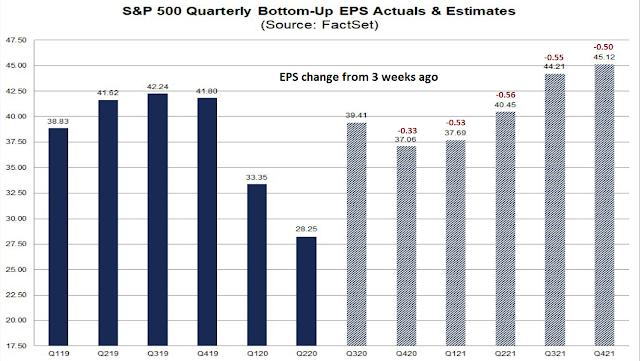

In yesterday’s post, I pointed out that, according to FactSet, consensus S&P 500 EPS estimates had dropped about -0.50 across the board over the last three weeks (see 2020 is over, what’s the next pain trade?).

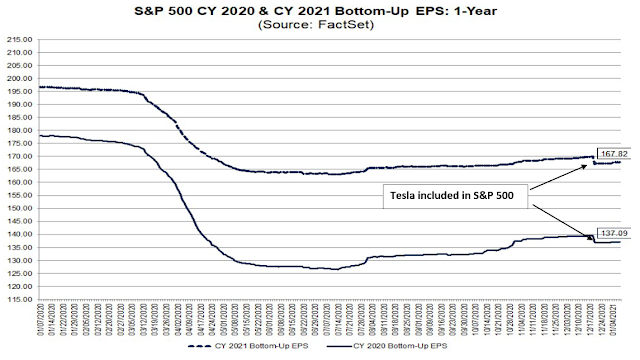

The decline turned out to be a data anomaly. A closer examination of the evolution of consensus estimates revealed a sudden drop in EPS estimates three weeks ago. Discontinuous changes like that are highly unusual, and it was traced to the inclusion of heavyweight Tesla in the S&P 500. In this case, analyzing the evolution of consensus earnings before and after the Tesla inclusion was not an apples-to-apples comparison. My previous bearish conclusion should therefore be discounted.

Nevertheless, I am becoming tactically cautious about the stock market despite resolving this data anomaly.

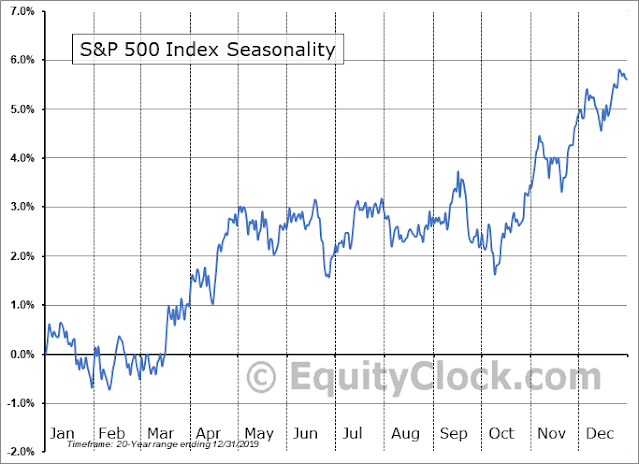

Negative seasonality

The first and least important reason is seasonality. Seasonality is a factor I pay attention to, but technical and fundamental factors tend to dominate price action more. We are entering a period of negative seasonality for the markets, and the January-March period tends to be choppy with a flat to down bias.

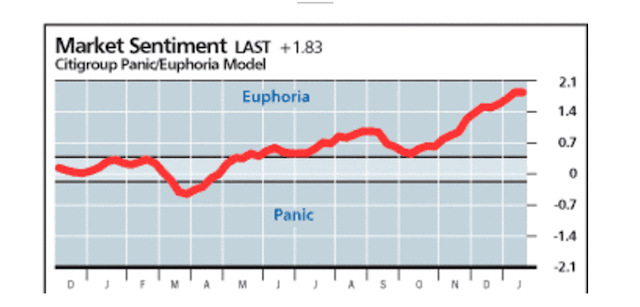

Extended sentiment

Sentiment models are still extended, though readings have come off the boil. The Citigroup Panic-Euphoria Model remains in euphoric territory and at historic highs.

Michael Hartnett’s BoA Bull-Bear Indicator is rising rapidly and nearing a sell signal.

I previously observed that the Fear & Greed Index displays a double peak pattern before the market actually tops out (see Time for another year-end FOMO stampede?). This was one of my bearish tripwires that haven’t triggered yet, though it may well be on its way to a sell signal.

