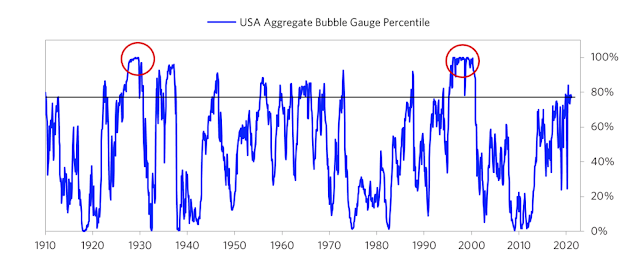

Is the US stock market in a bubble? Yes and no, according to Ray Dalio of Bridgewater Associates. Using a proprietary technique to create a “bubble indicator”, Dalio concluded that “the aggregate bubble gauge is around the 77th percentile today”, compared to a 100th percentile reading in 1929 and 2000.

Dalio qualified his analysis with some parts of the market are indeed very bubbly, but others are not.

There is a very big divergence in the readings across stocks. Some stocks are, by these measures, in extreme bubbles (particularly emerging technology companies), while some stocks are not in bubbles.

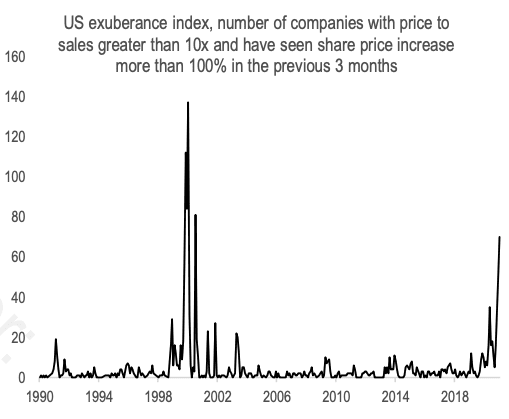

Credit Suisse came to a similar conclusion with their US Exuberance Index. The number of companies with price-to-sales over 10 have surged, but readings are not at the levels seen during the dot-com peak.

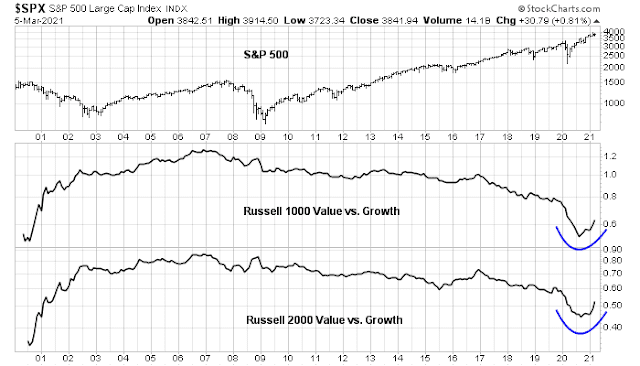

At the same time, the market is undergoing a secular shift from growth to value. Here are some important implications for investor portfolios in the next market cycle.

A (sort of) frothy market

While the US equity market is looking frothy, the amount of exuberance is limited to certain parts of the market. Bridgewater calculated the required earnings growth rate for stocks to justify current bond yields, and found levels are at the 77th percentile of historical observations.

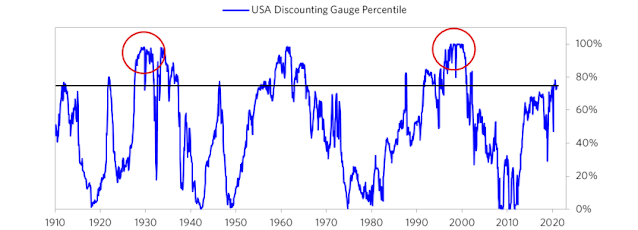

While the exuberance during the dot-com era permeated all parts of the market, the enthusiasm has been largely limited to the public pricing of equities. This time, corporate management is not responding with capital spending and M&A plans based on sky-high expectations.

