Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading model component of the Trend Model seeks to answer the question, “Is the trend getting better (bullish) or worse (bearish)?” The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

The boy who cried wolf

We all remember the story of the boy who cried wolf. The villagers got one false alarm after another, which made them increasingly annoyed. When the wolf finally came, his warnings were ignored and he suffered the consequence.

I want to tell a more modern story of the boy who cried wolf. In this case, the wolf is inflation. In the wake of the Great Financial Crisis (GFC), there was a cacophony of voices (myself included) who warned that all the QE and money printing would eventually result in runaway inflation and USD devaluation. Even Warren Buffett was caught up in that frenzy when he penned his “unchecked greenback emission” NY Times Op-Ed in 2009:

Once recovery is gained, however, Congress must end the rise in the debt-to-G.D.P. ratio and keep our growth in obligations in line with our growth in resources.

Unchecked carbon emissions will likely cause icebergs to melt. Unchecked greenback emissions will certainly cause the purchasing power of currency to melt. The dollar’s destiny lies with Congress.

Despite these dire forecasts of doom, the USD has rallied in the wake of the GFC and gold prices are roughly flat from that period. That thesis of secular runaway inflation turned out to be wrong.

Today, a different kind of inflationary wolf pack stalks the landscape. Instead of the specter of secular runaway inflation, the cyclical inflationary wolves are gathering. When they descend on the flock in 2016, it will be the macro surprise that almost no one is talking about.

Jim Paulsen and the Phillips Curve

Jim Paulsen, who had been very good in calling the turn in the spring of 2015, is out with another piece of analysis that investors should pay attention to. The title says it all: Full Employment Typically Brings a Sector Rotation.

Underlying the macro assumption of Paulsen`s analysis is the Phillips Curve, which postulates a short-term policy tradeoff between inflation and unemployment. Today, the effects of the Phillips Curve are seemingly global. Not only are wage pressures rising in the US, CNN Money reported that a Korn Ferry Hay Group survey concluded that Chinese and Indian workers are expected to get 8% and 10% raises respectively in 2016. So much for the benefits of offshoring.

Paulsen went back to all the way back 1948 and observed that once the headline unemployment rate falls below 5%, which is the latest reading for US unemployment, the equity market undergoes a significant change in leadership.

For completeness, here are the sector definitions from his study:

The above performance chart shows the results of Paulsen’s study. First of all, I would point out that there is no need for panic. An annualized market return of 7.39% is still quite respectable. Paulsen found that market leadership shifts to late-cycle sectors where inflationary pressures start to rise as capacity utilization hits its limits. Therefore the best performing sectors are clustered in energy (note mining is not really mentioned in the sector definitions) and capital goods sectors like business equipment and manufacturing.

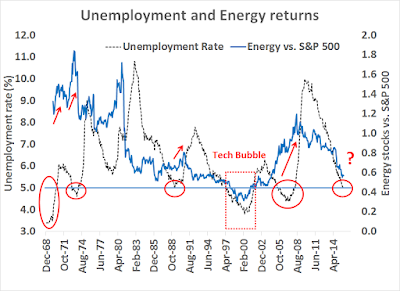

I was unable to reproduce Paulsen`s study going back to 1948, but I was able to find data that went back to 1970. The chart below shows the relationship between the unemployment rate (dotted black line) and the returns of energy stocks relative to the market (blue line). There were six episodes when unemployment fell to 5% or below during this study period. In all occasion except for one, energy stocks began a period of better market performance, which is reflective of the increased inflationary pressures. The sole exception occurred during the Tech Bubble of the late 1990s when market participants went overboard for internet related stocks to the exclusion of everything else in the market.

As the headline unemployment rate falls to 5% today, the stock market is poised for the appearance of rising inflationary pressures. As I pointed out last week (see Do you believe in Santa Claus?), the latest BoAML Fund Manager Survey shows a crowded macro trade of long USD, short resource stocks and short emerging market equities. When inflationary pressures start to tick up in 2016, it will be the macro surprise that will catch the market off guard, much like the metaphorical wolf who attacked the flock in the story of the boy who cried wolf.

However, it is probably tactically early for traders (though not investors) to buy into that trade. A glance at the breadth indicators of the energy ETF (XLE) shows a bearish pattern of lower lows and lower highs.

By contrast, the breadth indicators of materials stocks (XLB) is a bit more constructive as it is displaying an uptrend in % bullish indicator, though the advance-decline line is roughly neutral.

My inner investor is accumulating positions in energy and materials, while my inner trader is waiting for better internals or some signs of an upside breakout before committing to the long side on this macro trade.

Market outlook remains bullish

In the meantime, the stock market outlook remains tilted bullishly. The latest update from John Butters of Factset shows that the Street continues to revise forward EPS upwards, which is supportive of high stock prices.

