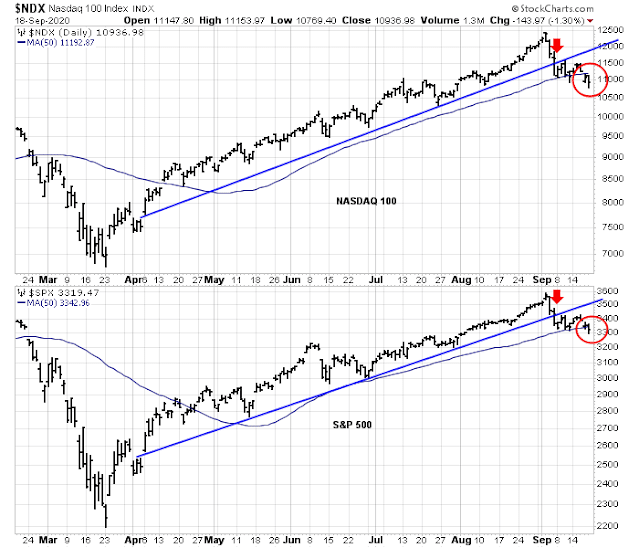

There is growing evidence that the stock market is undergoing a rotation from large cap technology to cyclical and reflation stocks. Exhibit A is the market action of the tech heavy NASDAQ 100, which violated a key rising channel and also violated its 50 day moving average (dma). By contrast, the broader S&P 500 is testing its 50 dma and only exhibited a minor break.

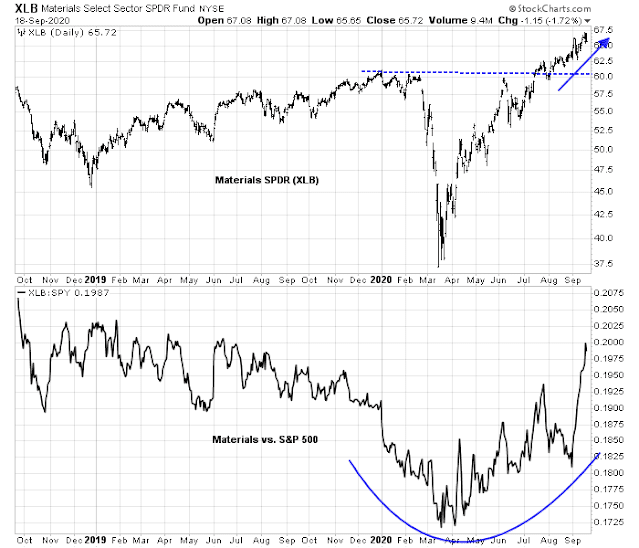

Even as the S&P 500 and NASDAQ 100 struggled, Material stocks have been making new all-time highs, and its performance against the S&P 500 has decisively turned up.

A well-telegraphed rotation

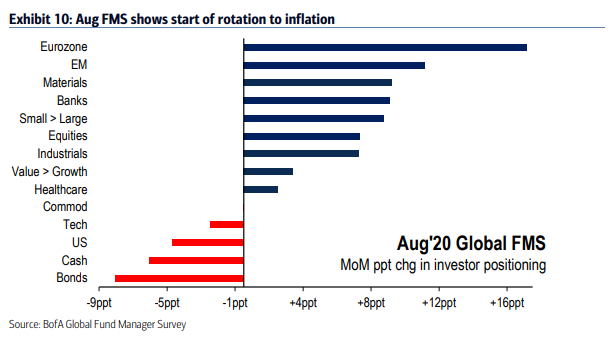

The rotation into the reflation and cyclical theme has been in evidence for a few months. The August BoA Global Fund Manager Survey showed that global managers were positioning for global reflation.

