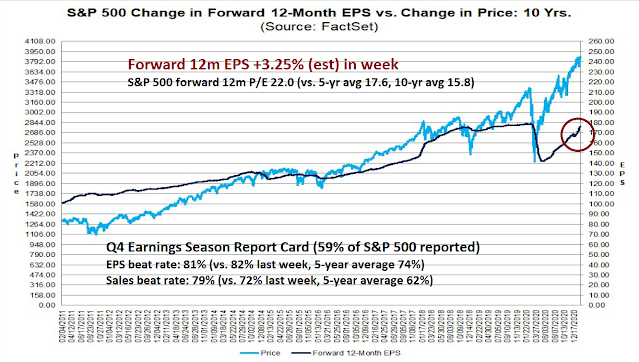

Q4 earnings season is in full swing, and results are strong. With 59% of the S&P 500 having reported, both the EPS and sales beat rates are well ahead of historical averages. Moreover, forward 12-month EPS estimates surged 3.5% in a single week.

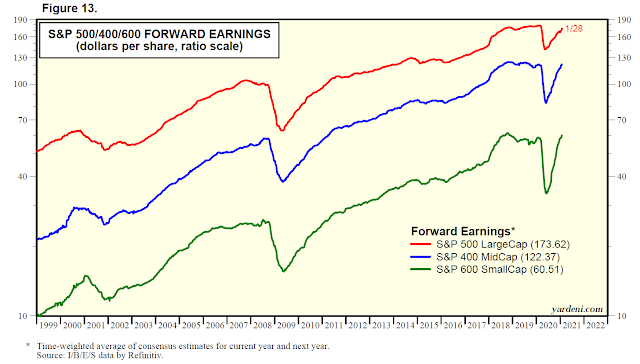

As well, estimates are surging across all market cap bands.

But it’s not all good news for earnings and the stock market.

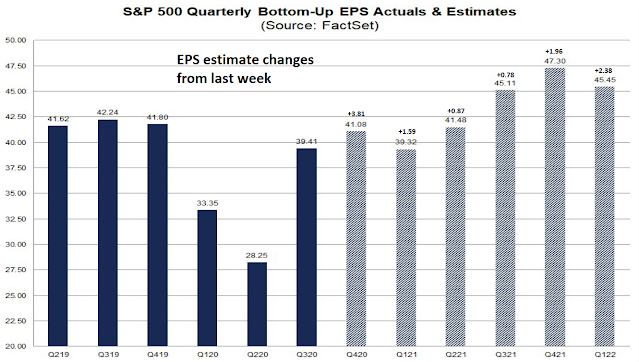

A surge in estimates

First, the good news. If we drill down to the quarterly EPS level, estimates are rising strongly across the board. In particular, Q4 estimates are seeing a surge in estimate revision. Q4 estimates rose 3.81 to 41.08 last week, an astounding 10.8%. Moreover, FactSet reported that the Q1 positive guidance is 64%, which is well ahead of the 5-year historical average of 33%.

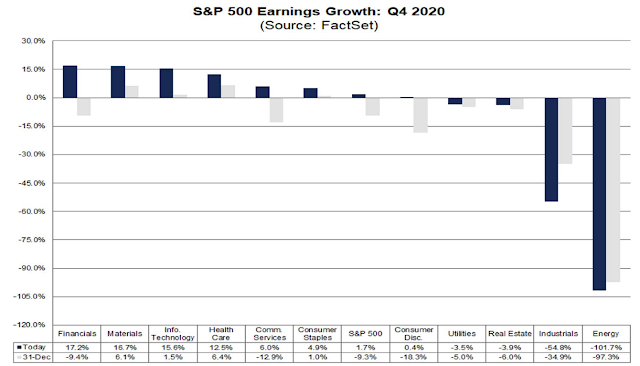

With the exception of the industrial (8.4% weight in S&P 500) and energy (2.4%) sector, Q4 EPS growth has beaten expectations in all other sectors.

