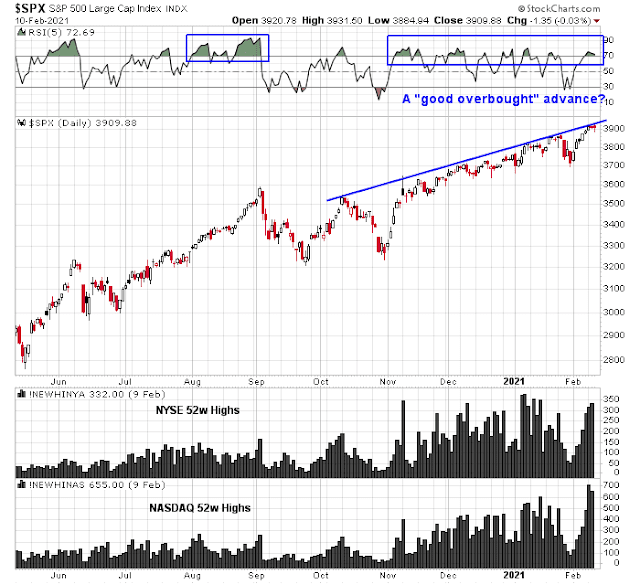

Mid-week market update: Despite my warnings about negative divergence, the S&P 500 continued to rise and it is now testing a key trend line resistance level at about 3920. Much of the negative breadth divergence have disappeared, though Helene Meisler observed that about 35% of the NASDAQ new highs are triple counted.

Is this another instance of a “good overbought” sustained advance?

The bull case

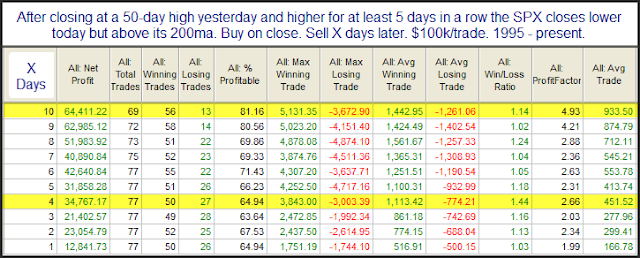

There is nothing more bullish than a market making new highs, and FOMO (Fear of Missing Out) price momentum has been relentless. Rob Hanna at Quantifiable Edges found that persistent moves to new highs rarely end abruptly.

Moreover, the price momentum factor, which measures whether market leaders continue to lead the market upwards, is also strong.

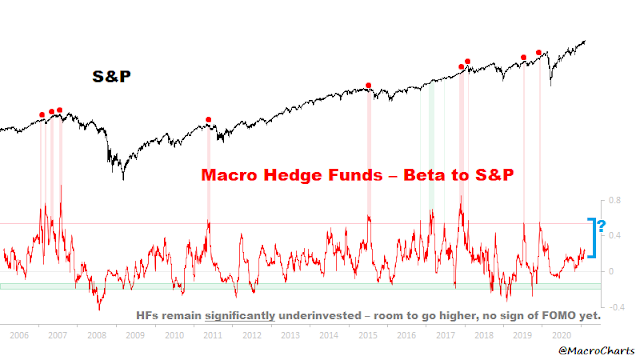

Macro Charts observed that the equity beta of macro hedge funds is in neutral territory, indicating a potential for a beta chase should the stock market rise further.

Extreme giddiness

On the other hand, do you really want to be chasing a market characterized by extreme giddiness? What do you call a market that celebrates a cash-starved car manufacturer like Tesla buying $1.5 billion in Bitcoin (instead of, say, investing in better and more manufacturing)? Bloomberg also reported that former NFL quarterback-turned activist Colin Kaepernick is co-sponsoring a SPAC.

What do you call a market when Reuters reported that a 12-year-old South Korean boy with 43% returns is the new retail trading icon?

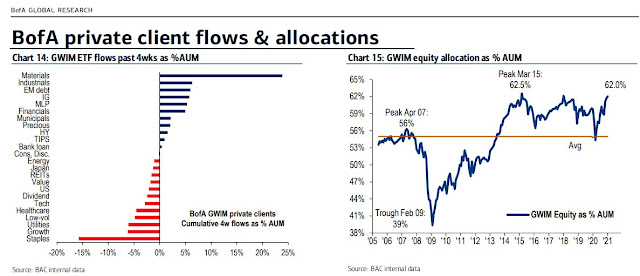

Notwithstanding anecdotal stories about Korean youngsters trading the market, BoA reported that private client equity allocation is near cycle highs.

While overly bullish sentiment is an inexact market timing signal, the atmosphere is becoming reminiscent of the dot-com era of the late 1990s.