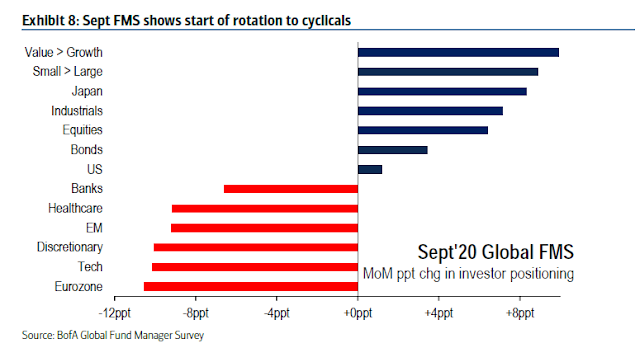

The September survey shows that the shift is continuing. While month-to-month readings can be noisy, managers continued the trend of buying industrial stocks, value over growth, small caps over large caps; and selling tech. In addition, managers regard US large cap tech to be the most crowded trade.

This weakness in large cap technology is overdue. Sentiment is becoming frothy, as evidenced by this tweet from Jim Bianco of Bianco Research.

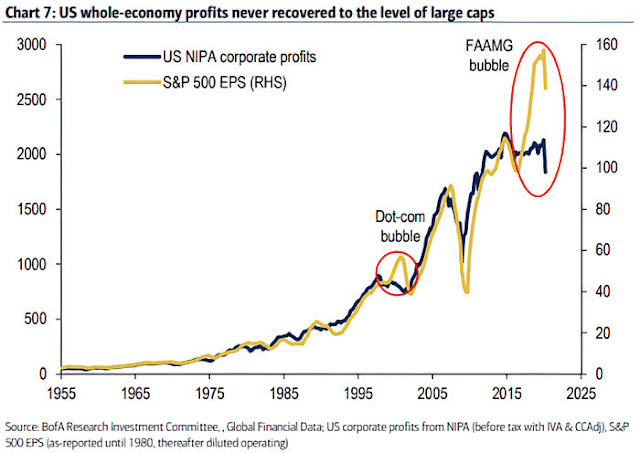

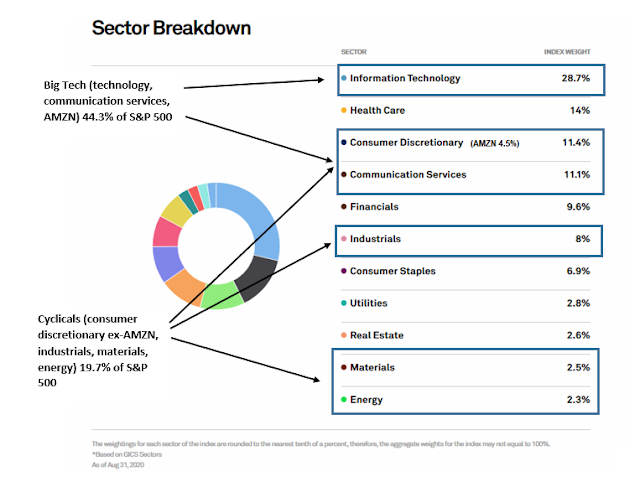

To be sure, US large cap technology profits have outperformed the rest of the economy. The combination of better profitability and investor enthusiasm has made Big Tech now accounts for 44% of the weight of the S&P 500.

