year than the last ten combined. All this fresh money is nervous money. The burst in inflation has investors unsettled. The prospect of higher rates made them nervous too. Plus the politics of America are pointing to gridlock after the mid-terms give the Houses to the GOP.

Junk bond spreads staying tight and low were my solid base and they are starting to fray. Global Central Banks are starting to tighten and Global leading economic indicators are starting to fall and both of these happenings have been a headwind to stock markets in the past.

All this to say we have uncertainty coupled with nervous investor coming off a prior period of high confidence. One saving grace is we are now in the strongest seasonal period for stocks.

2022 looks to be turbulent. Ask me where we are going end the year and I pick heads.

Has anyone checked futures over the weekend? I know there is a place where one can look up, but I forget exactly where.

https://www.ig.com/en/indices/markets-indices/weekend-wall-street

https://finviz.com/futures.ashx

https://www.ig.com/uk/indices/markets-indices/weekend-wall-street

Thanks.

https://www.ig.com/en/indices/markets-indices/weekend-wall-street

Thanks Rx.

Buying a gap down this morning would have been the easy trade – so naturally we have a gap up instead.

Traders appear to view the early strength as a selling opp.

Backtest at 4660 failed and the pullback did not hold 4630, clearly bearish price action, probably targeting 4550 then 4485.

According to a Deutsche Bank survey published yesterday only 10% of investors believe that Omicron will be “The biggest topic within financial markets” – 30% say it will be largely forgotten by year end, 60% say ” Still an issue within financial markets BUT only of moderate importance” – sentiment still a little too relaxed?

Taking advantage of the decline in futures and opening a position in SPY ~460.3x. Sizing up.

Adding to SPY ~457.5x.

Nice retest of Friday’s low.

If you stop to think about it, the response to any news of a taper is knee-jerk. We already know that it’s inevitable.

The issue is not so much the taper, but the hawkish pivot, acknowledging that inflation is broad-based instead of transitory. The discussion of an acceleration of the taper is just a reflection of that new stance.

Any bets we close in the green?

After hours action looks positive – let’s see if it carries over into Wednesday.

The Fed has actually told us a long time ago that they were going to tilt hawkish when their inflation target would have been met. That time has come and while they will remain data dependent – being data dependent also means that inflation may no longer continue to get ignored.

Taper tantrum 2.0?

Powell’s hawkish testimony today really surprised Wall Street. Money managers are now stuck between a seasonal Santa Clause rally and protecting their P&L (and their bonuses). Many will be hedging or even booking their gains for the year in December.

Note: R2K has lost most of its gains for the year. Probably so have Value stocks. The brunt of the selling / hedging in Dec may fall on the mega-caps and the growth stocks.

Any takers of this thesis?

Nomura agrees with the “protecting” part of your theory, the chase was on into Thanksgiving, but instead of chasing, people may want to protect the gains of the year. SPX and NDX stand out as the indices with major gains as Japan has gone nowhere and Europe has been hit hard already during this selloff.

Just my take – which we all know can be spectacularly wrong – but my takes are always intuitive and not contrived. Between Friday’s Omicron panic and today’s taper tantrum the market may have succeeded in convincing enough traders to disembark that it’s now free to begin the Christmas rally in earnest. The SPYders are trading sufficiently higher after hours to deter anyone who sold at the close to reopen a position – and may foretell a gap up on Wednesday.

I’m with you on the “rebound long trade” if SPX recaptures 4590 today, but we have seen two failed attempts to recapture that level so far.

Re-entered longs, very uncomfortable holding overnight.

I wouldn’t trust any trade that DOESN’T make me uncomfortable. It’s a game of risk and reward, and if you’re not uncomfortable then you’re not taking enough risk to make the trade worthwhile. JMO.

Today’s drop was relentless. Some may have sold into month-end. I think the market will take some time to digest the hawkish turn of JPow, and will remain worried about the omicron until we get some more clarity on its virulence as well as the upcoming drama in the Congress around debt ceiling.

After this sell-off, we should see a bounce tomorrow at the open. Whether it is sustainable remains to be seen, IMHO.

I’m still mostly long. Nov wasn’t kind to my portfolio. I also bought some IWM Calls a minute before the Close today. Would like to sell them on a modest bounce tomorrow morning.

4590 is probably as good a target as any. The market – which is after all the sum of hundreds of millions of bids/asks + buys/sells – is hands down the most effective system devised for deceiving most of the participants most of the time.

