Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

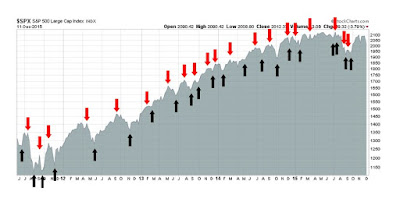

My inner trader uses the trading model component of the Trend Model seeks to answer the question, “Is the trend getting better (bullish) or worse (bearish)?” The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

The Dollar and euro’s most excellent adventure

I had expected that the markets might become little sloppy as we approached the FOMC meeting (see Waiting for the whites of their (oversold) eyes), but I didn’t expect the kind of risk-off tone seen last week. Despite the market weakness, I could tell you that:

- Fundamentals, such as forward EPS revisions, remain constructive

- The US economy is strong with no sign of a recession on the horizon

- The market is oversold

- Sentiment is showing a crowded short reading, while insiders are buying

- Seasonality is bullish for stocks

None of that matters very much, as the signals from the Federal Reserve next week will set the market tone, not just for the rest of the year, but for most of 2016. If I had to focus on one key market indicator coming out of FOMC meeting, it would be the reaction of the US Dollar to the Fed decision.

All eyes on the Fed

Watching the USD for direction

Reasons to be bullish

Analysis from Ed Yardeni indicates that forward EPS is highly correlated with coincidental economic growth. Therefore the trajectory of forward EPS serves as a confirmation of economic strength or weakness. Peering into the crystal ball, New Deal democrat’s monitor of long leading economic indicators show that there is no sign of a recession 12 months from now:

Among long leading indicators, interest rates for treasuries, corporate bonds, and mortgages all are neutral. Money supply, mortgage applications, and real estate loans are still positive.

His conclusion is that the American economy is currently undergoing a soft patch caused by USD strength.

As anticipated due to Thanksgiving Day seasonality, coincident readings improved from absolutely horrible to merely bad. The US economy continues to be buoyed up by housing and cars, with a continued though smaller than anticipated boost in consumer spending. I continue to anticipate further near term weakness in the US economy, although the growing service/consumer sector continues to overbalance the deepening industrial recession brought on most of all by the further strengthening in the US$.

A constructive technical picture

Aside from positive macro fundamentals, the technical condition of the stock market is oversold, which is bullish. The top panel of the chart below shows that RSI5 has flashed an oversold reading but exhibits a positive divergence. The second panels shows the SP 500 testing a support zone, as well as support at its lower Bollinger Band (BB), which can limit downside risk. The third panel shows the VIX Index, a sentiment indicator, is now above its upper BB where it has seen reversals in the past. The bottom panel shows that the term structure of the VIX is inverting, which is an indication of high fear levels. These are all signs of an oversold market, with the caveat that oversold market can get more oversold in the short run.

The reverse of investor and trader sentiment is the action of “smart investors” like insiders. The latest update from Barron`s show that insiders have been heavily buying stocks, for several weeks which is another bullish sign for equities.

Another bullish tailwind is the positive seasonality typically experienced by the markets. Ryan Detrick pointed that that December positive seasonality tends to manifest itself in the last half of the month and starts on the 15th, which happens to be the start of the two day FOMC meeting.

Detrick also pointed out that the market is oversold based on the McClellan Oscillator:

Indeed, other breadth metrics from IndexIndicators are flashing oversold signals, such as the % of stocks above a 10 day moving average (dma):

And net 20-day highs-lows:

Next week is option expiry (OpEx) week, which has historically had a bullish bias as traders tend to try to temporarily move stock prices and indices to their advantage for option expiry at the close on Friday. Further, Rob Hanna at Quantifiable Edges showed that not only does the market show a positive bias during December OpEx week, but the positive seasonality extends further into the next three weeks.

What about junk bonds, China?

Despite all of these bullish tailwinds, my inner bear is worried. He sputtered, “But what about the carnage in the junk bond market and the risk of a Chinese devaluation sparking a trade war?”

There is no question that the level of anxiety in the US junk bond market has been rising. The Marketwatch story “Why the junk bond selloff is getting very scary” provides a useful summary. In effect, trouble in the US high yield (HY) market has foreshadowed downturns in stock prices.

There is no question that misbehaving HY bonds is an area of concern. However, much of the trouble in HY is attributable to distress in energy and materials.

Should we get a dovish message from the Fed and the USD weakens, it should alleviate most of the stress evident in these sectors. Moreover, I pointed out before (see Profiting from a late cycle market) that such credit market developments are typical of a late cycle market where stresses start to appear. Rising credit spreads have historically been very early warnings of recessions so it is premature to panic. In other words, be concerned, but don`t get bearish too early.

Another risk to the market was the freak out last week over the prospect of another Chinese devaluation, which has the potential to spark a round of competitive devaluation leading to a trade war.

As this Bloomberg story indicates, the PBoC adjustment in the RMB is largely a technical move to peg the RMB against a basket of currencies, rather than just the USD, as the Dollar has been so strong.

In the meantime, the Bloomberg proxy for Chinese GDP growth ticked up, which also alleviates some of the worries that the Chinese economy is tanking (via Tom Orlik). So relax, the Chinese economy is doing fine and there is no need for them to engage in competitive devaluation.

Bottom line: If the USD were to weaken in response to Fed next week, which a big if, many of these bearish concerns plaguing the market would evaporate.

Place your bets for the week ahead

Early last week, I had forecasted a sloppy stock market, but to wait to buy until readings got to an oversold extreme (see Waiting for the whites of their (oversold) eyes). As stock prices weakened, my inner trader nibbled away to buy some small cap positions on Wednesday and added to long equity positions on Friday as readings became more oversold. By contrast, my inner investor ignored all these gyrations and remained long equities with a tilt towards commodity sensitive sectors.

Both are betting on a dovish FOMC statement and a reversal of USD strength. If the Fed message were to become hawkish – well, that’s what stop loss orders are for.

Disclosure: Long NUGT, SPXL, TNA

I think you are correct,,,the oversold nature of the market ,coupled with paranoia about the FOMC is a set up for a strong rally this week.Selling otm puts in the spy makes sense to me.

The post FED argument coupled with seasonality is compelling, but that was a nasty gap down in the NDX on Friday.

The British side at Bunker Hill were healthy. I’m worried this market may have pink eye that won’t be cured before Wednesday.

While providing a warning if the Fed meeting message is otherwise, this Bloomberg article leans towards a dovish call for the Fed meeting this week. The report referenced is from the JPMC quant head, Marko Kolanovic.

http://www.bloomberg.com/news/articles/2015-12-09/jpmorgan-the-fed-could-trigger-a-massive-stop-loss-order-nn-the-s-p-500-if-liftoff-goes-awry

Mr Kolanovic is quoted: “Given the poor liquidity near the end of the year and peculiar option technicals, we think a likely and rational expectation is for a dovish message on the pace of rate hikes next Wednesday”.

The following article from Zero Hedge illustrates a different perspective from the same JPM quant report:

http://www.zerohedge.com/news/2015-12-07/beware-massive-stop-loss-jpms-head-quant-warns-unexpected-downside-catalyst-looms-ne

The latter article doesn’t mention Kolanovic’s quote that Bloomberg included in their article indicating an expectation of a dovish message. The Zero Hedge report is a bit more frightening.