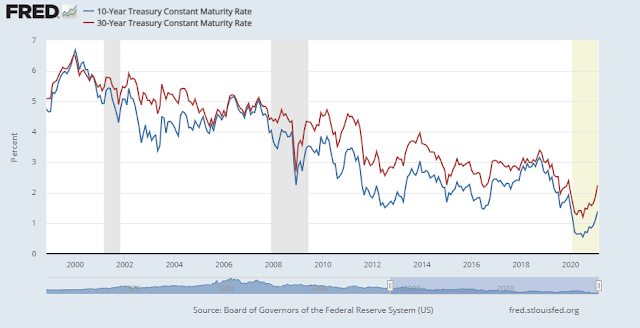

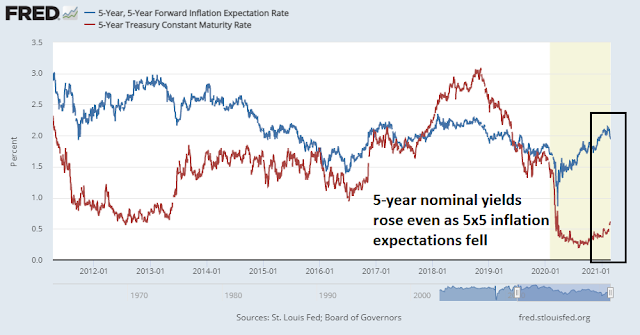

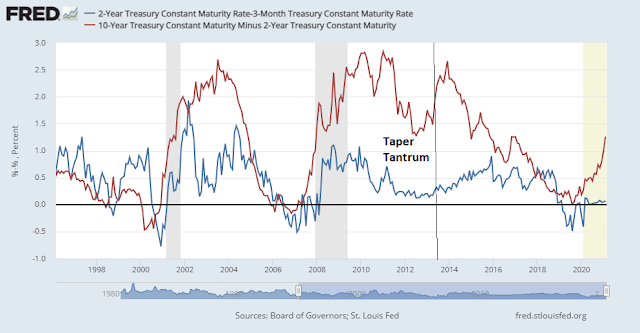

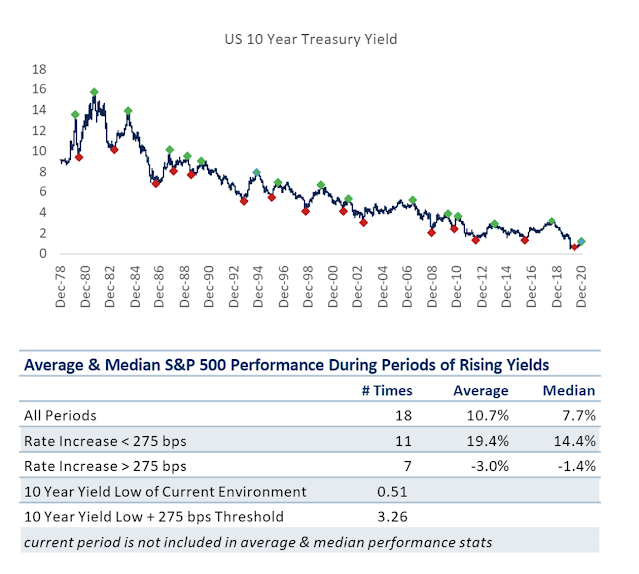

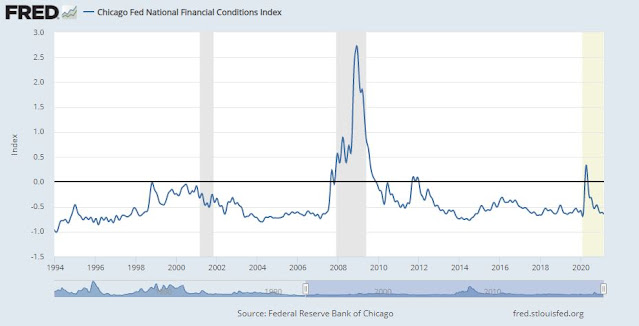

Jerome Powell’s Congressional testimony last week made the Fed’s position clear. Monetary policy will remain easy for the foreseeable future. Inflation dynamics change, but not on a dime. While Fed policy will leave short-term interest rates anchored near zero, the market’s inflation expectations have been rising. Last week, the 10-year Treasury yield briefly breached 1.6% and the 30-year Treasury yield rose as high as 2.4%.

