Mid-week market update: How should investors and traders react to the recent stock market weakness? The bears will argue that the S&P 500 spiked past a trend line resistance and fell back, which is an indication of bullish exhaustion. Moreover, the 5-day RSI recycled from an overbought condition to neutral, which is a tactical sell signal. The logical initial downside target is the 3840-3900 zone, which represents about a 5% pullback.

The bulls will argue that the bull trend remains intact. The S&P 500 is rising steadily in a channel, and the recent pullback is just a bull flag, which is a bullish continuation pattern. The market can go higher.

This is where the interpretative part of technical analysis comes in.

Bearish market internals

A more detailed analysis of the market internals favors the bear case. Equity risk appetite is turning negative. The equal-weighted ratio of consumer discretionary to consumer staple stocks is falling. As well, the ratio of high-beta to low-volatility stocks has been exhibiting a negative divergence since early April.

The relative performance of defensive sectors to the S&P 500 is starting to perk up, which I interpret as an equity bearish signal. The real estate sector has staged an upside relative breakout, and utilities are pressing up against a key relative resistance level. The other two defensive sectors, healthcare and consumer staples, are tracing out patterns of rounded bottoms on their relative performance charts.

What to avoid

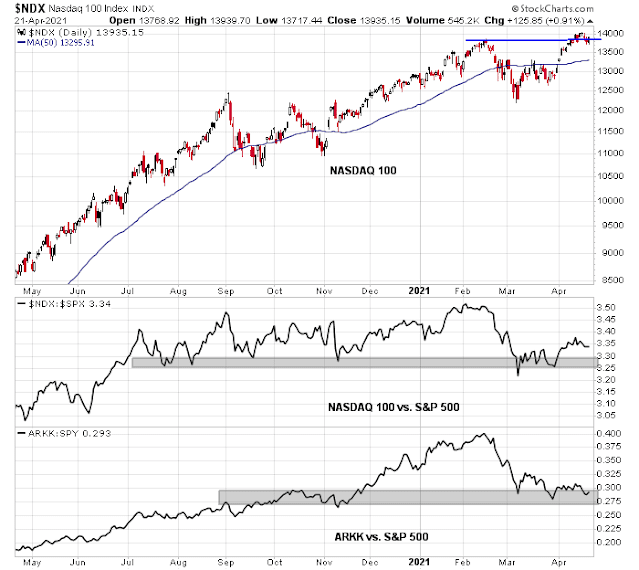

Instead of focusing on what to buy, I will focus on what to avoid for traders who want to take tactical short positions. The primary short-sale candidates are NASDAQ and growth stocks. The NASDAQ 100 is testing a key support level. The relative performance of the speculative and high-octane ARK Innovation ETF (ARKK) to the S&P 500 is extremely weak, indicating a lack of momentum in growth stocks.

I interpret the recent NDX strength as a counter-trend rally as a minor hiccup in the recovery in value/growth performance.

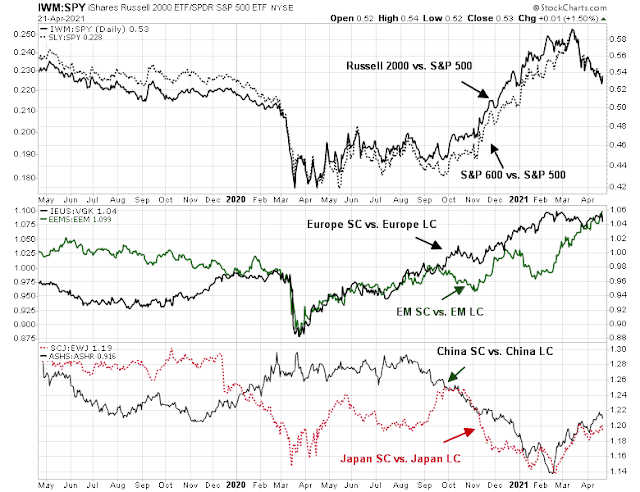

While the small-cap to growth stock ratio remains favorable for small-caps in the long run, traders should also expect further tactical underperformance of small-cap stocks. The small-cap rally became overextended in early 2021 and the Russell 2000 to S&P 500 ratio flashed an overbought reading on the 14-day RSI indicator. Wait for an oversold or near oversold condition before buying small-cap stocks.

However, I would expect small-cap relative weakness to be only temporary. An analysis of the size factor through a global lens shows that small-caps are either leading or flat with their large-cap counterparts in the other major regions of the world.

In conclusion, the stock market is starting to exhibit corrective action. My base case scenario calls for a downside target of 3840-3900 on the S&P 500, which represents about a 5% pullback. Pockets of vulnerability are NASDAQ growth stocks, and small-caps, which I expect to underperform during this period of market weakness. Today’s rally was no surprise, breadth readings had become oversold as of last night’s close but any bounce should be temporary.

Thanks, Cam. I’m in agreement with the pullback scenario, which would of course be a bullish development insofar as any sustainable rally requires corrections along the way.

It’s unusual to see indexes near ATHs when so many individual stocks are already in bear markets. Sentiment is unlikely to turn (sufficiently) negative until the higher-weighted large caps begin to significantly correct as well.

Based on closing prices for RYGBX/ RYPMX/ VTSAX/ RYZAZ/ VEMAX/ RYEIX – I would have done much better holding all positions another day. Or had I simply opened all positions a day later. There’s really no rhyme or reason as to when I hit a solid line drive or end up being early or late. Sometimes it works out (I bypassed both corrections last September and October, and again this January and February), and sometimes it doesn’t (multiple occasions when I’ve been off by a day or two). We don’t need to bat 1.000 in the trading game to come out ahead.

