After last week’s wild market swings, it’s time to have a sober discussion about risk control. I know that risk control isn’t a sexy topic, but better portfolio risk control can lead to better overall returns.

- Mis-specifying investment objectives and risk preferences

- How to take advantage of volatility

- Regime change risk in the form of:

- Unexpected tail-risk

- Changes in market environment (conventional regime change);

- Slow changing regimes that investors may be unaware of;

- Changes in modeling assumptions.

The right and wrongs reasons for trading

- It’s money you can’t afford to lose.

- You have no idea what you’re investing in or why.

- You’re buying purely based on emotion.

- You have no idea what tendies are.

- You have a family or other financial responsibilities that are more important than putting on a YOLO trade.

- You’re buying a stock because you saw someone talking about it on social media.

- You’re buying a stock because one of your friends owns it.

- You have no idea when you will sell it.

- You’re revenge trading.

- You don’t understand the risk involved in the stock market.

Take advantage of volatility

Increasing (decreasing) investment in an actively managed mutual fund when fund volatility has recently been low (high) leads to a significant improvement in investment performance. Specifically, volatility-scaled fund returns exhibit significantly higher alphas and Sharpe ratios than the original (unscaled) fund returns. Scaling by past downside volatility leads to even greater performance improvement than scaling by total volatility. The superior performance of volatility-managed mutual fund trading strategies is attributable to both volatility timing and return timing. Fund flows are negatively related to past fund volatility, suggesting that fund investors are aware of the benefit of volatility management.

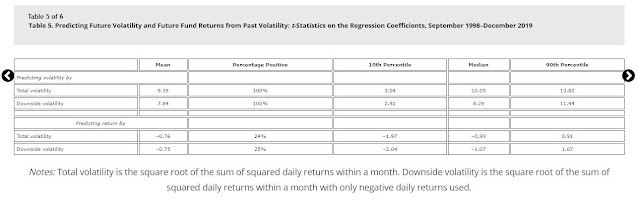

We estimated a similar regression of one-month-ahead fund returns on past fund volatility. For the predictor variable, we used both past total volatility and past downside volatility. We estimated the regressions fund by fund and report in Table 5 the distribution of Newey–West t-statistics of the regression coefficients.

When predicting future volatility with past total volatility, we found that the regression coefficient is positive and statistically significant for all sample funds. The results for downside volatility are similar, with all regression coefficients being positive and statistically significant. The above results are not surprising because volatility persistence is one of the most important stylized facts in the volatility literature. What may be a little surprising is that the relationship is statistically significant for each of the 1,817 sample funds.

Beware of regime changes

Tail-risk of widespread deaths

We start the analysis with a simple Ordinary Least Squares regression model where market returns are the dependent variable and our mortality metric is the independent variable. Depending on whether you use the “high,” “median” or “low” estimate for conflict, the correlation to the global equity market is between negative 30% and negative 38%, but not statistically significant with only 11 data points. For global bond markets the simple correlation ranges from negative 63 to 71%, which is statistically significant despite the small sample of eleven data points. For a typical 60% equity /40% fixed income institutional portfolio, the correlation averaged around negative 45% which is significant at the 95% confidence interval.

The “best fit” is between bond market returns and the “maximum” conflict time series with a correlation of negative 86% (r-squared = .74). This is statistically significant at a greater than 99.9% level. We chose not to control for other effects (inflation, changes in rate of GDP growth) as they may also be outcomes of the real world events, not independent effects. A second benefit of considering the log relationship is to shed light on the possibility that the OLS results are being driven by two large events where casualty rates spiked, World War I and World War II. The small differences in the regression coefficients suggest that the World War decades are not dominant.

Despite these tail-risks, the study concluded that bond market returns are far more impacted by widespread deaths than equity returns.

Given these empirical results, we can reject the null of our hypothesis that financial market returns will be negatively correlated to conflict mortality for both fixed income markets and the blended 60/40 portfolio. For equities alone, the result has the correct sign but is not significant on eleven observations. We can also confirm that fixed income markets are more acutely impacted.

A pandemic under and over-reaction

- Herding effects. The West first under-reacted to the bad news about the virus and it is now over-reacting. When China first downplayed the effects of the pandemic but shut down a city of 11 million, Tufekci realized that the problem is serious. Today, the press is full of stories about the shortcomings of different vaccines, but the fact is Operation Warp Speed was a resounding success. Even the “failures” of the vaccines as specified in research papers meant that patients usually didn’t die and only experienced very mild COVID-19 symptoms. Moreover, the world has reached a milestone of more vaccinations than reported cases despite the uneven manner of vaccination programs around the world. That’s good news that the market consensus is ignoring.

