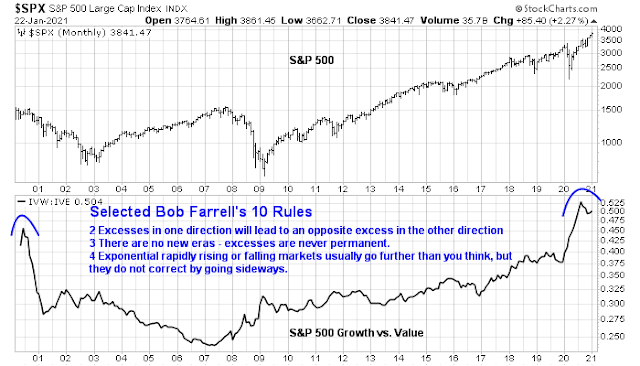

What would the legendary market analyst Bob Farrell say about today’s markets? I was reviewing the patterns of factor returns recently, and I was reminded of three of Farrell’s 10 Rules of Investing (which are presented slightly out of order).

Rule 3: There are no new eras – excesses are never permanent.

Rule 2: Excesses in one direction will lead to an opposite excess in the other direction.

Rule 4: Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

Applying those principles to the return patterns to growth and value over the last 20 years, we can see that growth has peaked out relative to value in 2020 (Rules 2 and 3).

Does that mean that this is the end of an era for growth stocks? Large-cap growth stocks comprise roughly 45% of the weight of the S&P 500. If they were to falter, does this mean investors are facing a major market top?

What would Bob Farrell say?

FANG+ = Nifty Fifty

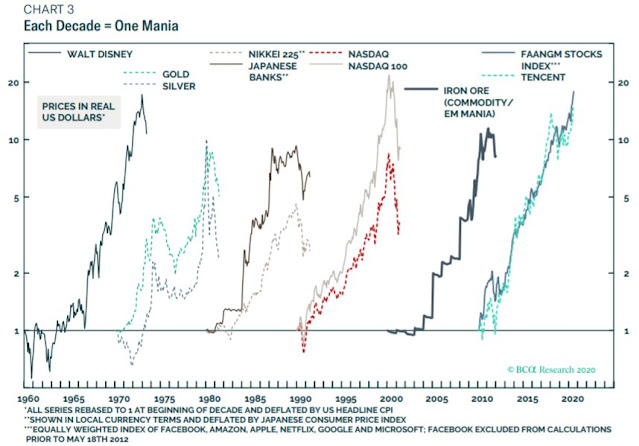

While Farrell’s 10 Rules is silent on the specifics of today’s FANG+ leadership, they were not silent on investor psychology. One thing is certain, investors are prone to recency bias, and the most likely parallels they might make is the dot-com bubble of the late 90’s. I beg to differ.

The mania of the late 90’s was characterized by a flood of unprofitable companies coming to market. I remember sitting through endless presentations of new companies with the mantra of “We expect to be EBITDA positive in two years, and earnings positive in three.” Even paper and forest products companies would not dare go into an institutional presentation without outlining a “broadband strategy”.

By contrast, today’s FANG+ stocks tend to be cash flow generative and have substantial competitive advantages, or moats. A more fitting analogy to the recent FANG+ leadership is the Nifty Fifty era of the early 70’s.

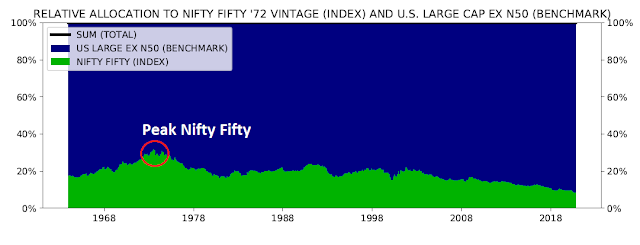

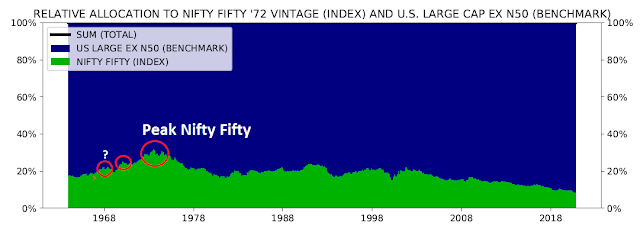

The Nifty Fifty era was characterized by a “growth at any price” mentality. The investment thesis was to buy good growth stocks and hold them – forever. The blogger writing under the pseudonym Jesse Livermore recently performed a

