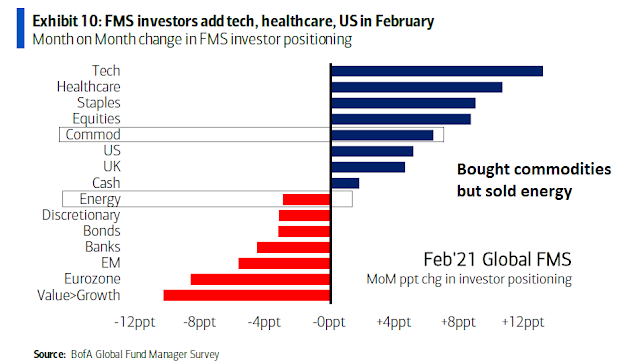

Is it too late to buy into the commodity supercycle thesis? The latest BoA Global Fund Manager survey shows that respondents have moved to a crowded long position in commodities. Many analysts have also hopped on the commodity supercycle train, myself included (see How value investors can play the commodity supercycle).

As a cautionary note, one reader alerted me to a well-reasoned objection on the commodity supercycle thesis.

Much depends on China demand

China watcher Michael Pettis raised his objections in a

Twitter thread. Simply put, a secular commodity bull doesn’t make sense from the demand side. Much depends on Chinese growth remaining at the current unsustainable levels.

I wonder if they’ve thought through the systemic implications. Given China’s disproportionate share of demand (50% or more of global production of major industrial metals, for example), to predict a new supercycle of rising commodity prices is effectively the same as predicting that China will run another decade or two of 4-6% GDP growth, driven mainly by surging infrastructure and real-estate investment. This in turn implies that China’s debt-to-GDP ratio will rise from 280% today to at least 400-450%.

This strikes me as pretty unlikely. For those who might argue that “all it would take” is for India to begin to replicate China’s growth story of the past four decades, it would take at least 15-20 years of replicating China before India were big enough to matter to anywhere near the same extent.

Pettis concede that we could see a cyclical recovery, but expectations of a secular bull are overblown.

We could of course get a temporary rise in hard-commodity prices as US infrastructure spending kicks in (although this year I expect Chinese hard-commodity consumption to drop temporarily) , but most of the variation in demand depends ultimately on what happens in China, and of course the more hard commodity prices rise because of non-Chinese factors, the harder it will be – and the faster debt must rise – to maintain the needed Chinese growth rate.

Warren Buffett, commodity bull?

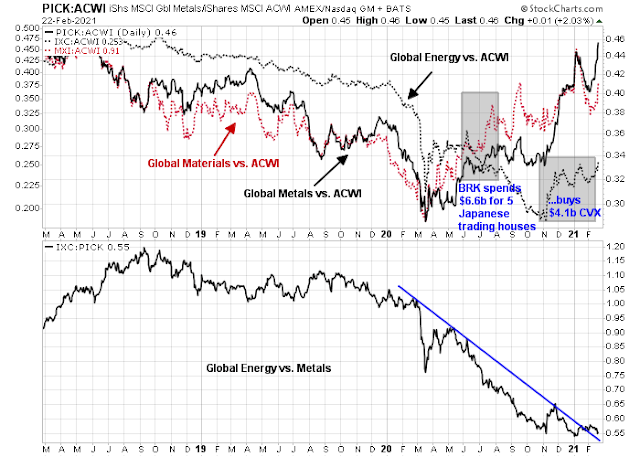

Before abandoning the commodity bullish thesis, investors should consider the recent moves by Berkshire Hathaway (BRK). In August, the company reported that it spent $6.6 billion to purchase positions in five Japanese trading houses. The surprising move was attributed to the low valuations of the trading houses, international diversification, and sector exposure. Specifically, these trading houses offers a window into the cyclical global economy, namely steel, shipping, and commodities. More recently, BRK announced that it bought a $4.1 billion position in Chevron.

These portfolio changes by Warren Buffett and his lieutenants are signals that BRK is buying into cyclical and commodity exposure.

As the chart below shows, the company’s sector bets were timely. Global materials and mining stocks have outperformed the MSCI All-Country World Index (ACWI) since the Japanese purchases were announced. As well, the relative performance of energy stocks appears to be constructive. Global energy is turning up against ACWI, and it is bottoming when compared to the red-hot global mining sector.

Cyclical or secular bull?

I return to the question raised by Pettis. Is this a secular or cyclical commodity bull?