The latest update from Barron’s show that the “smart money” insiders are still buying:

I want to address the concerns over the poor performance of US high yield, or junk, bonds (HY). The chart below shows the Chicago Fed’s National Conditions Financials Index and the St Louis Fed’s Financial Stress Index. Even though stress levels are ticking up, they are anywhere near danger levels.

Another way of measuring the level of anxiety in the HY market is to compare its yield spread to Treasuries vs. emerging market (EM) bond spreads. Such a comparison is especially useful as the latest round of concerns over default risk is coming from resource extraction industries like energy and mining – and EM economies tend to be more commodity sensitive. As the chart below shows, EM spreads suffered in the wake of the “taper tantrum” of 2013, when then Fed Chair Ben Bernanke floated a trial balloon that the Fed might start to taper down its QE purchases. As a result, EM bonds suffered disproportionately, though US HY did not get hurt as badly. Today, the spreads between US HY and EM bonds is just going through a normalization process where the spreads are returning to a more normal range.

I would be more concerned if EM spreads against Treasuries are blowing out, but that market remains fairly calm at the moment.

The week ahead: Another Zweig Breadth Thrust buy signal?

As I look forward to the volume light week ahead, two opposing forces are playing out in the US stock market. On one hand, we are entering a period of positive seasonality. This analysis from Ryan Detrick showed that the last week of December tends to be bullish.

Detrick also tweeted the following on December 24, indicating that the Santa Rally tends to last until January 5:

More importantly, the stock market may be on the verge of another Zweig Breadth Thrust (for full details and implications of the ZBT see A possible, but rare bull market signal and Bingo! We have a buy signal!). As the chart below indicates, the Zweig Breadth Thrust Indicator (bottom panel) has two more days (until Tuesday) to rally and move above 0.615. Should that occur, it would trigger another rare buy signal for stocks that foreshadows further significant gains.

Can the market achieve another ZBT during this seasonally positive period? I have an open mind but I am not counting on it, largely because ZBTs are extremely rarely buy signals that have occurred only 15 times since 1945. In addition, breadth indicators from IndexIndicators show that the market is either overbought or near overbought and vulnerable to a pullback.

Overbought markets can get more overbought. Compare current readings of net 20-day highs-lows compared to the readings at the last ZBT, which occurred in early October:

My inner investor remains long equities with a tilt towards resource sectors. My inner trader is giving the bull case the benefit of the doubt and he is long large and small cap equities in anticipation of a continuation of the Santa Claus rally.

What happens next? Stay tuned.

Disclosure: Long SPXL,TNA

Cam

When you state you are long SPXL,TNA-

Is that you only positions? I’m confused as you mention above being long in the resource sectors. TIA

Gene Mc

They would be my trading positions

In as much as I respect Cam’s view. I think the following points should be considered:

1. Because of the massive amount of QE injected into the system by various Central Banks the historical economic cycles that prevailed may have been distorted. The demand pull by historical low interest rates may now be over. I.E. with interest rates on an uptick consumer demand and financial engineering (stock buy backs) may have ended.

2. Until one is very sure of the composition and weighting of individual issues in an index comparisons should be done very cautiously. For example if one was to look at the S&P 500 index it is close to its all time high. However, an equal weighted S&P 500 index is already in a bear market with a series of lower lows and highs.

3. More troubling then the spread between Junk Bonds (foreign and domestic) is the huge diversion between the Dow Jones Transport Index and the Dow Jones Index. Historically, the transports tend to lead and decline based on the health of the US economy. Could the transports be telling us that we are tipping into a recession?

4. Historically, counter trend rallies tend to last 3-4 days. So, if the trend of the market is down then the S&P 500 index should stall at these levels -2050 to 2070. More so, because there is heavy resistance in this zone. The market was extremely over sold 3-4 days ago and now that is not the case as Cam rightly points out.

5. There is a huge divergence between Value and Growth Stocks. Recently, stocks like NKE, AMZN, FB and SBUX have begun to stall. If the market were to not GO UP in a historically favorable time period as shown by CAM’s article then the right strategy would be short the QQQ or go long SQQQ.

In conclusion be cautiously bullish but vigilant because if the market stalls at these levels it could very easily test the August lows.

Your thoughts Cam?