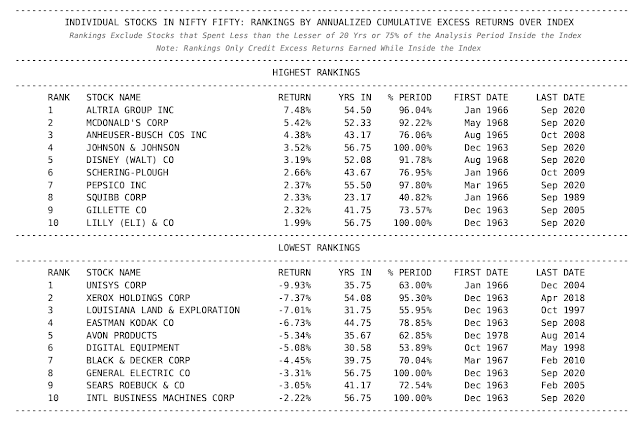

masterful analysis of the Nifty Fifty using the O’Shaughnessy Asset Management (OSAM) database. He took the Nifty Fifty list as of 1972 and analyzed the history from 1963 to 2020. Most of the survivors today have mature growth paths, the key theme of strong competitive moats is emerging from the analysis. Large-cap survivors include pharmaceuticals, along with selected consumer-oriented companies who have been able to maintain their branding (P&G, Disney, Coke, McDonald’s).

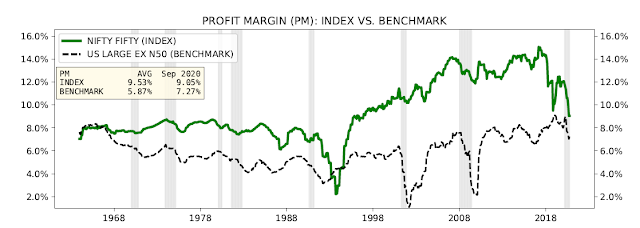

The key similarity between the Nifty Fifty list and the FANG+ list today is their competitive moats, as characterized by their ability to maintain high margins. Companies in industries with high margins will attract competitors. They will not survive unless they have strong competitive positions.

However, good companies don’t necessarily make good investments. Despite their strong levels of profitability, Nifty Fifty stocks peaked out in relative performance in the early 70’s and never looked back.

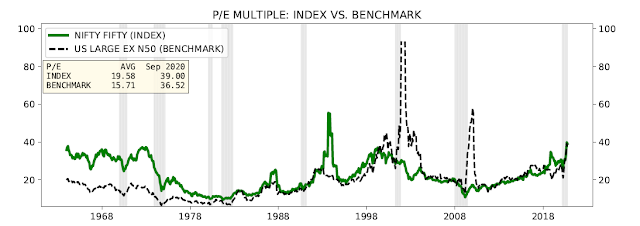

The analysis of P/E multiples tells the story of performance. Nifty Fifty stocks began as highly valued. Multiples collapsed when the investment theme peaked, and normalized to market levels starting in the early 80’s.

I don’t mean to leave the impression that all of the Nifty Fifty were successful investments. A glance at the top losers reveals companies that lost their competitive moats. Technology companies were at the greatest risk of this (IBM, Digital Equipment, Unisys, Xerox).

Timing the top

What does this mean for investors?

First, be aware of

Mark Minervini’s 50/80 Rule: “Once a secular market leader puts in a major top, there’s a 50 percent chance that it will decline by 80 percent—and an 80 percent chance it will decline by 50 percent.”

Mark Hulbert also recently warned about the possibility of a “valuation bear market”.