One perspective on whether expectations have become overly optimistic comes from looking at forward purchases. We apply this gauge to all markets and find it particularly helpful in commodity and real estate markets where forward purchases are most clear. In the equity markets we look at indicators like capital expenditure—whether businesses (and, to a lesser extent, the government) are investing a lot or a little in infrastructure, factories, etc. It reflects whether businesses are extrapolating current demand into strong demand growth going forward. This gauge is the weakest across all our bubble gauges, pulling down the aggregate read. Corporations are the most important entity in terms of driving this piece via capex and M&A. Today aggregate corporate capex has fallen in line with the virus-driven hit to demand, while certain digital economy players have managed to maintain their levels of investment. Similarly levels of M&A activity remain subdued so far.

P/E compression ahead

In light of the secular rotation from growth to value, here are some important market implications for investors.

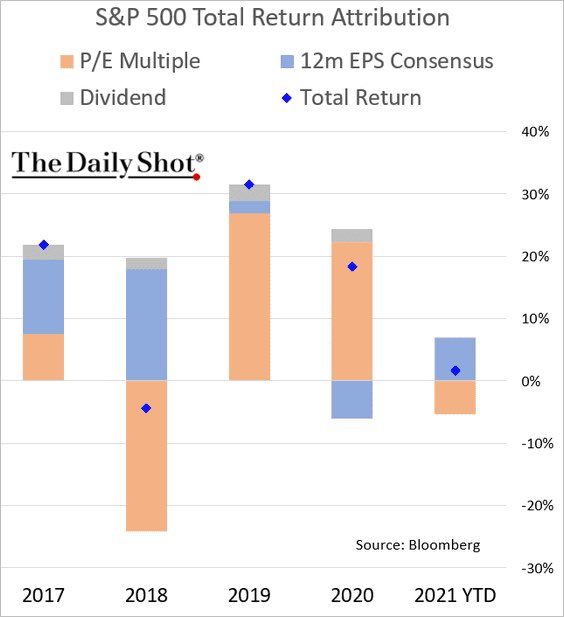

First, get ready for P/E compression. The analysis of the S&P 500 for YTD 2021 shows that gains were attributable to rising earnings expectations, while P/E ratios fell.

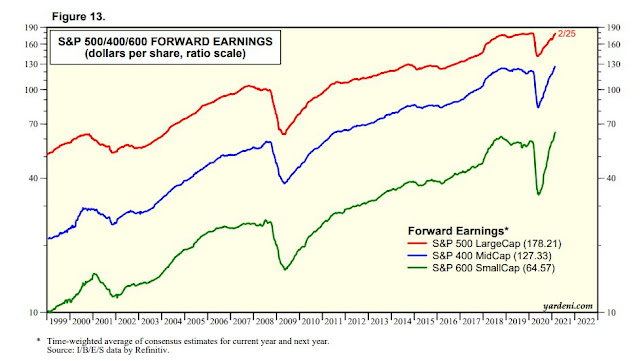

Fortunately, forward earnings estimates have been rising steeply across all market cap bands, with small caps the strongest of all.

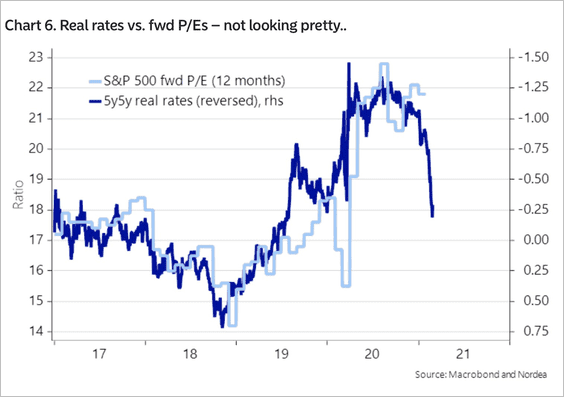

On the other hand, forward P/E are likely to compress as inflation expectations rise. However, investors need to distinguish between reflationary forces, which are reflective of positive real economic growth and equity bullish, and inflation, which leads to central bank tightening and equity bearish. As I pointed out last week, the current tactical narrative is reflation (see

Will rising yields sideswipe equities?).