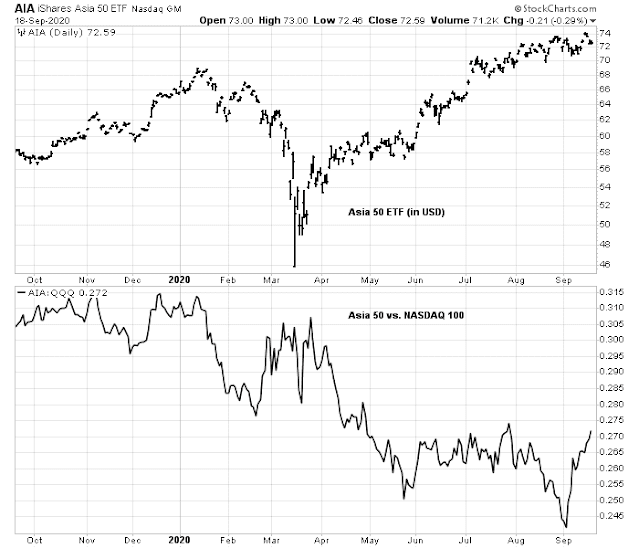

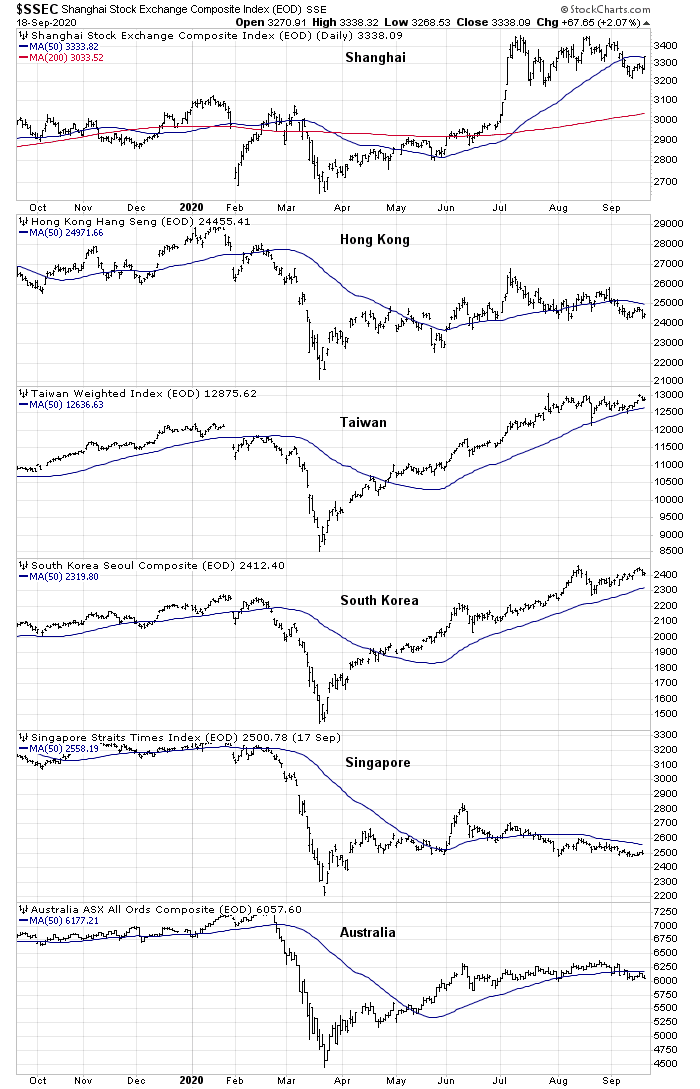

However, Cormac Mullen at Bloomberg pointed out that there are cheaper ways of gaining large cap technology exposure. The S&P Asia 50 Index is just as concentrated in Big Tech names, with Tencent, Samsung Electronics and chipmaker TSMC as its three biggest stocks, accounting for over 40% of index weight. The S&P Asia 50 Index trades at 14x forward earnings compared to 27x for the NASDAQ 100.