- Thinking in exponents. The above chart shows a shortcoming of the human brain. We are simply not hardwired to think in terms of exponential growth outside of a few venture capitalists who are trained to think in that framework when funding startups. Case growth has been growing exponentially. Hence the initial under-reaction to the virus. Vaccinations are now catching up, but the consensus is not thinking in those terms. On the other hand, the growing dominance of the UK strain, which has a higher transmission rate, poses a threat to the global pandemic fight (think in growth rate exponents).

Corrosive corruption

Our empirical investigation began by calculating the ratio of equity market cap to GDP for a sample of about 100 countries for 2012. The correlation of market cap/GDP to the corruption index was negative 45% (r-squared = .21) which is highly statistically significant (T > 5). We repeated the analysis annually starting with 2002. In this case, the number of countries with functional equity markets was only 82, but the correlation of the market cap/GDP ratio was even higher at [negative] 48% (r-squared = .23) which is also highly significant (T > 5).

Climate change risk

In some ways, the phrasing of “climate change risk” is a misnomer. In financial markets, the word risk is often used as a proxy for uncertainty. There is little uncertainty about the direction of what is happening in climate. The “risk” is in what the economic effects will be. Against a background of natural variation in temperatures over centuries, the increasing existence of greenhouse gases in the atmosphere has biased the process of global temperature variation toward increases rather than decreases. The world is being made hotter by some amount, and the increased energy levels associated with this greater heat is manifesting in various ways including higher intensity and frequency of extreme weather events. While it will take hundreds or thousands of years to prove to a statistical certainty that the recent changes in average temperatures are the result of human activity, the increasing concern of investors with respect to the environment is clear.

The most obvious question facing investors is the future of fossil fuel production and consumption which is widely accepted as the single largest cause of global warming. The most basic question is whether to reduce or eliminate investment in oil, coal, natural gas, and other fossil fuel related enterprises. The first research on this point was published nearly a quarter-century ago. In diBartolomeo and Kurtz (1996) a detailed analysis is done to attribute performance differences in an equity index which had been “screened” for environmental effects against a similar but unscreened equity index (the S&P 500). At the time, approximately 80% the variation in relative performance could be attributed to the inclusion or exclusion of fossil fuel related firms. This study was subsequently updated in diBartolomeo and Kurtz (2011) with similar conclusions. Both papers also illustrate how investors could change company level weights in their portfolios so as to minimize the variations in relative performance over time.

Many asset owners are large investors in geographically bound assets such as real estate and the financing of public infrastructure. Baldwin, Belev, diBartolomeo and Gold (2005) provides a detailed approach to evaluating the risk of real estate and similar assets. A key fact is knowing exactly where that asset is located, down to a specific neighborhood or even street address. A major part of climate change risk is the expectation that sea levels and weather patterns will be changing and these changes will naturally impact some locations more than others (e.g. waterfront cities).

Modeling regime change

We start our analysis with an examination of the question of the adequacy of the P/B measure to capture the value effect in today’s economic environment. The economy has rapidly moved from agriculture to manufacturing to a service and knowledge economy. Therefore, we have economic reasons to believe that simple measures of value, such as B/P, are problematic. For example, a company presumably undertakes the creation of intangibles (e.g., research and development, patents, and intellectual property) because the managers expect these investments to enhance shareholder value. These investments are typically treated as an expense, however, and are not accounted for as amortizable assets on the balance sheet, which effectively lowers—we would argue understates—book value by the amount invested in the intangibles…Many of these stocks would have been classified as neutral or value stocks if the value of the internally generated intangible investments had been capitalized, thus increasing book value.

In other words, value investing, as measured by P/B, is misspecified. Arnott et al found that adding back intangibles improves the performance of value stocks (where HML stands for book-to-market minus low book-to-market).

Using alternative measures of value, the authors of the study found that other metrics performed better than the book-to-price ratio.

