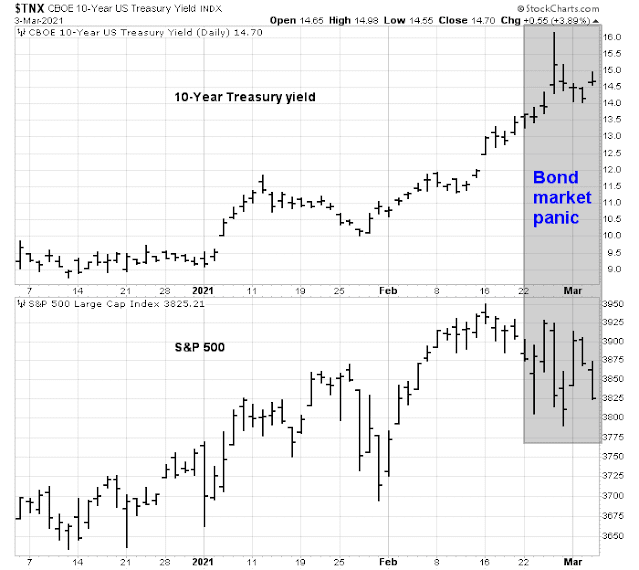

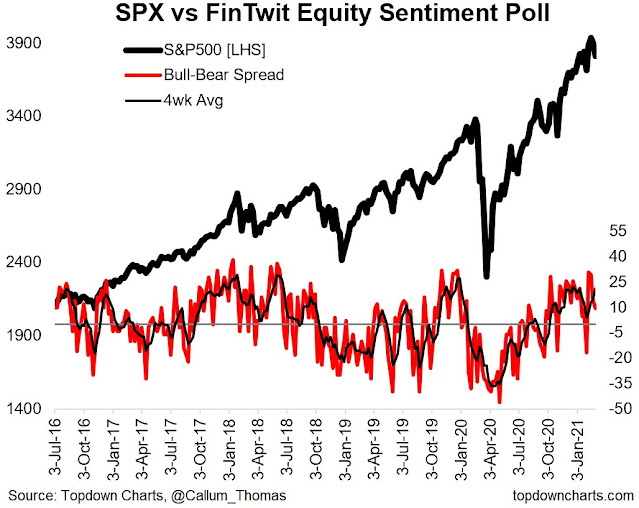

Mid-week market update: Is the bond market panic over yet? The 10-year Treasury yield touched a high of 1.6% last week. It fell when the Reserve Bank of Australia began to engage in yield curve control, but it is edging back towards 1.5% again.

Short-term bullish

Downside risks

The risk of a disorderly ARK unwind

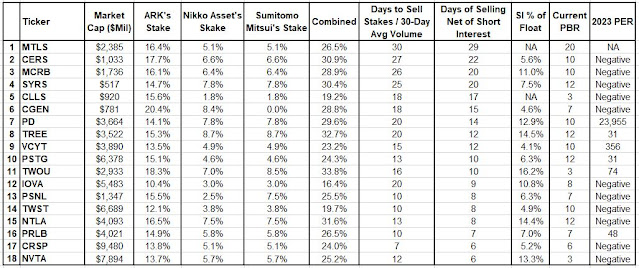

Ark now owns more than 10% of at least 29 companies via its exchange-traded funds, up from 24 just two weeks ago, according to data compiled by Bloomberg.

Less discussed are holdings of Nikko Asset Management, the Japanese firm with a minority stake in Ark that it has partnered with to advise on several funds.

When combined, the pair own more than 25% of at least three businesses: Compugen Ltd., Organovo Holdings Inc. and Intellia Therapeutics Inc. Together they control 20% or more of an additional 10 companies.

The list below shows ARK’s 18 most illiquid holdings, as measured by the number of trading days it would take ARK to exit its position. ARK a precarious liquidity trap with these positions that represent about 20% of NAV. So far, these stocks haven’t seen significant selling pressure yet. In short, the ARK organization is apparent lacking in risk management control, but it may be only a matter of time its holdings experience a disorderly “flash crash” as the combination of selling pressure and redemptions threaten Cathie Wood’s franchise.

