With 96% of S&P 500 companies having reported, Q4 earnings season is all but over. For the markets, the earnings reports contained both good news and bad news.

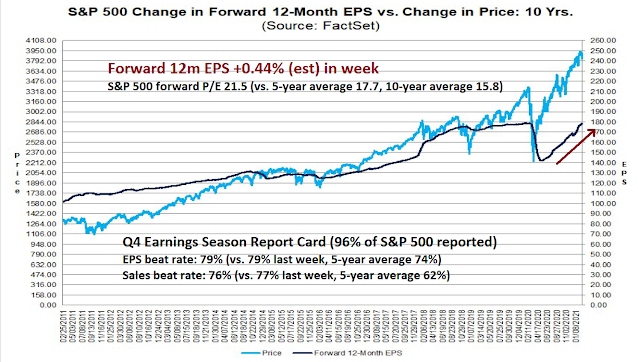

There was plenty of good news. Both EPS and sales beat rates were well above their historical averages. In addition, consensus earnings estimates have been rising steadily, and forward 12-month EPS estimates have nearly recovered to pre-pandemic levels.

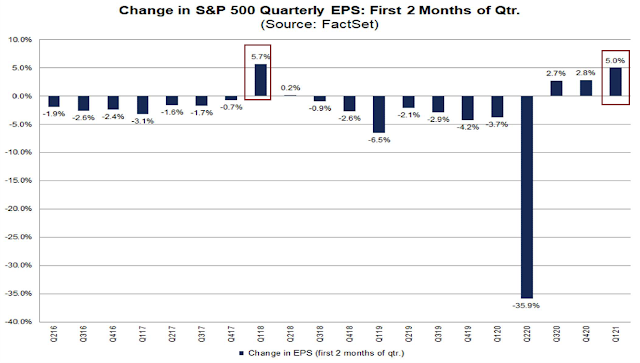

In fact, the pace of Q1 estimate revisions is the second highest in FactSet’s history, second only to Q1 2018.

The bottom-up assessment

The tone from earnings calls is nothing short of giddy, according to The Transcript, which monitors earnings calls.

Covid cases are dropping, vaccines are being administered and warmer weather is coming. Fatigued consumers are ready to return to normal. We especially miss traveling.

Barring another wave of rising infections, the consumer is ready to spend.

Covid fatigue is real“Now after 11 months of pandemic, I think we all know that COVID fatigue is real. People are clamoring for the opportunity to have experience outside their homes. Every day, we see signs of people want to get out and get away” – Royal Caribbean Cruises (RCL) CEO Richard Fain

And cases are dropping“So I must admit every single day I go on the COVID U.S.A. chart on Google, and so how the trend line is and it’s just plummeting. So my sense is, is that we’re getting closer and closer to good news.” – Royal Caribbean Cruises (RCL) CFO Jason Liberty

By April vaccines should be available to everyone“…vaccinations were ultimately going to be the deciding factor. And the quicker we vaccinate where we get to the point of herd immunity, which by most accounts, that timeframe is in the July, August time. So sometime in summer, the experts believe that by the end of April, anyone who wants a vaccine…will have access to one that all bodes well.” – Norwegian Cruise Line (NCLH) CEO Frank Del Rio

And we’re getting closer to warmer weather“…we believe based on all the experts that we talked to, including the Healthy Sail Panel that we’re going to see a continuation of the significant drop in cases as we enter spring summer, as we continue to vaccinate over 1.5 million Americans a day, as more people get infected and recover.” – Norwegian Cruise Line (NCLH) CEO Frank Del Rio

Consumers are ready to get back to normal“…we’ve already been seeing the leisure recovery pick up since the beginning of the year when it was at its low point. Not only has occupancy been picking up in February, but overall bookings have consistently increased each week so far this year.” – Pebblebrook Hotel Trust (PEB) CEO Jon Bortz

People miss traveling more than anything else“We did a survey recently of American travelers and we found a couple of things. The first thing we found is that people missed traveling, that’s not surprising, but we also found that people missed traveling more than any other out-of-home activity. People missed traveling more in America than going to a restaurant, going to sports, live music or other activities.” – Airbnb (ABNB) CEO Brian Chesky

There’s a lot of pent up demand“Bookings and rebookings of weddings into the second half of 2021 and 2022 have been very strong, and we’re seeing rebookings of group into the second half of 2021 and all of 2022 as well…We’re very encouraged about how well group is shaping up for 2022 at this point.” – Pebblebrook Hotel Trust (PEB) CEO Jon Bortz

“…historically, we don’t really talk about 2022. But what we’re seeing continue on is our customers — there’s a lot of pent-up demand for vacations, right? They’re saving more. They bypass many of their vacations. And so they’re trying to eye out when, we’re going to return to service. And they’re going to be able to go and enjoy the vacations that they had previously planned. And so I think when you look at the first half of 2022, again, it’s very, very early, the pricing that we’re seeing relative to like-for-like for 2019 shows that our rates are up with or without any application of future cruise certificates.” – Royal Caribbean Cruises (RCL) CFO Jason Liberty