For investors, this has a number of important portfolio positioning implications.

- Avoid the high-flying growth bubbly growth stocks.

- Focus on the value parts of the market.

- Focus on the parts of the market exhibiting better earnings growth, such as mid and small-caps.

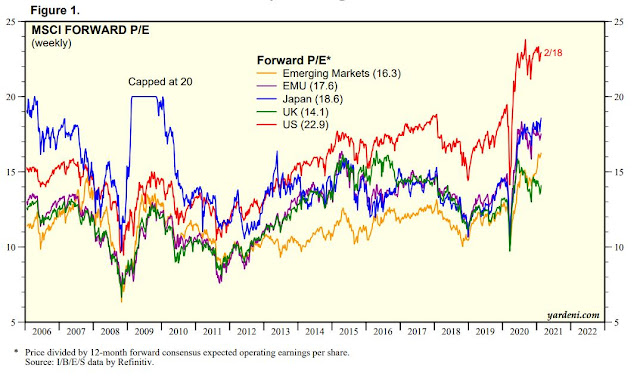

- Focus on non-US markets, which are trading lower forward P/E ratios than the US. With Big Tech comprising nearly half of the weight of the S&P 500, the US P/E premium to the rest of the world is becoming overly stretched and due for some mean reversion.

Portfolio construction: Structural changes in stock-bond correlations

The other portfolio implication is the changing nature of the stock-bond correlation. In his latest

letter to Berkshire Hathaway shareholders, Warren Buffett warned about the current level of yields and joined the chorus about the “bleak future” for fixed-income investors.

And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.

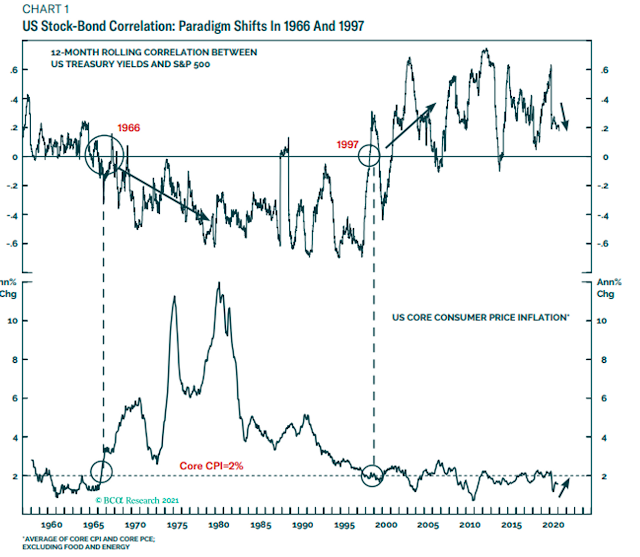

As inflationary pressures heat up in the next market cycle, the low to negative stock-bond price correlation experienced since the late 1990’s is going to change. (Note that the chart below shows stock to Treasury yield correlation, and bond prices move inversely to yields).

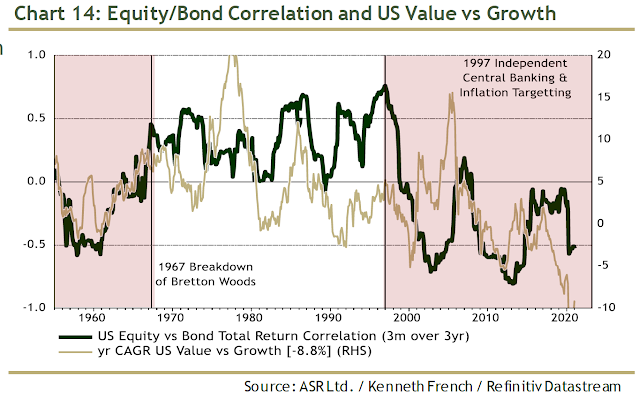

If history is any guide, the shift from growth to value will also mean a rising stock-bond correlation.

