Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

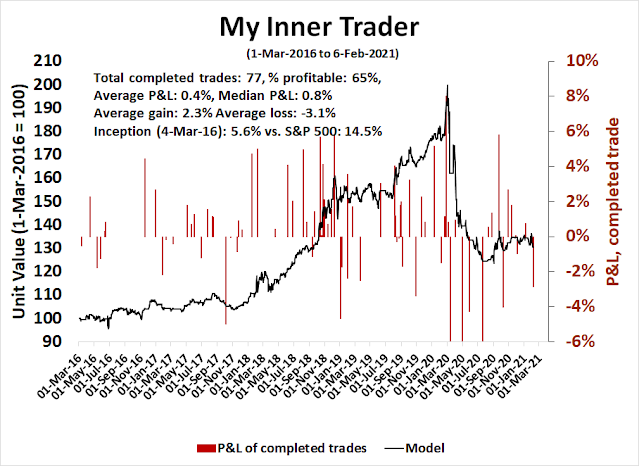

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A brief storm?

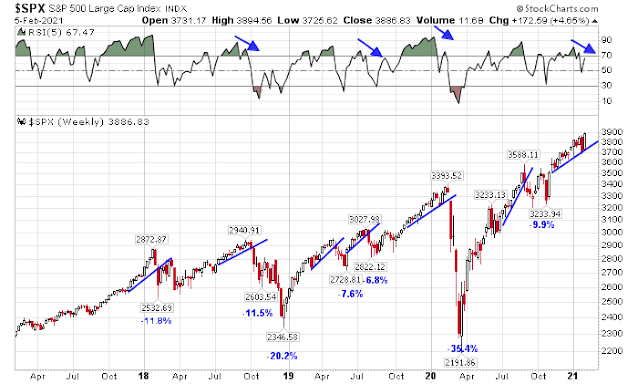

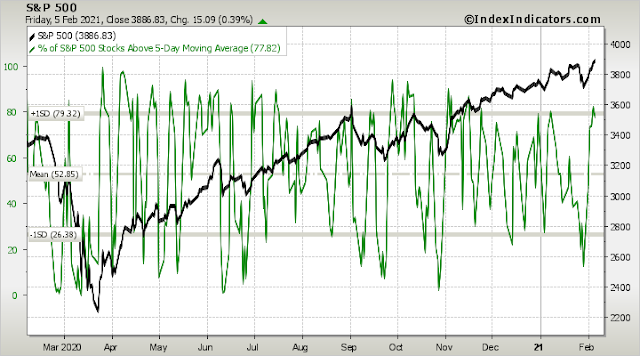

Was the recent bout of r/WSB induced volatility just a brief storm? The S&P 500 remains in an uptrend on the weekly chart, though it is exhibiting a negative 5-week RSI divergence.

Despite last week’s recovery, technical alarms are ringing everywhere. Will the market gods rip the bandaid off now with a minor pullback or face a major bearish episode later?

Still frothy

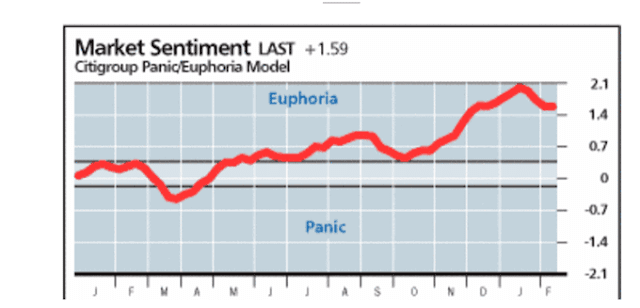

A number of indicators with long horizons are flashing warnings. The Citigroup Panic/Euphoria Model recently reached a record high euphoric level but readings have stabilized after backing off slightly.

Business Insider reported that BoA’s Sell Side Indicator is showing signs of “dangerous optimism” not seen since August 2007. This indicator is only 2% away from a sell signal.