Early stealth rotation warnings

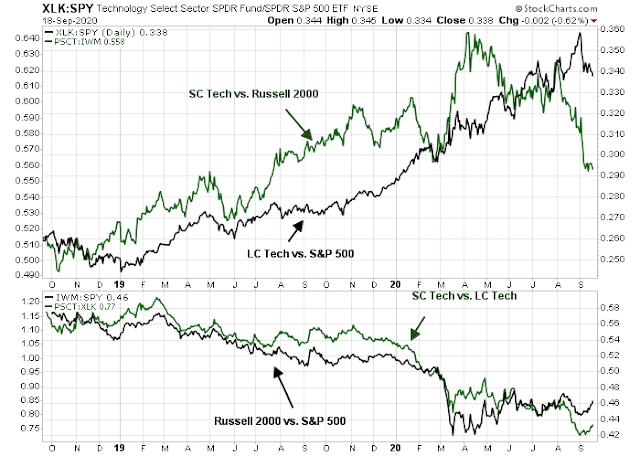

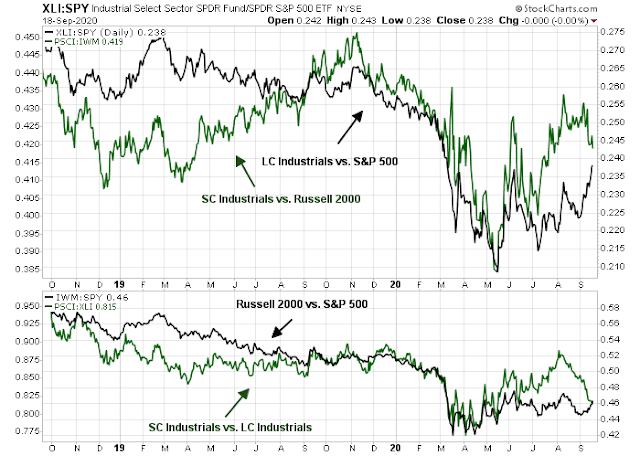

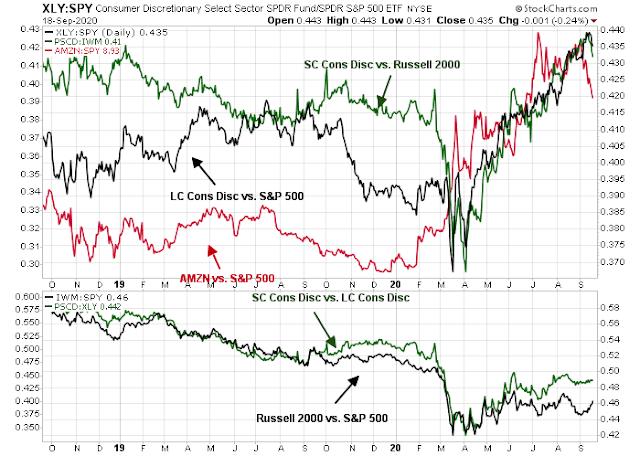

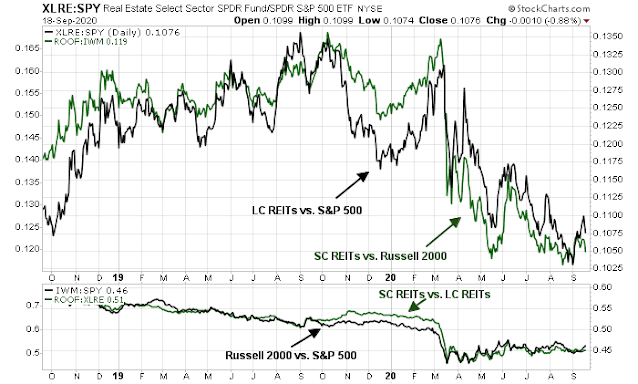

There is also extensive evidence of sector rotation under the market’s hood from the behavior of small cap stocks. These sets of charts are designed to disentangle sector and size performance by answering the following questions:

- How is the large cap sector performing against its large cap benchmark, the S&P 500? (Top panel, black line)

- How is the small cap sector performing against its small cap benchmark, the Russell 2000? (Top panel, green line)

- How is the small cap sector performing against its large cap counterpart? (Bottom panel, green line)

- How are small caps performing against large caps? (Bottom panel, black line)

The first chart shows the divergence between large and small cap technology stocks. Even as large cap technology remains in a tenuous relative uptrend, small cap technology relative returns peaked out in April and have been lagging ever since.

Large and small cap industrial stocks are also exhibiting a divergence, but with small caps leading the way upwards. Small cap industrial stocks began to turn up in relative returns in early July, and telegraphed the eventual relative upturn of their large cap counterparts.