Time for a pause

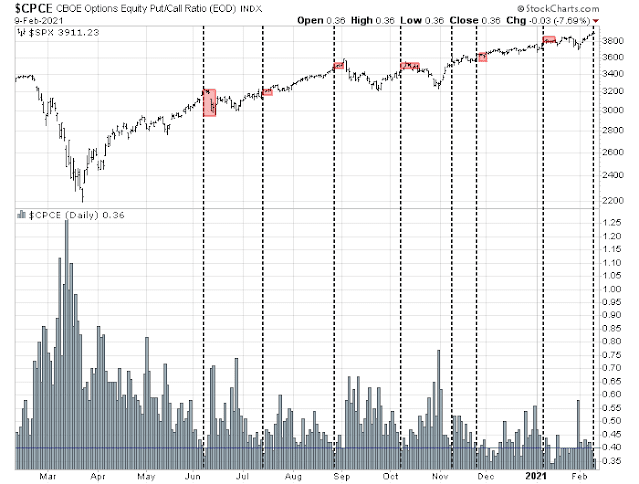

In the short-run, the market is likely due for a pause. Urban Carmel pointed out that the CBOE equity put/call ratio recently fell below 0.4. If history is any guide, the market has experienced difficulty rising over the short-term. However, most of the episodes in the past year have resolved themselves with sideways consolidations rather than pullbacks.

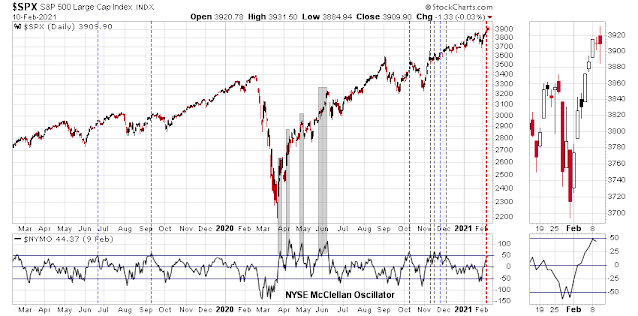

In addition, the NYSE McClellan Oscillator reached an overbought extreme on Monday. In the past two years, the market has paused and pulled back after such conditions.

My base case scenario calls for some sort of sideways consolidation and minor market weakness over the next one or two weeks.

VERU/ UAVS/ AYRO all trading off premarket.

1. Closed VERU premarket for a small gain.

2. Two premarket trades in AYRO to try navigating the downdraft has me with an adjusted basis of 9.61. Currently bidding 9.17 so I may end up taking a loss on this trade.

3. It’s purely psychological, but I opted to close UAVS more or less flat in order to focus on AYRO.

Still bearish on the broader market indexes. Sure, we could continue higher but I don’t think it’s worth the risk. We’ll see a correction soon enough – maybe even today – and I’ll look for more attractive entry points then.

AYRO off @ 9.42 and off my back.

I’m looking over my watch list right now (~80 ETFs/ stocks), and what strikes me immediately is that there are no attractive prices. Everything has gone straight up for several days.

Another sign the rally may be nearing an end is my P/L. A +4% gain over six weeks/ +12% over four months usually means (given my risk tolerance) that the SPX has moved almost twice as much over the same periods. I’m a strong believer in reversion to the mean over extended time frames.

Adding to SPXU.

Only two asset classes look attractive right now.

1. I’ll be looking for a reentry into RYGBX.

2. Although I categorically avoid shorting, I’m taking a flyer in SPXU here.

Be careful with SPXU. Must trade it daily. I held it longer than a few days once, bad idea. Just my $0.02.

SPXU, like SPXS has a horrible decay…so timing is critical.

One thing to consider is when it spikes and there are signs of a bottom is buying puts with some life so not 3 days but a few weeks or months and let that decay work for you. Of course what happens when the market tanks and you feel fear, it’s hard to believe that spxs or spxu will go way back down, but they do. The premiums get pricey though.

Right. My holding period will not exceed today’s session.

Stopping out of SPXU here. Basically to avoid turning a profit into a loss.

Reopening a position in RYGBX at the close.

Opening a starter position in BNGO after hours.

TLT continues to sell off this morning. Not all trades will work out as nicely as the last trade in RYGBX. Regardless of what happens intraday, my plan is to close out the position end of day.

Out of BNGO.

TLT will close at the day’s low, and I’ll end up giving back Wednesday’s gains on RYGBX and then some.

On the other hand, I traded in/out of BNGO all the way up to 14+, which should eclipse the loss on RYGBX.

Unbelievable end-of-day rally in the indexes.

As it turns out, I took a hit on the day due to a larger-than-expected loss on RYGBX.

The only way to win is to acknowledge there will be losses on a daily basis, and keep grinding away. There will never come a time when we book gains on each and every trade.