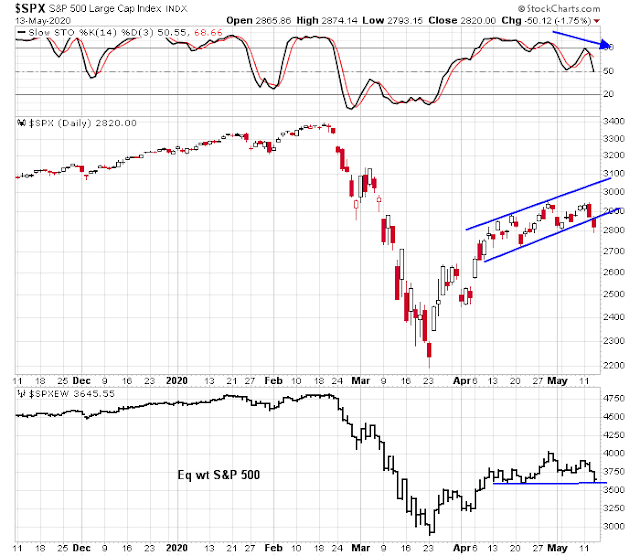

Mid-week market update: Is this market starting a new bear leg? There are numerous signs that may be happening. The SPX violated the trend line of a rising channel while the stochastic recycled from an overbought reading, which is a sell signal. The chart of the equal weighted index, which filters out the effects of heavyweight leadership, looks worse as that index tests a key support level.

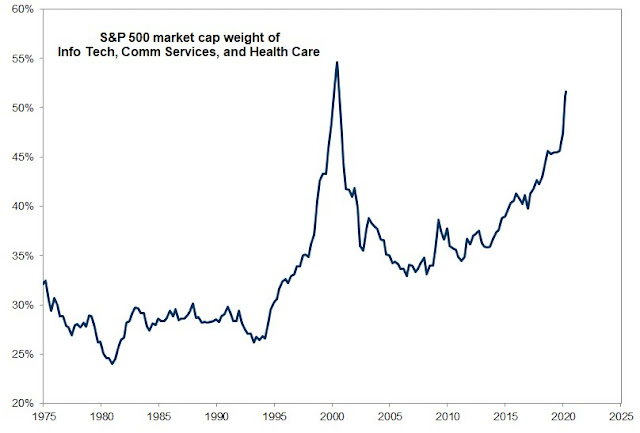

The market’s narrow leadership is evidenced by the concentration of the current leadership of technology, healthcare, and communication services, which is nearing the highs set during the Tech Bubble.

Narrow leadership and high concentration are high risk “this will not end well conditions”. Could the latest pullback be the bearish trigger?

Sentiment signals

It may be turning out that way. Sentiment signals are flashing contrarian bearish signs. About a month ago, I had highlighted the surprising results of New York Fed’s consumer expectations (see The 4 reasons why the market hasn’t seen its final low). The latest update of the monthly survey shows that expectations of higher stock prices 12 months from now surged even higher.

These results make me speechless.

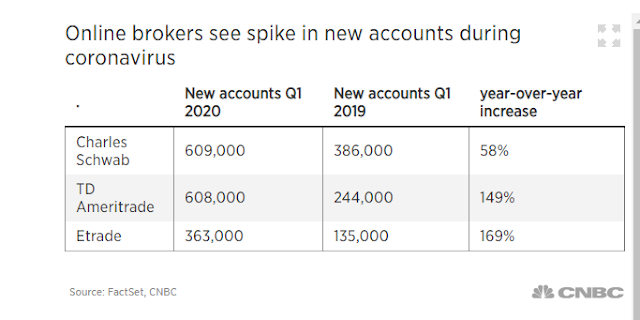

I had also discussed the apparent anomalous AAII sentiment survey crowded short reading on the weekend (see Setting up to climb a wall of worry?). I suggested that new low-information traders and investors had rushed into the market. The market’s advance could be partly explained by their stampede into FANG+ and small speculative names. Indeed, CNBC reported that online brokerage firms had seen a surge in new investor accounts in Q1.