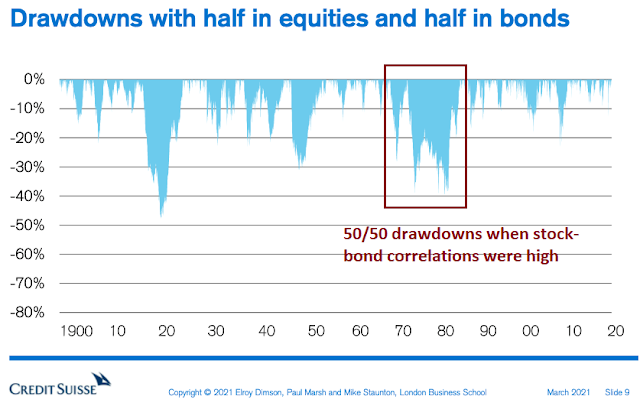

This has important considerations for portfolio construction and investment strategy. No longer can investors expect a low or negative correlation between stocks and bonds. While fixed-income holdings will still be diversifying in a balanced portfolio, they are far less likely to act as ballast if stock prices fall. Investors holding the traditional 60% stock and 40% bond portfolio should therefore expect higher volatility. The latest historical study from Credit Suisse shows that the drawdowns from a 50/50 portfolio were significantly higher during the period of high stock-bond correlations.

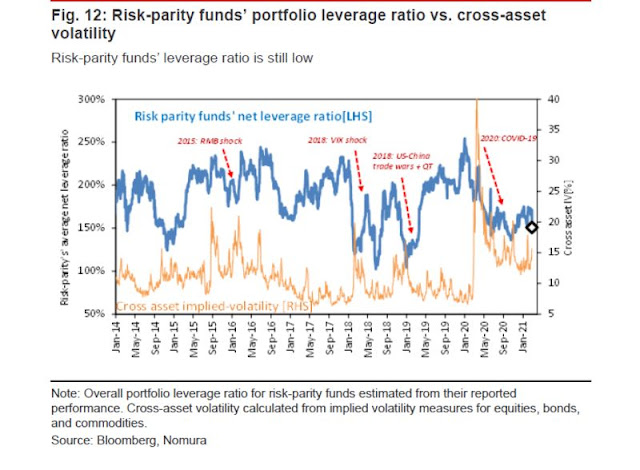

In addition, the underlying assumption of portfolio strategies that depend on low and negative stock-bond correlation such as risk-parity will face considerable difficulty.

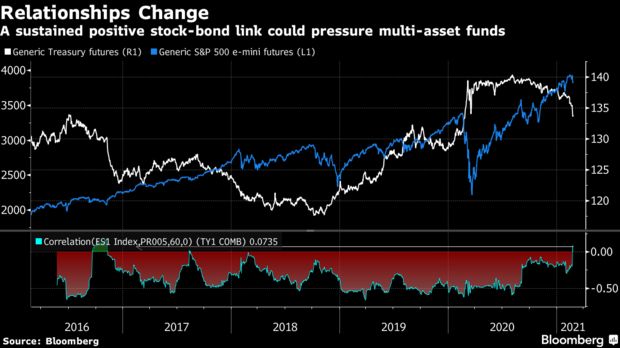

Bloomberg recently documented the headwinds faced by risk-parity funds.

Risk-parity and other volatility targeting strategies employ leverage to achieve their risk-adjusted returns. While current levels of leverage are relatively low and lessen the risk of a disorderly unwind of positions, the longer-term outlook for such strategies depends on assumptions about asset return correlation that may not exist under a regime change scenario.

Accounts that invest in such strategies should re-evaluate their long-term commitment to such funds.

In conclusion, a secular rotation from growth to value isn’t as simple as it sounds and has important implications for investor portfolios. From a stock selection perspective, investors should:

- Avoid the high-flying growth bubbly growth stocks.

