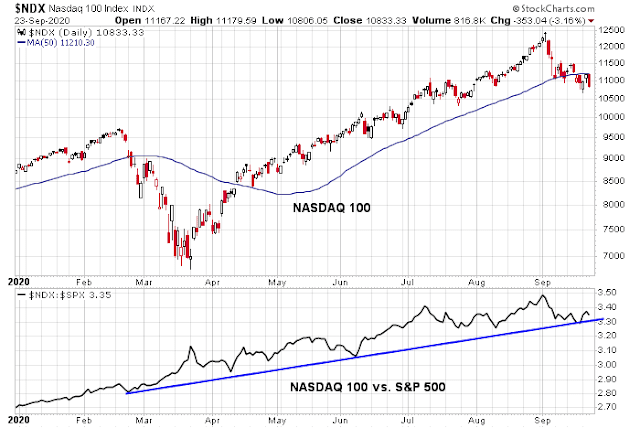

Mid-week market update: I have some good news and bad news. The good news is the performance of the NASDAQ 100, the market leadership, has stabilized. The relative performance of the NASDAQ 100 against the S&P 500 successfully tested a rising relative trend line, and the relative uptrend is still intact.

The bad news is the NDX rally failed at the 50 day moving average, and the rest of the market is maintaining a risk-off tone.

Sentiment not washed-out

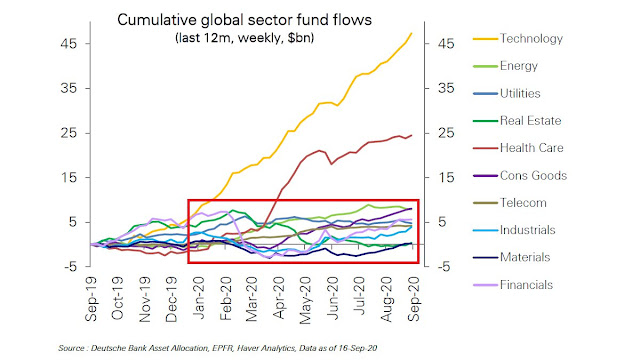

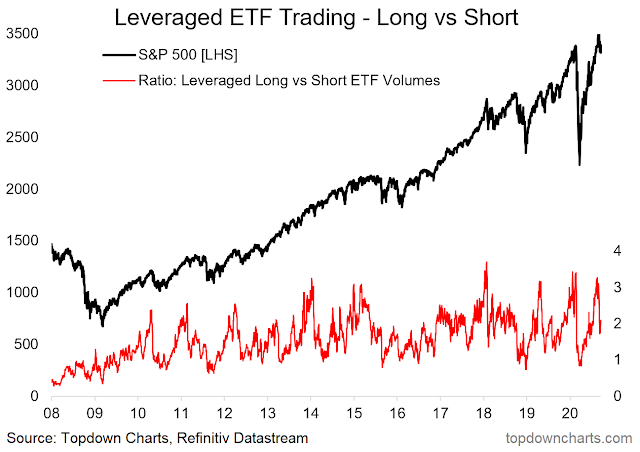

There are numerous signs that sentiment is nowhere near a capitulation wash-out. Macro Charts highlighted analysis from Deutsche Bank indicating that equity flows are still strong for technology. These are not signs of fear, but greed.

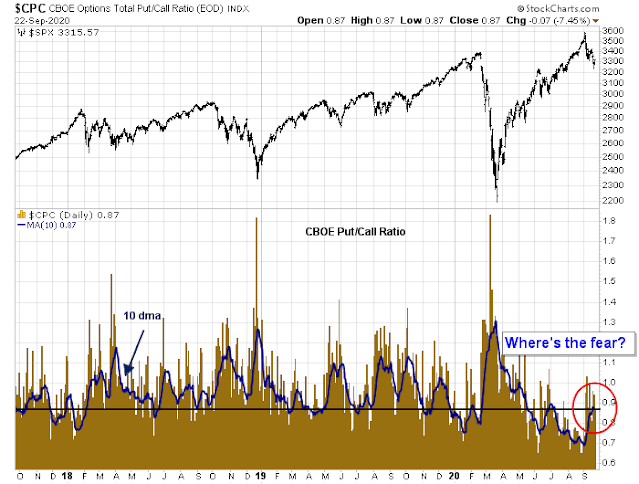

Despite the market decline, there are few signs of anxiety in the put/call ratio, which is hardly elevated compared to levels seen at past short and intermediate term bottoms.