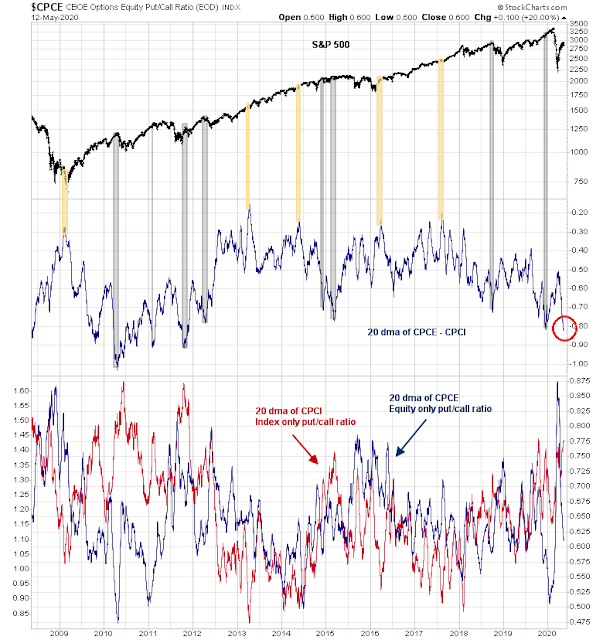

In light of the entrance of new traders, a unusual bifurcation has appeared in the option market. The equity-only put/call ratio, which tends to be the main playground of retail traders, has diverged from the index put/call ratio, which is more used by professional traders and hedgers. In the past, significant gaps between these ratios have been either decent buy signals (in yellow), or high risk signals where the market advance either stalled or fell (in grey). Readings are now at or near a sell signal.

Other warnings

There are also other warnings about the market. Hedge fund manager Stan Druckenmiller recent warned that the risk-reward calculation for equities is the worst he’s seen in his career, and “I pray I’m wrong on this, but I just think that the V-out [recovery] is a fantasy”.

CNBC reported that Appaloosa Management founder David Tepper said that this is the second most overvalued market he has ever seen, behind 1999. He went on to question the upside potential of the popular FANG+ stocks.

Tepper also called some of the popular tech names including Amazon “fully valued.” Amazon has been one of the first companies to roar back to a new record after the coronavirus sell-off. The e-commerce giant is up 27% this year as investors bet on its resilient business.

“Just because Amazon is perfectly positioned doesn’t mean it’s not fully valued,” he said. “Google or Facebook … they are advertising companies. …They are not rich but they may be fully valued.”

Macro Charts observed that the market has become extremely overbought. Overbought conditions without a breadth thrust (Zweig, Whaley, etc.) tend to be bearish for stock prices.

The consolidation scenario

Before everyone gets overly excited about a new bear leg, we have to think about the possibility that the bulls losing control of the tape doesn’t necessarily mean that the bears are in the driver’s seat. Two days of market weakness are not definitive signs of a bearish break. We have to consider a scenario of choppy sideways consolidation for a number of reasons.

First, the advance from the March lows was led by FANG+ and momentum stocks. Different measures of the price momentum factor shows that momentum is still alive.

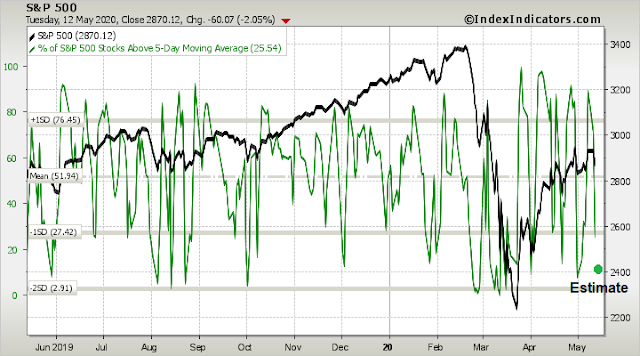

Short-term breadth had reached a near oversold condition yesterday (Tuesday), and today’s decline pushed readings further into oversold territory. The market is setting up for a near-term bounce, and the last hour rally today is supportive of that thesis.