I was about to say with the exception of politics – but we at least expect lies and deception in politics, whereas the proliferation of numbers and charts when trading markets gives the illusion of logic and rationality when in fact little of either are present.

https://www.sfgate.com/coronavirus/article/omicron-variant-San-Francisco-Bay-Area-16660658.php

Excerpts:

‘The underlying message from all three was that San Francisco Bay Area residents don’t need to panic or cancel plans because of the variant. While scientists around the globe are racing to learn more about omicron, Rutherford said, “The preliminary news from South Africa is [omicron] is associated with milder disease. ”

‘All three experts said the best thing Bay Area residents can do in response to omicron’s worldwide spread is get vaccinated.’

Q: Should I cancel any upcoming travel plans?

A: Not if you’re vaccinated, all three experts said.

“Even Dr. Francis Collins (head of the National Institute of Health) thinks the vaccines will work against Omicron so people should not cancel holiday plans (if vaccinated) over the new variant,” Gandhi said. “President Biden just messaged this in a holiday message this morning to the US.”

These are the same three UCSF docs who advised us to stay home/ cancel plans/ stay safe prior to the vaccine.

Hey Sanjay- November may have been unkind, but those IWM calls will kick off December with a bang!

The selling intensity since Friday may be enough to launch a sustained three-day rally. That’s my base case.

The SPX absorbed a sucker punch on Friday and a blow to the knees on Tuesday – and refuses to stay below 4600. That’s as bullish as it gets.

In case anyone is wondering – still holding, but not necessarily by choice. I was preoccupied with work this morning, and now I’m faced with the kind of situation I don’t typically find myself in.

Rx, I wasn’t so sure. For me, it was a quick trade. I sold the Calls this morning for a modest profit.

I think the next 1-2 weeks will still be volatile. I expect money managers to book their profits and their fees, and call it a day.

https://twitter.com/hkuppy/status/1466094188190175237

Not as bullish as some of you and that sentiment is really coming from the last day or two. I have always liked to replicate what technical analysts are seeing and Andrew Thrasher reminded us yesterday that “Nasdaq 100 is less than 2% from a 52wk high but has over 5% of stocks at a 52-week low. This level of breakdown in breadth has not historically been positive and creates a major headwind for bulls going into year-end.” Here is my version of that analysis in the moving GIF which showed the signal yesterday, Nov 30, 2021.

https://i.imgur.com/ZSGdDeH.gif

The original study by Thrasher is shown here:

https://pbs.twimg.com/media/FFchrg7WYAwKTh4?format=png&name=large

The only time in the last 6 years that this signal did not work very well was on 11/03/17 where we saw the market continued to thrust upwards until the the of Jan, 2018 and then quickly corrected ~10%. So it is still possible that we see a year end rally.

The system blocks comments with more than one link and needs to be approved. If you find that your comment is blocked, please email me and I will approve.

Wow. This price action makes me ILL.

I hear you. I’m trying to come up with own plan.

The first question I have is for Cam. Does today’s reversal have your Inner Trader reconsidering his bullish stance?

A few more gaps to be filled from 10/14, 10/18 and 10/19 of 2021.

Not as bullish as some of you and that sentiment is really coming from the last day or two. I have always liked to replicate what technical analysts are seeing and Andrew Thrasher reminded us yesterday that “Nasdaq 100 is less than 2% from a 52wk high but has over 5% of stocks at a 52-week low. This level of breakdown in breadth has not historically been positive and creates a major headwind for bulls going into year-end.”

The only time in the last 6 years that this signal did not work very well was on 11/03/17 where we saw the market continued to thrust upwards until the the of Jan, 2018 and then quickly corrected ~10%. So it is still possible that we see a year end rally. My prior post with GIF link seems to be under moderation.

In my mind, it comes down to whether we’re on track for a rally into year end – and enduring bouts of volatility intended to mislead us – or genuinely in danger of a correction.

I’m streaming real life in real time. I’ve taken off all three positions in SPY after hours.

Why?

(a) I still have decent ytd profits to protect.

(b) I’m in capital preservation mode.

(c) I have a rule about taking losses immediately when I’m wrong. It’s unfortunate that I was away most of the day, but that’s life.

(d) It was very difficult for me to make the sale. And the correct move is usually the more difficult one to make.

No question that the after hours sales hits me hard. It happens.