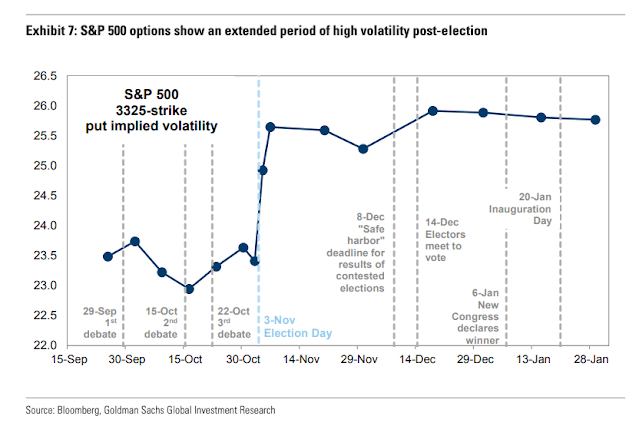

However, the nervousness in the option market can be seen in the term structure of option implied volatility, or premiums. A recent analysis from Goldman Sachs shows that the market expects volatility to be elevated until well after the election. I suggested several weeks ago that a contested election after the November 3 might be possible (see Volmageddon, or market melt-up?). That scenario is being priced into the markets.

Risk appetite still cautious

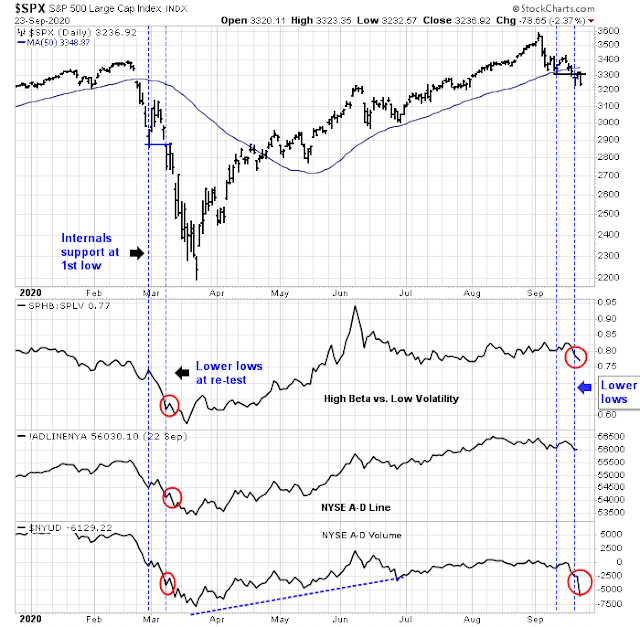

Risk appetite indicators are neutral to negative. The ratio of high volatility to low volatility stocks exhibited a minor negative divergence when the market re-tested and broke technical support this week. As well, NYSE A-D Volume exhibited a strong negative divergence on the support break, though the NYSE A-D Line was neutral. These negative divergences were not as strong or clear as the negative divergences when the market broke support on a re-test in March. However, current market internals are nevertheless concerning.