Cross-asset divergences

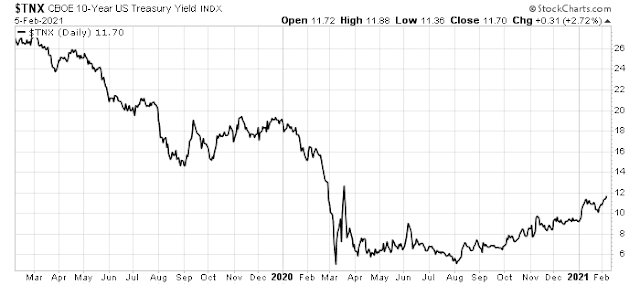

The 10-year Treasury yield has been rising steadily and stands at 1.17%. The increase in yields will present bonds as a more attractive alternative to stocks put valuation pressure on equity prices.

The USD, which has been inversely correlated to stock prices in the last year, is strengthening. This is also setting up as a negative divergence to be concerned about.

Deteriorating internals

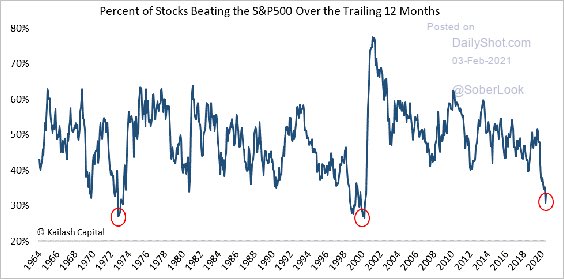

Market internals are weak. Leadership is narrowing to levels last seen during the NASDAQ bubble top and the Nifty Fifty top. Just remember Bob Farrell’s Rule #7: “Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

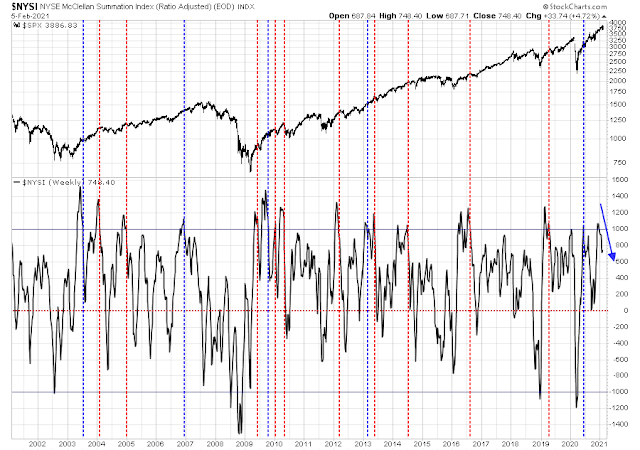

Momentum is fading. The NYSE McClellan Summation Index (NYSI) surged to over 1000 and recycled. About two-thirds of similar past episodes (red vertical lines) have resolved bearishly. In most of the cases where the market has pulled back, NYSI fell to zero before making a bottom.

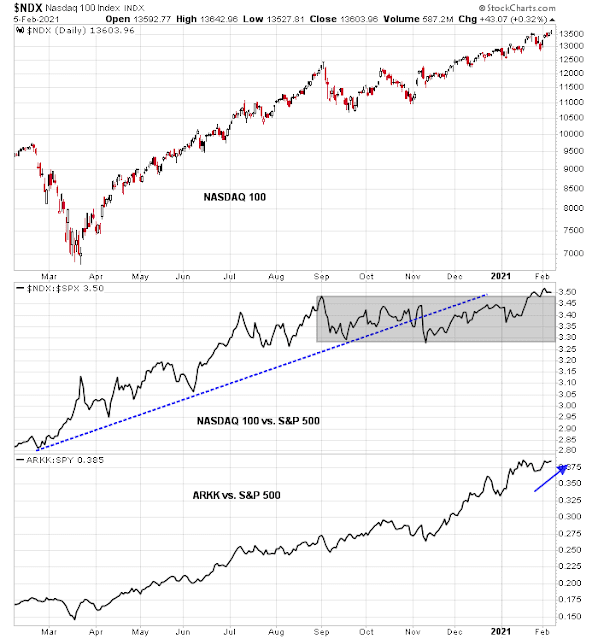

The levitating NASDAQ

The one exception to the picture of deteriorating internals is the amazing NASDAQ. The NASDAQ 100 broke out of a relative consolidation range (middle panel) after breaking a relative uptrend in late October and early November. Moreover, the high-octane ARK Innovations ETF (ARKK) appears to have found a second wind relative to the S&P 500 (bottom panel).