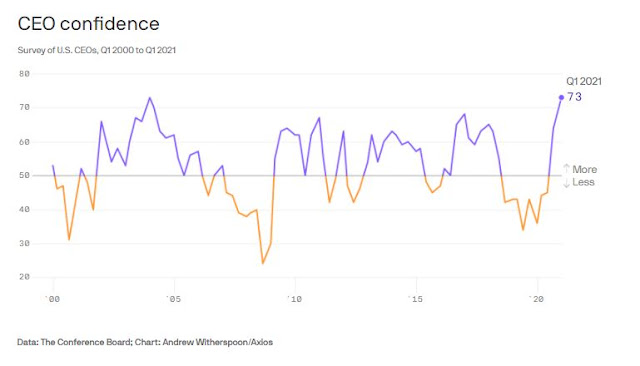

For investors with a 2-3 year horizon, it probably doesn’t matter. The global economy is undergoing a cyclical and reflationary rebound. Conference Board CEO confidence recently reached 17-year highs. Companies are on track to increase their capital spending plans, which translates into high commodity demand.

While there may be some short-term potholes in the road (see

No reasons to be bearish?), this is the start of a new equity bull. Investment-oriented accounts should position themselves accordingly.

I reiterate my view that commodity bulls should look for contrarian opportunities in energy. While the most recent BoA Global Fund Manager Survey showed an excessively long position in commodities, the monthly change indicated that managers bought commodities but sold energy.

Copper is in a secular trend because of the electrification thesis. Not only EVs, but grid and other infrastructure demand copper, tin, cobalt, lithium, silver, etc. This is true for developing as well as developed economies to the extent that they invest in electrification.

How they construct these over/underweight statistics is important. If a portfolio manager has a commodity normal weighting of 5% then 6% is a 20% overweight.

When a bull market in anything happens for a long period of time, ones normal weighting creeps up. Over the last ten years, commodities have been more and more hated with target weightings likely much smaller.

Also, is this a weighting in raw commodities from a futures trading hedge fund or is it resource stocks?

Just a few thoughts.

My guess is that the entire market cap of resource company shares is less than the market cap of Apple. A whiff of inflation and a small tilt towards resource stocks from Growth stocks would have a big impact on resource stock prices.

Ken, excellent points, thank you. What are your preferred vehicles? XLB seems like a blunt instrument. Cam uses PICK for reference sometimes. Thoughts?

Hard to see this is going to be a secular bull in commodities. Look around the world, every country is going to look like Japan: aging population and very high debt load. In this kind of setup high GDP growth is just a pipe dream.

It is more like a cyclical rebound and then moderate growth owing to inflation caused by massive money base expansion countered by structural disinflationary force.

Hard to invest in commodities futures. Very sensitive to data fluctuation. So DBB, DBC, DBA are not ideal. Stocks are very small. How high can they go? For example, I bought FCX a few months ago. Now it is up almost 300%, going vertical. How much room left?

Cam is right about energy. Especially in light of recent Texas freezing, there will be a re-thinking about the policies. But even energy is not a secular play.

Here we go.

QS/PLTR/NIO selling off hard. That’s OK. High-beta positions will sell off at least twice as hard during market pullbacks.

What’s interesting is what’s NOT selling off hard. EFV/ VTV/ EWZ/ EEM/ VEU.

I think a reasonable downside ‘target’ for the SPX is 3800. Intraday low thus far is 3805. A retest to let’s say 3790 followed by a recovery would be ideal.

If I had to guess, most traders are embracing the selloff. It’s a relief. It allows the bull to continue without having to wait for the other shoe to drop.

IMO, today’s selloff (and of course ensuing recovery) – ie, a third and hopefully final brutal shakeout prior to resumption of the rally – was the single most efficient/ helpful move the market could have made.

Adding a third and final tranche to all existing positions here and at the close. No, I didn’t buy during the morning selloff, as it wasn’t clear then that a recovery would in fact take place. Adding to positions here is a safer and certainly more relaxed process.

The only problems I see are:

1) DXY

2) 30Y + 10Y Treasuries – % is UP, in case of 30Y = 2,2!

3) DXI – dark pools are selling

S&P 500 still close above the 30 day average. Market still looks strong.

Very strong. I thought the bears might finally pull one off – definitely not the ’85 Chicago Bears, who were unstoppable and had a truly phenomenal year.

Cam – What’s your inner trader saying here? Do you think we rally today, but then go right back down to retest yesterday’s lows? Or was yesterday’s brutal selloff enough to have reset sentiment?

1. Fear was evident Tuesday morning, especially in the Nasdaq/ high-beta names.

2. What about the SPX/ DJIA? A mix of fear in a few names but also a high degree of complacence in the so-called reflation names.

3. Gun to head – I think we need to retest SPX 3800.

4. Along with the trades outlined earlier, I also opened/ reopened a string of trades in a few high-beta names I’ve been playing near Tuesday’s close. BLNK/ FCEL/ AYRO/ OEG/ SOLO/ FTFT/ DPW. With the exception of OEG, the trades are paying off nicely.

5. Among the index funds, VTIAX (~30% of the total) currently set to close unchanged and VEMAX (~10% of the total) indicated -0.76% lower. However, positions in VTSAX/ VTRIX/ VVIAX (totaling a combined 60% of the total in index funds) will close over +1%.

Given what is now a bearish ST take, I’m closing all positions either here or end of day. All in all, giving back ~-0.7% and should end the day +3.5% ytd.