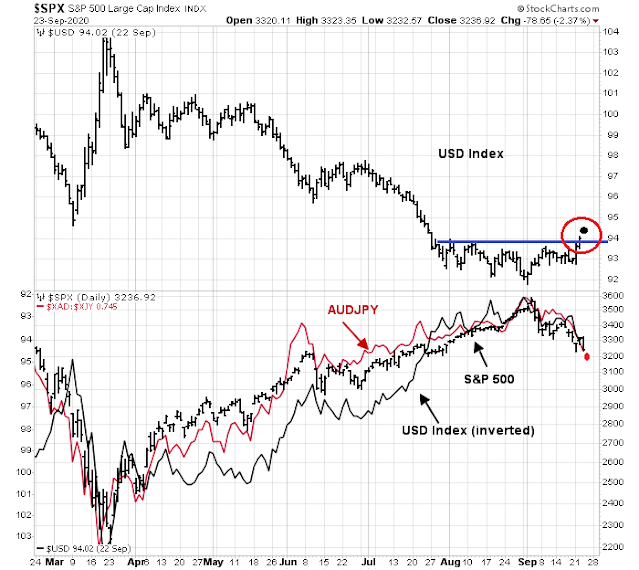

Weak risk appetite is also evident in the currency markets. The USD Index staged an upside breakout of the 94 level. The USD Index has been highly negatively correlated with the S&P 500 (bottom panel). In addition, the Australian Dollar to Japanese Yen exchange rate (AUDJPY) is an extremely sensitive barometer of currency market risk appetite, and it is also showing signs of weakness.

In conclusion, investors and traders should brace for a period of sloppiness and volatility until the November election. Sentiment is nowhere near wash-out levels, and risk appetite is weak. The path of least resistance for the stock market is down.

Disclosure: Long SPXU

Why would gold and silver be dropping so much? Dollar strength fears?

Dollar strength and a reversal in real negative yields. Still deeply negative, but the trend has changed:

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldYear&year=2020

Short term and Intermediate term indicators are getting oversold. A 10 % to 15 % pullback is normal in a bull market. Therefore we should be receptive to the possibility that we find a bottom at these levels. Cam where would you reserve your position and go long the SPX and NDX?

sorry reverse. It self corrected. Technology!!!

In the 2000 election that was decided a few weeks after election day in the Supreme Court, the market went down 12% during the recounting and Supreme Court ruling.

That was an unexpected event and we could understand why the decline started the day after. But it looks very much like results could change from Trump to Biden this time and cause decent. It’s a known factor this time.

Everyone is betting on significant volatility post-election. I am wondering if there is a cheap way to take the other side.

What if the results are clear cut and the winner is decided within a few days.

What’s the best play here? Sell Vol? Buy SPY Calls on Nov 4?

According to several Boston Consulting Group surveys, the majority of investors were expecting more weakness for the rest of 2020 in April/May and possible new all time highs in 2021. We know how that played out.

It’s true the market fell close to 12% in that period but 2/3 of that occurred in the six trading days after the Supreme Court settled the election for Bush.

This suggests volatility could continue after the upcoming election is settled.

Taking another swing @ SPXU ~9.7x.

The market broke the 3216 weekly fib on the open then bounced back up through yesterday’s low and fib. We are back down to that low now and trying to decide if it wants to bounce or head lower.

Weak volume on this bounce. Entered a small short position even though this isn’t an ideal spot.

Volume still weak. There is a daily fib just above today’s high.

Covered short, looking to reenter at a better price. Leading indexes are choppily higher. Volume still light.

Reentered SPXS short just under the daily fib above today’s high. I run the daily fibs on the SPXL which puts it at 48.43 and 6.33 relative to SPXS.

Making a run at the upper daily fib. Indicators mostly look bullish, volume neutral to bearish, intra-day pattern is higher lows and higher highs.

Broke the upper daily fib with a volume spike. Either breakout volume or exhaustion volume. Pullback looks unlikely so I’m exiting the short for a small loss. Will reevaluate and probably avoid further shorts today unless the intra-day pattern changes.

At least my portfolio longs are looking at around a 50% recovery today from yesterday which had shaved 0.78% off the total portfolio value.

We are approaching the 3290 weekly fib after briefly breaching the 3220 lower fib early this morning. Leading indexes still look strong but volume on this rally is neutral to weak.

Volume seller showed up just above the 3270 low from two days ago.

Aaarrrrgggg. This fib has not been nice to me. I tried to reenter a short. It traded at my price but no fill. Bears look to be taking control.

Bouncing at yesterday’s LOD and fib. We may revisit that area before the close.

And SPLAT! This annoying day is over.