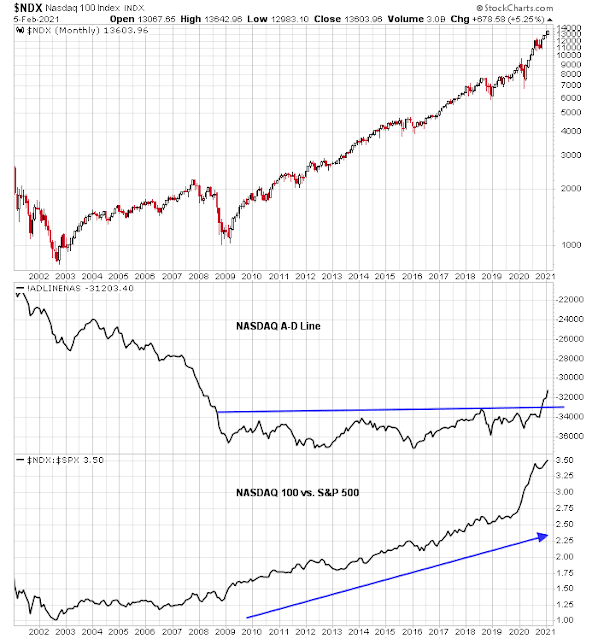

From a purely technical perspective, NASDAQ leadership is well deserved. The NASDAQ Advance-Decline Line broke out of a multi-year base and its performance relative to the S&P 500 has been stunning.

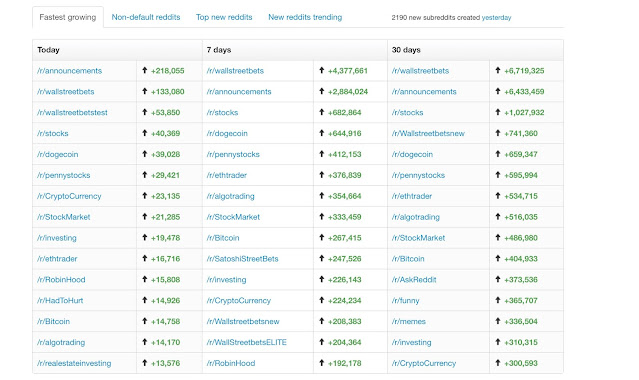

Are the animal spirits stirring again? Just look at the growth in Reddit groups. These readings suggests that small retail investor trader activity is the root cause of the latest NASDAQ frenzy.

The

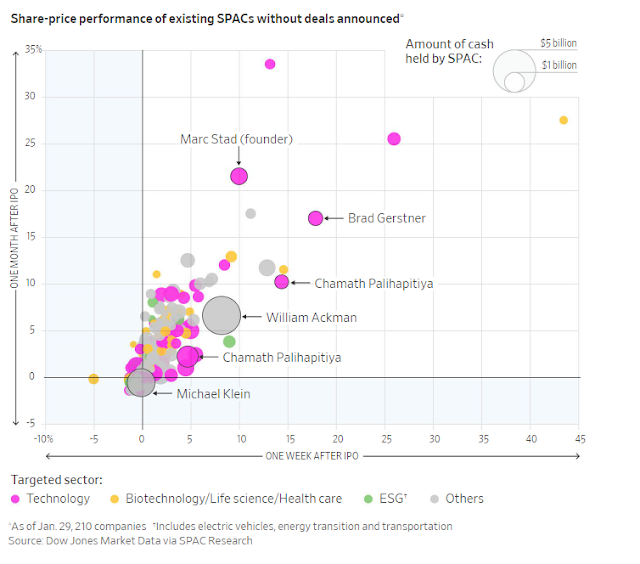

WSJ reported that the day trading crowd are moving into SPACs, or blind trust shells with no underlying businesses. I can see that this is going to end well and everyone is going to be rich.

Day traders fueling enormous gains in popular stocks such as GameStop Corp. GME 19.20% are also powering big swings for another suddenly hot investment: so-called blank-check companies.

