Mid-week market update: About a month ago, I warned that the market was undergoing a regime shift from growth to value (see What would Bob Farrell say?) and compared today’s Big Tech momentum stocks, not to the dot-com mania, but the Nifty Fifty era. On the weekend, I rhetorically asked in a tweet that if Bloomberg TV has to explain r/WSB lingo to its audience, it’s probably a sign that speculative momentum was nearing the end of its run.

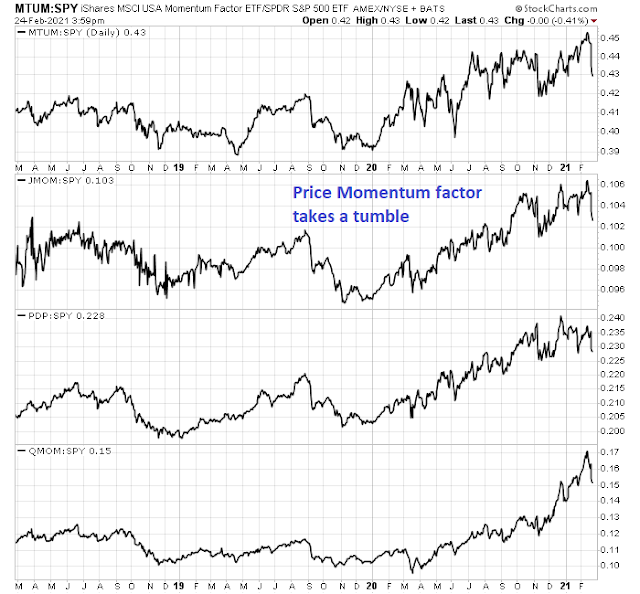

It finally happened this week. The MoMo (momentum) crowd is losing its mojo. The price momentum factor, however it’s measured, is undergoing a sharp correction.

Here is what that means for the stock market.

A growth to value rotation

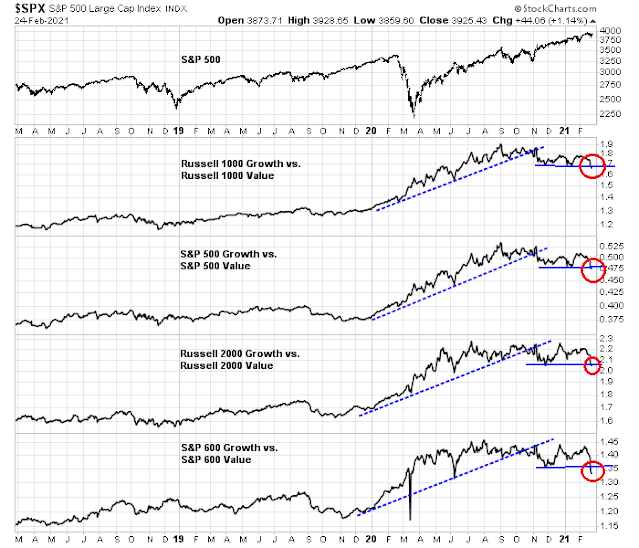

The S&P 500 tested its 50-day moving average (dma) yesterday and recovered. Beneath the surface, however, a strong rotation from growth to value is evident. The growth-heavy NASDAQ 100 (NDX) was not as lucky as the S&P 500 as it violated an important rising trend line. As well, its relative performance breached a rising trend line, and so did the high-flying ARK Innovation ETF (ARKK). The technical deterioration was foreshadowed by a negative divergence in the percentage of NASDAQ stocks above their 50 dma indicator.

The growth to value rotation can also be seen in the relative performance of different large and small-cap growth and value indices, which are either testing or violating key relative technical support levels.