Take what happened in the wake of the internet bubble bursting, for example. From the stock market’s March 2000 high to its October 2002 low, according to data from Dartmouth’s Ken French, the 10% of all publicly traded stocks closest to the value end of the spectrum outperformed the 10% closest to the growth end by more than 22 annualized percentage points—though they still lost ground on average. But small-cap value stocks—as represented by the Russell 2000 Value Index—actually rose slightly during that bear market.

Despite the apparent evidence of a reversal in the relative performance of large-cap growth stocks, we have to allow for the possibility that this is not the top. A more detailed analysis of the relative performance of the Nifty Fifty revealed false bear market positives in the late 60’s.

However, the length and magnitude of the gains of FAANGM stocks suggests that these issues are due for a secular top.

Where does that leave us? The weight of the evidence suggests that US large-cap growth stocks are turning down, and their secular bear is just beginning. Value is just starting its cycle of outperformance, and investors should tilt their portfolios towards out-of-favor value stocks.

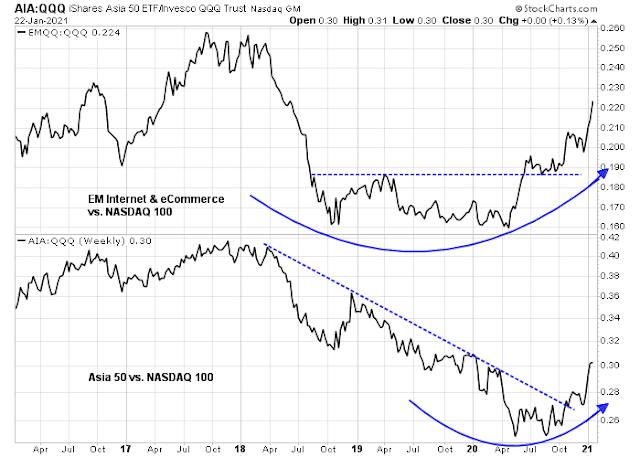

Investors who would like exposure to growth can look outside the US, such as the tech-heavy Asia 50 (AIA) or Emerging Markets eCommerce and Internet ETF (EMQQ). Both of these ETFs have turned up relative to the NASDAQ 100.

In the chart above entitled PE Multiple Index Versus Benchmark it is instructive to see the Benchmark line shoot up after the 2000-2002 and 2008 recessions. This is when profits are down for cyclical companies. Today the pandemic is depressing earnings of so many companies hopefully temporarily.

So many bearish market gurus point at high PE

valuation as a reason to avoid stocks. But you can see that this was just temporary after previous recessions. It goes away as the economy recovers.

We Canadians see this every cycle since our economy is much more cyclical than American. But the pandemic has Canadianized it. We know to buy cyclical stocks when their PEs are sky high.

Canadian press bashed Trump for four years. Yet Trump is good to Canada. Biden cancelled Keystone pipeline in his first day in office. The result is 20K job loss and lower oil price for Canada. What is Canadian press gonna say now? Without oil/gas where to find subsidy for the green stuff?

I think he would scratch his head in disbelief! But that is my dissonance. If it had popped in March 2020 we would say it was the top, only it wasn’t. I didn’t buy bitcoin when it was under 300 bucks because I thought it was insane, 40k is insane, but if it goes to 1 million, then 40k is not the top. I think people know when things are irrational, what nobody knows is when it will pop, so to quote Prince (not the singer) “while the music is playing we keep dancing”. When you consider that the yield on the SPX is about 2%, you need 50 years to get your money back. Of course there is appreciation of the securities (maybe) but many companies don’t last 50 years. When I read Edwards and Mcgee (or is it MacGee?) the first time, what struck me was how the charts were of companies I had never heard of. So yeah, there will be a ginormous dump at some point, but maybe the S&P has to go to 5000 first, who knows?