Special-purpose acquisition companies—shell companies planning to merge with private firms to take them public—are rising more than 6% on average on their first day of trading in 2021, up from last year’s figure of 1.6%, according to University of Florida finance professor Jay Ritter. Before 2020, trading in SPACs was muted when they made their debut on public markets.

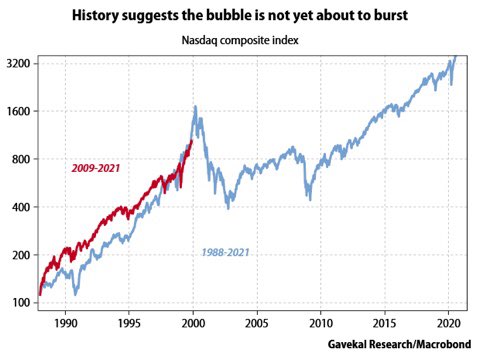

If you have to justify NASDAQ strength by pointing to the dot-com bubble, something is seriously wrong.

A complex double top?

What should we make of the market’s continued strength in the face of all these warnings? Alex Barrows recently declared

a major monthly sell signal.

Barrow then qualified his bearish call by proposing a scenario of a “complex double top”.

In conclusion, this market is highly extended and can pull back at any time. The market gods can rip the bandaid off now with a minor 5-10% pullback or allow the market to advance further and resolve this in a major bearish episode.

While I remain long-term bullish, short-term risk levels are high. Investment-oriented accounts should refrain from deploying new cash and consider lightening up equity positions on rallies. Traders can play the melt-up game, but at their own risk. The more prudent course of action is to stay nimble and watch for a downside break before turning overly bearish.

We have just had the VIX at 37 hardly a week ago. Surely the odds favour more gains over the next couple of weeks at least. The big correction scenario mid year seems likely. It would be a brave person who shorts the market right now in the face of the Fed. Once the ten year rises a little I can see rotation back to bonds though.

The current dispersion of individual stock performance is a few standard deviations above normal. That means many stocks are already correcting while others make bold new highs.

This is now a market of stocks not a stock market.

Market of stocks with very narrow leadership.

It is a conundrum…supposedly when people panic they sell everything, but when the market is more complacent the correlation drops. Only now we have some loss of breadth which is supposed to be not so good, only somehow it is. I think this highlights the need to assess things in a way which is resistant to confirmation bias.

I don’t know, but I think the market will grind higher because there will be more government money because Covid is going to be around for quite a while and this money will get into the economy….maybe thesis what is going on

Only, it defies reason that when things are so bad it just keeps going up….that’s where we get all these confirmation bias issues….find a technical system and follow it

I think we had a correction. Now we’re awaiting a retest. We may not get a retest.

I believe there are significant opportunities and risks ahead. Thus we have to make decisions in an uncertainty environment.

1.9 trillion stimulus will favorably impact profits of many companies. As mentioned in this page, more stimulus (maybe fiscal) is possible and the whole picture is unprecedented.

As pointed out in this forum there are opportunities related to green trends, such as electrical vehicles, metals, mining, etc…

There is still a lot of uncertainty regarding the pandemia. Rich countries have the illusion that they will vaccinate their population and the problem is over. I believe that we need to vaccinate the world population until we reach herd immunity. Otherwise other mutations will develop such as the UK and southafrican. I still see opportunities in the human health industry, since it is possible that we have to vaccinate ourselves every year.

I believe that the effect of the stimulus will fade away in two or three years and inflation will raise. Interest rate would raise in three to five years. IMHO bandaid is an understatement. I see a lot of opportunities and risks. I do learn a lot with all of you.

https://www.barrons.com/articles/the-biden-stock-market-wont-be-like-the-trump-market-what-to-expect-51612535400?siteid=yhoof2

Watch interest rates, which may be on the rise. If so, rally may be in its last stages.

No one wants to give up growth stocks and that is contrarian bullish for value.

Reopening PLTR @ 38.4x.

Adding @ 37.2x.

Trim @ 37.7x.

Reopened/trading around QS/ UAVS/ COTY as well.

Reopening ALTO (formerly known as PEIX).

Way too many traders expecting a correction.