Mid-week market update: Boy, was I wrong. Two weeks ago, I wrote Why the S&P 500 won’t get to 2400 (in this rally). Despite today’s market strength, stock prices may be restrained by a case of round number-itis as the Dow crosses the 21,000 mark and the SPX tests the 2,400 level.

In addition, the market’s reaction to President Trump’s speech to Congress was at odds to the reaction from Street strategists. While the market went full risk-on in the wake of the Trump speech, this Bloomberg summary of strategist comments made it clear that the speech was long on themes and short on details. Perhaps stocks are rallying because Trump did not go off script and sounded statesmanlike and presidential. How long the market remains patient with his lack of the specifics on tax reform, which is Wall Street’s major focus, remains an open question.

In the meantime, the SPX has broken above its trend line and appears to be staging an upside blow-off. When animal spirits start to stampede like this, you never know when the rally will end.

Does this mean it’s time to jump back on the bullish bandwagon? Not so fast. The week isn’t over and there are a couple of other major developments (other than the Trump speech) that warrant consideration.

The state of the (European) union

I suggested about a month ago that we may be nearing a peak in political populism based on the magazine cover indicator (see Peak populism?). The latest developments from Europe indicates that we may be nearing a political inflection point.

The populist Geert Wilders is losing ground in the upcoming Dutch election on March 15. Bloomberg reports that Wilders’ Freedom Party is running neck and neck with the establishment Liberals, which forms the current government:

Dutch Prime Minister Mark Rutte’s Liberals are making up ground on populist frontrunner Geert Wilders in the polls, suggesting that voter support is crystallizing in the final weeks of the campaign in favor of keeping Rutte in power.

Two polls released on Tuesday showed the Freedom Party with a one-seat advantage or even with the Liberals. That’s down from a lead of as many as 12 seats at the start of the year. A poll aggregator released Wednesday showed the Liberals narrowly ahead for the first time since November.

Business Insider also reported that Wilders has slipped to second place in one recent poll.

In France, conservative presidential candidate François Fillon’s political fortunes are imploding, based on the news that investigating magistrates have summoned him and his wife on charges that he put his wife on a government payroll for nonexistent work. In a press conference, Fillon decried the move as “political assassination” and vowed to fight on. This development has cleared a path for the centrist Emmanuel Macron to the French presidency. The latest Betfair odds shows Macron surging at Fillon’s expense. The anti-establishment and populist Marine Le Pen remains in second place, with little hope of winning the election.

As a consequence, the French-German yield spread has begun to narrow.

The state of the European Union is getting stronger.

A March rate hike?

In a Bloomberg interview on February 21, Cleveland Fed president Loretta Mester stated that the Fed does not like to surprise the market on interest rate decisions. At the time of that interview, the odds of a March rate hike was in the 20-30% range. It is now about 70% after one Fed speaker after another warned that not only is the March FOMC meeting “live”, there is a distinct possibility that they may raise rates at that meeting. San Francisco Fed president John Williams said that he expect that the FOMC will a rate hike will warrant “serious consideration” at the March meeting. In a CNN interview, New York Fed president William Dudley said that the Fed will raise rates “fairly soon”.

What does this all mean?

Fed watcher Tim Duy thinks that the question is whether the Fed wants to be preemptive, or it wants to wait to see how fiscal policy develops:

When I read the interview, it is hard for me to see that he has a strong conviction for drawing forward the rate hike to March. It seems odd to do so if he sees no change in the forecast and downplays the impact of the upside risks. If he does want to move in March, it tells me then it has little to do with either factor and is entirely about staying ahead of the curve. It is about the need for a preemptive rate hike. If his forecast is for three hikes and he wants to hike in March, then his patience has ended and he wants those hikes frontloaded. If for FOMC participants as a whole the forecast has yet to change much, then it is possible that the even if they raise in March, the median projection of three rate hikes this year remains steady.

Much of the data has been coming on the “hot” side, indicating a robust economy with rising inflationary pressures. By the book, the Fed should be thinking seriously about starting a rate hike cycle about now. Indeed, there were several data points that were released today that are supportive of that view.

