Mid-week market update: On the weekend, I wrote that the stock market was experiencing a bullish breadth thrust and the market is likely to see a series of “good”overbought readings where stock prices either continue to grind up or consolidate sideways as they get overbought (see RIP Correction. Reflationary resurrection next?). So far, so good. The market seems to be behaving according to the script I laid out so far.

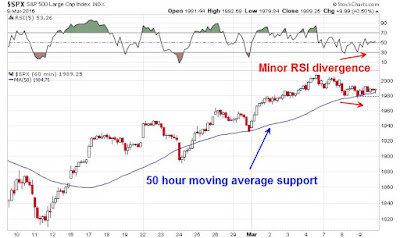

As the hourly chart of the SPX shows. The market weakness on Monday and Tuesday were relatively minor. The index saw a minor positive RSI divergence and the 50 hour moving average has so far acted as support.

As well, this chart from IndexIndicators show that the net 20-day highs-lows, which has been a good intermediate term (1-2 week) trading indicator, seems to have found support at a high level. If this continues, it would lend support to the “good”overbought bull case.

While I remain optimistic about the technical underpinnings of the bullish scenario, that`s only half the story.

The USD wildcard

If we were to move beyond the standard technical analytical framework and consider inter-market, or cross-asset, analysis, a different picture emerges. One of the fundamental foundations for a renewed upleg in stock prices has been the weakness in the US Dollar. The USD has started to roll over and weaken in the last few weeks. Indeed, the Broad based Trade Weighted Dollar has violated its technical uptrend, which suggests that the days of King Dollar are over.

A weaker USD has two benefits for stock prices:

- Improved earnings outlook: Large cap companies that do business overseas has seen their margins squeezed by the strong dollar. As the currency weakens, this will feed into better earnings growth for exporters and therefore an improvement in the EPS growth outlook, which would ultimately be bullish for stock prices.

- Turnaround in energy and materials: The USD is inversely correlated to commodity prices. A weaker USD translates into higher commodity prices, which is supportive of the beaten up energy and resource extraction sectors. While correlation does not necessarily equal causation, but the chart below shows the performance of the USD Index (top panel) and the relative performance of the US and European energy sectors (middle panel) and the relative performance of the US and European materials sectors.

Federal Reserve officials are likely to hold short-term interest rates steady at their policy meeting next week and leave open-ended when they’ll next raise rates given their uncertainties about markets and global growth.

For Fed Chairwoman Janet Yellen, that likely means crafting a message that gives the central bank flexibility to lift rates in April or June should the economy perform well in the weeks ahead, without committing to a move in case economic data disappoint or new market turmoil erupts.

If they don’t raise rates, which is the most likely outcome, will the FOMC statement be hawkish, neutral or dovish? Tim Duy thinks that Yellen will wind up leaning dovish next week (Cam: and what the Fed chair wants, the Fed chair gets):

Where does Yellen stand? My sense is that six month ago Yellen’s position would align close to Fischer. But I think she would now find Brainard’s position more persuasive, especially with Dudley’s support. That suggests that the Yellen will work to pull the Fed toward a neutral/dovish statement.

Bottom Line: Fed will hold steady next week. Key FOMC participants are shifting in a dovish direction. The financial market volatility, which induced clear tightening in financial conditions, bolstered the Brainard’s arguments. Despite solid incoming data, the Fed will find it necessary to tread cautiously in the months ahead.

At this point, Hilsenrath and Duy are only engaged in informed speculation. At this point, equity bulls should feel encouraged, but they shouldn’t let down their guards. There are a lot of balls in the air.

My inner trader remains nervously long stocks.

Disclosure: Long SPXL

Confirming your point about dollar weakness and EPS of multinationals, it is interesting to observe how companies like Coca Cola ( KO ) are beginning to outperform significantly.

Cam–If The Fed holds steady and is neutral/dovish on raises, what does this do to the dollar, oil and gold. Tightening bias would seem to be bullish for the dollar but bearish for almost everything else. Comments welcome. Robert Millman

One would imagine a dovish message would be USD bearish.

Cam

With the interest rate differential between the German Bunds and the US bonds won’t money flow into the US Bonds thereby strengthening the dollar?

Exactly. But remember it’s about what happens at the margin. If the market is at equilibrium (everyone has the right mix of UST and Bunds), how does central bank policy affect the exchange rate?