The investment seasons are changing. Two major factors are emerging in altering the risk and return profiles of multi-asset portfolios in the coming years, rising commodity prices and value investing.

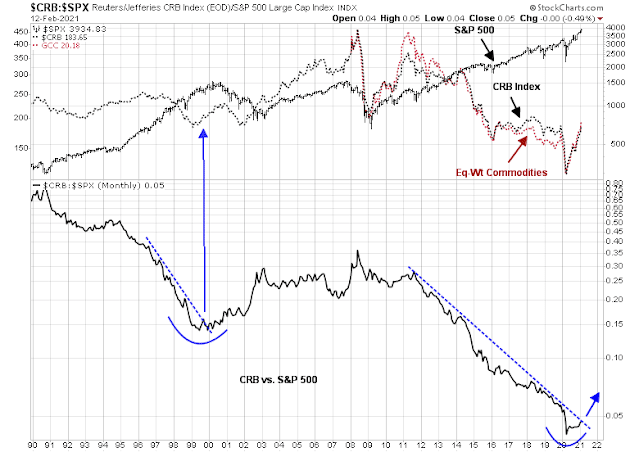

There is a strong case to be made that we are on the cusp of a new commodity supercycle. The last time the CRB to S&P 500 ratio turned up, commodity prices outperformed stocks for nearly a decade. The ratio is on the verge of an upside breakout from a falling trend line, supported by the stated desire of the Biden administration and the Federal Reserve to run expansive fiscal and monetary policies.

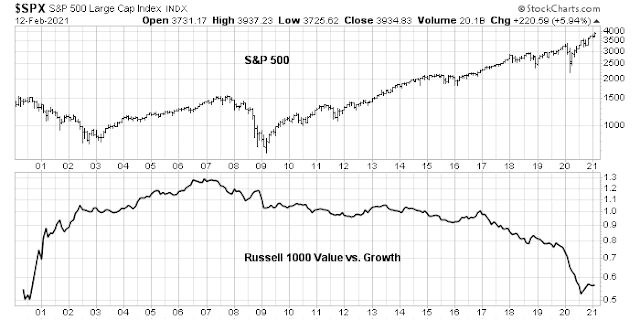

In addition, value stocks are exhibiting the start of a multi-year turnaround against growth stocks.

Here is how to combine value investing while participating in rising commodity prices. I’ll give you a hint with this mystery chart.

More on this value opportunity below.

Here comes inflation

Inflation is on the horizon, and there are good reasons from both a top-down macro policy perspective and a technical perspective. Both fiscal and monetary policy-makers have expressed the willingness to run a “hot” economy. President Biden has proposed a $1.9 trillion fiscal package. As well, the Fed’s Summary of Economic Projections, otherwise known as the dot plot, indicates it will not raise rates until 2023.

These policies have set off inflation alarm bells. The concern has not just come from deficit hawks, but thinkers who were former supporters of more deficit spending. Former Clinton-era Treasury Secretary and Obama-era Director of National Economic Council Larry Summers penned a Washington Post OpEd warning that the $1.9 trillion bill would overheat the economy. His views are supported by former IMF chief economist Olivier Blanshard. Former New York Fed President Bill Dudley, who was a dove during his tenure at the Fed, also wrote a Bloomberg Opinion article titled “Four More Reasons to Worry About U.S. Inflation”.

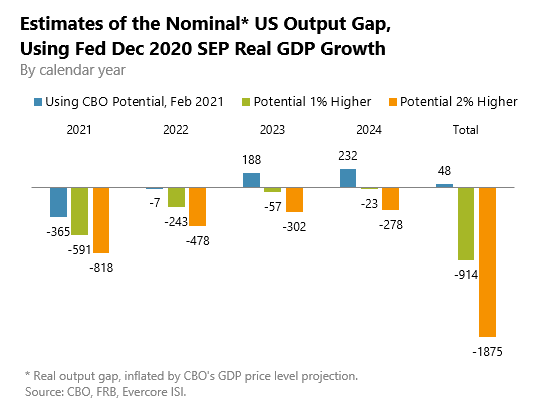

Summers agrees with Biden as to the intention of the spending, which is to do whatever it takes to enable the economy to recover from the pandemic induced recession. His concern is the size of the package exceeds the economy’s “output gap”, which represents the difference between current economic growth and the economy’s growth potential, or “speed limit”. The $1.9 trillion spending initiative would raise aggregate demand well above supply, which overheats the economy and bring on inflationary pressures. Instead, Summer believes the package should spend funds gradually over time and be focused on long-term investments.