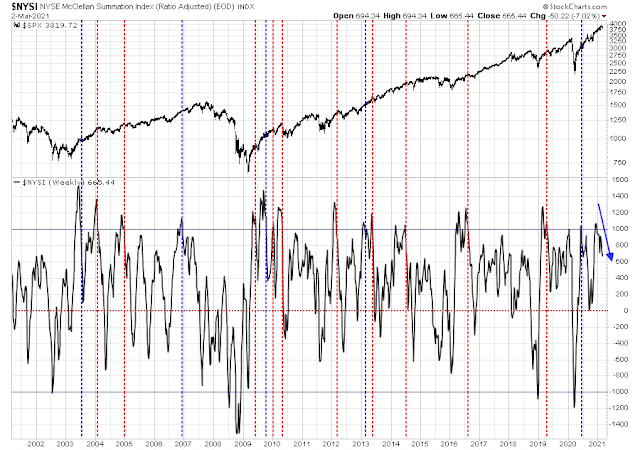

As well, the NYSE McClellan Summation Index (NYSI) reached an overbought reading of over 1000 and recycled late last year. In the past, the stock market has found difficulty finding a base until NYSI reaches a neutral condition of between -200 and 200, which hasn’t happened yet.

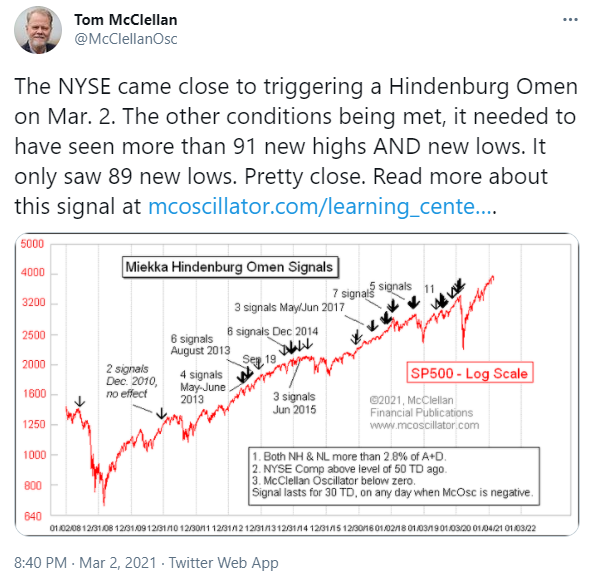

Tom McClellan also observed that the market was close to flashing a Hindenburg Omen this week.

Despite its name, Hindenburg Omens have had an extremely spotty record at forecasting market crashes. I concluded in 2014 that such signals were indicative of market indecision and potential volatility (see The hidden message of the Hindenburg Omen).

The Hindenburg Omen indicator has a lot of moving parts and it is therefore confusing. I believe that the most important message in the Hindenburg Omen is the expansion of both new highs and low, indicating divergence among stocks and points to market indecision.