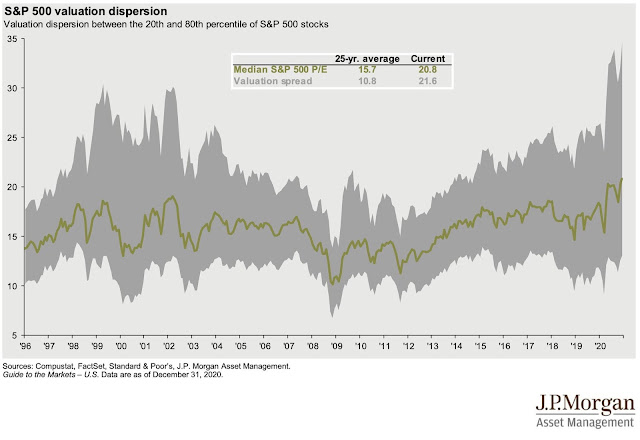

My conclusion from this to means that value investing isn’t dead. The dispersion of low and high P/E stocks is highly elevated, indicating that there are opportunities in value investing. The last time the market saw such a high level of P/E dispersion was at the end of the dot-com bubble and shortly thereafter. Growth stocks tanked, and value stock soared then.

In conclusion, instead of focusing on sources of alpha from stock, sector, or country selection, investors can also add value through better risk control by some “outside the box” analysis of the risk framework. In particular, investors can think about the following:

- Mis-specification of investment objectives and risk preferences

- How to take advantage of volatility

- Regime change risk in the form of:

- Unexpected tail-risk

- Changes in market environment (conventional regime change);

- Slow changing regimes that investors may be unaware of;

- Changes in modeling assumptions.

One massive factor regarding climate change is the enormous amount of industrial metals that will be needed for electric cars, solar and wind including the infrastructure to support them. I was listening to a podcast where the speaker simply took the amounts of lithium needed for car batteries multiplied by the number of vehicles to be sold. It was mind blowing. The amount of copper and nickel as well as other metals needed in cars and green infrastructure will also be in desperate short supply.

It take a long time to develop mines unlike oil that flows as soon as you drill a well. Meanwhile commodity prices will soar. This could be a commodity boom like no other.

I was in the oil boom from the mid-1970s to early 80s and it was a party that made the Dot.com pale in comparison. We Canadians understand commodity booms. It’s in our DNA.

Here is a summary of Goldman’s commodity strategist’s medium term bullish commodity view:

One key element is the nature of green stimulus. While moves to electrify and decarbonize the economy will, in the long run, reduce the commodity-intensity of economic growth, these benefits are felt on the back end after years of capital expenditures. In the short run, faster growth and investment will naturally increase demand for commodities by delivering a jolt to growth and consumption. What’s more, because of environmental reasons, and the potential lack of long-term demand for, say, oil, these price increases won’t be met with increased investment in new production/mining/exploration etc. the way they might normally in a price boom. Again, if you think the long-term future is an economy less dependent on hydrocarbons, why invest now, even if prices are moving higher?

FWIW the downside risk to a jurisdiction like Alberta is its credit goes under the lens of ESG bond investors. That’s especially relevant when Premier Jason Kenny wants to open up the Rockies to coal strip mining.

Sorry, I just realized my last sentence would have appeared to endorse oil as a current investment. Totally not my intension. In fact I’m avoiding oil. I just wanted to say a metals commodity boom can be a huge money maker like it was for oil back then.

Ken, you were clear about what you meant to be saying, what was oil back then, may be commodities going forward. Commodities are usually a two decade cycle. The last cycle bottomed in the last couple of years and we could well be in the early stages of an upturn (ten year upswing, ten year bust).

Ken, why are you avoiding oil? Since your twist signal back in November, It is up 60%. I have been long XLE, and it has outperformed the base metals? Everybody argues oil is going away in this “EV” world, yet it is still in a bullish trend.

Oil is a ‘Fragile’ sector. Fragility is happens when something falls much more than other sectors in a correction. In the last couple of years, it has rallied the most from a correction low and then failed later in a big way. The May to June 2020 huge rally was a case in point that failed badly.

Energy gets clobbered too much in a downswing then rallies mightily but long term it is an area that institutions will be avoiding for ESG reasons. It’s just a trade.

I should trade it but I find it too treacherous.

Isn’t it a classic to buy what is hated?

ESG may shun oil, but we have to be realistic…all that lithium and metals extraction and infrastructure work requires energy, and if exploration is down, some kind of squeeze is in the books….what time frame, I don’t know.

Unless they can crank out EVs that are cheaper than ICE, the demand for oil will still be there. So there should be opportunity in that space.

Commodities should do well, only will there be a big market drop and everything goes on sale or does it just keep going higher?

Based on what you have written here, larger allocation to Commodities (especially base metals), Lithium, Next generation energy are in order.

