Recently, a growing narrative in the market is arguing for a pause in the reflation trade for the following reasons:

- Both the cyclically sensitive copper/gold and base metal/gold ratios have moved sideways.

- The 10-year Treasury yield peaked out in March and it is now falling, which is an indication of the bond market’s belief of a retreat in growth expectations.

- The Chinese stock market has tanked relative to global stocks, as measured by MSCI All-Country World Index (ACWI).

If these market signals are indeed pointing to a pause in growth expectations, then investors should be prepared for either a risk-off tone in the markets or some choppiness and consolidation in the months ahead.

I beg to differ. The reflation theme is alive and well.

A different kind of rotation

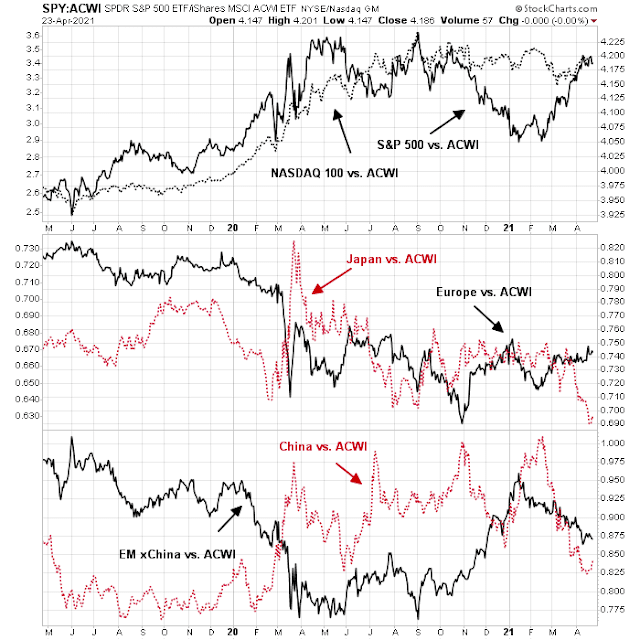

My analysis of global markets reveals a different explanation of market action, and it’s attributable to a rotation in global equity markets based on specific regional factors as shown by the chart below of the relative performance of different regions against ACWI. In the US, the S&P 500 has been outperforming ACWI since late February while the NASDAQ 100 has traded sideways. European markets have been flat against ACWI since December. Asian and emerging markets have lagged.

Equity markets are moving because of different factors specific to their regions.

- In the US, the S&P 500 has risen too far too fast, and it is due for a period of choppiness and consolidation. The rotation from growth to value remains intact.

- China is experiencing a slowdown that is dragging down the economies and markets of her major Asian trading partners (see A “value” industry that’s about to be the “Next Best Thing”).

- The paths of European and other emerging market equities are being driven by progress against the pandemic, which is uneven.

Too far, too fast

In the US, the stock market is overextended. The S&P 500 overran a rising trend line, and recycled while exhibited a hanging man candlestick indicating a possible reversal. Similar past episodes have marked blow-off tops that resolved with short-term pullbacks.

I have also been monitoring the evolution of the equity call/put ratio from a long-term perspective. While most analysts have pointed to the spike in equity call option volume as a sign of excessive speculation by individual traders, past rising equity call/put activity has been coincidental with equity bull phases. Now that YOLO call traders have retreated and retrenched, the 50 dma of the equity call/put ratio has fallen below the 200 dma. In the past, such events have signaled pauses in market advances.

However, the growth to value rotation remains intact. The 5-day RSI of the Russell 1000 Value to Growth ratio recycled off an oversold condition, which is a buy signal.

Moreover, the valuation dispersion between value and growth stocks are still historically high, which gives room for the trade to converge.

As well, the

NY Times had a cautionary message for tech and growth investors. Regulators are going after technology companies all over the world, which will be a headwind for their growth outlook and represents an attack on their business models.

China fined the internet giant Alibaba a record $2.8 billion this month for anticompetitive practices, ordered an overhaul of its sister financial company and warned other technology firms to obey Beijing’s rules.

Now the European Commission plans to unveil far-reaching regulations to limit technologies powered by artificial intelligence.

And in the United States, President Biden has stacked his administration with trustbusters who have taken aim at Amazon, Facebook and Google.

Around the world, governments are moving simultaneously to limit the power of tech companies with an urgency and breadth that no single industry had experienced before. Their motivation varies. In the United States and Europe, it is concern that tech companies are stifling competition, spreading misinformation and eroding privacy; in Russia and elsewhere, it is to silence protest movements and tighten political control; in China, it is some of both.

The most convincing argument against a pause in the reflation trade can be seen in commodity prices. Both the CRB Index and equal-weighted commodities made fresh all-time highs. Does a pause look like this?

China is slowing

Over in Asia, the markets are showing concerns over the nascent signs of a slowdown in China. Credit growth is rolling over, which usually leads to a deceleration in GDP growth.