- Focus on the value parts of the market.

- Focus on the parts of the market exhibiting better earnings growth, such as mid and small-caps.

- Focus on non-US markets, which are trading lower forward P/E ratios than the US. With Big Tech comprising nearly half of the weight of the S&P 500, the US P/E premium to the rest of the world is becoming overly stretched and due for some mean reversion.

From a portfolio constructive perspective, investors should be prepared for rising stock-bond correlations. While stock and bond holdings will still be diversifying, balanced portfolios with are expected to experience higher overall volatility, and volatility targeting strategies such as risk-parity will be less effective in achieving their objectives.

Here is an interesting story which relates to shifting from Innovative Growth to Value.

CalPERS, the California Pension fund and one of the biggest in the world in the 2000 fired all the outside money managers they were using who had outperformed in the year 1999. There reasoning was simple, if a manager did well in the Dot.com mania, they were bad investors. It was a brilliant move that paid off for them.

The same could be said regarding last year. If a money manager did well in 2020, they are too risk oriented and technology concentrated. They aren’t going to do well in normal markets going forward.

Start by firing Cathy Wood at ARK.

Fire Cathie Wood? That sounds unnecessarily harsh, Ken. I don’t know much about Wood or her fund, but based on the little I’ve read I’m confident she’s pretty sharp and will navigate her way out of this current (and future) setbacks. That’s what good managers do. I can recall Warren Buffett, Bill Miller, Steve Jobs, Larry Ellison and countless other CEOs/fund managers taking heat at low points in their careers – but setbacks are a part of life and people like that tend to prevail over time. Not saying Wood is necessarily in that class – but to get to where she is takes the right stuff and we have to respect her accomplishments.

Ken: “The same could be said regarding last year. If a money manager did well in 2020, they are too risk oriented and technology concentrated. They aren’t going to do well in normal markets going forward.”

I find this statement to be an indictment of investors who believe that future growth of the economy, advances in crucial areas of climate change, health, reducing inequality, education, transportation etc. etc. are going to come through innovation, research, and technological changes. Two recent examples to illustrate:

1. Covid-19 vaccines. From the moment the virus was sequenced to the first shot in the arms was within 365 days!! No one thought it possible. Technological advances were the ‘disrupters’.

2. Battery/Hydrogen fuel technology. Rapid advances are providing the capabilities to phase out use of internal combustion engines in new cars in 20-30 years.

It is messy in the beginning. Many new participants enter. Not all succeed.

Predicting poor performance in normal markets? I think it is a bit audacious. What we consider disruptive today becomes normal in a few years. Robotic surgery was disruptive 15 years ago, it is common place today.

I think there is a catch-up trade but only that. People will not go out twice as much to eat, travel twice as much when it returns to the new normal. Movie theaters may never get back to old days. Cruise lines may take a long time. The psyche of people has changed in ways that is not well understood.

I admire people of Carhie Wood’ ilk. They lead so we can follow to a better future.

Sorry, correct spelling is Cathie, not Carhie.

The same could be said in the year 2000 when CalPERS made their bold move. The internet WAS going to have a profound impact and grow amazingly and YES Cisco was going to grow for twenty more years at a rapid rate. BUT the stocks of even great companies were way too high and did poorly for a decade.

So the idea and the starting valuation is important.

You’re making too many assumptions, Ken.

(a) CALPERS firing all of the outside managers who had outperformed in 1999 was a brilliant move? How do we know? Perhaps CALPERS would have shown a better return had they retained the same outside managers.

(b) You also assume that managers who outperformed in 1999 were ‘bad investors.’ How do we know? They had a great year – let’s give them credit for that. Those managers may have been the type to quickly capitalize on what was working in 1999, and then pivot to a different portfolio composition when it stopped working -that’s the very definition of a good investor! In other words, you’re assuming little to no changes in their portfolios. I would be interested to know how those managers performed going forward – especially in comparison to the managers who replaced them at CALPERS.