Delayed gratification says to just walk away from this market and wait till things calm down. Instead of buy the dip, buy the dump….only when the dump happens we are too scared….maybe in a secular bear the third twist is the charm. This is the big advantage of the individual vs the asset manager….the individual can sit back and not be 100% in the market…if he does not score big for a couple of years, nobody fires him. Makes me think of Chubby Checkers back in the 60s with the Twist. When the COMP went parabolic at the Dotcom bubble, it broke out above the upper channel. This is one thing I am looking for as a sign of a final blowoff top. But then I never bought Bitcoin.

In 1979 I took a class titled the Psychology of Perception. I still remember the name of the guy who taught the class – Professor Uttal. We learned a great deal about the way(s) in which the human mind interprets the vast amount of stimuli to which it’s exposed on a daily basis – many of which I learned to appreciate in hindsight.

One day Uttal digressed in the midst of a lecture to say, ‘By the way. You all know, right, that just because you read something in a book – it doesn’t necessarily mean it’s true. That includes the books that I’ve written. You should take everything you read or that I teach with a grain of salt – I don’t know everything and neither does anyone else. We all do the best we can – but always question everything you read or hear.’ Or something to that effect.

All of that applies in spades to what we read/hear in the financial media each day. I appreciate the way Cam attempts to separate the wheat from the chaff, presents both points of view, and ultimately still acknowledges that we don’t have any hard and fast answers.

Are we headed for a ‘valuation recession?’ It’s a reasonable opinion, but just one of many. I’ll keep the possibility in mind, but I don’t plan to sit out any rallies that precede it, and there’s the possibility it may be years away. Will value outperform growth? That’s another reasonable opinion – but I”m also paying attention to the fact that the Nasdaq 100 reasserted itself in the past two days, greatly outperforming the value indexes.

The market loves to fake out the majority. It will make that happen in ways we have yet to experience and are therefore unable to anticipate. Navigating the markets on our own is similar to sailing a small boat in the open sea. It can get choppy once in a while. It’s certainly not easy, which is why most people leave their money in managed funds – nothing wrong with that, although in my opinion that’s just another way of saying it’s too much work and/or anxiety.

Right now, I’m sitting in cash and still ~+2% ytd. I don’t have a compelling take re next week, but as always I will (by necessity) come up with one by the time the markets open on Monday.

Remember Buffett’s 2 rules…1 is don’t lose money and 2 is see rule 1.

For me, the most valuable strategy is position size because it puts a lid on fear and greed. The emotions can really lead us to ruin. It’s why I also get out when I have a good profit. I know that this means I won’t get a huge gain like holding TSLA for the last year, but once again people say things in hindsight like “you sold too early” or “you held it too long”, that’s also the problem with Elliott waves…they are hindsight based because you can change the count.

We are lucky that we have exposure to Cam and Ken because both of them analyze things in a forward looking manner. Admittedly references are made to the past for comparison which is ok

I gotta say I’ve been a subscriber for about a year . love the charts. The short term trading indicators, I go the opposite way. The last year track record for this has been a great contrarian indicator.

But this post takes the cake. I’ve listened to Bob Farrell on David Rosenberg’s site. He is not dead!

As per Elliott Waves, if you followed Avi Gilbert’s service you’d have made a fortune.

This is a sentiment driven market.

I believe in waves, absolutely…waves are found everywhere, but when you change the counts is a problem if after the fact you say that it all was there. They have this open house this weekend at Elliott and they show a chart going back 100s of years. What I find interesting is that there were a few huge melt ups that ended up going down in a similar fashion. So I will keep an eye on that because if things take off on rocket fuel there will most likely be a descent similar to the nasdaq in 2000.

We’ll see

I believe rule 3 is the most controversial. Over the decades I see some long lasting changes. 1. In the good old times financial assets valuation were more or less driven by fundamentals. The COVID crisis has shown us that impaired fundamentals were compensated by monetary measures. 2. Under new MMT a lot of money has been printed in many countries. I do not believe such excess spending will reverse ever. 3. Money printed flows to assets not included in consumer goods such us real state and financial assets. 4. In many countries there is a deliberate effort from government to report lower than “real” inflation. 5. Central banks seem less independent than 20 years ago. 6. In the US there was a deliberate effort from government to backstop losses in some financial markets. Therefore investors perceive that the likelihood of a meltup is higher than the likelihood of a meltdown. Like Yodoc I will keep an eye on it, but I do not count on a meltdown soon.