Supply chain bottlenecks constraining growth

The Transcript, which monitors earnings calls, summarized the mood this way:

It’s hard to believe that we’re approaching a year since the U.S. economy shut down due to COVID. Vaccines continue to roll out though and people are ready to have fun. Strong demand is putting pressure on COVID-impacted supply chains and potentially creating inflationary forces.

Demand is strong, but supply chains are stretched, which is leading to inflationary pressure:

Economic activity is stronger than anticipated“Despite experiencing a series of new COVID-19 related restrictions around the world, our results reflect a stronger market environment than we had anticipated, with revenue growth and new opportunities in select markets.” – ManpowerGroup (MAN) CEO Jonas Prising

Strong demand is stretching supply chains“I just want to say that the most interesting thing that’s happening is the rate at which demand has increased. We’ve never seen an increase in demand happened as quickly. And that combined with COVID and the pandemic has really stretched the supply chain…The supply base is generally tight, not just semiconductors, which has gotten a lot of press, but many of our components, are on longer lead times. Our suppliers and we are struggling with absenteeism due to COVID.” – Cummins (CMI) President & COO Livingston Satterthwaite

“I would tell you on the new car side, we lost unit sales, because…we couldn’t replace the inventory…in December, we had many stores below a 20-day supply and that’s a 20 day supply across all model line. So individual hot models you didn’t have any day supply…we sat here a quarter ago and thought by the end of the first quarter days supply would be back up to normal. But because what’s going on with the microchips and some other things, it’s probably going to bleed well into the second quarter before inventories gets back.” – Asbury Automotive Group (ABG) CEO David Hult

The supply chain is not stable“I think one of the problems that we’re dealing with is that the supply chain is not as stable. You know, we’re finding that, you know, [subcontractors are missing deadlines]. Well, what happened? Well, what happened was they got a [de-commitment] from their supplier. They didn’t get some bundles they were expecting. They couldn’t hire some people, somebody tested positive for COVID. So they had to send 50 people home, who had come in contact with it.” – Microchip (MCHP) CEO Steve Sanghi

There’s no slack in the system“…we expect that the constraints we are currently seeing are likely to continue through much of calendar year 2021 and possibly into calendar year 2022…there is no slack in the system. Everything that gets built, get shipped, there’s absolutely no slack in the system.” – Microchip (MCHP) CEO Steve Sanghi

This leads to inflationary pressure“We are seeing quite a bit of commodity inflation and a larger foreign exchange impact as we go into 2021, particularly in Latin America, in Turkey, in India and in South Africa. And we’ve got some commodity inflation coming through, in particular, tea in India, in palm oil, in liquid oils and in food ingredients. So we’ve got some inflationary pressures coming forward. And we do expect mid- to high single-digit commodity inflation in the first half.” – Unilever (UL) CFO Graeme Pitkethly

“We have a situation right now in the supply chain…There’s a huge capacity issue, where there’s not enough capacity, and we know they’re going to have to — they’re going to start spending money around steel, iron ore, mining, copper, plastics, all these things.” – Emerson (EMR) CEO David Farr

“Though we are seeing an improvement in our in-stock levels as compared to where we were during Q2, we were not immune to the supply chain disruptions and rising freight costs, which were prevalent across the industry.” – The Container Store (TCS) CFO Jeff Miller

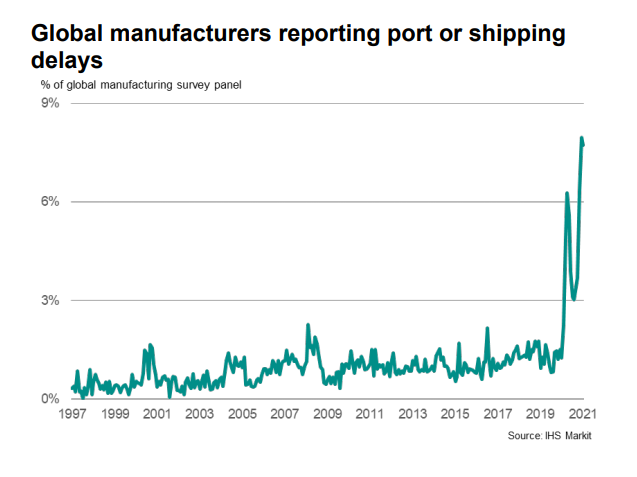

Chris Williamson at IHS Markit confirmed that supply chain constraints are hampering global growth.