Reflation, or inflation?

If interest rates are rising on the heels of reflation and real growth, that is positive for risk assets. In the last few decades, when interest rates have risen, it has been due to real growth. The markets have shown they are willing to tolerate the Federal Reserve’s suppression of interest rates in such a scenario.

But if interest rates are rising because of faster inflation, then that is not good for risk assets. All else being equal, inflation depresses real economic growth and earnings as purchasing power dwindles. During the inflationary period from 1966 to 1982, stocks lost 65% of their real (after-inflation) value as inflation raged. These real losses were not recouped until the mid-1990s. Inflation has not been a problem since the 1990s.

Here comes the YOLO recovery

Australia and New Zealand’s success in suppressing Covid-19 — outside isolated flare-ups — has sparked a snap-back in household and business sentiment, spurring activity and hiring and laying the ground for a sustained recovery. With vaccines being rolled out across the developed world, the prospect of a return to normal is tantalizingly within reach.

Households Down Under are cashed up due to government largess and limited spending options during their respective lockdowns. That prompted Aussies and Kiwis to salt away funds, freeing up room to consume.

“Substantial fiscal boosts, combined with an internalization of spending has driven a sharp rebound in spending by households in Australia and New Zealand,” said James McIntyre of Bloomberg Economics in Sydney. “Rising asset prices are delivering a further boost. But both economies could see recoveries whither as fiscal boosts fade and borders reopen.”

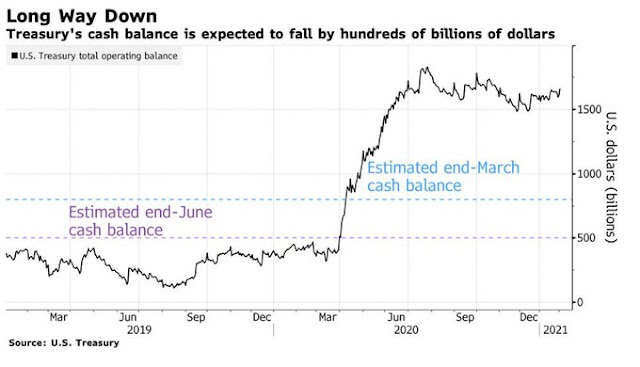

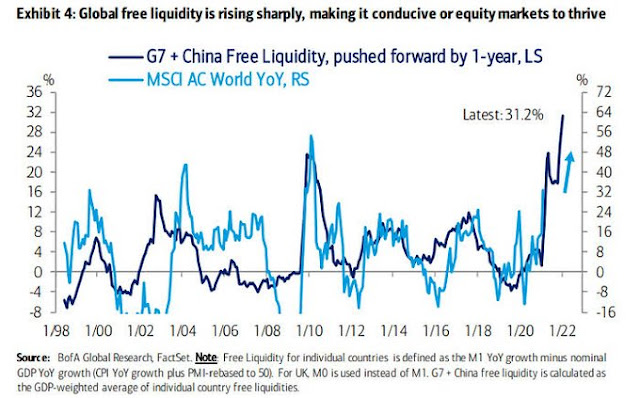

The Treasury’s decision — unveiled at its quarterly refunding announcement — will help unleash what Credit Suisse Group AG analyst Zoltan Pozsar calls a “tsunami” of reserves into the financial system and on to the Fed’s balance sheet. Combined with the Fed’s asset purchases, that could swell reserves to about $5 trillion by the end of June, from an already lofty $3.3 trillion now.

Here’s how it works: Treasury sends out checks drawn on its general account at the Fed, which operates like the government’s checking account. When recipients deposit the funds with their bank, the bank presents the check to the Fed, which debits the Treasury’s account and credits the bank’s Fed account, otherwise known as their reserve balance.

The flood of liquidity will have several effects. First, it could push short-term interest rates below zero, as Treasury has fewer needs to issue Treasury bills as it draws down its cash balance at the Fed. Watch for the Fed to announce that it will raise the rates it pays on excess reserves (IOER) to offset the downward pressure on short-term yields. If it does, don’t misinterpret this as tightening. It is only a technical change to the plumbing of the money market to prevent short-term rates from going negative.