The Biden administration believes the US faces existential threats in the form of a global pandemic and climate change which necessitates an FDR-era Big Government activist response. Biden learned his lesson from the negotiations over Obama’s 2009 stimulus bill, whose effects were smaller than originally envisaged. As well, the “output gap” is a difficult figure to estimate, much like the natural unemployment rate that the Fed used to steer monetary policy. As an example, a study by ISI-Evercore found that if we use the CBO’s economic potential to estimate output gap but the Fed’s GDP economic growth path, the output gap is closed in 2022.

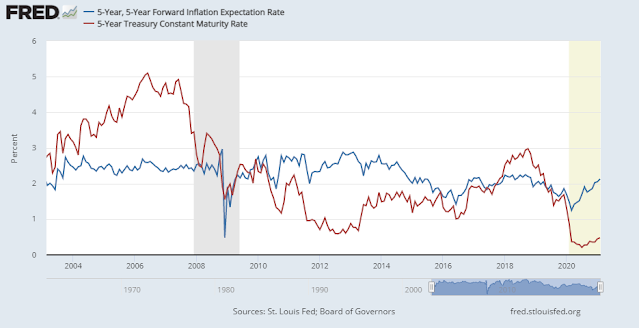

In the meantime, inflationary expectations are rising. The 5×5 forward inflation expectation rate is above the Fed’s 2% inflation target and well above the 5-year Treasury yield.

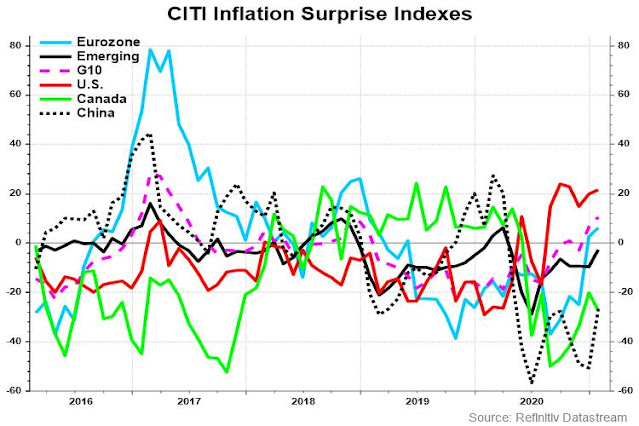

The debate started by Larry Summers is over the secular path of inflation. At a minimum, these conditions call for a cyclical rise in inflation. Indeed, the US Inflation Surprise Index (red line) has been elevated since mid-2020, and inflation surprises have recently spiked all over the world.

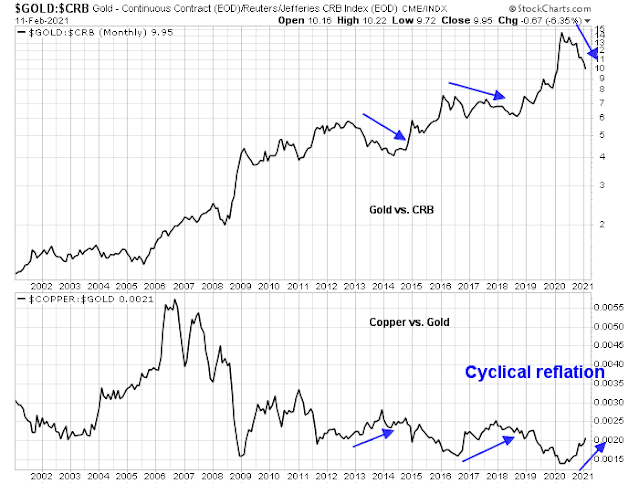

For investors, the secular vs. cyclical inflation debate is irrelevant and an academic exercise. From a technical perspective, the chartist could argue that when gold outperforms the CRB Index, it is a sign that inflationary expectations are rising. When gold lags the CRB, and in particular when the copper/gold ratio rises, it is a sign of cyclical reflation.

The value play

The investment hedge to an inflationary environment is to add commodity exposure. Equity investors should add exposure to the commodity producing sectors of the stock market.

