U.S. Trade Overview

Consider the nature of U.S. trade in context. By country, the lion’s share of U.S. imports comes from the North American trade bloc at 29%, followed by China at 14% and Europe at 24%.

The accompanying chart shows the U.S. goods trade balance by country. Keep in mind that the U.S. runs a trade surplus in services, such as from technology platforms, that is not shown in the chart, and the reported trade deficits are accounted for by specific circumstances. The U.S. would have a trade surplus with Canada if oil and gas imports were stripped out, and much of the trade deficit with Ireland, and the EU by extension, is attributable to pharmaceutical intellectual property rights parked there owing to its low-tax regime.

The Isolation Strategy Failed

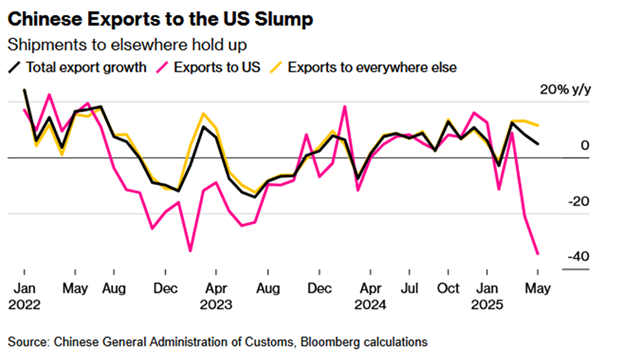

Even though a trade truce was achieved, the U.S. objective to isolate China on trade failed. The recent release of China’s H1 2025 trade shows a surging trade surplus. More importantly, China is posting a $115-billion monthly trade surplus even in the face of 40% U.S. tariffs.

The latest round of the trade war revealed the key supply chain chokepoints that China controlled, such as its prominent position in the production of certain rare earths.

- The U.S. once made nearly 30% of the world’s printed circuit boards (PCBs), now it’s 4%. Most of the production has migrated to Asia, and China in particular, due to lower labour costs and decades of local government subsidies.

- Asia now produces 90% of the world’s PCBs, and over 50% comes from China.

- “Congress included guidance in the FY 2022 National Defense Authorization Act Section 851 that requires the Department of Defense to have a plan by 2027 to remove from the defense supply chain all dual-use components originating in China, Russia, Iran and North Korea. What is missing are restrictions on Chinese components that live in our critical infrastructure: air traffic control, medical systems, banking, telecommunications, the electric grid, and others.”

- “U.S. PCB manufacturers companies serving the trusted and secure PCBs for the defense industry are operating at record capacity consumption levels and would be unable to scale up in a time of crisis.”

- Schild offered solutions such as “China plus one”, which is sourcing PCBs from China and one other friendly source, friendshoring or nearshoring, sourcing from another source other than China, such as Mexico.

- Tariffs are not the solution. “Many inputs required to produce PCBs are only available from the very countries subject to tariffs. Overall costs for U.S. PCB manufacturers absolutely increase in this scenario.”

You get the idea. China cannot be isolated. Be prepared for Trump to engineer a face-saving deal where he can declare victory. Don’t be surprised at further positive developments but no strategic breakthroughs that erode China’s competitive position in the upcoming Trump-Xi meeting.

China’s manufacturing workforce is over 100 million, compared to about 13 million in the U.S. In effect, Trump’s industrial policy is to replace high value-added industry employment such as artificial intelligence and biotechnology with low value-added jobs such as making sneakers and apparel.

In the 1950s, American intelligence suggested that the Soviet Union was leapfrogging U.S. capabilities across a range of military technologies. Then on Oct. 4, 1957, the Soviet Union launched the first satellite, Sputnik, into space.