I pointed out that the equal-weighted SPX was testing a key support level. Market declines often pauses at the initial test of support. My inner trader is keeping an open mind about whether this is the start of a new bear leg, or the beginning of a period of choppy sideways consolidation.

Subscribers received an alert today (Wednesday) that I had taken partial profits in my short positions in anticipation of a relief rally into Thursday and possibly Friday. If that scenario unfolds as anticipated, my inner trader expects to add to his shorts.

My inner investor remains cautiously positioned.

Disclosure: Long SPXU

fyi – Hulbert’s sentiment index pulled back 24 percentage points from Monday’s close. It’s only a small piece of the sentiment puzzle and open to interpretation, but based on my observations that’s a sizeable two-day drop and supportive of a near term rally.

First SPY tranche opened yesterday @ 281.xx. Second tranche with a limit buy ~275 – not an exact match for SPX 2750 but close enough – which may trigger later in the day (although I think buyers may have succeeded in setting an intraday low ~2766).

A reversal in financials appears to be underway.

Opened a lottery ticket in airlines.

Cam–what does your technically supported “intuition” tell you about the seriousness of this bear trend. I sense fear in my friends. That does not make them wrong of course. Fear is often closer to the truth than optimism–except at extreme levels. robert Millman

The recent escalation of the China-US conflict has so far been dismissed as the usual sabre rattling with both sides shying away from real meaningful action. Last year Trump was just playing his game where he tried to look though against China and then sign a trade deal just in time to reap the economic beneftis before the election. This campaign tactic however seems likely to fail with everything that happened this year and now both candidates have a bit of a credibility problem with “being tough against China”

What’s in it for China? They want to look tough as well and it seems more and more likely that their “appeasement tactic” versus Trump is not leading to the kind of result they wanted. Plus of course that being nice to Trump is losing more and more of it’s appeal as his reelection is no longer a sure thing.

Cam, when valuing the S&P it looks very expensive on a historical basis, but it is really a bifurcated market; growth looks very expensive and value looks cheap. Following the .com crash, value did very well while the S&P fell. Could you see a similar scenario laying out today as the economy reopens? It appears as though several industrial metals have begun to improve.

Sorry I didn’t reply earlier. Value stocks may be a reasonable place to hide, but with a caveat.

Value/growth mean reversion depends on a number of things:

1) A rule of law and certainty about property rights

2) Some degree of certainty that the competitive landscape isn’t being totally disrupted, e.g. Netflix destroying Blockbuster.

In the current environment, there are a number of doubts about 2. Retail, REITs, energy, and even banking (threat of negative rates) are under pressure. Understand that, in the near term, those are the kinds of bets you would be making if you started to buy value stocks.

Forwarding a letter to the editor from a guy in Menlo Park which seems to encapsulate many of the thoughts making the rounds re reopening in California.

[Editor,

Some doctors are warning politicians about the risk of opening up our economy too soon; and politicians are agreeing without questioning the validity of such extreme caution.

However, as an attorney, I have personal knowledge of several aspects of medical advice that should be considered.

First: Many doctors are justifiably conservative because, if they are not conservative, they run the risk of a medical malpractice lawsuit.

Second: Consider what every trial lawyer knows:

“Every medical expert has an equal and opposite medical expert.”

For example: Are Swedish doctors wrong to permit substantial economic openness? Are South Dakota doctors wrong to reject shutting down? Now then, since there is a good basis for either argument, here is what would be best.

Trust the common sense of business owners and customers to do what is right.

