Remember the Great Financial Crisis (GFC)? As the GFC engulfed the global economy, China stepped up with a shock-and-awe campaign of fiscal and monetary stimulus that stabilized not only the Chinese economy, but global growth. Can China save global growth again?

China recently reported surprisingly strong export growth for April, but the closely watched early May trade figures from South Korea badly missed expectations. Exports plunged -46.3% YoY. Exports to China fell -29.4%, which is hardly the picture of a robust economic revival.

Since China was the first major economy to enter the pandemic crisis, what does that mean for the world, based on a first-in-first-out principle?

What stimulus?

As the extent of the COVID-19 outbreak became apparent, Beijing made the deliberate policy decision to shut down the economy. As the pandemic got under control, the next step is economic stimulus.

Bloomberg reported that the PBOC has announced stimulus measures to support China’s economy, but few details were forthcoming:

The People’s Bank of China said it’ll resort to “more powerful” policies to counter unprecedented economic challenges from the coronavirus pandemic, without giving further details on what measures it will use.

The central bank will “work to offset the virus impact with more powerful policies,” paying more attention to economic growth and jobs while it balances multiple policy targets, the PBOC said in its quarterly monetary policy report, released Sunday. It reiterated that prudent monetary policy will be more flexible and appropriate and it’ll keep liquidity at a reasonable level.

The remarks reflect the PBOC’s growing concern over the unprecedented economic downturn and the risk of a second quarter of contraction, given sluggish domestic demand and the collapsing global economy. While the central bank has increased liquidity supply to banks and eased rules on banks’ buffers to allow them to extend more credit, the scale of the stimulus is limited compared to other major economies globally.

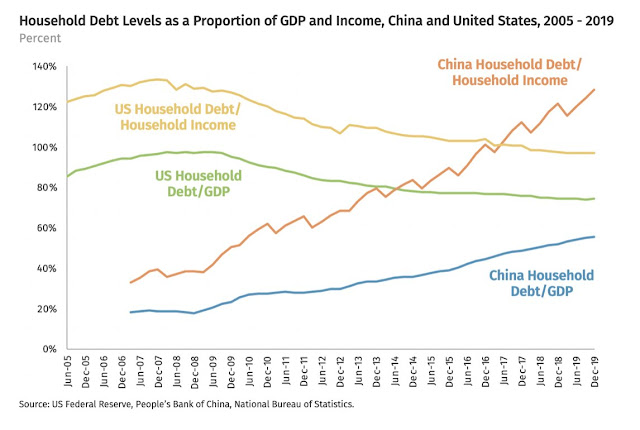

The authorities face a dilemma in crafting a stimulus package. Household debt levels are already stretched. Debt service is already at levels seen by US households just before the GFC collapse. The Chinese consumer has little spending power left to support the economy.

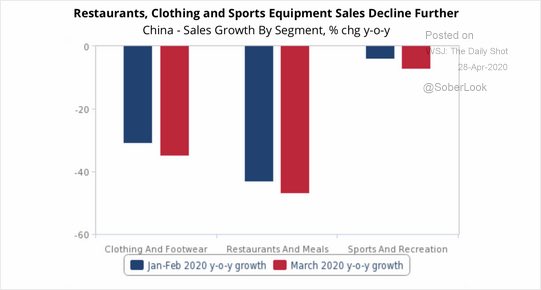

In fact, Chinese discretionary spending has weakened further since the COVID-19 lockdown was gradually lifted.

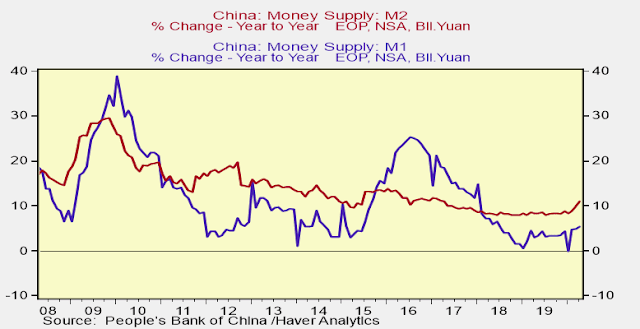

Chinese M1 and M2 growth has ticked up because of stimulus measures. However, growth rates are nowhere near the levels seen in the wake of the GFC shock-and-awe campaign.

Is Beijing running out of bullets?

The limitations of stimulus

There are severe limits to Chinese stimulus this time, according to Peking University finance professor Michael Pettis. In an interview with Swiss periodical The Market, Pettis warned that hopes of a rapid recovery, led by China, will most likely be disappointed.

A lot of people say Covid-19 has changed the world. I don’t agree with that. I think what it has done is it has accelerated a lot of things that were going on anyway. In the case of China, the elephant in the room is the level of total debt. In my view, the real underlying growth rate of China – by that I mean the growth rate that is not artificially inflated by debt-financed overinvestment – has for years been much lower than the officially stated rate. While official growth was around 6%, I’d say the real economic growth rate was less than 3%. The way they got to the official numbers was through the big increase in debt.

The main obstacle to growth is excessive debt that was accumulated in the last cycle.

What about the other two healthy sources of growth, exports and private sector investment?

Chinese exports will be down this year, as they suffer from the global slowdown. Which leaves investment by private companies. But most of that serves either as consumption or exports, at least the good stuff. So private corporations are not going to invest much. All in all, the good type of growth is probably going to be negative this year. Consumption will be down, exports will be down, private sector investment will be down.

Which only leaves the unhealthy sources of growth?