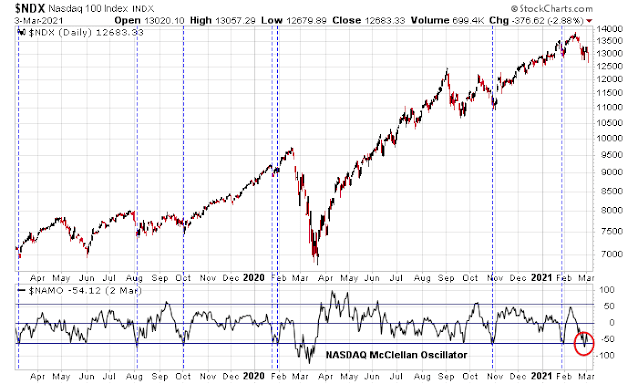

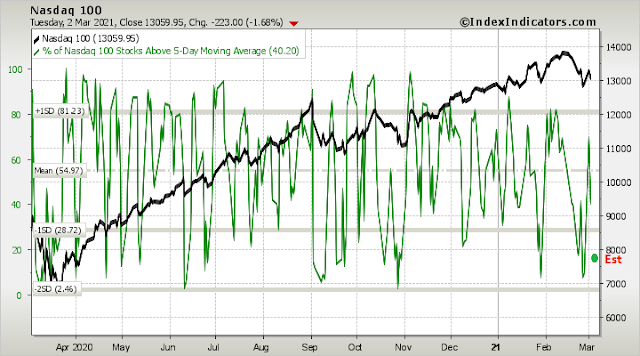

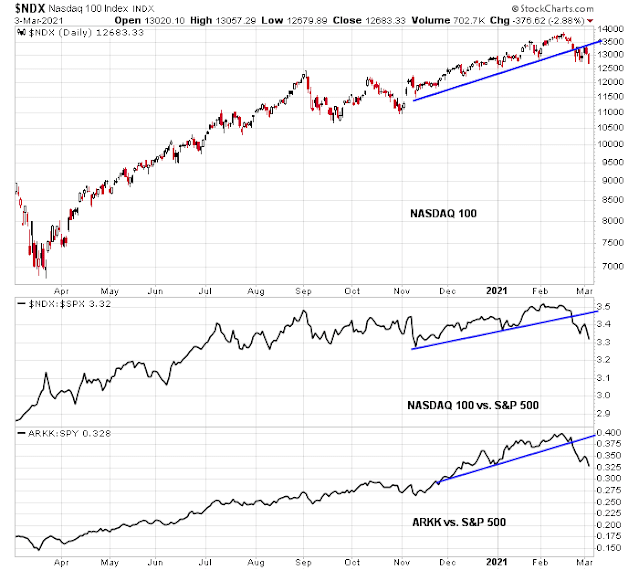

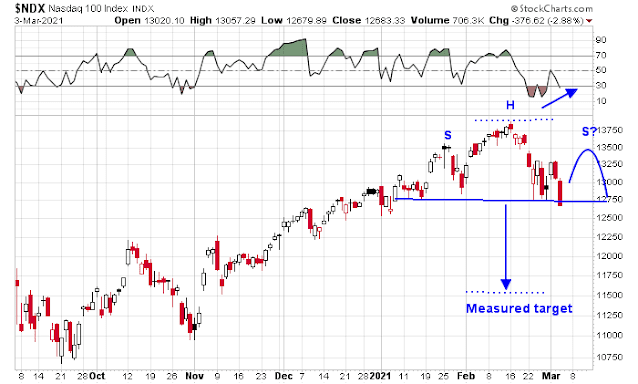

The NDX is tracing out a possible head and shoulders formation, but as good technicians know, these patterns are not complete until the neckline actually breaks. The index is now testing neckline support while exhibiting a positive 5-day RSI divergence. My base case scenario calls for a rally, followed by weakness and a likely break of the neckline.

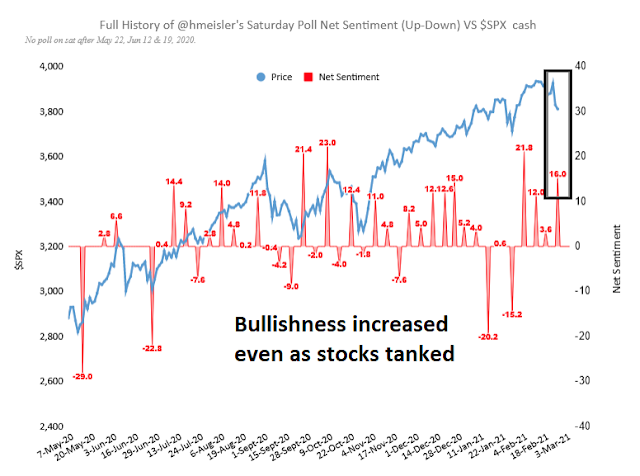

In summary, there are reasons to be both bullish and bearish, but on different time frames. In the short-run, the relief rally hasn’t run its course just yet and more upside is possible. Once the market works off the momentum from an oversold rally, it faces further downside risk from the combination of excessively bullish sentiment and unfinished business to the downside from a technical perspective. At a minimum, expect choppiness and volatility in the weeks ahead.

Disclosure: Long TQQQ

Cathie Wood addresses the claims of Hui, and others, here. Start at about 33:15.

https://ark-invest.com/videos/market-commentary/february-26-2021-in-the-know-with-cathie-wood/

Regardless of the misunderstanding/misrepresention of ETFs vs MFs, no surprise high-growth stocks can correct by by a f***-ton all on their own.