Market implications

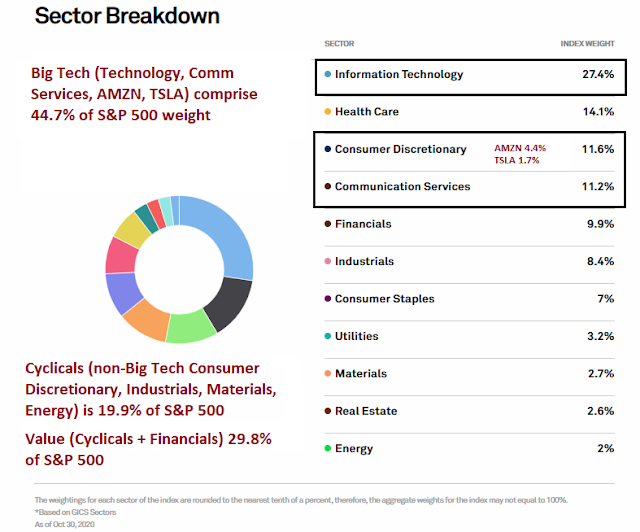

The failure of price momentum and growth to value rotation should translate to a minor headwind for stock prices. The weight of Big Tech growth is roughly 45% of S&P 500 weight, while cyclical stocks account for about 20%, and value sectors 30%. Weakness in Big Tech growth should create mild downward pressure on the S&P 500.

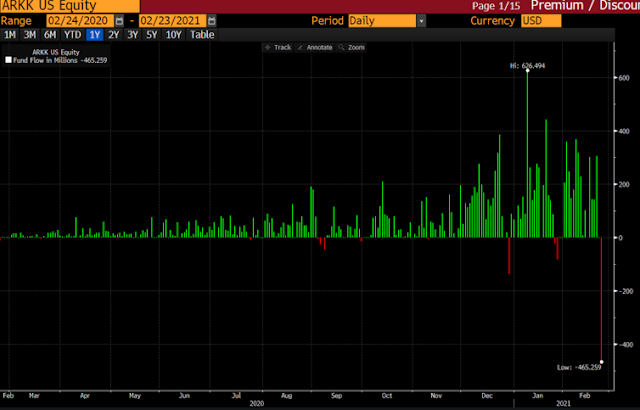

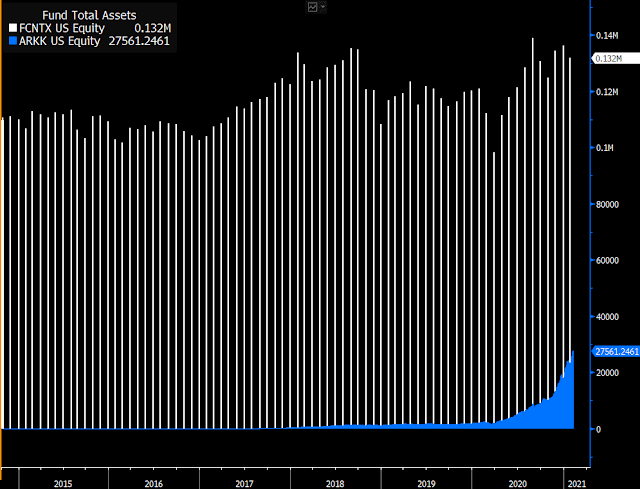

Cathie Wood’s ARKK saw investors pull $465 million from its fund on Monday (ARKK reports flows t+1 so we won’t know Tuesday’s flows until after the close Wednesday). The redemption was the first major outflow during a period of heavy inflows.

Here is the risk to the fund. ARKK holds a number of large illiquid positions, measured as a percentage of outstanding shares, in a variety of small and micro-cap stocks. These positions are known on a daily basis. Should the momentum sell-off continue, these illiquid positions are juicy targets for hedge fund bear raids where they drive down the stocks through short sales. Such bear raids have the potential to spark a stampede out of ARKK, which will have to sell its most liquid positions first, such as TSLA, followed by the less liquid ones. This could translate into a flash crash style panic in growth stocks, and small-cap growth in particular.

Downward pressure on growth stocks, which comprise about 45% of the S&P 500, will create significant headwinds on the S&P 500. To be sure, funds are rotating into value stocks, but since value sectors only make up 30% of the index, this will be bearish for the index overall.

