Recently, an investor aptly characterized value investing as a portfolio of problems with a call option on good news. One sector stands out as a group of value stocks that are taking on growth characteristics. As shown by its relative performance against MSCI All-Country World Index (ACWI), this cyclical industry bottomed out on a relative basis in March 2020 just as the stock market bottomed and it has been on a tear ever since.

That industry is mining and the mystery chart shows the relative performance of the iShares MSCI Global Metals & Mining Producers ETF (PICK) to ACWI.

Here is my bullish thesis on this group.

The promise of electric vehicles

The electoral win by the Democrats has profoundly changed US climate change policy. In particular, Biden is pivoting toward green energy initiatives. Green energy is a complex subject for investors, and the supply change is complicated with many players.

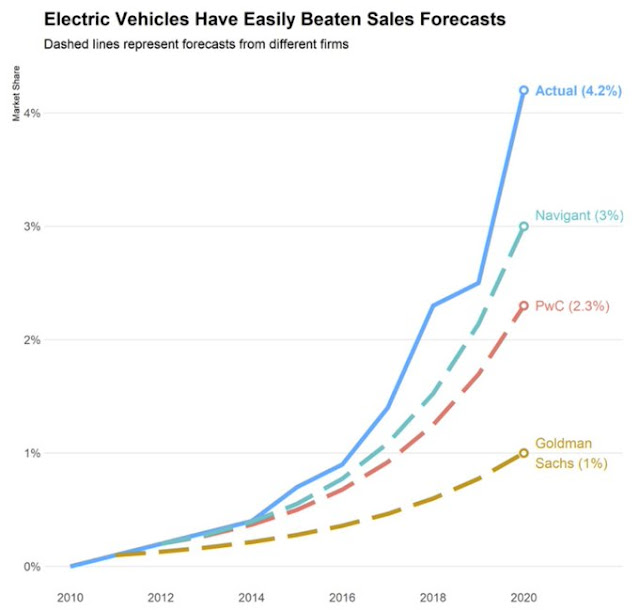

One focus is the auto industry. GM has vowed to produce all-electric vehicles by 2035. Volvo has gone further and promised an all-electric offering by 2030. In fact, EV sales have overrun analyst forecasts.

Rising EV demand means a secular shift from hydrocarbons to a variety of metals – lots of it. Even the CME has gotten into the act by launching a lithium futures contract.

Experienced commodity analysts understand that at relatively small swings in the supply-demand imbalances can create large price swings. In the face of escalating metals demand, the supply of many metals is about to fall into a significant deficit. Take aluminum, just as an example.

Here is copper, which is a key component in wiring, and it is expected to see a structural deficit in the near future.

As the combination of renewable electrification and EV adoption takes hold over the next decade, the demand for metals is expected to explode. That’s bullish for base metals, and for the mining industry.

Metals and mining stocks are perceived to be value stocks. They are about to become growth stocks over the next few years.

Cyclical cross-currents

However, the industry faces a number of cyclical cross currents over the next 6-12 months. The bull case consists of rising cyclical demand as the global economy re-opens after the pandemic. Numerous indicators signal a V-shaped recovery. Job postings have risen to pre-pandemic levels.

IHS Markit reported a spike in global input costs and selling prices. Translation: rising input costs mean commodity inflation.

Global industrial metals PMIs are spiking. Copper PMI shows strength in the US and Europe, but some softness in Asia.

This brings me the key cyclical risk to the metals complex. China is slowing. A year after it engaged in a bout of emergency stimulus, Beijing is pivoting to a policy approach of quality over quantity growth. Credit growth is rolling over.

As a sign of Beijing’s policy tightness, corporate borrowings have been falling. In particular, the borrowings of government-backed SOEs have fallen the most.

In the past, commodity prices have been correlated with changes in Chinese credit. However, investors need in mind the bullish cyclical effects of the global economic recovery as an offsetting bullish factor.

Investment implications

What does this mean for investors?

First, my preferred diversified ETF of choice is iShares MSCI Global Metals & Mining Producers ETF (PICK), which allows the investor exposure to a variety of global and non-US mining companies. As the table below shows, the largest US company on the list ranks fifth in portfolio weight, indicating a lack of choice for American investors in this industry.

From a technical perspective, PICK is in well-defined uptrends, both on an absolute basis and relative to ACWI. In the short-term, some caution may be warranted as it is exhibiting a series of negative RSI divergences as it broke out to an all-time high.

The deceleration in price momentum is probably attributable to weakness in China. Tactically, I am monitoring the following indicators. First, China’s Economic Surprise Index, which measures whether economic statistics are beating or missing expectations, peaked out last summer and has been falling ever since.

The relative performance of the Chinese stock market to ACWI and the markets of China’s major trading partners are all either falling or trading sideways. This is an indication of a loss of economic momentum throughout the region.

Chinese material stocks have been underperforming global materials and testing a relative support zone, indicating weakness in this sector compared to the rest of the world.

These are all signs of weakness in Chinese infrastructure spending. However, the relative strength of PICK to ACWI is an indication that the market expects the other major regions to become the locomotives of global growth. I am also watching China’s credit market. The Huarong Affair is becoming an acid test as the price of its bonds plunged. The key question is whether Beijing will allow an SOE majority-owned by China’s finance ministry to default on its debt. Should the credit markets become disorderly, the authorities will likely resort to their well-tested method of flooding the financial system with liquidity, which would be supportive of commodity prices.