The next question is what will happen to the billions as Treasury injects cash into the banking system. A rising tide lifts all boats, and undoubtedly some of the funds will find a home supporting consumer spending, and some will support stock prices. This development should be net equity bullish.

Here comes reflation.

Reflation is equity bullish

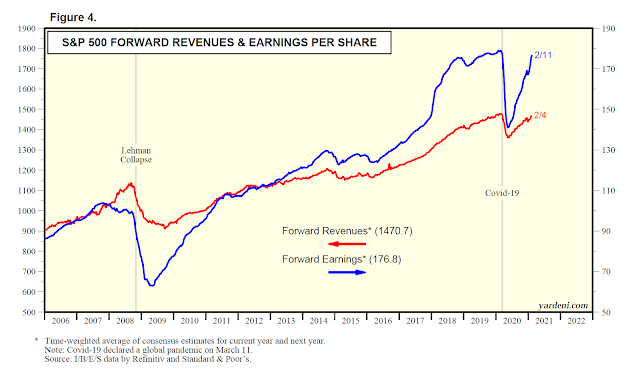

In the short-run, reflation is dominating the fundamental narrative. During the initial phase of an economic recovery, both earnings estimates and bond yields rise together. Equity prices rise because the bullish effects of rising earnings estimates overwhelm the bearish valuation effects of rising yields. Indeed, Ed Yardeni pointed out that forward S&P 500 revenues and sales are enjoying a V-shaped recovery.

When does the party end?

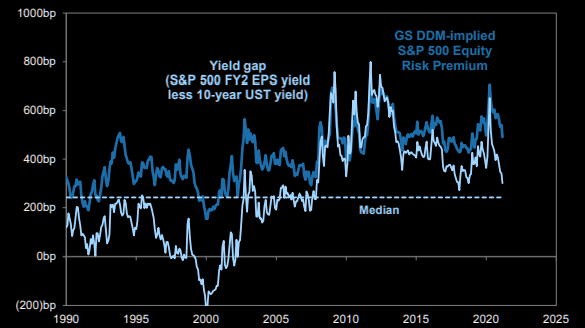

Moreover, stock market valuations aren’t overly stretched based on the equity risk premium even with higher Treasury yields, according to Goldman Sachs.

Investors ask whether the level of rates is becoming a threat to equity valuations. Our answer is an emphatic “no.” Although the S&P 500 forward P/E multiple of 22x currently ranks in the 99th historical percentile since 1976, ranking only behind the peak of the Tech Bubble in 2000, our dividend discount model (DDM) implies an equity risk premium (ERP) that ranks in the 28th percentile, 70 bp above the historical average. Similarly, even after the recent rise in yields, the 300 bp gap between the S&P 500 forward EPS yield of 4.6% and the 10-year US Treasury yield ranks in the 42nd historical percentile. Keeping the current P/E constant, the 10-year yield would have to reach 2.1% to bring the yield gap to the historical median of 250 bp. If instead the yield gap remains unchanged, and rates rise to 2.0%, then the P/E multiple would fall by 10% to 20x. But in today’s economic environment, our macro model suggests the ERP should be narrower than average.

Markets ebb and flow as they move towards an important future peak. Every day there is a list of positive narratives and a list of negative narratives.

If markets dip, the media will choose from the negatives and interest rates are on that list now. Media will also highlight gloomy market gurus then.

If markets are surging media will choose from the positive list and highlight upbeat gurus.

All of this creates news and keeps us watching media. It increases trading volumes and magnifies swings in stock prices.

The interest news is early but will have an increasingly important role in effecting markets since the world is more indebted than ever. History shows that economically sensitive Value stocks have earnings rising faster than interest rates as the economy comes out of a recession and outperform in a rising interest rate world. A good reason to own Value.