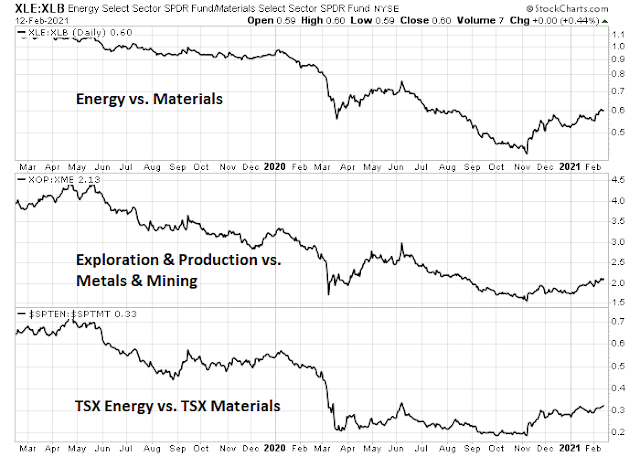

It’s time to reveal the mystery chart, which is the ratio of energy stocks to material stocks. Since the materials sector is relatively small and has non-mining companies such as steel, the second panel of the accompanying chart shows the ratio of oil & gas exploration and production companies to mining. The bottom panel shows the ratio of TSX energy to material stocks listed in Toronto, which has a broader sample of companies in both sectors. The patterns are all similar. Energy had been lagging materials, but it is in the process of making a saucer-shaped relative bottom.

Addressing the climate change threat

Value investing is by nature uncomfortable. It’s natural to be leery of energy stocks. From a fundamental perspective, the main reason to avoid the energy sector is the growing acceptance of climate change and global initiatives to lower the carbon footprint. The Intergovernmental Panel on Climate Change’s Global Warming of 1.5°C report laid out what needed to be done. To reach the Paris Agreement’s goal of limiting warming to 1.5° Celsius above 2010 levels, every nation must cut its carbon-dioxide emissions by about 45% by 2030 and reduce to net-zero by 2050.

Today, 9 of the 10 largest economies have pledged to reach net-zero emissions by 2050. 29 countries, plus the EU, have net-zero pledges for all greenhouse gases. Some 400 companies, including majors such as Microsoft, Unilever, Facebook, Ford, and Nestle, have signed on with the Business Ambition for 1.5°C pledge. GM announced that it will stop selling internal combustion vehicles by 2035. Royal Dutch Shell boldly stated last week that its production likely reached a high in 2019 and expects it to gradually decline. These initiatives are sounding the death knell for carbon-based energy sources like oil and gas.

Here is the bull case for oil prices over the next few years, as outlined by Goldman Sachs commodity strategist Jeff Currie in a Bloomberg podcast.

His basic argument has a few parts. One key element is the nature of green stimulus. While moves to electrify and decarbonize the economy will, in the long run, reduce the commodity-intensity of economic growth, these benefits are felt on the back end after years of capital expenditures. In the short run, faster growth and investment will naturally increase demand for commodities by delivering a jolt to growth and consumption. What’s more, because of environmental reasons, and the potential lack of long-term demand for, say, oil, these price increases won’t be met with increased investment in new production/mining/exploration etc. the way they might normally in a price boom. Again, if you think the long-term future is an economy less dependent on hydrocarbons, why invest now, even if prices are moving higher?

Currie also notes that Biden has a lot of discretion about taxes on drilling on federal lands and that he can institute a stealth carbon tax, lifting the global price of oil in a bid to make clean energy (wind, solar etc.) even more cost-competitive.,,

The other big aspect of his view is economic redistribution. It’s well understood by now that lower-income households have a higher propensity to consume, rather than save, their marginal dollars. So, direct checks, and other forms of wealth redistribution under Biden, will grow the economy faster than, say, the Trump tax cuts. But furthermore, says Currie, the consumption of lower-income households is more commodity-intensive than the consumption of higher-income households. Hence wealth redistribution gives you a double jolt: more growth, and more commodity-intensive growth specifically.

In other words, the supply response to rising oil prices is likely to be muted owing to the expected long-term decline in demand. That said, Bloomberg reported that shale producers are expected to ramp up production as oil prices stay above $50.

American oil explorers will boost drilling and production later this year as crude prices are set to stay above $50 a barrel, according to a U.S. government report.

Supply from new wells will exceed declining flows from wells already in service, raising overall crude production from the second half of this year, the Energy Information Administration said in its Short-Term Energy Outlook. The agency increased its forecast for 2022 U.S. crude output to 11.53 million barrels a day, up from January’s estimate of 11.49 million.