Yesterday we were oversold, and I’m guessing that today we’re overbought. At least that’s how it feels.

Canaccord’s Tony Dwyer expects a 10% pullback. Cam had outlined a 5-10% pullback earlier. JPMorgan’s Kolanovic wrote yesterday:

“Our view is that the reflation and reopening trade will resume, with yields moving higher and rotation from growth, quality and defensives to value and cyclicals,” Kolanovic wrote. “Beneficiaries will include Energy, Financials, Materials, Industrials, small caps, high beta stocks, and various reopening and inflation themes.”

Same facts and data, different outlooks. I interpret it as a near term pullback with a resumption of cyclical leadership.

Surprisingly, high growth potential stocks had a rip your face off rally today!! What does that tell us?

Sell in May and go away?

The market has been front-running the April strength, so if you are expecting weakness in May, maybe some investors will be trying to front-run that too.

Based on this post, I sold qqq,vgt,vug and viov in the premarket. Of course, they are all up at noon. I didn’t sell any of them at a big discount from the previous close and I made decent money on all but viov, so I really can’t complain. But, I’d like to improve my technique and make better selling decisions so as to leave less on the table. Any thoughts?

Vantage points can change on a dime.

I know, I’m feeling better about my decisions after Biden’s surprise announcement of his intent to raise cg taxes on high income individuals.

FWIW the Canadian capital gains taxes system makes for fewer political fights up here. You keep 50% tax free and the rest gets taxed at income rates, which is progressive. No one-year holding requirements either though if you trade too much they may assess you as a trader and tax it all as income.

Support for the value thesis:

https://apple.news/AdKq3KC-iRASIJebgaF6Apw

Beautiful call by Cam!

XLE/ KRE/ PICK.

VIAC/ DISCA/ IQ/ PLTR/ NIO.

Flip trades, if they work out.

GDX/ GDXJ.

RIOT.

COIN.

JETS.

Out of all positions. That’s all it takes to make my day.

If we close at the lows, then opening in the hole on Friday might be a decent set-up.

GDX/ GDXJ have pulled back from opening spikes to what may be attractive entry points.

QQQ has basically retraced its entire -10% drop in March.

I think my investment horizon is longer than yours, which may partially explain why I no longer think QQQ is a particularly good investment. The 50 day sma of obv has been in a decline for the last 2 months even as the stock was moving up. I htink this divergence presages a decline in the stock. Also, the 50 day sma of the ratio of qqq to spy has been in a decline for the last two months, so it is no longer outperforming spy as it has done for quite a number of years. On a shorter term basis, MACD has turned down and the MACD histogram is barely positive at 0.048. It may make a comeback and if it does, I’ll change my opinion, but for the moment, I am looking at other opportunities.

All positions off. Minimal gains.

Reopening positions in NIO/ PLTR/ QS/ VIAC/ DISCA/ IQ.

All positions off. Minimal gains. (Posted under wrong thread earlier.)

Cam-Do you think this is a snapback rally, or has your opinion changed as to the course of the market? If not a snapback, I really need to get my money back to work.

Snapback rally. More detailed comments this weekend.

rxchen2- I looked at all the positions you opened in your last post above and they were all in stocks which had suffered recent large declines. Is that your general strategy or do you invest in stocks in a long term uptrend as well? Would be very interested to see a post outlining your investment strategy.

Regards,

Nothing esoteric.

The stocks listed above are companies I wouldn’t mind owning over a longer term (ie, longer than a few minutes!). However, as you stated they’ve all sold off hard, and until proven otherwise I assume they will continue to sell off. Basically, they’re all undergoing brutal bear markets. Under those conditions, I abstain for using a buy-and-hold strategy. Why? I don’t like losing money! However, I also know that the most violent rallies occur in bear markets, and so it’s possible to capture sizable gains during brief periods of upside momentum. I keep the symbols on a watch list and if I’m fortunate enough during the day to notice spurts of upside momentum – even better, if I’m fortunate enough to witness the kind of panic selling that took place yesterday where traders simply want out – then I’ll open positions with the intention of a quick flip. In general, the shorter my anticipated holding period, the larger the position size. IMO, trading is an art and not a science. If fundamentals and technical analysis were sufficient, then everyone would always be on the same page and any edge would be immediately priced in.

That said, I’m only a day trader right now by necessity. I prefer swing trades that last weeks to months to years. Given the chop we’ve seen in April, what else can I do? Day trading beats watching your positions go up one day and then back down the next. Far better to lock in each day’s profits and then try to repeat the process.

By the way. I read somewhere recently that mutual fund inflows over the past five months eclipses the inflows over the previous twelve years. Sure, we can take advantage of the inflows as they squeeze the market higher, but IMHO this is not the time to be long and strong (as it was a year ago).

Let me amend my last statement. We only know in hindsight that last April was the time to go all in. No one had a clue what would ultimately transpire (a doubling of the SPX in a year’s time). So the appropriate stance last April was in fact to be cautious, and then to become aggressive only as the market showed its true intentions.

Even then, it’s necessary to scale in, or to wait for pullbacks. I allowed myself to get carried away at one point last summer, when I made a strong bet

on June 8 – just in time for a -7% decline the following week. An emotional response on my part (I’m a guy who hates to chase). It happens – we’re all human. I eventually recovered, with above-average profits over the past several months.

I’m looking forward to hearing what Cam has to say this weekend. He has a unique approach to the markets.

Thanks for your reply, it was very informative. April has been a difficult month and your approach makes eminent good sense in choppy markets. I wish I had the time during the day to do what you do but unfortunately my job doesn’t permit it. I wish you continued good luck in your trading venture!