In conclusion, the mining industry is currently viewed as value stocks with cyclical exposure, which is bullish as the global economy recovers. In addition, it is a beneficiary of the coming electric vehicle boom, which is expected to give the industry some growth characteristics. A short-term risk is a China slowdown which dampens commodity demand. Investors should view any fears related to a Chinese growth pause as a buying opportunity.

I believe it. At least in the US, everything seems to be in shorter supply. Anything to do with building a house or something related to electronics seems more expensive or harder to find recently. It could also just

be anecdotal.

As for vaccine distribution, 202 MM administered in the US. 80% of 65+ have received at least 1 dose. On other hand, my locale county has 1000s available appointments now at the mass vax centers. Last few weeks it was almost impossible to get one.

On a personal level, I’m seeing signs of economic improvement. All of my acquaintances (about 4) that were laid off last year have received multiple job offers, two of them are starting their new jobs in June. Crossing my fingers that this keeps getting better.

Thanks for sharing the ground level truth from your vantage point.

And in the UK. Jobs seem to be rebounding well, but there are supply problems and higher prices for parts etc. everywhere.

Bicycles, which are generally sourced from the China and Taiwan, are an example of a product group which is simply unavailable to purchase now, and likely will be until next year.

If one needed another proof that momentum investing works. Ken had mentioned this sector sometime back and PICK in particular!

For globally diversified portfolios, PICK could constitute a component that will add not just overseas exposure, but also cyclical names and a non-correlated asset to a portfolio.

Mining and metals are usually a 20 year cycle and we seem to be in an early upswing that could be a decade long cycle in front of us. The previous cycle peaked out about a decade ago.

Lithium, Copper, Cobalt etc. are at the heart of these, and BHP is the grand daddy of them all.

Welcome to my world, the Canadian world of resource investing which is great fun when the stars align as they now appear to be doing.

Here is a chart of several key mining ETFs rebased to the first correction low in early February (keep it, it updates daily).

https://refini.tv/3sluTAc

As Cam mentioned, there are few American mining stocks so they can do better than PICK when (and it is very rare) American investors discover mining stocks. XME is the American Metals and Miners ETF.

For high octane investing, COPX the Copper Miners ETF will give you thrills and a rollercoaster ride than makes Bitcoin look tame.

The Lithium ETF LIT, is a rollercoaster ride that went off the rails. It peaked and plunged when the Innovative Growth stocks peaked in mid February. My guess is the ARK and Robinhood crowd got supper excited about Clean Energy (which has also crashed) and Lithium got way to high. But who knows, maybe this is an opportunity. My approach is momentum and LIT doesn’t qualify. BTW Lithium is one of the most common elements on earth.

One big problem about buying individual stocks in international mining is the surprise political problems. Once the industry starts making big money, poor countries where mines are located, put on big taxes or find ways to steal the mine and give it to their cronies. A reason possibly to own the US XME.

The thing about mining profits is that they go up exponentially with metal prices. If your cost is $2.00 a pound to mine copper and the price goes from $2.50 to $4.00, your profit margin goes up from 50 cents to 2 bucks or 4 times. Also, your resource base in the ground goes up big time with higher prices since ore in the ground goes from uneconomic to very economic. A mine life might go from 5 years to twenty and justify a big mine expansion with higher earnings. Also technology is transforming mining from robotics to self driving mining trucks to make it more profitable.

A secular resource cycle can be great fun. I took one client in the 1970s from $50,000 to $1.4 million in five years as a new stupidly confident and believing stock broker in that resource boom.

Lithium is not in the top 10 elements on earth. It is considered comparatively rare. This is based on my search on Google. You might be thinking about some other element.

I own LIT, ALB, SQM for metal and mining exposure to batteries used in BEV, Energy storage, etc.

Sorry, totally right Ravindra, Lithium is in so many things but in minute amounts.

No worries! By investing in bigger Macro trends, I have learned to ride the roller coaster. These trends last for a longtime and can be very profitable. I believe Renewable and Clean Energy are in early innings. There is both policy and investment tail winds. It is not value by traditional definition but if one considers the growth potential, it is value investing to boot.

Food for thought.

https://www.mauldineconomics.com/frontlinethoughts/tsunami-warning

I haven’t kept up with Mauldin after he remained bearish in the face of the first wave of Fed stimulus in the early 2010s. Is he still a perma-bear?

John Mauldin has been a “the world is going to end” prophet for decades, partly in support of the absolute return strategies (hedge funds) that he is marketing.

To complement PICK, let’s add PAVE.

PAVE is an absolute beautiful momentum ETF mathematically with a very true simple narrative, the US needs massive infrastructure spending and it WILL happen. That is the combination I seek out. PAVE is the best way to access that future. I can stay with it confidently as long as it keep outperforming. Thanks Ingjiunn for pointing it out. It’s a star in my momentum work.

The infrastructure bill under consideration may not be as stimulative as the headlines imply. Roughly 20% is traditional infrastructure spending over eight years. Much of it maybe priced in, limiting further gains.