The Beige Book, which released today, showed a lot of “modest to moderate” growth. Labor markets are tight, with “moderate” employment growth. Some districts reported labor shortages. These are the kinds of conditions that Dudley referred to when he described an “economy continues on the trajectory that it’s on, slightly above-trend growth, gradually rising inflation” as the prerequisites to the removal of monetary policy accommodation.

This morning also saw the release of the ISM Manufacturing Survey, which rose and came in ahead of expectations, as it continued a trend of beating market expectations.

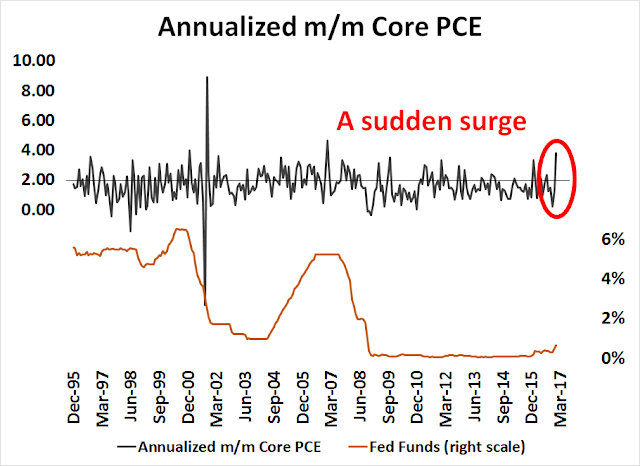

As well, month-over-month Core PCE, the Fed’s preferred inflation metric, was released this morning. It also came in ahead of expectations and surged to an annualized rate of 3.8%, well ahead of the Fed’s 2% inflation target.

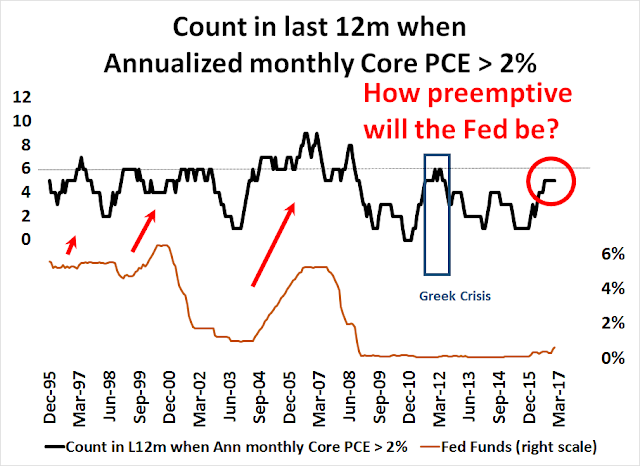

To put this data point into context, I counted the times in the last 12 months that annualized m/m Core PCE has exceeded 2%. As the chart below shows, the Fed has historically begun a rate hike cycle whenever the count reached six (dotted line). The count currently stands at five, which begs the question, “How preemptive does the Fed want to be?”

Fed chair Janet Yellen and vice chair Stan Fischer are scheduled to speak on Friday. If they want to give the market further direction, we should get it then. In addition, Fed governor Lael Brainard is scheduled to speak a 6pm ET today (Wednesday). Brainard is one of the most dovish governors on the Board, if her tone sounds hawkish, then watch out!

A market blow-off

In summary, the stock market is undergoing a blow-off with no end in sight. We are starting to see bullish political developments out of Europe, but one wildcard is the possibility of a March rate hike. Should the Fed preemptively raise rates, not only would the normal macro effects of slowing the American economy be applicable, it would push up the US Dollar. A rising USD would be bearish in three ways. First, a strong greenback squeezes the margins and therefore the earnings of large cap multi-nationals companies. It would be supportive of the “America First” contingent within the Trump administration in their protectionist policies. As well, a strong USD would pressure the emerging market countries and companies with USD debt and raise the odds of an EM debt crisis.

My inner trader initiated a small SPX position on Tuesday. He is maintaining his position in view of the downside risks to the market.

Brace for further volatility.

Disclosure: Long SPXU

You are like many – you get it wrong and do not know why.

This is because unlike John Maynard Keynes you cannot change your mind when new information appears. Mainly because you just don’t get it.

Try thinking 60 million Americans voted for Trump.

Though the implications could be a shock for you

What we saw last night is what Trump supporters see. A committed strong businessman leading America to a stronger economy even at the expense of every other country. They ignore his weird side while we get caught up in it and miss his theme. Last night he stayed to his theme with no tweet-type strangeness. Listen to the basic theme and it explains the unrelenting strength of this market.