“…we are very encouraged and very pleased by the strong booking activity driven by pent up demand across all three brands for 2022 voyages…For the first half of 2022 and for all of 2022, in fact, our load factor is currently well ahead of pre-pandemic levels” – Norwegian Cruise Line (NCLH) CEO Frank Del Rio

Consumers are flush with cash“The leisure customer has a humongous amount of money in the bank. There’s huge fiscal stimulus in the system and more coming, the Fed has been pumping capital into the market.” – Pebblebrook Hotel Trust (PEB) CEO Jon Bortz

Limited supply creates pricing power“…this is a finite capacity business. I can’t cruise with 150% occupancy. So there’s going to be a squeeze play here. That demand is going to exceed supply…you got less supply, you’ve got pent up demand. You’ve got people with money in their pocket. I think this is just the making of a boom time for the cruise industry. And since we can’t expand, supply any faster than it’s coming online, pricing is what’s going to dictate the day. And we’re seeing it. I mean, it’s astonishing to me in the 25-plus years, I’ve been in this business.” – Norwegian Cruise Line (NCLH) CEO Frank Del Rio

The top-up assessment

The top-down assessment upbeat. New Deal democrat, who monitors high-frequency economic data and splits them into coincident, short-leading, and long-leading indicators, has a highly constructive view of the economy.

(1) The economy is primed for strong takeoff once the pandemic is brought under control, as housing, manufacturing, and more generally production are strong, and commodities are red hot.

(2) The pandemic appears to finally be being brought somewhat under control, as about half of people in the high risk groups have received at least one dose, nursing home deaths are already down sharply, and with a third vaccine being approved, we are on track for herd immunity probably by the end of the summer.

(3) Seeing all this, together with the likely approval of a large new stimulus bill by Congress, the bond market has reacted by pushing rates higher. This is a “bullish” reaction, as the yield curve is very positive.

(4) The weather issues affecting some of the data series are transient and likely to last only one or two more weeks at most.

The fly in the ointment

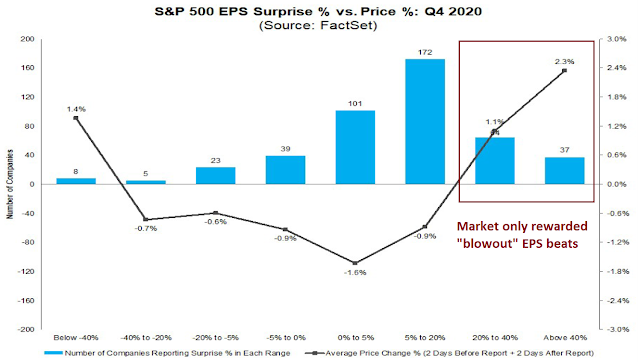

Here is the bad news. The market has not reacted well to earnings beats, except for blow-out earnings reports.

In my recent publication (see Will rising yields sideswipe equities?), I made the case that the market is in a reflation phase of the market cycle. Reflation phases are defined by rising earnings estimates and rising bond yields. The bullish effects of rising estimates overwhelm the bearish effects of higher rates.

However, the muted market reaction to earnings beats raises the question of how much has been priced into earnings expectations. This represents a short-term risk to the stock prices, which may need a further sentiment reset before it can sustainably advance higher.

We heard the bearish estimates of S&P 500 last year, down to sub 2000 level. Have not heard bubblacious estimates to a market peak. It appears that all kind of bubbles are being inflated by cheap money. Here is an interesting article;

https://www.politico.com/news/2021/03/01/bidens-market-bubbles-economic-risk-471835

How about Nasdaq @ 25k (current 13.5 K), before all is said and done? This market seems to remind me of Y2K.

“It’s a bizarre environment that’s confounding even the most seasoned economists and investors: an unusual mix of sentiment seen in 1999, just before the dot-com bust, the period a decade ago after the 2008-09 financial crisis, and the early years of the roaring 20s after the pandemic a century ago that concluded with the crash of 1929”.

“Print baby print” !! “Bizarre environments that no one seems to be talking about.

“Markets are really being underpinned by these rock-bottom interest rates around the world and as that changes, there are going to be real bouts of turbulence this year, despite what should be a healthy economic rebound,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “We think most of this will be isolated. But a lot can happen and things could get pretty severe in certain areas of the market.”

Haven’t we heard of “isolated events” in the past?

What IMHO we are seem to witnessing is an unbelievable environment where US national debt is now 27 Trillion $. Have not seen much being talked about this either. Even Mr. Buffet has not said much. I just am unsure how everyone is sanguine about the underpinnings of all of this.

https://www.visualcapitalist.com/americas-debt-27-trillion-and-counting/

ZM up an additional +10% after hours on earnings beat.