Buried in the story is the key expectation of falling aggregate production.

Despite the EIA’s expectation for rising production in the second half, the agency sees U.S. output declining in the coming months, hitting 10.9 million barrels a day in June, with the number of active drilling rigs below year-ago levels. The agency estimated 2021 production at 11.02 million barrels a day this year, down from a previous forecast of 11.1 million.

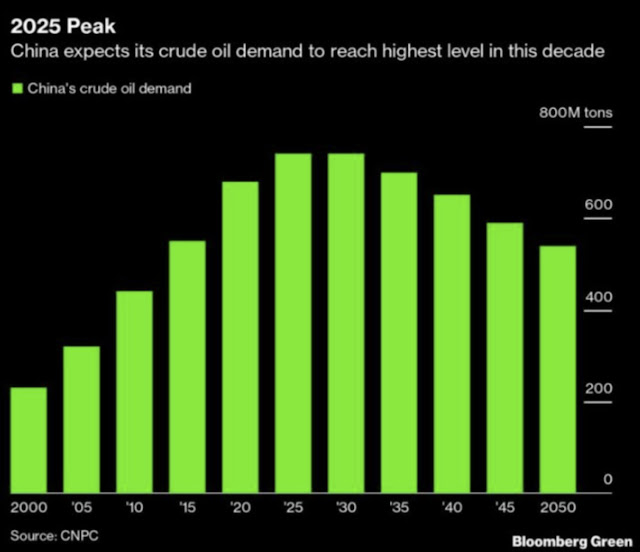

This chart of projected Chinese oil demand tells the story. Oil demand is expected to rise and peak in the latter part of this decade, followed by long-term decline. Over the next 5-10 years, however, it’s difficult to wean an economy off hydrocarbons.

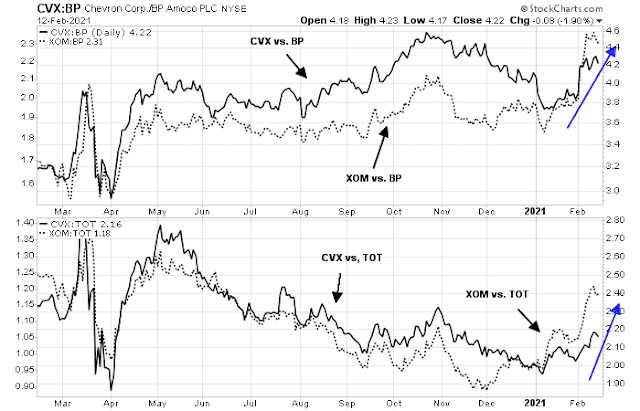

The market response to corporate initiatives to diversify into green and alternative energy also tells a bullish story of legacy energy producers. Contrast the attitude of European companies like BP (BP) and Total (TOT), which recently paid substantial premiums to buy into UK offshore wind farms, to the more conservative views of American giants like Chevron (CVX) and Exxon Mobil (XOM). The relative performances of BP and TOT to CVX and XOM also tells the story of the market’s assessment of the two strategies.

Here is another reason to favor energy over material stocks. Even if you wanted to participate in the upside of a commodity supercycle through resource extraction stocks, the enthusiasm for materials over energy stocks is substantial from a relative value and fund flows perspective. The latest BoA Global Fund Manager Survey shows that global investors have been raising their weights in both sectors, but they are already in a crowded long in materials, while their energy sector weight is only at a neutral level.

In conclusion, the global economy is poised for a bull market in commodity prices. Within the commodity-producing sectors, there is a substantial value opportunity for investors in energy stocks owing to the reluctance of management to invest in new supply should oil prices rise.

The cyclical rebound should translate into higher oil prices over the next 12-24 months. In the past three years, the ratio of energy stock prices to crude oil has been relatively flat. Energy stocks should rise in line with oil prices, which creates considerable profit potential under a bullish oil scenario.

Disclosure: Long XOM

I apologize for changing the subject. Anybody has experience with REIT´s? Underlying assets are real estate and should provide some protection against inflation. I know it is not liquid and is not exchange traded. However it might be a good addition to a long term portfolio

REITS are not all created equal.

I would stay away from:

• Shopping Mall REITs

• Office REITs

I would consider:

• Housing rental REITs

• Industrial / Warehousing REITs

Invest for income, don’t expect serious growth. You can buy REIT index based funds. Before you buy any REIT, especially the index funds, research the properties in the REIT / the holdings of the index fund. Google search “reit index funds”.