It’s totally clear why markets roared today. More investors got swept up in the gusto. Americans as a group look inward while the media and intellectuals are worldly. It’s easy to see that they love the idea of beggering their neighbors to get their economy booming. This narrative has lots of room to run before economic reality throws cold water on it.

For me this was a classic example of a big event and the accompanying risks fogging the underlying technical picture of what the market was doing. There is a case to be made however, that the market was getting a bit more skeptical on the new administration, until Trump’s comment on more details about the tax reform in the next 2-3 weeks and now the relief reaction yesterday. With that out of the way, there are other things to focus on.

Also this reminds me of September 19th 2014, the day Alibaba went public and the market peaked on that day. My gut feeling is that it will need another strong earnings season before the S&P 500 will close above 2400. Pretty weak analysis, I know.

So, the Atlanta Fed GDP now is forecasting a 1.8% Q1 2017 GDP growth, sharply down from 3.5% forecast on 1-31-17. Here is a link: https://www.frbatlanta.org/cqer/research/gdpnow.aspx?panel=1

Lael Brainard, last night (see Cam’s post) seems to be warming up to rate rise, “soon”. http://www.cnbc.com/2017/03/01/feds-brainard-citing-improved-global-economy-says-rates-can-rise-soon.html

Rising oil prices, as noted by financial journalist Ambrose Evans Pritchard (The Telegraph), in the last three months or so, could “smash through” the Fed’s inflation target of 2% before the end of the year. As the core PCE graph, above shows, inflation is not exactly sleeping here, though core PCE is quite volatile.

Yes, all in all, the Fed is now likely to lead the market, considering inflation pressures are rising. Animal spirits are singing, cooing the Joe six pack into the market. Professor Robert Shiller’s CAPE valuation is projecting poor returns going forward. It is anyone’s guess whether the S&P rises another 20-25% from here closing in on 3000, give or take, with valuation in nose bleed territory. The tide of rising market brings with it enhanced risk and long positions need to be carefully monitored, with proper hedges in place. Cam is right, this is time to watch with patience, than be cavalier about what is happening. March 2017 would be the 8th anniversary of the bull market, which is one of the longest on record. Margin interest is at a record high. Sentiment is rising. Yes, even a 25 billion $ Snapchat starts to look like Venus or Adonis, depending on your male or female preference. Let us see if this is the “Snap” market peak here. Market corrections usually start with a peak, are gradual, slow developments, and have an uncanny way to be associated with complacency. For now, we are not in the euphoria phase, but, the Trump pantry appears to be dishing out a culinary mix with delicious aroma. Let us see what it tastes like, once it is served to the Congress.

A fearsome squeeze yesterday. It traded like a short market and on reflection it is clear that the market was thinking Trump might be combative, and the unknown nature of his address caused some risk reduction prior to the event. We could see a few Trump reflation trades stalling. However as soon as the event passed without a hiccup, shprts had to cover and longs bought = higher stock prices.

We are clearly in a blow off phase, however until a proper top is formed there is no benefit to shorting and if one wants to go long, then really it is pauses or dips that should be bought. Makes for v tough index trading.

A lot of Trump’s economic ideas are from the stone age and stimulus on top of full employment with a large deficit already in place makes little sense. However, it will take time for the -ve effects to play out, ie higher wages leading to reduced profit share of GDP for corporates, a stronger USD and higher yields.

The reduction of regulation I can see as a massive stimulus and if that really happens then we can maybe assume we are currently in 2005 and head back to 2007 in terms of leverage and silly financial behaviour.

And one has to remember 8 years after the GFC the US electorate have just re-installed Real Estate Tycoons, Hedge Funds and Goldman Sachs to run the government again. Mnuchin fits all three. ! How that fits with draining the swamp I don’t know and given the POTUS likes tweeting about stock rallies…….heaven help him when there is a bear mkt !

Lastly, a better trade IMHO is shorting AUDUSD…..commodities are having a small roll over, the mkt is long the AUD, the US yield curve is moving (hawkish FED). If you get risk off it will go lower and should struggle to rally as US rates tighten as that hurts China.

Disclosure – I’m short.