The performance of consumer discretionary stocks make an interesting case study. Amazon dominates the weight of the large cap sector, but the relative performance of both large and small cap consumer discretionary stocks parallel each other, and small caps were able to achieve these returns without the aid of Amazon.

Key risks to rotation thesis

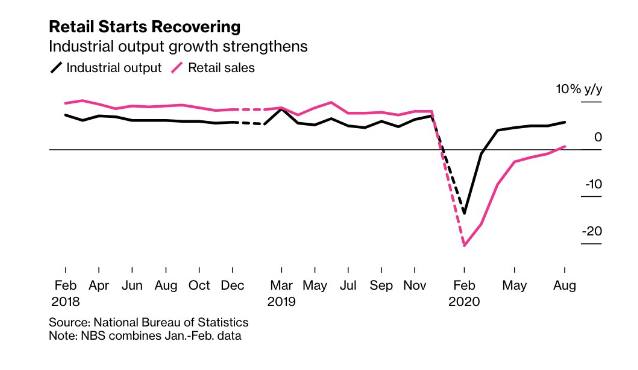

There are several key risks for investors who want to jump on the cyclical and reflation trade. One risk is the global cyclical rebound may be a Chinese mirage. China is a voracious consumer of commodities, and its cyclical rebound has been powered by a policy-driven industrial production revival at the expense of the domestic economy. The signals from commodity prices may therefore be a mirage, and they may not be sustainable if global consumer demand does not rebound.

Well-known China watcher Michael Pettis explained the nature of China’s unbalanced and uneven recovery in an

FT Alphaville article.

Economic recovery in China (and the world, more generally) requires a recovery in demand that pulls along with it a recovery in supply. But that isn’t what’s happening. Instead Beijing is pushing hard on the supply side, mainly because it must lower unemployment as quickly as possible. It is this push on the supply side that is pulling demand along with it…

This recovery isn’t sustainable without a substantial transformation of the economy, and unless Beijing moves quickly to redistribute domestic income, it will require either slower growth abroad or an eventual reversal of domestic growth once Chinese debt can no longer rise fast enough to hide the domestic demand problem.

The markets are already starting to discount the risks of an unsustainable recovery. The stock markets of China and its major Asian trading partners have flattened out after several months of gains.

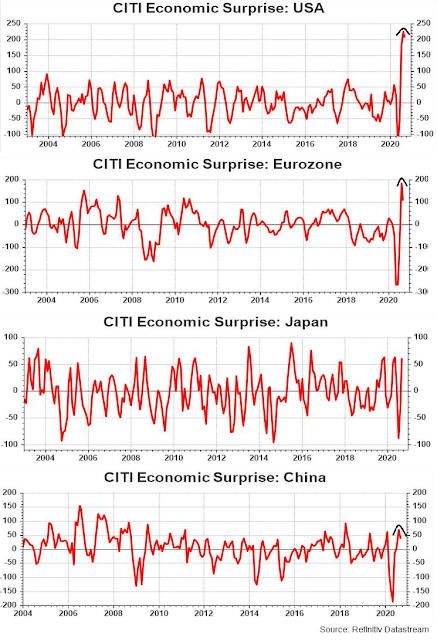

From a global perspective, the Citigroup regional Economic Surprise indices, which measure whether economic data is beating or missing expectations, are peaking and in the process of rolling over. This is an indication that the momentum of the recovery is starting to stall, which is bearish for the cyclical recovery thesis.

The second key risk for investors is a credit crunch that brings economic expansion to a halt. In the past, the usual sequence of events in a recession is: recession, credit event and blow-up, and banks tighten credit in response. As the extent of the credit event and blow-up becomes known, the stock market anticipates the monetary response and recovers. This time, the stock market rallied even before any signs of a credit blow-up.