Rajiv

Yes, there are a lot of cat calls for rising inflation. I heard these in the middle of last decade from Alan Greenspan and am now hearing them again, much like the boy who called wolf. Here are counter arguments against inflation;

1. Unemployment in the US has dropped from 10 to 5% (see graph above). However, inflation as measured by CPI remains low in the US during the entire GFC. Wage pressures seem to be building, but inflation remains subdued. This has been a conundrum for which several explanations have been put forth. Health care costs have increased the total cost employment of US workers, negating the effects of low unemployment. Unemployment in the US during the GFC was around 4% for US college graduates and higher levels of education. Let us call them white collared workers. For such workers, there is a global arbitrage of wages and hence wage pressures amongst such workers will unlikely become a reality. If the US has shortage of educated/white collared workers, there are always Canadian or Western European or Indian knowledge workers that would take up the slack. Let us now ask what about blue collared workers? Yes, wage pressures in this portion of the US economy could manifest themselves, as there is no global wage arbitrage for these (like builders, restaurant workers, plumbers, electricians and so on). The jury is out there whether such wage pressures will amount to much in the future, as $/hour for these worker is much lower than white collared workers.

2. The graph of energy above and unemployment shows that low unemployment causes increase in energy prices. This time, both fell (see circa 2015, at the right extreme of the graph). There is an oversupply of energy globally, but energy costs per $ of GDP output has fallen in the last 50 years or so. The US economy is also not growing as fast as it would following recessions in the past, so one expects a disconnect in energy prices and unemployment, as we see in the graph above.

3. Are there wage pressures in China and India? Yes, an IT worker in India will do the same work for say 8000 US $ per year as one in the US for around 40-50k (just my estimates). China does not compete with IT workers from India but has gobbled up the manufacturing sector of the world, and yes there are wage pressures in Chinese manufacturing sector. Because both these segments of global wage arbitrage are at much lower wage levels, global inflation would be unlikely to cause significant inflation in larger, western economies (like US and Western Europe and Japan). Indian inflation for the last decade (give or take) has officially been around 7-8%, unofficially 12% or so and in food 15-20% or so. A 9-10% rise in Indian worker’s wage is therefore to be expected. Furthermore, the Indian Rupee has dropped around 50% during the GFC, and hence Indian wage inflation is US dollar terms is subdued. US companies that are sending jobs to India, are paying them in constant US $ terms not INR terms. I do not know similar statistics from China, that I can confidently write about, but I am sure that the Chinese desperately want to devalue the Remnimbi for similar reasons.

4. So let us examine further the premise of inflation. Gold, the classic hedge against inflation has fallen since making a top circa 2011, despite printing a few more Trillion $ since then. Commodity complex (oil, industrial metals, coal, natural gas, grains), have been in falling. Baltic dry goods shipping index is at a multi year low. Low oil prices, I was told, would increase disposable income and that was an year ago. US gasoline prices at the pump as I write are around 2$ a gallon in the midwest, last year at this time they were close to 3$ (give or take a quarter). If US retail sales are to be taken as a barometer of the health of US consumer, I would have to submit that lower energy costs in the US in the past year have not spurred excess consumer demand (see stock prices of US retail store).

5. TIPs are also not indicating significant inflation down stream (may be a contrarian buy).

What does it all mean? Here is my toke. Global asset prices has reached a level from where then are likely to struggle. As an example Grade/Class A American farmland in the US midwest (Iowa, Illinois, Indiana) has risen 4-5 times since year 2000. How much higher would they go? Would they double from here in the next five years? Why would they go up if corn and soybean prices and ethanol demand is not spiraling up (Corn and Soybean prices are 50% lower than their peak in the same time)? US housing prices suffered a 50% collapse of value from their peak. There are ample indications that the world is facing powerful deflationary forces, not the opposite. Would love to hear from anyone reading this, as to why inflation is in store for 2016 despite what I have written here. Thanks.

Nobody can argue with DV’s reasoning. I guess the only thing that one can never factor in is a “Black Swan” event. In this case Saudi Arabia and Iran going to war or for that matter if the Straits of Hormuz being blocked. Even if that were to happen and the price of crude were to shoot up, I think most economies around the world are flat on their backs. I think the trickle down effect would be slow to permeate through the economy.

All very good points.

Don’t forget that I am arguing for a cyclical upturn in inflation, not a secular upturn. Many of the points made are against a secular revival in inflation.

Scott Grannis has pointed out that the TIPS market is discounting further drops in oil prices, which would be hard to believe as a base case scenario: http://scottgrannis.blogspot.ca/2015/12/markets-may-be-underestimating-inflation.html

The point being that we are likely seeing the nadir of inflationary expectations for this economic cycle. They have nowhere to go but up.

Thanks for the feedback. Yes, there could well be a cyclical upturn in inflation as oil prices stabilize in the next few quarters. I had not realized that, so thank you for explaining. On a side note, I saw yesterday that Americans are driving more miles, Saudi Arabia cut budgets (they also issued bonds last quarter in anticipation of a budgetary shortfall). Yes, S&P earnings per share would likely go up if oil prices were to go up slightly.

Is there an estimate of S&P earnings for 2015, without energy companies contribution and how it compares to such metrics in the past few years? Thanks.