I am not forecasting a stock market crash, though a crash in growth stocks is a possibility depending on how the animal spirits behave. For some sense of scale, the asset size of Fidelity’s Contrafund dwarfs ARKK. The effects of any growth crash will likely be contained.

The road ahead

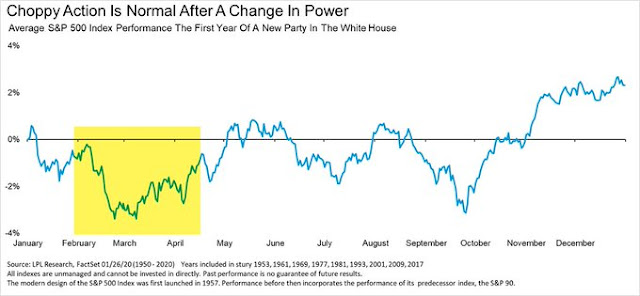

In conclusion, the market is undergoing a rotation from growth to value, which also manifests itself as a failure of price momentum. This will put minor downward pressure on stock prices. Expect a choppy sideways to down market environment in the next few weeks, but no major downdraft in the S&P 500.

This is consistent with the pattern found by Ryan Detrick, who observed that the stock market tends to have a minor bearish bias in March when a new party takes control of the White House.

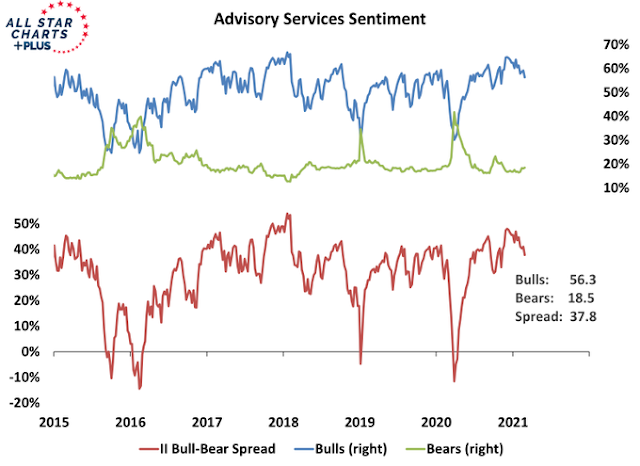

As well, II sentiment is recycling from a bullish extreme, which is a constructive development as the market undergoes an internal rotation.

Once again, I think looking at the general market is so misleading. The market may be choppy in March because the ostriches and goats are going in different directions. Look at this chart of ARKK

https://product.datastream.com/dscharting/gateway.aspx?guid=38027716-d192-4104-a2a9-25b3336aaf6d&action=REFRESH

Now look at these two of the Value ETF and the US Bank ETF

https://product.datastream.com/dscharting/gateway.aspx?guid=2c359ae9-1348-4d66-911e-4f15e9f18f7f&action=REFRESH

https://product.datastream.com/dscharting/gateway.aspx?guid=e51fb19a-e81e-4d38-99b7-ad9fe399c440&action=REFRESH

They are a different breed of animal. Put them together and then try to envision the weighting of the ostriches versus the goats and your head starts spinning. Looked at separately, one animal is wounded and failing and the other gleefully skipping ahead.

As you have so brilliantly scoped out, Growth and Value is flipping leadership. But because Value, comprises economically sensitive, cyclical

companies and the business cycle is rapidly improving beyond our previous expectations, these stocks are going up with their future earnings estimates also rising.

Worrying about a crash makes one hesitate about the general market but each day this week has seen Value stocks going up while the ARKK innovative stocks with dreams and no earnings falling.

On Wednesday, Powell has reinforced his TOTAL support for continuing massive monetary stimulus into the longer term and said he doesn’t see a bubble. He is not worried about inflation or the rising long rates. Who am I not to believe him? He doesn’t sound like a guy who will stop the party.