I agree totally. Central Bankers have boxed themselves into allowing a debt bubble to build where normalising rates will pop it. The Fed is relying on a Japanese or European cultural response to free money where the people don’t borrow and overheat the economy. Americans are optimistic and big spenders. When the Covid is behind us, expect severe upward pressure on rates and inflation. Then what?

At some point things break, but it could take a long time. One thing that may happen is a widening spread between treasuries and loans. Who says that a Heloc has to be at prime + whatever %, it could be prime + 2xwhatever, because it really comes down to the economy. If unemployment is bad and many jobs are threatened, the banks will adjust rates for the risks. When things turn sour will the Fed be allowed to keep buying bonds that it should not be buying? We may end up having 2 tiers…what the treasury has to pay, and what everyone else has to pay. It can’t go on forever.

Totally agree

Citi euphoria index almost going off the page

https://twitter.com/sharkbiotech/status/1351860162886307841

I have always been a big user of sentiment indicators. Now, for the first time i will ignore them for as cyclical indicators. The CITI Euphoria is one of the best. It coincides beautifully with market peaks with one year forward results very weak after an indicator high like now. But the Euphoria in the markets also was at an economic high where the Fed would be stepping in to cool out the economy. Early in 2020 when the stock market and the economy were hot (30 year low in unemployment) the Fed was in full easing mode and the government was running a $trillion deficit. In other words, the Fed no longer leans against Euphoria. Yellen has stated a dual Fed and Fed agenda to goose the economy and stocks for years. As long as they ignore extreme optimistic sentiment then I will too.

You are probably right from now on to ignore the sentiment indicators. After social media are invented, I realize that polled opinions have very little real value. Decades of dumbing down of the masses have resulted in dramatically deteriorating independent thinking ability. I don’t pay attention to anyone in the media anymore. Like: Trust no one, believe nothing.

One thing is still true: momentum investing. When market internals are still strong, we just proceed until it is reversed. Can’t sit here worrying about the top. Predicting a top is a national past-time but it does not pay.

We are now in a different era. Now everything is financialized and Gov cannot afford a collapsed market. Don’t believe it. Just remember how Gov dealt with this COVID crisis last year.

One other very important factor is a phrase coined by Josh Brown: relentless bid. Did you see it play out in real time since last Feb? Market participant behaviors are forever different now. This is a reflection of our fundamentally changed society. Everything is a concept and every value is an opinion.

Correction to article: Bob Farrell is still alive.

Recent interview here: https://cmtassociation.org/podcast/fill-the-gap-episode-1-with-special-guest-robert-j-farrell/

Farrell on regime shifts:

“But you know, in my Like, right now, it’s kind of become pretty well accepted that value is coming back in favor. And that growth is losing its command and maybe is overdone, and mostly waiting to the tech area. And my experience is that more often than I can say all the time, but most of the time, when there is a big shift taking place, like from one sector to the other sector, like going from growth to value, it occurs in a decline more than just is passed the baton. And now let’s do these because the other one’s gotten over done a bit. And right now, I think that’s one of the questions because I think we are moving to an extreme on the upside opposite to the extreme on the downside and March. And I think before the long term shift is cemented on to value or small caps, I think there will be a market decline that will impact what was in favor, and which is faltering now. And usually, it’s the warmer leadership that has the bigger decline in a reaction that enables this change in leadership. And it’s the new leadership that doesn’t get down anymore. You know, back back in 2000, that you pointed to in March, that was when we cracked all the tech stocks, but at the same time only out of favor stuff and industrial and other types of value type stocks. They didn’t get down, but some of them went up into the spring of 2000, or into the summer of 2000. So that’s what I’m I’m looking for and in a temporary is how I trade in the market.”

This is tried and true for traders/investors. Watch stocks which did not go down much or even go up in a down market. That’s where we should focus on.