The Huarong debacle has also sparked increasing worries in the bond market. Yield spreads are widening, which is an indication of tightening credit conditions that exacerbate slowdown risk.

The anxiety can be seen in the relative performance of Chinese stocks against ACWI. The bad news is MSCI China have plummeted on a relative basis. The good news is it is holding a key relative support level, indicating that the market does not expect a disorderly rout in the Chinese economy.

A pandemic driven market

As for the rest of the world, the stock markets of the remaining regions are still driven by the progress of the war against the pandemic. Until the global population reaches herd immunity, either from immunization or the ravages of infection, the world is not protected against the virus and the global economy is at risk of slowdowns and supply chain disruptions.

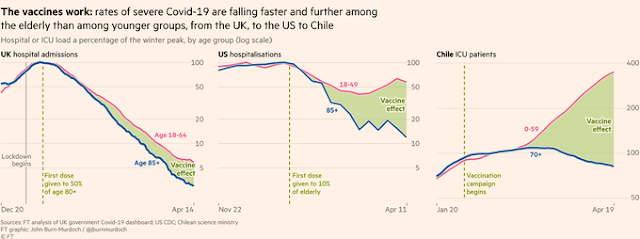

These

Financial Times charts illustrate the vaccination effects in different countries. Keep in mind that UK vaccination rates are one of the highest in the world, which explains the dramatic drop in hospitalization.

Israel is one of the few developed economies that has made the greatest progress in vaccinations, followed by the UK, and the US. The EU is just starting to ramp up after some teething pains, and Asian countries are lagging behind. Large emerging market countries like Brazil and India are still struggling.

Here is what this means for the relative performance of different regional stock markets and economies in the months ahead. The EU equity outlook should start to improve as it reflects the ongoing vaccination ramp-up in Europe. Both large and small-cap eurozone equities have been flat to up against ACWI. UK equities, however, have been held back by the ongoing Brexit problems in Northern Ireland.

European equities could be a source of better relative performance in the months ahead. Eurozone equities are not highly valued and their outlook is expected to improve as vaccinations rise. As well, Germany’s top court handed down a welcome decision last week to allow the country to ratify the EU pandemic recovery fund, which opens the door to more fiscal stimulus. UK equities are cheap by developed market standards. The UK is nearing herd immunity, though investors bear the risk of an unraveling of the Good Friday Accord.

On the other hand, Asia and emerging markets are areas to avoid for a variety of reasons. Asia is vulnerable owing to a China slowdown, which will affect China’s major trading partners in the region. As well, the pandemic appears to be out of control in India, whose case counts are skyrocketing amid reports of an overwhelmed healthcare system is near collapse.

A number of other EM countries are not faring well with the pandemic either. The World Health Organization recently warned about rising infection rates in Argentina, Turkey, and Brazil. In addition, there are over 30 countries that haven’t even begun to vaccinate their populations, most of which are in sub-Saharan Africa.

The world is not protected from this virus until we all are. As the vaccination rates of the developed economies rise, the attention will shift to the vaccination rates in EM countries and their lack of progress. This could be the spark for a global growth scare in the months ahead.

To recap, I believe that the reflation trade has not paused. Cyclically sensitive indicators of global trade, such as Korean and Taiwanese exports, are surging.

However, global markets are undergoing a rotation away from an extended US market. Europe offers more attractive opportunities in the months ahead. Asia and the emerging markets should be avoided owing to a combination of China slowdown risk and the re-emergence of the uncontrolled spread of COVID-19 in a number of major EM countries.

Looking at your chart of change in mobility level vs. change in new cases, Israel is clearly leading the way. Any thoughts on Israel etfs as potential investments? With the exception of EIS they all look pretty tech heavy, and even EIS has over 37% exposure to tech.

The Israeli market has always been tech heavy and tracks the NASDAQ

EWT can be a good bet going forward. Its biggest component is TSM. All other components (most of them tech-related) also have tail winds. The biggest tail wind of all is the realignment of supply chains due to new China-US cold war. Taiwan is the biggest beneficiary of this new development. Besides it does have a well-controlled COVID19 situation.

On the other hand we should monitor South Korea’s situation. Current prez Moon is in close ties with China. His party suffered big blows in recent election, and is expected to lose big in next year’s general election. His own poll numbers are about 30%. Samsung is now without a leader after its CEO was put in jail due to the bribery case of previous prez Park. Many moving parts. Very interesting scenario.

But as a general rule if you engage in biz with China you should expect to lose your trade secrets and knowhow. Samsung and LG and Hynix also face this problem, despite the efforts to safe-guard their knowhow in their factories in China. TSLA is starting to feel it. Last week the auto show in Shanghai saw a woman jumping on the top a Tesla car and making a big fuss. And then the state media ganged up on Tesla. This is exactly the modern day version of Cultural Revolution. Let’s see how the invincible Musk deals with it going forward.