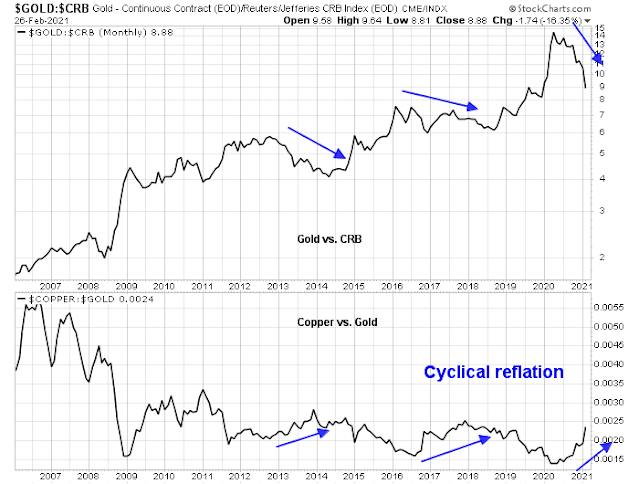

Gold had a violent downturn yesterday. Why?

Is this move done? Is this time to add to gold positions?

https://www.schwab.com/resource-center/insights/content/message-from-recent-bond-market-turmoil

Excellent commentary from Kathy Jones from Schwab. Real yields are still in the negative, but for how long?

From the above:

“Moreover, the Fed has tools at its disposal to offset the rise in long-term rates. The first step likely would be more communications about why it sees the need to keep rates low. After that, it could buy more long-term bonds, and/or shift some of its purchases of mortgage-backed securities to Treasuries. It could also increase the amount of bonds it is buying”.

The moral hazard of yield (curve) suppression stays with us to this date. John Paulson should have never done what he did in 2008. The US Fed should never be in the business of manipulating asset prices by intervention.

More bond buying, more yield (curve) suppression, more funny money, keep calm and keep buying, until 50 Trillion $ balance sheet is reached.

https://www.schwab.com/resource-center/insights/content/elevation-some-v-shaped-economic-data-to-cheer

Another master class analysis from Liz Ann Saunders. She continues to create pithy articles that catch the pulse of the markets in a way few are able to, and her ability to deliver complex messages in simple English has only improved over time.

I am focused on lack of improvement in services and lack of consumer confidence. I am happy to see that with time, these two can only improve, adding to spending by Joe six pack. Such consumption can only add to profits in the future. Cam keeps sending the graph of increasing EPS of S&P 500.

A thought on gold. Generally it is dead money that investors now think is better in stocks. That’s a general trend thought. As to why the big drop recently, maybe those folks who own gold as a portfolio hedge saw a low in long term bonds being made on Friday and decided that a switch from a gold hedge to a bond hedge was a good trade. Until recently, long term bond interest rates were so low that they provided no portfolio hedging. These are just thoughts.

I’m always a believer in today’s world that these things are too complex to figure out and therefore one should use momentum strategy. Gold is underperforming so I avoid it. I will own it at some future point from a low rebase point of the general market and it starts to outperform.

Cam was very bullish long term on bullion in his A focus on gold and oil Posted by Cam Hui – December 5, 2020.

Since then, the drop to 1720 area seems a technical move after loosing the 1820 support area.

idk. Certain out of favor.

There are other experienced analysts who are increasing gold positions in portfolios. That said, Ken’s reply about gold being dead money rings true, at least in the short term. Long term, inflation adjusted bullion price is 2700$ per oz.

https://www.youtube.com/watch?v=ssbMrjqOCt0

Emerging technician/chartist, Carter Worth does a great job with charts.

Gold to 3K, silver 50 $. The was in July 2020.

Recent price action is revealing the VERY different performance of Value versus Growth.

Let’s look at the charts of three key sector ETFs highlighting the 2021 action; Value ETF VLUE, Equal Weight Growth RPG (no FAANG overweight) and Innovative Growth (ARKK). We had a surge to new highs in mid-January with all of them and then a dip into late January. Since the bottom of that dip Value has hit a much higher high and the last weeks dip has it still above the January high. The Growth ETF has fallen back to the January dip low, a sign of flagging strength since it is not going up a stairway of higher highs like Value has. The ARKK Innovative ETF is much lower in this dip than it was at the end of January. That is a sign of a possible negative trend change of this previous leader.

Last week, I said that innovation was looking tired and it basically collapsed this week. I have been saying that Value and Growth are on differing paths at this stage of the business/stock market cycle. These charts underscore that.