Nice after-hours flush in the indexes – DJIA futures down as much as -130 points. A prelude to what will hopefully be a red-to-green transition overnight that leads to a gap up in the morning.

With ARKK down 6% today, put a nail in that coffin.

It is the poster-child of what I call Innovative Growth stocks. These are no-earnings favorites with dreamy business models that could change the world but unfortunately have been bid up o one hundred times sales. In my book, that bubble is popping.

At the same time Innovative Growth is plunging, Regular Growth is being pulled down but much less, Regular Value is doing well and Resource Value is up today.

I believe we have two separate stock markets Growth and Value with differing paths.

Within Growth we have Innovative Growth and Regular Growth (profitable companies with consistently growing earnings.

In Value we have Regular Value and Resource Value.

Watching these four types and investing intelligently as the economy unfolds will be key.

ES 3778 was the overnight low. Is that enough of a pullback? I hope so.

Currently positioned with lower-than-average risk exposure @ 28% long. Doing my best to protect Monday’s gains while positioning for a bounce.

For now, closing EWZ on its +2% premarket gap up.

Adding second tranches to FXI/ASHR.

Adding a position in JETS.

Brutal corrective action in the Nasdaq 100.

Taking a swing at PICK on its -3% pullback.

My approach to risk management here is two-fold:

(a) Smaller position sizes.

(b) Avoiding individual stocks.

(c) In terms of stops, I tend to focus less on price levels than on P/L. In other words, I try to keep my portfolio balance from falling below a certain level. That’s the approach that works best for my mental equilibrium.

Added a third tranche to QQQ on the morning selloff. At this point, the plan is simple-> if it fails to close green, I’m out.

Taking the 30-minute +1% gain in PICK.

The morning selloffs in QS/NIO feel like capitulation. Reopening starters in both.

In other words, upping my risk exposure by adding individual stocks. The brutal selloff this morning removed a great deal of risk, IMHO.

Copper futures are on a wild ride today. Financial Times reported about large speculative bets being put on in China and copper futures have been plunging >5% earlier in European trading, but there has been an impressive turnaround in early US trading. The day is still young, but fake breakdowns are certainly bullish.

I think that the problem is that things are very fragile. The toilet paper, disinfecting wipes crisis of 2020 is evidence. We are so interconnected now that a true crash is unacceptable. In 1929 when the crash happened, many were still on the farm, the dust bowl of the 30s did not help. What would happen now if things fell apart? Social unrest would be extreme. This I think is the issue that must give those in power sleepless nights. Can you imagine the havoc that would have happened if there had been no stimulus? No free vaccines? No support checks?

I remember going to look for pinto beans and the shelves were empty.

Does anyone think that if things had been allowed to run their course that you could go to Krogers for free food and the farmers would bring their food to market for free? I’m not going to say “impossible” but how about 6 sigma unlikely?

They have no choice. Well, a global war I guess, but nowadays with MAD still in effect it’s unlikely. So there would be chaos.

When there was the migration from rural to urban was very positive for many things, but it reduced systemic resilience.

Sometimes I think the least affected places will be the amazon jungle or in Papua New Guinea where they are still not connected.

We can’t do like in 1837 or 1873 (I think those are the years) because the system can’t take it, unless we want some serious social unrest. It may come some day in spite of this, but those in power will do their best to push it away.

It is not totally altruism, those in power want the system that has favored them to stay afloat.

This does not mean we can’t have a market crash, we can, but the support will continue. It’s not about the market but the system.

So if over the next 10 years they need to print 100 trillion for entitlements like social security, medicare etc, they will. Old people can vote and do you think that if they get shafted on medicare or social security they will do nothing? Or if younger people with no jobs by the millions will just go play street hockey?

So they will print, because they can, it’s the beauty of fiat……yeah….hopefully I’m gone before the wheels come off the cart.

Everything was going well until Powell started speaking.

With the exception of two index funds which will be closed end of day, I’ve closed all positions. The decision was easy and based entirely on P/L->I will manage to retain about half of the gains I booked on Monday.