It was easy to foresee at least one headline writer using ‘Zoom Video Zooms Higher.’

Reopening a partial position NIO after hours following a negative reaction to earnings. I think it’s another buying opp.

Last autumn, the pandemic was going to be around until 2023 and a vaccine was thought to maybe be available in a year. The GOP was against any further support for the unemployed as well as states (especially Dems) that were in financial difficulty.

Flash forward to now. Herd immunity is around the corner and 1.9 trillion is heading out to boost the economy (plus the normal now deficit of $1 trillion). Yellen and Powell are outdoing each other in dovishness. Seems like a simple recipe for stocks to go up. Why complicate it with comparisons to the past that have nothing to do with what’s happening now.

The market is up about 10% from last fall to now. Seems like the difference in outlook justifies that and more.

I agree, sometimes simple is best! And there is more to like: a potential infrastructure bill and the steady hand of the current administration which I believe leads to business investment. Maybe it’s just spring (here in CA at least), there is a lot to like about our current situation!

https://www.ft.com/content/eb0a07f0-edad-475f-869a-8bc489276fb2?ftcamp=traffic/partner/feed_headline/us_yahoo/auddev

The economic recovery around the world is very uneven (look at this mornings german retail sales) – the ECB for instance already went into full panic mode just on these very small moves in government bond yields. The RBA and the JCB also immediately started to intervene. On the other hand we are seeing inflationary pressures rising in the US. If the Fed is willing to let yields move a little higher, there may be significant adjustments in currency exchange rates, but for now there is no indication that Powell is even thinking about thinking about that and the looming USD appreciation may further incentivise the Fed to reiterate how ultra-loose they are going to remain. It’s “close your eyes and full-speed ahead” as the central bankers are hoping that the inflationary pressures are going to sort itself out somehow by themselves. Powell has said again and again that we do not fully how this even works.

…fully understand…

And as we have learned during the very brief end-of-February “baby taper tandrum” – the response to higher inflation is more QE.

Totally agree. The are doing a massive monetary policy experiment with no end game.

Australia just posted 20% YOY rise in house prices at the same time they are doing a huge injection of QE because the 10 year government bond rate went up.

Future economists that pick up the pieces of the mess we will make and will look at the current economic theories the way we look back at early doctors bleeding sick patients to release the nasty Four Humors in the body, Yellow Bile, Phlegm, Black Bile and Blood. All the experts believed in the Humors back then

We need a new Maynard Keynes to state the obvious “The Emperor has no clothes” and propose the right path.

There is backwardation in asset prices (oil gets cheaper with time). This alone indicates that inflation is likely to be temporary.

Yes, there is asset inflation, which is what one expects with currency printing. However, with 10% or so unemployment, does one really expect much wages inflation? Labor market slack is significant.

Furthermore, M2 money supply is up, but velocity of money is down. See second to last graph:

https://www.schwab.com/resource-center/insights/content/elevation-some-v-shaped-economic-data-to-cheer

Reopened a few positions in the premarket session on significant pullbacks from yesterday’s exits. JETS/ EEM/ EWZ/ FXI/ ASHR.

Out of all positions for minor losses.

Now looking for a retest (50% retrace or otherwise) to set up the leg up. Just doing my best to discern the next move.

next leg up…

The late-day pullback feels right-> it forces traders to decide how committed they are to positions, especially if the positions were opened during yesterday’s rally.

Unlike Friday’s pullback, I’m disinclined to buy this one. A 17-point decline in the SPX doesn’t quite do it for me. 45 points, perhaps. Better yet, 60 points.

I will tell you my understanding of what is going on, which of course is not necessarily correct. The main intention of the QE program is to improve the real economy functioning during recession or crisis periods. QE is not primarily aimed at financial markets. In this particular case the crisis was caused by COVID. The immediate effect of the QE program would be to lower the interest rate and increase liquidity. This foundation would encourage companies to invest and increase production capacity. The rationale of the program is explained in a 2014 article published by the Federal Reserve of Saint Louis.

https://www.stlouisfed.org/publications/regional-economist/april-2014/the-liquidity-trap-an-alternative-explanation-for-todays-low-inflation

During the first stage of QE the money is kept in reserve accounts in the financial system. This newly printed money is not available to everyone, thus there is not inflation at all. M2 goes up while the money multiplier falls (M2 divided by monetary base). Velocity of money also goes down. I will post a couple of phrases from the cited article which illustrates the authorities way of thinking.