Beware the NAV trap. NAVs are highly suspect and can change significantly over time with minimal apparent relationship to stock price, in my experience.

For what it’s worth, I don’t hold any REITs or REIT index funds at this point, although I have done extensively in the past.

I have a ton of eREIT and mREIT stocks, as the bond substitute. You are right to stay away from mall and office REITs at this moment. But things can change. I think office REITs will be back after people got tired of staying home and watch their kids. Office is actually very important to tech co’s. Some of the malls might be converted to warehouse and distribution centers since they are nicely located with all infrastructure already in place. Amazon has done that in some Midwestern states.

You are also right to stay with secular trends: rental and industrial REITs. I might add for: digital economy, triple net lease, aging population, renewable energy, legalized gambling/cannabis.

They are stable so I can’t resist using options to enhance the yields. It beats the boring bonds by a wide margin. 60/40 is dead already. We are not going back. it will only get worse from now on since D is dead set on “Everything is free forever” course. Wait till enough people start to get on board and you will know. That’s how that started just about in every country.

Amusing interview with Bill Gates:

‘…they’re trying to show 1.5 degrees isn’t the biggest joke ever…’

https://youtu.be/d1EB1zsxW0k?t=565

Am I the only one troubled by our technologically advanced society’s number one solution to too much CO2 in the atmosphere being to slow the rate at which add to the problem ? We know it cannot be solved that way, only “mitigated”.

Where is the government’s offer of substantial reward to the one who comes up with the way to rid the atmosphere of 100ppm of CO2 ? Or are they unsure that that’s the problem ?

Seems to me the same guys who figured out how to make Gamestop shareholders worth more could have us shivering by this coming summer.

Here is a VERY important tip on investing in commodity producers. I have lived through a number of big commodity booms.

As the stocks rise, it is easy to think they are too high because we anchor on recent previous stock prices. Also we see commodity prices compared to the stock prices. For example, a copper mining stock might be up 100% with the price of copper up 80%. Does that make the stock expensive?

The key is to understand that the profit of a mining company goes up GEOMETRICALLY its profit margin expands with the higher commodity price. If a company, let’s say, produces a product with a cost per kilo of $5 and the price goes from $6 to $10, their profit margin goes from $1 to $5 a kilo or 400%.

The other thing that spurs profits beyond expectations when a new cycle begins, is the fact that all producers have been in hard times for a long time and have become very efficient. That means higher commodity prices go straight to the bottom line. After a few years of future boom conditions we will see lax, wasteful business policies. Companies will expand too much and borrow foolishly on marginal high cost mines. But not during the first few years of a new cycle.

So, if you believe a new multi-year commodity cycle began on November 9, the day of the Covid Vaccine, it is best to simply commit to owning their stocks or ETFs for a long period of time and not be shaken out by seemingly near term high prices compared to where they were a few months ago. Trading them will be counter-productive since once sold, if they shoot up unexpectedly, they will seem too expensive to buy back. It’s very difficult or impossible to get back on a moving train when it leaves the station.

The academic work on momentum theory has examined commodity prices and found their trends persist.

Oil and Industrial Metals are very different commodities. Higher prices can see a quick response by the oil industry as they drill and start producing new wells. A mine takes a VERY long time with feasibility and environmental studies as well as negotiations with governments and possibly indigenous peoples.

The need for metals for green infrastructure, solar, wind and electric cars is huge and beyond current production. It is very long term.

Energy could very well have near or medium term good supply/demand dynamics. The stocks could do great. I live in oil country and its my hope that this unfolds. But a Biden deal with Iran could unleash their production. Russia and the Saudis could ramp up production. Maybe Venezuela is let back into the world. Maybe air travel will see a permanent shift lower. Maybe the European energy companies know what the future will be. Who knows where the price of oil will be in five years? The futures price for 2025 is $12 or 20% below today’s spot. That’s the professional view.

I do know that the demand for industrial metals is clear and supply not a problem.

Excellent insights, Ken, Thanks for sharing them.

I agree with you analysis but materials is already a crowded trade and energy isn’t (yet).

Industrial metal investments are a strange new area for investors. The stocks are up but I don’t think investors have embraced a secular outlook. I expect that in future there will be a silly, grossly optimistic peak. People are currently in them for a trade. Since they have be so out of favor for so long, a bit of support looks like a crowded trade.