If grocery stores can open safely, so can the rest of businesses, using appropriate precautions.

We have had enough time in shutdown to know that, with new medical treatments, scientific discoveries and reasonable precautions, we can open up without government-imposed restrictions.

Government needs to step back now. We Americans are “risk takers.”

Let the public decide when and how to open their businesses; let people decide if they want to stay in their homes or venture out.

It’s time to go “back to normal.”]

Up to the individual family to decide their risk tolerance. However we don’t have good data, that’s why testing is so important. I live in Santa Clara county, where the virus has been in the wild for some months now (early February). The case numbers are low which is great however I have no way to know how many have antibodies and doubt the true number because the level of testing isn’t there.

It’s akin to investing with just the CNBC dashboard or flying a plane with no instruments. Sure you can navigate at some level, but you’d prefer to have Cam’s insights and full instrumentation.

There isn’t a right answer, I’m just saying it’s difficult to figure out an acceptable risk right now without more testing.

The same analogy occurred to me this morning in reference to investing.

Cam always drafts a good flight plan, whereas on my own I’m flying by the seat of my pants.

Tim Duy captures it well in his May 4th blog post:

“What to do? We need a coordinated public health effort sufficient to mitigate the risks of the virus enough to provide a reasonable degree of confidence among the general public, extended aid for workers and firms that is less restrictive and phase out on the basis of economic outcomes not time, and aid for state and local governments. The longer we delay these actions, the less robust will be the recovery.

Bottom Line: The public health response is the most important economic policy. The economy will be stuck at a lower equilibrium until the public is confident in their ability to manage the personal safety. Until that point, we limp along at sub-optimal levels.”

https://blogs.uoregon.edu/timduyfedwatch/

When solving technical problems or problems that requires expertise, you should always scrutinize for factual evidence to support the solution – and make sure the basis for the solution is supported by hard evidence.

Always be on the lookout for hucksters, they’re everywhere these days.

The SPX appears to have defined the lower end of Cam’s trading range scenario. Until the market shows its hand, buying ~2750 and selling ~2950 may be a good play.

Despite today’s rally, Hulbert’s index closes down an additional 3 percentage points – a (ST) sign of disengagement in the bounce, which may be enough to lift the SPX to 2900. I would probably exit on a move to/near SPY 290 on Friday – alternatively, I would add on a retest of 276.

I hedged my bets end of day and closed half of the SPY position.

Apparently Credit Suisse (Andrew Garthwaite, global equity strategist at Credit Suisse) has just released a report forecasting a major bubble in US stocks, with PEs running to 45 to 60. This is due to an expected negative interest rate environment (notwithstanding FED / Powell statements). Can’t find a link right now.

Is this the answer to cure and prevention of Covid-19?

….the researchers at Sorrento found that there was one particular antibody that showed to be 100 percent effective in blocking COVID-19 from infecting health cells — STI-1499.

https://www.foxnews.com/science/covid-cure-california-biopharmaceutical-coronavirus-antibody-breakthrough

The stock SRNE is up over 100% in the last hour.

Sounds promising, Wally.

The one thing that troubles me about the CEO is the repeated use of the phrase ‘100 percent.’ Nothing in life is 100% . Other than that, I hope they succeed.

In the med/ science world today– Santa Clara study claiming low mortality of COVID has been debunked. STILL not peer reviewed. https://www.buzzfeednews.com/article/stephaniemlee/stanford-coronavirus-neeleman-ioannidis-whistleblower

Next edition of UCSF Grand Rounds.

https://www.youtube.com/watch?v=n3mtPC6V408

Wachter spends the first thirty minutes interviewing two critical care physicians who recently returned from a stint in NYC – one of whom relates that despite having anticipated the worst while preparing for the trip, the reality was even more chaotic than he imagined. The magnitude of the situation (‘the incredible numbers of sick and dying around you’ and the extent of pain/suffering) was overwhelming and ‘somewhat shocking.’