To be sure, the Fed has stepped in with an extraordinary level of accommodation, but while the Fed can supply liquidity, it cannot supply solvency. Only the fiscal authorities can make the decision to rescue firms that get into trouble. Fed Chair Jerome Powell made it clear that under the “Main Street Lending Facility”, 13(3) requires good evidence that the borrower is solvent. Dodd-Frank made it more difficult to do emergency lending in 13(3) on purpose. In the absence of further fiscal support, expect mass small and medium business bankruptcies.

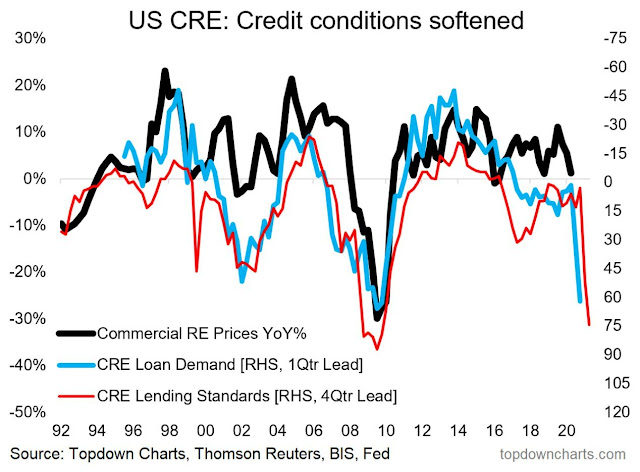

The real estate sector is especially vulnerable to a credit crunch. In the past, tightening credit conditions led to softness in commercial real estate prices. In addition, tenant eviction moratoriums puts increasing financial pressures on residential property landlords, and a credit blowup in real estate is on the horizon if Congress doesn’t take action.

Both large and small cap REITs are lagging the S&P 500, with no bottom in sight.

The combination of a possible credit event, and financial repression will pressure on banking profitability. The Fed’s Summary of Economic Projections (SEP) from the September FOMC meeting shows that it expects inflation, as measured by core PCE to be 1.7-1.9% in 2022 and 1.9-2.0% in 2023, and its Fed Funds projection to be 0.1% in 2022, and 0.1-0.4% in 2023. While the initial reaction that this was a dovish pivot by the Fed as it is making an implicit promise to not raise rates until 2023, it also implies a significant period of negative real policy rates, which is a form of financial repression that destroys bank margins. As well, if the Fed is to hold rates down until 2023, it will also have to eventually engage in yield curve control to hold down rates further out in the yield curve, which will also pressure bank margins.

Lastly, investors need to consider why the market would rotate from large cap tech and growth to cyclicals and value. During recessionary and slow growth periods, the market bids up growth stocks in an environment of scarce growth. As a recovery broadens out, sector and style rotation shifts into cyclicals and value as growth becomes more abundant.

This brings up two problems. First, economic recovery depends on the effectiveness of health care policy, fiscal policy, and monetary policy, in that order of importance. The effectiveness of global health care policy remains a question mark, as this pandemic needs to be controlled all over the world to prevent reservoirs of the virus from leaking out to spark periodic outbreaks. In addition, the US fiscal policy response has been uneven, even though monetary policy makers are doing all they can to backstop the economy.

In addition, a rotation out of Big Tech into cyclical sectors presents a liquidity problem. The weight of Big Tech is 44%, which is over double the size of the cyclical sectors. Investors deploying funds out of US Big Tech will need to find better opportunities either abroad or in other asset classes. This will mean lower overall stock prices.

In conclusion, the market has been undergoing a rotation from US large cap tech into stocks with cyclical and reflationary exposure. Whether the rotation is a “healthy” one remains to be seen. There are several risks if investors were to hop on the cyclical rotation theme. The global cyclical revival may not be sustainable; a credit crunch sparked by tightening lending requirements could stop the recovery in its tracks; and the rotation could put downward pressure on the S&P 500 because of the massive weighting of Big Tech stocks compared to cyclical sectors.