The aim of recent semiconductor initiatives from US and EU is to become less dependent from Taiwan, and many Taiwanese companies also have factories in mainland China. So longer term the inevitable consequence of increased investment is excess capacity, especially for mature node processes like UMC is offering. TSM may be able to keep their advantage in high-end nodes, but TSM’s valuation reflects that and the US will favor Intel to let them reemerge as a more serious competitor.

Diving deeper into the semiconductor issue the supply chains remain highly complex and globally interconnected, Japan and South Korea also have important companies (of course with factories in different geographies) as the current shortages are not just about foundry capacity, but also substrates, copper foil or laser drilling and packaging machines.

Instead of EWT one could invest in a basket of companies with very difficult to overcome moats like ASML, Soitec, BE Semi, ASM International (Europe) LRCX, AMAT, KLAC, Teradyne, Kulicke & Soffa (US) Shin-Etsu, Sumco, Mitsubishi Electric, Disco Corp, Tokyo Electron, Lasertec, Ibiden, Shinko (Japan) just to name a few, but I understand individual stock picking is not the main objective of this site.

You raised a valid point. Currently the sweet spot in fab process node is 28nm. That’s why UMC stock is flying. They raised prices and are already fully booked this year.

But I think EU and US are overly optimistic about the fab plan. Several factors make Taiwan and SK the only two places in the world where fabs are so advanced:

1. Cheap and capable engineers working like suicide squad.

2. Tightly packed supply chain. In Taiwan usually within 1hr of driving.

Samsung and Intel are at a disadvantage in another aspect. They are also competitors with their big customers. I don’t think AMD and Nvidia will give their orders to Intel; AAPL not likely to Samsung.

Whatever, it is very intense. CIA black OP people have stations inside TSMC fabs, then to ASE. And then military planes fly the packaged chips back to US. A crazy world.

Excellent though a short discussion on the semis! Would love to hear more of these nuggets of information from the semi as well as other industries.

Thank you.

Though I am not in the industry, I don’t think the US or the EU would like to be reliant on semi supplies coming from Taiwan or South Korea. They are all within China’s geographical reach and can be invaded / occupied by the PLA if the circumstances ever become so dire.

I think everyone shares with your concern about CCP’s ambition. However the situation is not likely to change anytime soon.

1. It comes down to will of the countries. Do you think EU and US are up to challenge? Look at how they handle COVID19.

2. There is big difference in culture and regulations. I have toured many fabs in different countries. I was really impressed with TSMC, almost in military precision. Germany is known for clockwork-like precision. But I found fabs in Dresden not up to par with TSMC, possibly due to EU regulations.

3. Talent and capital. Capital is easier to come by, but talent is totally different. EU has never had enough talents in microelectronics to start with. US has lost a whole generation of talents the last 20 years in this area. Where can you find enough people willing to toil in PhD programs in MatE, EE, ME, ChemE for many years, and then wear the anonymous bunny suits working in clean rooms as a career? And then they saw people playing games in glorious fictitious coins and make big money. What do you think? I have a friend with an MD from Harvard. No need to reiterate the hard work he put in. He saw the dumbest guy in his undergraduate class making a lot more. He is not happy and back to school and get an MBA and become a Wall St analyst. He is making big bucks now. So how to convince the best and brightest to get into microelectronics? How to produce Robert Noyce and Jack Kilby of today?

4. CCP ambition is something US and EU has to deal with together. You (I should say the elites together with globalists) got greedy and handed everything to CCP to make one more buck. Now you need to find ways to save your own ass. It is not easy and can be done. CCP is not that strong and things are always fluid inside China. Look at China’s history. It is not that coherent as a country.

You make good points. I would counter that though most chips are being manufactured in the Far East, the US and some European companies dominate the manufacture of the semi-equipment and the EDA software, and also own the fundamental IP (e.g., ARM chip designs). The West has probably lost the operations / know-how in manufacturing in many industries (semis, smartphones and many others).

You’re right about the talent. Most US-born students do not want to go through the rigor required in engineering disciplines, especially when an undergrad in liberal arts and an MBA may promise you more money and a faster rise in the career.

The US needs to continue to attract students from overseas to replenish the talent gap in these industries. The finance industry has become too big as a percent of US GDP. I doubt if it is not really helping much in terms of expanding US or the world GDP. Maybe we need to clip the growth of finance, as well as find ways to make engineering more attractive (money and recognition). Elon Muck is a good role model here.

EWT has a nice chart. moving toward a Bollinger Band buy signal.

Can anyone recommend an investable index of UK stocks? Are UK small caps better than large caps?

EWU and EWUS. Cam has suggested that UK small caps (EWUS) may be better than EWU.

EWUS is the ETF. If you are looking for an index, the FTSE 250 is the next tier below the large cap FTSE 100. The 250 is more midcap than smallcap.

Thank you D.V. and Cam!