How would you evaluate a manager with this kind of 10-year investment performance? Terrific? Or Meh!

It depends on when you got in. Sure, the 10 year numbers look terrific, but he is roughly flat with the benchmark over five years and he had a difficult 2015.

What if I told you this track record was none other than the legendary Warren Buffett? The chart represents the relative performance of Berkshire Hathaway B (BRKb) against the market. It’s how ordinary mortals like you and me participate with Buffett in his management of BRK.

The Buffett track record in context

The five year track record looks positively ordinary. What happened to Buffett the investment giant? The Oracle of Omaha?

This longer term chart puts the relative performance of BRKb into context. BRKb has had an excellent long term track record, though the shorter term five-year record can best be described as so-so (top panel). As Buffett is well known to be a value investor, his struggles reflect the difficulties that value investing has experienced (bottom panel). In fact, BRKb has actually performed quite well against other value managers, as measured by the Russell 1000 Value Index, over the last five years (middle panel).

When viewed in the context of an underperforming value style, Berkshire’s 5-year market matching returns looks positively stellar.

How patient are you?

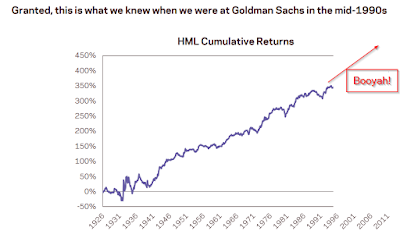

The struggles of Buffett and others bet the question of whether the value style is dead. No, you just have to be patient and recognize that the market goes through value and growth or momentum cycles where each style dominates returns. Consider this Cliff Asness discussion about his experience with value investing. At first, value factors backtested very well (via Alpha Architect).

Asness was unfortunate enough to implement the strategy just as the Tech Bubble was getting started:

The truth of the matter is, the value style has been facing severe headwinds for over five years, which is beyond the time horizon of many investors and fiduciaries. This chart from Morgan Stanley tells the story. The underperformance of global value stocks is as severe as it was at the height of the NASDAQ Bubble in 2000.

Trading vs. investing

The moral of this story is, there is a big difference between the kind of time horizon favored by traders and investors. Traders would not tolerate the kind of relative drawdowns experienced by Buffett in the last year. Even a legend like the Oracle of Omaha is not perfect. Jeff Matthews recently criticized Berkshire for two bad acquisitions, namely the purchase of Precision Castparts for 20 times what may (or may not) be peak earnings and Hudson City Bancorp.

Not everyone is good at everything. For the last word, consider Mark Hulbert’s tribute to the late Richard Russell. Hulbert detailed how Russell had been correctly bearish in the early 1970’s and then called the turn at the bottom of the bear market in 1974. Russell went on to presciently turn bearish in August 1987, two months before the Crash. Admittedly, he wasn’t the best at trading calls:

In contrast to catching these and other momentous changes of major trends, Russell’s timing advice for the market’s shorter-term trends was less impressive. This was especially the case over the past decade, when his daily blog sometimes descended into what struck some subscribers as a stream of consciousness and, on occasion, contradicted itself from day to day.

But advisers who are good at catching changes in the market’s major trend rarely excel at short-term market timing, and vice versa. And though neither pursuit is easy, the former — Russell’s specialty — is far rarer. According to the Hulbert Financial Digest, Russell’s market-timing advice in the 1980s and 1990s was at or tied for the best performer among all monitored market timers.

Russell’s enduring legacy may therefore be that catching even some of the market’s major trend changes can make up for many missteps involving the shorter-term trend. And to catch those major trend changes, you must be willing to go against strongly and widely held opinions.

The secret of investment success is to know your own core competencies, sticking to your guns and learning to be patient.

Disclosure: Indirectly long BRKb

The underperformance of value in the period leading up to 2000 was versus growth stocks based on no earnings and measured by dot.com internet clicks not sales. The Shiller CAPE was at 45, value was cheap and the old economy based on American factory assets and shopping malls was intact and the stocks in those industries were ready to outperform when the silly season ended.

The underperformance to same extent now is versus real companies with real earnings who are leading a digital revolution that is transforming the basic global economy not just trying to sell dog food on Pets.com as it did in 2000. Who could have imagined the power of smartphones we have in our pockets or that 95% of 1.3 billion Chinese would have a cellphone. Digital technology is changing the way business operates. The underperforming value stocks are not keeping up to their excellent tech-savvy competition. Warren admits he is tech dumb and proudly avoids the area other than a poor investment in IBM. He, along with most long time successful money managers are not understanding the creative destruction in important industries that is picking up momentum. Active mutual fund management has never underperformed the market index so much as it has in the last two years. I believe this is the reason. Will that value/growth relationship trend turn around like it did in 2001? I think not. Will Walmart get its mojo back and claw back customers from Amazon.com? Hmmm. Will the research that says the banks, the shining stars of solid value will lose 80% of their consumer loan business to internet shadow banks in the next ten years be wrong? The longer a portfolio manager has benefited from owning Canadian banks, the more likely they will be blindsided and holding them as they underperform over the next decade if the research is right. They will be value stocks all the way down.

My suggestion to value investors is to always use momentum with value to make sure some new competitive factor isn’t skulking in the background.

The future secret of investment success is recognizing our lack of technology competency, sticking to learning and not staying with sick patients in our portfolios.

Don’t forget that Buffett was big on understanding the moat, or competitive advantage. If you plan on owning a company forever, which he does, then you better understand its competitive position.

Problem nowadays is that while you are in your turret with your trusty crossbow watching the moat, some competitor is sending a drone over or sending a fiber-optic cable under the moat to get you. Things you never heard of when you built your moat. The future challenges to a moat??? Who the hell knows? Forever is not what it used to be.

See this article as a demonstration of how WMT has a moat in certain segments of its business, even against AMZN:

http://www.businessinsider.com/walmarts-highest-selling-product-says-a-lot-about-its-business-2015-12

Some momentum /Growth stocks like TSLA &NFLX exhibit the type of growth mania that is unlikely to end well.There are a number of one product, phase one biotechs that are similarly over valued

Stocks in this category are excellent trading vehicles &are easily manipulated by active hedge funds. Value investing is harder than following momentum, evaluating real value takes time &patience.A useful approach for me is to activelytrade ,while spending time to ferret out value .

The best of bothworlds.