(c) Finally, how did the underperforming managers perform going forward? Obviously, they underperformed – but by how much? If they all missed the boat, are they really the guys you want to take over? In my experience, underperformers tend to…underperform! In other words, are you going to hire winners or laggards?

(d) By the way. CALPERS itself seems to have a management problem.

Cathie Wood is a winner who’s having a bad quarter. A lot of quarterbacks have bad stretches. But I always give winners the benefit of the doubt.

I just checked out the performance of ARKK since inception. Wow! I don’t about you, but if I were an investor in her fund I would be quite pleased. I don’t think anyone would consider firing Cathie Wood a ‘brilliant’ move.

Ken’s statement needs qualifications. He is not critical of Cathy Woods, the way I read his comment. He is simply saying ARK funds have become too expensive and one should be careful with them. Valuations matter. I saw this movie being played out in year 2000 in the Naz and we see it being played out in a smaller scale in the ARK arena.

Furthermore, I find a PE ratio of 34 and PEG ratio of 2.9 on MSFT expensive or an AAPL with 27 and 2.36 respectively. It appears that overvaluation is not limited to just ARK funds.

D.V. that is exactly what I am saying.

After 2000, portfolio managers that had been swept up into the craze and did great in 1999 I would bet had terrible performance for many years.

Let’s look at 2020 with the S&P up 16% during an economic depression. If a portfolio manager did 20% let’s say, what kind of portfolio would he have had? It would have to been a number of the high fliers in the NASDAQ that soared over 40%. I don’t think those managers are owning Banks and other Value stocks that could outperform for years. It’s almost impossible to switch from one narrative to another when you have had great success in the old winners.

I think we’re underestimating portfolio managers.

(a) They’re smart guys. I honestly don’t believe most of them held losing stocks for very long. They’re active managers, and generally succeed because they have the ability to navigate a downturn. There will be a few who were MANDATED to hold stocks within a certain sector, and were thus unable to let’s say transition out of technology stocks and into bank stocks.

(b) I also don’t believe that Cathie Wood’s intention is for anyone to invest their entire stake in her fund. It’s very specialized. She would probably recommend to any potential investor to allocate a maximum of x% to her fund, and explain clearly the risks.

All I’m saying is that to recommend firing her for doing an excellent job at running a fund that is intended to invest in disruptive companies is nonsensical. She’s clear about her goals. And has wildly succeeded at achieving them. If one were to approach her and ask why she hasn’t pivoted to banks and metals, well hey – she’ll probably tell you straight out that’s neither her forte nor the intended purpose of her fund. She’s good at what she does. She’s not a market timer.

MSFT under-reports its profits deliberately using various accounting tricks. It is cheaper than it looks.

The context to what happened in 2000 is crucial. Most companies crashed, some more than others. Many disappeared. But many survived and grew. Bookings(Priceline), Amazon, Google, to name a few. Good Managers change. If not, people move on.

Is 2000 phenomenon a raison d’etre for investing in lower p/e stocks now? Many ‘value’ stocks have high p/e based on the assumption that earnings will catch up. What’s so different for growth stocks?

Ken:

“If a portfolio manager did 20% let’s say, what kind of portfolio would he have had”?

The 20% returns is meaningless without knowing what kind of risk underlies such a portfolio. This a trick question!

You get my point about Kathy Woods. She has done a great job of putting together several excellent portfolios. It would be good to buy her portfolios after correction of 80-90% (like the NAZ, last decade).

Nothing goes up in a straight line!

Dalio’s Bridgewater Associates, a risk-parity pioneer, famously pared nominal bond exposure last year to shift to inflation-protected notes and gold on fears that government debt would no longer be an effective hedge against equities.

Did this move to gold work out, now that real rates are moving away from being less negative?

Thanks, Cam. Given the new ‘no place to hide’ scenario, I’m considering a 60/40 portfolio allocated to Cash/Value. The 60% in cash will be deployed at opportune inflection points (such as yesterday’s turnaround in the QQQ), while the 40% in value provides the volatility (price movements) needed to capture upside (and downside) on a daily basis.