Value ETF Chart

https://tmsnrt.rs/36JIEOU

Equal Weight Growth ETF Chart

https://tmsnrt.rs/2QNHqvi

Innovative Growth ETF ARKK Chart

https://refini.tv/3k2fMsM

Stay safe. Get the jab. We are in this together.

Ken

I’m bullish on US growth this year. I’m seeing signs that the US Government will actually deliver its promise to re-open the economy by mid-summer.

The vaccination program promised by the Biden administration is showing progress and is already weeks ahead of schedule.

In my local area, all vaccines distributed to the county have been successfully administered and distributed before end of each week. There’s multiple mass vaccination sites already setup and awaiting increased distribution. These sites can vaccinate 100s people an hour.

Nationwide distribution statistics are very positive. 100 MM doses will be administered before mid-march. 70.5 MM doses have been administered so far.

In conversations with peers, not many believe that 300 MM doses can be produced by end of March. However, getting even 2/3 would still be a huge win.

I am putting the pandemic in the rear view mirror. We may have a few outbreaks here and there, but the vaccines offer a durable solution, IMHO.

Vaccines can be tweaked to combat Corona variants (vaccines can be scaled up or down and horizontally to tweak and expand coverage).

Sure, there may be vaccine naysayers. So be it. These people were always there and will be there in the future. Remember we have people who doubted the moon landing? Anecdotal survey from local pharmacies, last month showed me that everyone who had an appointment at a US pharmacy came to take the vaccine. Furthermore, some of the vaccine nay sayers are now requesting vaccines (!). Go figure.

You buy growth when growth is scarce. When growth is abundant, the value style performs better. If you bullish on US growth, then you should be positioned in value.

Agree. Spot on. We were in Growth at any price regime, propelling Technology to sky high valuations. Non-tech sectors seem to be the place to be. Once tech has reset itself, over the long term, would become something to buy into.

https://www.morganstanley.com/im/en-us/individual-investor/insights/articles/the-top-ten-trends-of-2021.html

There is a big bad world outside the US of A. Ruchir Sharma seems to echo similar sentients to what has been written by Cam, Ken and others on this group. We could be in an early cycle of global growth revival.

https://www.cnbc.com/video/2021/02/26/cashin-there-are-fears-the-fed-has-lost-control-of-the-bond-market.html?

This may mean a rapid rise in bond yields towards 2% on Ten year treasury. It will lead to Fed buying “assets”, as stocks correct.

Is there anything essential or constant about this idea of technology stocks performance and rising nominal interest rates? If one was to put a label of ‘tvalue’ on these stocks, would they behave better?

It seems that many cyclical stocks are overbought in the short term. Delta airlines almost flat to a year ago level with myriad difficulties ahead. Similarly for many others like Marriott. Momentum would keep you in these names but it may be prudent to trim or take profits.

Not sure if there are ‘myriad difficulties’ ahead for Delta and Marriott. But otherwise I would agree with the gist here.

The ten year averaged 6% during the 90’s. GDP growth around 4% annually. Yet growth stocks did pretty well.

Consider: Abundant growth, a 6% 10-year, contrasted with the high multiples put on growth in the latter half of that decade.

And now there is ‘duration risk’ for high multiple growth because the 10-year is at 1.5%? Double this, and you don’t even reach the bottom of the 90’s range.

‘Myriad uncertainties’ likely conveys the idea better than ‘Myriad difficulties’. Thank you!!

Air travel, particularly business travel, is likely to take some time to return to pre-pandemic levels. Many adults we know are not planning air trips any time soon. Wait and see attitude.

Our millennial children can’t imagine being in a crowded space. A reluctance, hesitation, may be fear.

I just think the pent up demand will not come pouring out as a gusher but build up slowly.

There is no holy grail in investing.

(a) How many active managers are able to CONSISTENTLY outperform a passive index?

(b) How many report wrong calls/losses as consistently as they do correct calls/gains?

(c) How many generate more income from their trades than they do from their fees?

(d) How many correctly attribute a significant percentage of their success in trading to luck?

If there is a holy grail in trading, I would call it risk management – perhaps a combination of position sizing and the discipline to take losses quickly when wrong.

Cam’s inner trader was wrong for much of 2020 – so what? It happens to the best, and he was upfront about it. When it comes to transparency – he ranks up there with Doug Kass. It’s no coincidence that both also display a great deal of humility.