Sentimentrader.com said that the commodity index is up about 5% over the last two years and usually goes up 40% at a peak. In today’s super-charged investment world, who knows how high these could go if an inflation meme goes wild.

PICK ETF is the Global Mining ETF that has the huge global mining companies. XME Mines and Metals ETF is 100% U.S.

XLB the U.S. Materials ETF has less than 15% in mining companies.

The Canadian Materials ETF has a large number of gold miners.

None of this is a recommendation since I don’t know your circumstances or risk profile.

Cam, I have a major concern against investing in oil (though I do have a small position). Many large investors are staying away from the fossil fuels because of bad publicity and their own ESG policy.

Also, as you said, if the oil producers are not investing to produce oil as they see the demand waving, why should investors put money in the sector as they can also see the long-term decline.

The oil producers can post great earnings in short-term but may not be rewarded by the market.

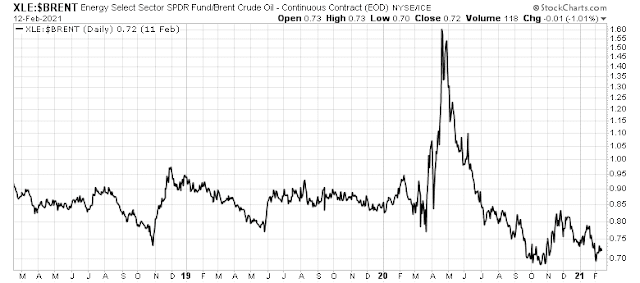

As I pointed out, oil & gas is an industry that people love to hate. Over the next 2-4 years, few are going to invest in new capacity even if we get a cyclical rebound. This will push up oil prices, which also push up the stocks (see the last chart of how XLE moves with oil price).

It’s the new tobacco. Tobacco use is in widespread decline all over the world. The tobacco companies are throwing off terrific cash flow for shareholders. Similarly, XOM has a 7% dividend yield, CVX has a 5.6% yield.

That’s what value investing is all about. It makes you uncomfortable.

I agree Cam. Don’t get me wrong. Metals and Oil are a beauty contest.

I own high dividend energy stocks for balanced clients but metals more. For growth clients my tilt to metals is much higher. Overall my commodity allocation was extremely small over the last three years and now isn’t. A high weight is confirmed by new momentum performance and economic projections by trusted economists and market gurus.

BTW I haven’t owned metals oriented investments since 2016 when they had a good year. I’m always just a fair weather investor.

Take a look at how global energy (IXC), global materials (MXI) and global mining (PICK) have performed.

https://stockcharts.com/h-sc/ui?s=IXC%3APICK&p=D&yr=2&mn=0&dy=0&id=p18714209491&listNum=1&a=899093109

My take:

1) Mining has surged against ACWI

2) Energy is bottoming and it is the laggard value play

3) IXC vs PICK is tracing out a similar bottoming pattern as the other charts

These sectors are very small. It is not going to be able to absorb big money inflow. If you have a small portfolio it will make a difference. But if you have a big one, not much influence, better with hardware/software/semi/web/bio.

About carbon neutral thing, I think it is more about virtue signaling. The advanced economies and big corps have done a lot to minimize their share to almost negligible. If you cannot get China and India to do the job, it does not matter. I see this as a money scam in all kinds of agreements, rules, and regulations cranked out by all kinds of govs and agencies. You don’t need a lot of info to know that. Just look at UN and its finance and you get a clear picture. And just look at State of CA and its carbon credits regulations. This is how Elon Musk got his money by sniffing out the opportunities, ZEV credits, using politicians’ propensity to engage in grandstanding. Add to that bought and paid for so called “scientists.”

How are EVs going to help? It is a mystery. You shift pollution to the power plants. That’s not ZE. And you add tons of copper and cobalt and lithium. The latter two are very difficult to mine and very energy (fossil) intensive. A lot of environmental destruction and air pollution. As for copper, if you paid attention, it is getting very difficult to mine, as opposed to public perception as easy and abundant.

Let’s look at the big picture. All of the green stuff are not economic viable without heavy subsidy. Traditionally govs tax oil/gas to fund them. Going forward it is not going to be sustainable with declining oil/gas. So what will you do? Raise prices/taxes? If you accept that you need to accept lower economic growth.

Thank you all for your insights. Excellent!