Cash is a highly underappreciated asset. That’s understandable if one is a fund manager. After all, what do you tell clients – you’re paying me a fee to hold your cash in money market funds? Yet cash is what allowed me to survive the 2000 downturn (with a hat tip to Bob Brinker for getting me out in May), the 2008 downturn (I recall debating to no avail on the Bill Cara blog that cash would outperform precious metals), and the 2020 downturn (thanks to you!).

(If I were a fund manager, I would tell clients ‘You’re not paying me to hold cash – you’re paying me to tell you when to hold cash, and when to use it.’ Similar to a plumber who charges $300 for a 5-minute fix. ‘You’re not paying me to replace the bolt. You’re paying me for figuring out that’s what you needed.’)

As Kass often points out – cash is not trash! The portfolio is up +15% since the end of last September, and if it’s still up +15% at the end of this September I’m OK with that.

Given the recent spike in yields, does anyone know where Shiller’s ECY (excess CAPE-yield) stands today?

Increasing bond market yields are not good for what Prof. Shiller was talking about

Hi Cam, for fixed income what alternatives are more attractive than bonds for the upcoming new era?

I can’t see having more than 15% in cash. Precious medals? Real estate? Would be curious about your general thoughts. I use bonds as ballast and for zero tax income (local state bonds).

I haven’t done the study but a logical replacement for bonds is inflation indexed bonds.

Inflation indexed bonds are an income proxy?

1. Calpers has done nothing the last 20 years. The problem is not fund managers. It is the size. Last year the bulk of the return comes from fixed income side of it, thanks to the Fed. This year (still early) is shaping up to be a very bad one for Calpers at this moment. I think it can just employ auto-pilot algo-driven methodologies and will have better return.

2. ARK is suffering from market mechanics and the funds’ prospectus requirements, but the fundamental strategies are sound. Just one problem: AUM size. It happens to everyone. Eventually the laws of big numbers come into play, especially for funds like ARKs who are focused on only a handful of stocks. For small investors you don’t need to buy ARK etfs. Instead you can research the fund holdings and come up with candidates. Add some TA and you will be better off than 99% of all investors.

I’ve known very successful individual investors using Fidelity select funds as starting points and add technical analysis to trade/invest in individual names and profit. Let big guys do the fundamental research for you and then you use TA to see how money flow looks like to set your moves. All the info to succeed is there, for free. You just have to incorporate into your own strategy.

3. Perhaps it is also a good idea to talk about available investor money and available vehicles in the markets and investor behaviors and algos. There is just too much money for investable vehicles, plus time compression. That implies that price movements will continue to be sharp in either direction. I personally like this style. 10 years ago it would take the whole year to get a return now achievable in 2-3 months. Plus the correction is very quick. So there is no need (actually not advisable) to chase returns. You will have your opportunities very often. Repeat and repeat and you are there. The world is different now. Forget 60/40 to achieve lower portfolio volatility. That is lazy thinking.

Value ETF ‘VLUE’ is frequently quoted. I looked at the top 10 businesses representing roughly 36% of the assets.

Trailing P/Es are as follows:

INTC. 12.3

T. -39

MU. 37.4

GM. 12.4*

IBM 19.6

TGT. 22.9*

CSCO. 19.6

C. 15.4*

F. -38

PFE. 27.4

There are few businesses here that are promising (*). Many of them have lagged due to poor management and inability to shift business model. I would not bet on them for secular growth in coming years.

Please share PEG (not just PE), to make this analysis meaningful.

I will be happy to buy AMZN with PE of a million, but PEG of say 0.1, any day. Thanks.

You guys should learn to wait for the Sunday post to comment.

Saturday is old news after one day.

If you comment on Sunday, on the other hand, people are forced to wade through your pearls of wisdom all the way to Wednesday market close.

Too funny, len!

Agree!