Global manufacturing remained encouragingly resilient in January despite rising coronavirus disease 2019 (COVID-19) infection rates and fresh lockdown measures in many countries, according to the latest PMI survey data. Especially strong expansions continued to be reported in the US, Germany and Asia excluding Japan and China, notably in India and Taiwan.

However, export growth slowed close to stalling, dampening production growth compared to prior months, with an especially notable renewed fall in exports out of mainland China. Factories worldwide meanwhile also reported that exports and purchasing continued to be dogged by supply delays, which worsened further as demand often outstripped supply and logistics delays caused increased transportation issues. The resulting increase in supplier pricing power and shipping surcharges caused input prices to rise at the fastest rate for almost a decade, with prices charged by factories also hitting a near ten-year high.

Transportation constraints are becoming a serious problem.

If supply chain bottlenecks persist, the global economy could be nearing peak growth.

An uneven market reaction

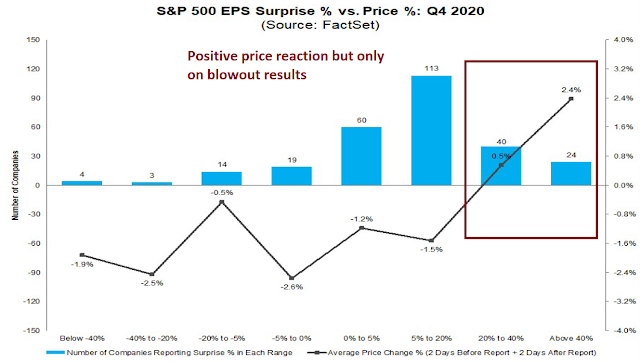

Despite the strong earnings results, the market reaction has been less than enthusiastic. The market has punished earnings misses and it hasn’t rewarded earnings beats, except for blowout results.

Strong Q4 earnings should be supportive of the reflation and cyclical rebound investment theme. However, cyclical sectors have not performed well relative to the S&P 500 except for semiconductors. The poor relative performance of cyclical groups is probably reflective of supply chain bottlenecks that constrain growth. In particular, the lack of positive reaction of transportation stocks to rising shipping costs is worrisome.

In conclusion, Q4 earnings season has been a good news and bad news story. The good news is results are strong and the Street is revising estimates upward. The bad news is the muted nature of the market reaction and signs of possible peak growth. A market that struggles to react well to good news is a warning for traders and investors.

Incredible move off the January 29 low for the SPX. That’s a major advantage of buy-and-hold – it captures all of the unexpected upside moves. Of course, avoiding extended declines is the reason most of us attempt to time the market.

How much, if any, of the recent gains will be given back? I still think we retest the January 29 low.

Like this: Russell 2000 small cap breaking out of 37-year base vs. Russell 1000 value.

Extended tho.

https://twitter.com/MikeZaccardi/status/1358745717259571201/photo/1

A 10% jump in future earnings in one week has got to be a huge positive. It is a testament to the unexpected efficiency and speed of deploying of vaccines pumping up businesses. Demand is surging ahead of supply and supply chains are stretched. That will lead to better selling prices and margins. The LA ports are so busy they are backed up.

I expect analysts will be continually surprised at how big the profits surge will be for cyclical companies going forward as we leave the pandemic behind us. They have never lived through an economic shutdown and reopening.