And here is some incredibly great news from the magazine, Atlantic. Experts now thing normalcy could be here by early summer, much sooner than the most optimistic estimates. This article is entitled, ‘A Quite Possibly Wonderful Summer.’ Read it and put a smile on your face as your confidence in your Value stocks rises.

https://www.theatlantic.com/health/archive/2021/02/summer-2021-pandemic/618088/?utm_source=newsletter&utm_medium=email&utm_campaign=atlantic-daily-newsletter&utm_content=20210219&silverid-ref=NjY4ODk3MTQ5MTE1S0

I don’t see the Value stocks being in some optimistic bubble when I do see it in the innovative Growth area.

I say look at them separately or your head will be spinning and you might miss a big opportunity.

Nothing looks good this morning. Most if not all sectors on my watch list have slipped into the red.

TLT continues to implode.

Reopening a position in TLT.

Taking the hit on TLT. I keep getting burned on this trade. Perhaps at some point the yield itself becomes attractive enough that we’re all able to park money in bonds – but I suspect that time is at least a year away.

Reopening positions in NIO/ PLTR/ QS.

Closing all positions for minor losses.

https://www.barrons.com/articles/why-buying-the-dip-in-growth-stock-prices-makes-sense-51614214694?siteid=yhoof2

https://www.marketwatch.com/story/stick-to-your-favorite-growth-stocks-and-just-forget-about-whats-next-with-inflation-says-this-analyst-11614255569?mod=home-page

50 analysts have 100 different opinions (depending not the hour of the day).

As rates climb, there will be increase in Fed funds until we get a rate tantrum (20-30% hair cut let us say). Following that, Federal Reserve will buy across the board treasuries to bring rates down. I have marked 50 Trillion $ of initial liquidity for such adventures by the Fed.

It might take a series of 25 basis point moves by the Fed.

Each Trillion raises price of gold by 100$ per oz, give or take.

BND back to where I sold all of my holdings a year ago. Must be a bottom here.

How can you pass up that juicy 1.25% yield?!

Watching these levels on 10 year treasury;

1.20, 1.56, 1.96, 2.20, 2.25.

So, we closed today @ 1.53. From here in on, and up to 1.96% we enter “cry uncle” territory. What I would like to watch are credit events, junk bonds and finally Muni bonds, which would be the last to sell off. Such events would definitely mean another QE, to suppress rates/yield curve control. Never say never, but bond vigilantes may be on the prowl here. It may take a few quarters here, but at the speed at which bonds have been selling, it may not take another quarter to 1.96%.

The question now is whether SPX 3825 represents a sufficient retest.

I doubt it. Buying into today’s selloff just doesn’t feel like the right thing to do. The pain trade is lower, not higher.

There’s little panic right now. Wait until Friday, when we may open deep in the hole.

I would take a swing in the SPX 3750 to 3780 range.

So glad I threw in the towel on my SPY 380 puts yesterday.

Any idea what happens if rates keep going up?

I see Cam has turned bullish, but I’m unable to access Gmail right now. Can someone forward his comments to this thread?

Scaling into EEM/ FXI/ BABA.

Added QS/ NIO/ PLTR.

Adding JETS/ KRE.

Adding EFV/ XLE/ PICK.

Adding VEU/ XLI.

Adding ASHR/ EWZ.

Adding second tranches to all of the above.

Adding QQQ/ XLF.

Reopening a position in RYSPX at the 730 window.

Opening a position in WPC. I’ve been reading about ‘bond alternatives’ over the last several weeks, and REITs seem to be an attractive alternative. The thing is – you need to focus on the best companies. WPC ranks high. Yield in the 6% range right now.

Plan A was to open in the hole. I jumped the gun a bit, but hopefully not by much.

At some point, you just need to jump in. And hang tight.

Making my first buy in AAPL in a long time.

Adding VTV.

Will reopen positions in VTRIX/ VVIAX/ VTIAX/VEMAX at the close.

Will also reopen a position in RYOCX (Rydex Nasdaq 100) at the close.

The best scenario is a red-to-green wave that brings back the momentum crowd.

Personally, I think the DJIA closes at least a hundred points in the green. JMO.

So much for what I think.

I’ll take the silver lining – better reentry prices on all index funds.

If I were to guess, new highs are next on major indexes.