I notice many traders out there ‘welcoming’ this selloff as a good thing and looking forward to putting cash to work. That makes me wonder how much money they’re losing. Personally, when markets sell off suddenly on Fed-speak, I prefer to panic first and ask questions later 😉

Based on what Cam has written this looks to be a healthy reset. I’m putting more money to work.

Looks like you timed a nice entry!

My ST outlook is less sanguine. Today’s selloff, coming on the heels of indexes already in decline, is a shot across the bow. That’s just my opinion, of course. It will take some time to repair the damage.

I tried going long but got stopped out. Will wait for another entry. I don’t think the market will have a sustainable rally until rates reverse.

Your stops did exactly what they were meant to do. No point in second-guessing – that’s what gets many investors into trouble.

I believe Fed´s communication strategy is to encourage people to put money to work in the real economy. “Therefore, the correct monetary policy during a liquidity trap is not to further increase money supply or reduce the interest rate but to raise inflation expectations by raising the nominal interest rate” the quote is not a conspiracy theory. It comes from the St. Louis Fed web page and was written in 2014. This communication strategy is independent of weather or not inflation is really coming. I believe the latter is impossible to predict at this moment because it depends on the behavior of companies and people.

No one knows if Powell’s comments will be the catalyst that bears have been looking for – but based on the price action it may well be. So I would be careful. The greatest advantage that individuals have over fund managers is the ability to move to cash for extended periods. We’re not burdened with a mandate to remain 97% invested at all times, and we’re not compensated based on RELATIVE performance. I’m more concerned with ABSOLUTE performance, because ultimately that’s all that matters to me.

Nothing wrong with sitting on the sidelines while this selloff plays out.

The bulls have been in charge for a long time. Momentum may be shifting to the bears, and I plan to respect what appears to be multiple broken (up)trend lines until that changes. Downtrends have a tendency toward steeper angles, and if you’re going to try catching a bottom then be prepared to stop out quickly if you’re wrong.

Tough day for stocks, but thankfully gold and bonds are demonstrating their diversification benefits. No, wait…

The bond market sell off was coming, no one had any doubts there.

I suppose gold sell off is because bonds are now offering some yield, with gold offering nothing.

Looks like we are just resetting to more reasonable multiples, that’s why the oversold conditions do not seem to be working. We may also finally find acceptance that the era of ultra-low rates is ending. I believe the afternoon bounce was a selling opportunity. This is no panic, but the Fed party may be over.

I agree. Dip-buying may offer another selling opp in the morning. You know how composers will sometimes separate symphonic movements with a single cymbal clash? Today’s post-Fed reaction is somewhat reminiscent of that, and in hindsight may have signaled the start of a new phase in the markets.

The portfolio closed off over -1.4% for the day. If that seems high for a portfolio that was just 28% invested last night, it’s because I added several positions as the market rallied off the early morning lows and was closer to 50% invested when Powell’s comments hit the tape.

I can’t say that I would do things differently next time, as it’s a sound strategy most of the time (adding to positions as a brutal selloff reverses to turn green).

Now +3.4% ytd.

We now have downside momentum. Good chance the SPX retests 3723, with the next support level ~3694. Below that I only see strong support ~3600.

So, we broke the Nq neckline @ 12750. The “Head” was at 14K, so we may be looking at another 1250 points lower as a measured move if this Heads and Shoulders pattern is not a fake.

Bond yields are still rising in after hours futures markets. We are now closing in on 1.57% on the tenner. With this downdraft in the bond market now firmly in place, one is left wondering when we get that Taper tantrum, in a month or will this be a multi quarter event?

With all the massive call option activity in place, we could be in for a steep, forced liquidation, sooner than later (!).

If we backtrack to Cam’s February 13 post, I would say he made the right call re a bet on energy (versus materials). Clearly evident today.

Yup, the Financial Times reported end of February that there have been speculative positioning in Copper futures, those apparently were being unwound yesterday.

So, S&P 500 futures are 19 points in the red.

Decent odds we’ll see SPX futures tag 3723 overnight (3735 right now). The ultimate scenario (from a bull perspective) would be 3694 followed by a green open on Friday. I just don’t think the bulls have it in them to make that happen.

The 200dma for the QQQ is ~284. I can see that happening quickly.