We appear to be at the cusp of an upturn in commodity plays, though Oil majors may not be the place to be (?).

See above. I’m avoiding oil.

Commodity based countries (Australia, Canada and Chile) come to mind. Have I forgotten anything?

There’s also Brazil and South Africa.

The bull case for the oil majors is this: There will be consolidation in the sector and they should be the primary beneficiaries. XOM, as an example, yields 7.2% and they’re undergoing a proxy fight with activist groups about becoming more aggressive to be carbon neutral. CVX yields 5.8%.

Thanks, Cam.

Yes, there may be consolidation in the fossil fuel sector, but until cheap capital is available for drilling, would we end the drilling boom? Higher oil prices may lead to more drilling and supply, keeping a lid on prices.

Furthermore, Saudi Arabia seems to have inconsistent policies of energy supply, and the entire sector appears to have become difficult to invest.

What are the issues with Alberta credit rating? I do not know much about it.

I’m avoiding oil. Why battle ESG when metals are a much clearer winner.

No burning issue with Alberta’s credit, other than a possible ESG premium getting built in. Alberta is a major oil and gas producing province in Canada.

While it is true that traditional Growth like FAANG is expensive, I think, this group is giving way to new set of growth companies. The funds that encompass such names are in ARK funds run by Kathy Woods.

Yes, ARKK has become the poster child of dotcom boom ala Janus 20, the companies in these funds are the next generation of growth. Many of these are in the renewable energy space, biotech, space, Fintech and Robotics.

Mining, as an example, is amenable to robots and I am sure may become a large source of automation.

Traditional banking is a yoke around current businesses and desperately needs innovation. Modern hospitals need robotic surgery (Intuitive Surgery) and countless other such innovation.

An alternative to ARK and Cathie Wood (some questions about control of ARK) is MACGX (MS Discovery).

Thanks Ravindra.

Both internet ETFs soared last week, the U.S. FDN and Chinese KWEB. Alibaba has made peace in China but what is happening in the U.S.?

Cam, you have posted in the past an Asian tech specific ETF. Could you please post that symbol or name again?

Thanks

AIA

Thank you Cam!

A paradox of clean energy and solar renewables is the extreme dependency on metals. Mining (as opposed to metals) is on the low end of ESG factor scale by S&P Global analysis. Score is particularly low on Environmental factors and Social (land use, nimby etc.) factors. One ignores these risks in the medium term for long term benefit of decarbonization but introduces other environmental factors.

Will all commodities benefit equally?

https://www.fool.com/investing/2021/02/06/warning-energy-to-investors-coal-is-dead-and-oil-i/

So what commodities benefit disproportionately from EVs (Lithium, Copper I suppose, Nickel).

https://www.fool.com/investing/2021/02/06/warning-energy-to-investors-coal-is-dead-and-oil-i/

So what commodities benefit disproportionately from EVs (Lithium, Copper, Steel I suppose, Nickel)?

How do you buy shares in Norilsk Nickel? I suppose BHP is an everything company.

https://www.google.com/finance/quote/NILSY:OTCMKTS

Norilisk trades on OTC. Please inquire about fees before executing your trade.

Thanks.

An ETF focused on batteries is LIT. Another focused more on upstream miners is BATT. I own LIT and will look more carefully at BATT.

Maybe I am just a short term trader and this discussion is above my intellectual pay grade. My understanding is that risk in simple terms is a loss of capital. Investing in its purest form is an appreciation of capital and the choice of asset class is a means to attain that given end.

Cam, in the last trade had a good trade which unfortunately went against him. Rather then state what I do I remembered some rules that Jack Sanders had stated in his trading career. Jack Sanders was the President of the Chicago Mercantile Exchange and so what he said and did carries some weight and is something good to reflect on. It has helped me and as Ken often says we are all in this together. If it helps one trader or investor it is worth the effort. Here are the rules:

1. Never let a profit turn into a loss.

2. Always use a trailing stop.

Think Game Stop going from 500 to under 100!

3. If not profit take a loss. Reverse at the same time.

Very difficult to do but a true badge of a professional. Not only do you loose money in the first trade but also have to intellectually concede that you were wrong on your analysis.

4. ALWAYS have a stop.

Think long term capital. 1987 etc.

5. Never average a loss.

6. Have a plan or an investment discipline and consistently follow the discipline.

After a bad trade or lack confidence because of a loss we sit on the sidelines and the best trade of the year goes by.

To call the top or bottom in a a market is very difficult. The probability at best is very low. The easy money is what Ken does.