According to Glenn Beck’s research we have only a few weeks until the color revolution begins in the banana republic we call home. You have but a few weeks to express to any young impressionable people you know, like Bernie Bros, how, why and when America was the greatest country in the world and how a return to that greatness does not come from following the socialist road. We’ve been on that road for decades now, and it is not capitalism failing, but rather the affects of the implementation of socialism that we are experiencing. And of course, if you live in New York, Portland, or a similar city run by far left leaders (like Biden), it’s probably not too early to start picking your zoo animals that look like they would be the best addition to your freezer.

The applicability of all this to the market involves, in part, the bad polling data saying that Biden is a shoe in. It’s not real, and the betting data that Cam analysed, my presumption is that it was from a fat finger. A politician’s popularity just doesn’t skyrocket coincident with the release of evidence that they are sexual predators, …that just doesn’t happen. It was a fat finger.

If you don’t know how to express to people why capitalism and freedom are superior, you might use my favorite example. When the wall between eastern communist Europe and western Europe came down, there was such an influx of hockey talent into the US and Canada that the game changed enormously. It became a much better game to watch.

You have to understand that in the future that is being laid out for us, we will likely have more free time as in Europe, but if an event similar to the destruction of the Berlin wall was to again occur, the athletes would be going to China, not the US. American basketball players would be going to China to play for the big bucks. The vast majority of new rich people would be being created in China, not the US. I wish you all good luck in the chaos that is fast approaching.

I should add that I was kidding about the zoo animals, and the markets will be fine. This is not a reason to panic about the markets, it’s a reason to help your country by educating any of the idiot youth (as I call them) you are in contact with. If your children join the rioting to end America (as we know it), it would be my contention that you have failed as a parent, and failed as an American. Yes this info is applicable to investing, but it is more applicable to the need to reign in the idiot youth.

“The business of Progressives is to go on making mistakes. The business of Conservatives is to prevent mistakes from being corrected. ” G.K. Chesterton 1874 – 1936

Conservatives won’t defend their values, so the left wins virtually unopposed. Whose to blame?

So Chesterton was British, and that means that

the Conservatives of which he speaks are not like American political Conservatives. So how this quote is applicably to people in America with totally different political views, I don’t know. However I believe by definition, it is the little people who are to blame, the people without any power.

How do I up vote your post, mmcnally? Cam?

The question is buy Yom Kipur?

Are we looking at a move by bulls to retake control of the tape?

Yeah, that… idk. A pretty strong bounce.

Reopening AAPL ~110.

Keeping it small. Plenty of time to scale back in if a directional change is underway.

That felt like a whipsaw fake to the downside. Of course, I won’t know if I’m right or wrong until the market shows its hand.

“Sell Rosh Hashanah, Buy Yom Kippur.” Will it continue to work? Yom Kippur ends Monday evening.

Exiting SPXU here.

May open a starter position in SPY near the close.

Reopening positions in SPY/DIA/IWM/QQQ.

Not necessarily recommending anyone else do the same.

Kind of feels like spreading chips across the 6-8-4-10.

Good luck, RX. I have no feel at all for how the market will open tomorrow.

Democrats planning a $2.4trn bill. There is news of the two parties starting the negotiations again.

https://www.bloomberg.com/news/articles/2020-09-24/mnuchin-expects-to-resume-talks-with-pelosi-on-new-stimulus?srnd=premium

https://www.schwab.com/resource-center/insights/content/unwind-simple-rotation-or-something-more-sinister

There is a wealth of data in this post. In particular the massive short positioning in the NAZ100.

Cam, ERP seems to be telling stocks are relatively cheap to risk free returns of US treasuries. Other valuation metrics seem to suggest stocks to be expensive. Which is a better metric?

So, what happens when Chinese property developers collapse?

To answer my own question, European bank stocks are hitting new all-time lows while Nasdaq 100 futures are green. It is the obvious trade for now, but how safe are investors in those megacap tech stocks?

If you are talking about China Evergrande, it’s too big to fail and they will probably hammer out some sort of compromise solution.

As for the European banks, have you looked at BBVA in the last couple of days? It has enormous exposure to Turkey.