“Therefore, the correct monetary policy during a liquidity trap is not to further increase money supply or reduce the interest rate but to raise inflation expectations by raising the nominal interest rate”

“Fed Chair Janet Yellen said in 2009 when she was still president of the Federal Reserve Bank of San Francisco that inflation would not take hold during a recession because of little pressure for prices and wages to increase given that resources through the economy were underused”

When fiscal stimulus kicks in, it is a different story. Money leaves the financial system indirectly via fiscal deficit. For example, stimulus checks, forgivable loans and other kinds of “helicopter money” enable the money to leave the liquidity trap (hopefully to the needy) and potentially generate inflationary pressures. A certain amount of money leaves the liquidity trap and is ready to be spend or saved. Some people choose to buy securities with his stimulus money.

Another way of influence of financial markets in the real economy is by tightening or loosing lending standards.

Definitely inflation is a risk. Rise in inflation expectations is intentional as explained above. When additional demand comes in, a CEO may choose to increase supply (by using idle capacity) or increase prices or both. I imagine it mainly depends on competition. In some industries utilization of capacity comes at a cost. For example, you may need to reopen facilities of hire personnel for a new shift. I trust that the Fed and Treasury will have the ability to perform such a balancing act. It is a risk anyway. Who knows?

There may be two problems in a real-world environment. First, QE has been taken advantage of as the corporate bond market has been flooded with issuance and especially the large tech companies have been able to borrow at ultra-low rates. Fueled by central banks buying Apple bonds among others of course. Second, the economic recovery is uneven. America may be reopening, but other central banks are still in panic mode. That may lead to sudden shifts in currency exchange rates and even conceal inflation for a while if the Dollar continues to strengthen. That would be consistent with the developments of the Deutschmark in the run-up to the Weimar hyperinflation period and with the “currency wars” taking place after the GFC. Central bankers will have their hands full keeping the the bond markets stable, but will be unable to manage inflation. The treasury may stabilize the government bond market by increasing taxation, but that may spill over into the corporate bond market and would likely be focussed primarily on tech companies. OPEC may play it smart because they know another fracking boom may not be popular with the new administration. Lots of risks because people have motivations to exploit the current environment.

@Jan Will the release of the Khashoggi report have any impact on the oil price?

I’m wondering about the implications of tense relations between the US and the KSA.

FOMO is a natural part of trading. I regret not having reopened FXI/ ASHR/ EEM at Tuesday’s close. On the other hand, I try to use my own emotional responses in an attempt to predict the next move or two. Once I’ve done that, then it’s time to neutralize the FOMO, as it’s a psychological disadvantage when trading. The way I’m managing it this morning:

(a) I was able to open positions (and size up) during last Friday’s selloff. I then closed positions into Monday’s rally – mostly at the highs – for a +2.2% overall gain for the portfolio. That’s an above-average one-day gain, and it was appropriate for me to lock it in.

(b) Had I opted to hold all positions into Tuesday, I would have given back 30% to 40% of gains.

(c) I bought the opening dips in FXI/ ASHR/ EEM in the early going on Tuesday, only to close all positions for minor losses.

(d) I thought about reopening near Tuesday’s close, but the -17-point decline in the SPX ~1245 pm just wasn’t compelling enough. I made the mistake of walking off the field around that time, and missed the additional decline in the final minutes. That may have made a difference.

(e) There’s no point in chasing this morning. I’m up ~+5% ytd, and +14% since the September 25 low. That’s already twice my personal target of +7% a year.

(f) So a->e takes care of the FOMO.

Plan A is to look for a move down to SPX =<3845 followed by a recovery above 3850, at which point I would swing long.

Restarting a position in RYSPX at the 730 window.

A little choppy here, so it’s a 50/50 bet.

Restarter positions in EEM/ QQQ here.

Adding VT.

At this point in the game, no point in playing the numbers. A pass line bet is the way to go.

Adding ASHR.

We’re seeing the kind of grind in the Naz necessary to reset sentiment.

Adding a second tranche to EEM.

Getting a little worried about QQQ->unless it closes>last Friday’s lows, the plan is to stop out.

I sense POSSIBLE capitulation in the QQQ here – adding a second tranche. I could be wrong, in which case I’ll stop out quickly – I’m not a fan of advertising stop levels, but ~ the intraday low.

We always knew it was a bubble.

Adding a position in EWZ.

Adding FXI.

Will reopen a position in RYOCX (Rydex QQQ) at the close.

Overall, cautiously positioned for a bounce on Thursday. Whereas I was 80% invested last Friday, I plan to be just 28% invested end of day.

We’ll find out tomorrow if Wednesday marked a successful retest of last Friday’s lows. There’s no point in predicting one ahead of time. I’m sized appropriately for a failed retest, but also well-positioned to add into a resumption of the uptrend without much FOMO.

Nice call re watching for an actual break of the neckline, Cam.

I’ve seen too many last-minute saves since last March not to give them the benefit of the doubt. Good to see negative sentiment for a change, though.