Who could have predicted Larry Summers saying there is too much stimulus. He is just slight less to the Left than Bernie and as Obama’s economic advisor constantly called for much more stimulus than other economists. If he says there’s too much then there is WAY TO MUCH. Expect a surprising surge in consumer spending to follow.

It stands to reason that, the lockdowns etc have caused a build up in future demand, just like borrowing and debt can bring future consumption forward….or so they say. But Covid aside, at the end of 2019 the market was already expensive and at some point we get a big correction aka a bear, we have to some day. So all these big earnings jumps are like water sloshing in a bucket, and one day good news will be bad news. If something drops 50% and then goes up 50% you are still down 25%, but wall street wants to just wave the gains in front of our noses. I have no idea when this bull will end, but it will one of these days or months or years. For now it still looks up, but I have to say I’m really nervous.

The US has administered 41 million vaccines as of yesterday. This is a huge positive (although there are variants that may need a booster dose). Having said that, total US cases are subsiding rapidly.

Cam, don’t you think supply chains will keep improving through the year? wouldn’t this be bullish for both US and overseas markets?

The US is actually one of the better performing countries in terms of vaccinations. See https://ourworldindata.org/covid-vaccinations

Europe, except for the UK, is still lagging. Don’t be so US-centric in your analysis. This is a global problem.

Though it is a global problem, it seems like it has taken a disproportionate effect on US profits. Europe is equally affected so far as profits go. The US (and European) centricity is a good thing to focus on as it will become the engine of global growth in the near future.

Asian economies are relatively less affected and would benefit from surging demand. You and Ken have both alluded to this (Cyclicals, EMs, Commodities, Overseas markets etc.).

https://www.marketwatch.com/story/rush-of-overseas-bidders-sparks-u-k-deal-making-boom-11612866120?mod=mw_latestnews

This was long expected. The dividend pay out has reduced from around 1.60 circa 2007 to about 30 cents. Cam had recommended this a while back. Still not late to buy. The UK has significant oil and mining companies.

I think main street has discounted the effects of a $2 trillion stimulus. I don’t blame them. Lower income US citizens lost their jobs months ago and the homeless population has grown in proportion.

In terms of the stock market, I can’t get myself to buy at these prices but I’ve stopped selling off long positions since price action seems to be holding. Would not be surprised if the S&P 500 goes to 4000 next.

I think the SPX makes one more run at an ATH before a significant pullback.

I wouldn’t refer to today’s tepid rally as a ‘run,’ but there’s a chance that another ATH today may mark the beginning of a reversal.

1. COTY. I closed the position premarket as soon as the negative reaction to the sales ‘miss’ hit the tape. Minor loss.

2. Closing UAVS here.

3. Trimmed PLTR earlier in the session.

4. Still holding ALTO/ ICLN/ QS.

Reopening SOL here.

Closing all positions here for a small overall gain. +0.134% – it may not sound like much, but if the SPX closes where it is now it will eclipse today’s +0.05% gain in the SPX.

There is one asset class that presents an attractive entry point right now.

Reopening a position in RYGBX (Rydex Long Bond) at the close.

Starter position in VERU after hours ~19.

Reopening a position in UAVS after hours. I have a nice ‘buffer’ on this one, so I’m not averse to reopening at the intraday high.

VERU/ UAVS both indicated higher in the premarket session. Not taking any off here, but I probably wouldn’t be opening here either.

Reopening starters in QS/ NIO.

Adding XPEV.

Adding GSAH.

Partial trim of VERU at the open.

Reopening PLTR.

Trimming XPEV/ NIO.

Adding positions in JETS/ EWZ.

UVAS off here.

Taking a swing at WIMI.

Reopening UAVS/ VERU.

Out of UVAS for the day.

UAVS.

UAVS.

All positions that can be closed have been closed.

I also plan to close RYGBX end of day for about +0.6% one-day gain.

RYGBX came in better than expected @ +0.95%.

After hours – reopening positions in VERU/ UVAS and opening a new position in AYRO.