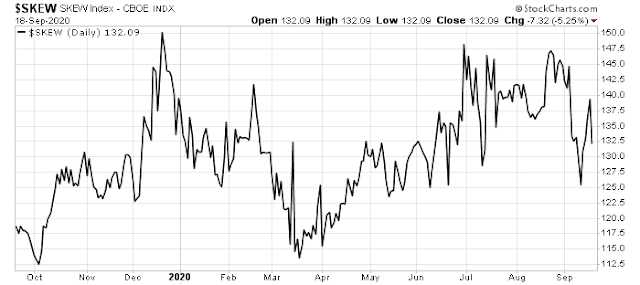

Under these conditions, investors are advised to focus first on risk, rather than return expectations. SKEW, which measures the cost of hedging tail-risk, is elevated indicating a high level of uncertainty as we approach the election in November. Volatility may stay heightened if a clear resolution isn’t known after November 3.

As I pointed out before, the path of economic recovery depends on health care policy, fiscal policy, and monetary policy, in that order of importance. Until there is greater clarity about the path of health and fiscal policy, there will be few catalysts that reduces equity implied volatility and tail-risk – and that’s the probable reasoning behind the elevated SKEW.

We all are concerned about the market break down Friday but there is something even more important going on.

As you probably know, Justice Ruth Bader Ginsburg passed on Friday. We can all mourn her death but her passing is going to throw the election and possibly the markets into what will seem like never ending turmoil.

First, Republicans cannot leave her seat vacant. President Trump and the Senate must act. They are duly elected and of the same party, thus a nominee will be named and a confirmation process will proceed. This may last beyond October and will be the most contentious nomination in our lifetimes. Democrats are going to go ballistic. A Trump nominee would push the court to conservatives and threaten Roe v Wade.

This will benefit Biden because now the Democrats have a huge issue to get out the vote. Even if the nomination process is complete before November (unlikely) Liberal Pundents have argued for adding justices to the court to dilute conservative leanings of the court. This is going to be the election October to end all election year Octobers. Violence around the country could escalate dramatically and it could absolutely tank the stock market.

Thanks for bringing up a scenario that hadn’t occurred to me.

For some reason, this election year reminds me of 1968 Nixon/ Humphrey race.

Humphrey, Mondale, Dukakis, Biden, they are all big time losers.

This situation potentially could be very volatile. Conservatives have not forgotten how judge Kavanaugh was treated at confirmation hearings. So they are dead set to push a quick confirmation this time and are ready to ram it through. Democrats have not forgotten Merrick Garland saga of 2016. So both sides are on a collision course.

Roe vs Wade, as always, is just a weapon used by the left to grab power. The left have never a care about everything beneficial to Americans ever since 1920s when they first landed at America during mass immigration of Europeans after Bolshevik victory at Russia. Only tactics change but their goal and intent remain the same today.

I am registered as an independent and now more of a data science guy. So I am ready for fireworks. It might rise to the level of case of John Adams and Thomas Jefferson in 1800. John Adams’s party confirmed an SC Justice in a month and packed the federal courts with a lot of judges. The subsequent 4 years Jefferson was like driving into strong winds. Nothing gets done. If Trump loses in Nov, expect something similar.

Actually America’s system is based on conflict and negotiation from the very beginning. It can never produce a dictator. Our founding fathers are a tenacious and quarrelling bunch but they are erudite, totally opposite from today’s lowly politicians. Early days of this country are full of political dramas. Today as a nation we have lost the art.

Let’s see how it unfolds. As usual we do analysis and then synthesis. Observe and adjust.

A (really scary) storm coming!

https://johnhcochrane.blogspot.com/2020/09/storm-coming.html

I’ve been warning about this kind of scenario for several weeks.

Sanjay, Cochrane is a little over the top but any part of that could become our reality to our demise.

There is a good chance we might start to have a meaningful third party after the election. Hopefully more parties. The two-party system is a total failure. Both sides take turns enriching themselves. As of today, independents are 40%+ of the total population, meaningfully larger than either of the two parties. We can employ technologies in organizing activities.

We had a Tea Party last election. What happened? Has the epitaph been written on this movement?