Not everything goes up or down in one direction.

Thanks for your response – yes, the Chinese will not let Evergrande go down, but if bonds are being halted that still makes me go hmmm. Turkey also kind of stabilized their currency with the surprise rate hike, but still the bond market is sending some worrisome signals. It seems to me the trade for now is short the banks and buy big tech (as big tech is the safer place to be)

Still bullish.

Currently ~17% invested. During the first hour or end of day, I’ll be moving another 50% of the trading/investing accounts into one of the following Merriman profiles:

VTI (Large-Cap Blend) 10%

RPV (Large-Cap Value) 10%

IJR (Small-Cap Blend) 10%

IJS (Small-Cap Value) 10%

VNQ (REITs) 10%

VEA (International Large-Cap Blend) 10%

EFV (International Large-Cap Value) 10%

FNDC (International Small-Cap Blend) 10%

DLS (International Small-Cap Value) 10%

DGS (Emerging Markets) 10%

VFIAX (SPX) 28%

VVIAX (Large-Cap Value) 28%

FSSNX (Fidelity Small Caps/ Vanguard VTMSX unavailable via Fidelity) 10%

VSIAX (Small-Cap Value) 10%

FSPSX (Fidelity International Large-Cap Blend) 8%

VTRIX (International Value) 8%

VEMAX (Emerging Markets) 8%

SPXL sitting on daily upper fib at 46.50. Starting to break down. Lower end of morning range look like yesterday’s low or daily fib at 46.30.

Opps. Make that upper fib 47.50 not 46.50.

Bounced just under yesterday’s low and broke the upper fib. Next fib 48.65 just under yesterday’s high at 49.00. Leading indexes not constructive yet but volume picked up on the breakout.

Approaching the 48.65 SPXL fib. Next is yesterday’s high at 49. Remember the weekly fib is still sitting at S&P Index 3290. Volume looks bullish but not strong.

Couldn’t quite tag the fib at 48.65. Leading indexes rolling over a little. Considered a short there but didn’t pull the trigger. Volume turning a little negative.

Failed a second time just under the 48.65 fib. Will we try for three?

Mid day pennant forming which is a continuation pattern.

The subtleties. The pattern now looks more like a rising wedge which is bearish. LOL Volume has been neutral for over 2 hours. Leading indexes look bullish. I have no opinion of ST direction here.

Broke the fib, volume improved, leading indexes higher, but could this be a mid day bull trap?

Wally — Does fib stand for Fibonacci? John

Right, John. These are the standard daily fibs my charting software puts in and the monthly fibs based upon the monthly option expiration Fridays.

Breaking yesterday’s high. Next stop 3290 or about 10 points higher. Volume improving, leading indicators look bullish.

Daily fib coming up at 49.40 on SPXL that should coincide with the weekly S&P fib at 3290. Volume bullish and leading indexes bullish.

I don’t what’s happening with the fibs, but the market’s making good time getting there!

I’m hoping we can get over 3300 and close there. We’ll see. One more hour to go.

I’m with you.

Looks like a little correction here and tougher resistance at 3323 to 3329. I’ll be surprised if we get there today. Also, given the trend day, traders will probably come in with some selling in the last 5 or 10 minutes to even up their positions.

Paused at these fibs for about 30 minutes+ but it looks like we are about ready to bust through them.

I rarely seem to be able to figure out when traders are going make a counter trend push at the very end of the day. It looked like buying came in at the close.

Good job by the bulls on holding a 36 day low yesterday and gaining 1.6% today. In fact both the daily and weekly sum of summation indices of SPX and NAS will return to uptrend if the market close near their highs on this Friday afternoon. The last time SPX did this on the weekly summations was Friday 8/28/20, and the rally went on for another 2% in three more days, hitting the last all time on 9/2/20 before dumping the next day. Not saying it will hit another all time high in 3 trading days from here, but certainly a gain of 2% or more is possible and taking out the daily gap from 9/16/20 at 3385. If you are trading the lower time frames, it is easy to see where the turning points are and good trades can be made both ways.

https://postimg.cc/68PkrjZQ