Bearish tripwires

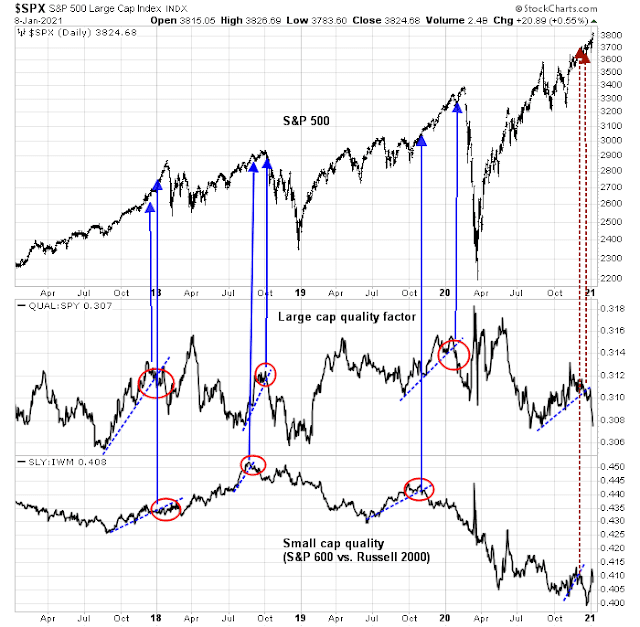

However, a number of my other bearish tripwires have triggered warnings. The low quality (junk) factor has spiked. In the past, low-quality factor surges have foreshadowed short-term tops in past strong market advances.

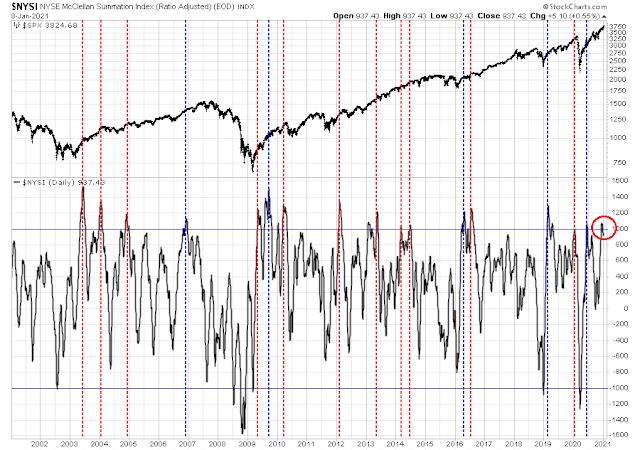

As well, the NYSE McClellan Summation Index (NYSI) reached 1000. which indicates a strong advance, and rolled over. There have been 16 similar episodes in the last 20 years, and the market has declined in 11 of the 16 instances.

I also warned that a rising 10-year Treasury yield could put downward pressure on stock prices. Bloomberg reported that trend following funds could sell T-Note and T-Bond futures and push rates upward.

Quantitative hedge funds are busy liquidating loss-making long Treasuries positions and could begin to establish new short ones if the 10-year yield breaches 1.10%, according to market participants.

Momentum funds known as Commodity Trading Advisors likely drove the initial move upward in yields on Wednesday, based on activity in futures markets, Citigroup Inc.’s Edward Acton wrote in a note to clients. The funds have been cutting losses since 10-year yields reached around 1.02%, said Nomura Holdings Inc.’s Masanari Takada.

CTA funds “appear likely to keep closing out long positions with yields at 1.02% or higher,” Takada wrote in a note Thursday. “We cannot rule out the possibility that CTAs could turn short,” at yields of 1.10% or higher, he said.

Vulnerable to a correction

Opening positions in two pharma plays-> PFE/ GILD.

Same, just watching markets.

I’m only holding a small allocation of XLE and may add to it on any major weakness.

Good idea. It’s unnecessary to be in the market(s) all the time. Patience will pay off.

What helps on days like this (from a psychological perspective) is to focus on a different aspect of your trading.

My latest trades were to open positions in PLTR/ XPEV/ ACB in the final fifteen minutes of Monday’s after-hours session -> I then closed them in the first 15 minutes of today’s premarket session. I also traded RIOT/ QS in the opening minutes today. Small positions, and all literally flipped within minutes. However – the total take added ~+0.2% to the entire portfolio. Is that a big deal? Sure – had I been 100% invested in the SPX I would be up in that neighborhood right now, and with far more risk. As it stands, I’m up anyway and FOMO is not a concern.

There are two sectors I’ve been tracking since last week – miners and bonds.

I made one round-trip on GDX last week on which I booked a minor loss. I think it’s worth another swing.

Opening a position in GDX here.

Opening a position in RYPMX (Rydex Precious Metals) + a smaller position in RYGBX (Rydex Long Bond) at the close.

By the way. Why PFE/ GILD? Investors sold the news (hard) on remdesivir and the vaccine. I just think both stocks have pulled back to attractive entry levels.

Reopening PLTR here.

Reopening ACB.

Opening a position in COTY.

Trimming PLTR/ ACB here.

Completed a couple of RTs in QS/RIOT for kicks.

Trimming COTY.

Opening a position in LMPX.

Closing for a minor loss.

Reopened RIOT.

Closing ACB.

Taking a swing at BTBT.

You never know what’s going to take off!

GDX is flat, but TLT is making a decent move. I plan to close both RYPMX and RYGBX end of day.

Making my own tactical move here.

All positions that can be closed intraday have been closed. Will close RYPMX/ RYGBX end of day.

I expect to end the day +0.3%, which combined with gains earlier this week will have the portfolio up around +2.25% ytd.

That’s good enough for now.

Looks like RYPMX will significantly subtract from gains on RYGBX, although I still expect an overall gain.

The loss on RYPMX ended up eclipsing the gain on RYGBX. YTD gain closer to +1.84%. It happens.