It’s amazing how sentiment can turn on a dime. I was a raging bull early this morning. As I watched prices undercut the morning lows, I immediately began closing positions. Less than five minutes later I had transitioned into a bear.

Kuroda explained how YCC works and Asia bought the dip. Here in Europe we are still trying to understand what’s going on. This entire concept of lending someone money and then getting paid for it, we do not know how this works. And then you have these stocks which are paying a dividend, we never bought them, because they are the ones that go down. We only bought the ones that go up, I’m confused.

The bulls pulled it off!

Nice move, livewell – you’re a much better trader than me.

What’s Plan A at this point? I remain bearish. That may (need to ) change.

In other words, I think the gap-up open is little more than an oversold rally and thus a selling opp. JMO.

The one asset class that (still) looks attractive is the long bond. It’s probably even more oversold than the Nasdaq.

Long AMZN @ 2965.

XLE is now +18% since Cam’s buy recommendation in mid-February.

AMZN off @ 2980.

Long QQQ @ 301.77.

Reopening AMZN @ 2948.

Turning bullish, bro! At least on the Naz.

Long TLT as it reverses from red to green.

Reopening VEU here.

Adding a position in VTI here (too chicken to buy IWM).

Reopening JETS on this morning’s -4% pullback.

Adding a position in GDX.

QQQ now less than 5% from the 50dma. We may get there! I’ll be stopped out before that happens.

SPX 3730. Is that close enough to 3723 – I don’t have a clue. But given the gap-up open this morning, I think it’s pretty damn close.

As grueling as it is watching the indexes pull back this morning – in the back of mind I’m slowly turning optimistic, hopeful that this is the pause that will launch the next leg up.

Much of the excessive optimism being wrung out of my favorite growth companies this morning. Reopening starters in NIO/ QS/ PLTR here.

Capitulation Day in the Naz/ AMZN/ QS/ NIO/ PLTR?

I think so. I didn’t catch the absolute lows on any of them, but I will come close to catching them at YTD lows.

Adding aggressively to QS/ NIO/ PLTR.

I applaud Cam’s steady hand. Anyone able to open TQQQ last week, watch it soar on Monday, pull back on Tuesday, move into the red on Wednesday, sink on Thursday, undergo a brutal whipsaw on Friday – and still be holding for what will likely be a stellar multiweek gain – has nerves of steel!

Now adding IWM.

Adding CGC/ BABA.

Adding VWO.

Opening several index funds at the close.

RYOCX (Rydex QQQ)

VTIAX (Vanguard International)

VTSAX (Vangauard Total US)

RYGBX (Rydex Long Bond)

RYPMX (Rydex Precious Metals)

VEMAX (Vanguard Emerging Markets)

If it turns out I’ll be opening the index funds at the intraday highs, that’s OK. I’ve already recouped all of Thursday’s losses. If the indexes keep rallying for the next three hours, I’ll simply be averaging in at higher prices.

Now +2% for the day. Another +1% seems possible, which on absolute (as opposed to percentage) basis would make it the best of my trading career. This reminds me of March 2009 – the day I realized what had happened and decided to fade the highly bearish stance I had adopted the night before. Both rank among the most incredible red-green reversals I’ve had the privilege of trading.

OK.

Pulling a double fade here (ie, fading my emotions twice in one day).

All positions closed here.

Taking the gains I have.

Now wary about the market pulling the rug out from under us once more.

Back to a bearish outlook!

Just an amazing day.

To be clear – I’ve cancelled all orders to open index funds (RYOCX/ VTIAX/ VEMAX/ RYPMX/ RYGBX) at the close.

I’ll be holding 100% cash over the weekend.

Rxchen2 you give me too much credit. I’m a long investor not a trader and occasionally I get lucky. Although this time I simply followed my plan to deploy more funds once S&P dropped 5%. I have been rotating and buying value since last fall, thanks to this blog.

I think we’ve come a long way since March and quite a ways since vaccine day so some choppiness and a reset is needed to make the next leg up. I feel strongly the pieces are there to do that summer and into 2022. At years end I’ll reevaluate, unless we make some amazing leg up faster than I expect.

Dipped my toe back into longs. Holding into next week