Exactly, and that is public sector investment and real estate development. It’s very simple: Because consumption, exports and private sector investment will be negative, public sector investment will just have to expand in China. There is no other way to keep growth levels in positive territory.

China has a dirty peg to the USD. This raises the impossible trinity problem. You can’t have a fixed foreign exchange rate; free capital movement (in the absence of capital controls); and an independent monetary policy all at the same time.

This is part of the catch with the impossible trinity they’re in. The PBoC has to act with restraint. Remember, they need foreign investment money to flow into China. One way to do that is to keep interest rates high relative to the Dollar and the Euro. And the other way is to limit the volatility of the currency. If you want to attract foreigners, you have to offer them a higher yield, and you have to alleviate their worry of a currency devaluation. So while the Fed reduced interest rates by 150 basis points, the PBoC only reduced theirs by about 20 basis points.

If the PBOC tries to stimulate too much, China risks capital flight. If they allow capital flight, the CNYUSD exchange rate falls, which will exacerbate already tense trade tensions with the US.

That kind of rhetoric from the White House shows that the relationship between the US and China is deteriorating even more. How do you see that playing out?

For at least the past two to three years, my message has always been the same: The relationship between Washington and Beijing is only going to get worse. So, as with other developments, Covid-19 has simply sped up a process that was already in place.

In summary, the policy makers in Beijing are caught between a rock and a hard place. Any stimulus efforts are likely to be small scale and highly targeted.

The market response

The market seems to understand the nature of China’s problems. The relative performances of the stock markets of China and her major Asian trading partners against the MSCI All-Country World Index (ACWI) have been unexciting. Relative returns rose starting in mid-February, but most markets gave back most if not all of the relative gains since the global market bottom in late March.

If there is any excitement over the prospect of Chinese stimulus, it can’t be seen in stock prices. This time, don’t count on China to save global growth again.

https://www.bloomberg.com/news/articles/2020-05-12/druckenmiller-says-v-shaped-recovery-for-u-s-is-a-fantasy

SPX bouncing well off the overnight low of 2825. A lot of traders went short at Tuesday’s close expecting a gap-down open this morning. I think they’ll be tested in the first hour of the regular session, but I think the bounce fails ~2900.

The first hour is always instructive. No bounce. That changes my take – I think SPX hold at the morning lows and bounces to 2900.

Famous last words.

The shorter your time horizon the tougher trading becomes. That’s my experience.

Long SPY at the close.

JMO, but I think we’re likely to retest SPY 294 to 300 before seeing 265. I would add to the position should SPX decline further to 2740 tomorrow.

Karlewitz thinks we may head to 2,740 now we are under 2,840.

https://twitter.com/ukarlewitz/status/1260351215398879232

We all have to make a stand somewhere – or simply refrain from trading.

In my investment portfolio, I began scaling back in as well. My thinking was to reopen 25% ~2850 – if it continues to sell off, I’ll add another 25% ~2750. If instead it retests 2950, I’ll exit the 25% and return to cash. If it sounds like a lot of work, it’s because I’ve never been the into buy-and-hold type – I’m not a guy who’s willing to sit through a -50% decline. I don’t think any of us are – or we wouldn’t be here.

Rxchen2, that makes sense. I also gradually scale into my positions (individual stocks mostly, and some ETFs for hedging).

https://www.cnn.com/2020/05/12/us/california-universities-fall-online/index.html

‘Most of the more than 770,000 students at California’s two main university systems aren’t likely to return to campus this fall.

‘The California State University system, which claims to be the nation’s biggest four-year university system, plans to cancel nearly all in-person classes through the fall semester to reduce spread of the coronavirus, Chancellor Timothy White said Tuesday at a board of trustees meeting.

‘At the University of California, which has 10 campuses across the state, “it’s likely none of our campuses will fully re-open in fall,” Stett Holbrook, a spokesperson for UC, told CNN in

an email.

‘Dr. Anthony Fauci, a key member of the White House’s coronavirus task force, told Congress on Tuesday that it is a “bridge too far” for schools to expect a vaccine or widely available treatment for Covid-19 by fall reopening time.’

China just imposed tariffs on Australia which are as vicious as possible without effecting the Chinese economy. US-China relations are likely to deteriorate substantially I think.

Thanks again, Cam. That was a brilliant trade.

Agree.

Yes, Indeed. Thank you.

Totally agree!

By the way, Kyle Bass is echoing Cam’s recent post about China:

“Investors should prepare for a U.S. ‘economic depression,’ warns Kyle Bass, but China’s fate could be even worse”

https://www.marketwatch.com/story/investors-should-prepare-for-a-us-economic-depression-warns-kyle-bass-but-chinas-fate-could-be-even-worse-2020-05-13?siteid=yhoof2&yptr=yahoo

Here is some happy news (sarcasm):

It will be ‘four or five years’ before Covid-19 is under control.

A vaccine “seems for now the best way out”, but there were “lots of ifs and buts” about its efficacy and safety, as well as its production and equitable distribution, she said. A vaccine could also stop working if the virus changed, she added.

“We will have to find a way as societies to live with this” and change from lockdowns to more “granular, targeted types of interventions”.

https://www.ft.com/content/69c75de6-9c6b-4bca-b110-2a55296b0875

More Fed easing on the way:

Powell’s gloomy outlook has investors predicting the Fed may make another big move soon (before or at the June 9-10 mtg)

https://www.cnbc.com/2020/05/13/powells-gloomy-outlook-has-investors-predicting-the-fed-may-make-another-big-move-soon.html