Americans were shocked but responded with confidence. Within a year the United States had created NASA and A.R.P.A. (later DARPA), the research agency that among other things helped create the internet. In 1958, Dwight Eisenhower signed the National Defense Education Act, one of the most important education reforms of the 20th century, which improved training, especially in math, science and foreign languages. The National Science Foundation budget tripled. The Department of Defense vastly increased spending on research and development. Within a few years total research and development spending across many agencies zoomed up to nearly 12 percent of the entire federal budget. (It’s about 3 percent today.)

Today’s leaders don’t seem to understand what the Chinese clearly understand — that the future will be dominated by the country that makes the most of its talent. On his blog, Tabarrok gets it about right: “The DeepSeek Moment has been met not with resolve and competition but with anxiety and retreat.”Populists are anti-intellectual. President Trump isn’t pumping research money into the universities; he’s draining it out. The administration is not tripling the National Science Foundation’s budget; it’s trying to gut it. The administration is trying to cut all federal basic research funding by a third, according to the American Association for the Advancement of Science. A survey by the journal Nature of 1,600 scientists in the United States found that three-quarters of them have considered leaving the country.

The response to the Sputnik threat was to go outward and compete. Trump’s response to the Chinese threat generally is to build walls, to erect trade barriers and to turn inward. A normal country would be strengthening friendships with all nations not named China, but the United States is burning bridges in all directions. A normal country would be trying to restore America’s shipbuilding industry by making it the best in the world. We’re trying to save it through protectionism. The thinking seems to be: We can protect our mediocre industries by walling ourselves off from the world. That’s a recipe for national decline.

Investment Implications

For investors, the reduction in trade tensions has two investment implications.

In the short run, economic policy uncertainty is receding but it’s not fully normalized. It’s time to adopt a risk-on posture.

Tactically, U.S. equities lagged the most during the trade war panic, and they are recovering and should be the leadership in the short term. Emerging Markets ex-China outperformed as the USD weakened, but the USD appears to be stabilizing and the outperformance of this region may not continue. The other regions, Europe, Japan and China, are likely to lag during the recovery phase.

In the long run, Trump’s America First policies of continuing trade wars and efforts to reshore low value-added industries are likely to erode U.S. productivity and competitiveness. The S&P 500 is already trading at a highly elevated forward P/E of 22.2. Equity investors should not expect U.S. equities to continue to outperform global stocks in the next expansion cycle.

A Resilient Stock Market

FOMO stampede continues

The BoA Global Fund Manager Survey tells the same story. Risk positioning is normalizing, but readings aren’t excessive.

In the absence of significant and unexpected shocks, the path of least resistance for stock prices is up.

Bond Market Risk

The Board of Governors of the Federal Reserve System shall have power to levy semiannually upon the Federal reserve banks…an assessment sufficient to pay its estimated expenses and the salaries of its members and employees…and such assessments may include amounts sufficient to provide for the acquisition by the Board in its own name of such site or building in the District of Columbia as in its judgment alone shall be necessary for the purpose of providing suitable and adequate quarters for the performance of its functions. After September 1, 2000, the Board may also use such assessments to acquire, in its own name, a site or building (in addition to the facilities existing on such date) to provide for the performance of the functions of the Board…The Board may maintain, enlarge, or remodel any building or buildings so acquired or constructed and shall have sole control of such building or buildings and space therein.

The Trump Collar

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

The Bullish Elephant in the Room

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)

- Trading model: Bullish (Last changed from “neutral” on 10-Jul-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Bullish Tripwires

My long-term timing model was on the verge of a buy signal based on the MACD crossover of the NYSE Composite from negative to positive. That signal was triggered and it has extensively discussed in these pages.

The final trigger was a broad improvement in breadth. The S&P 500 and the NYSE Advance-Decline lines had broken out to all-time highs, but net 52-week highs-lows hadn’t made a new 2025 high. Fast forward to today, that indicator (bottom panel) made a 2025 high last week, and the mid-cap S&P 400 A-D Line also broke out to a new high. The only shoe left to drop is the small-cap S&P 600 A-D Line, which is lagging and yet to make an all-time high. At this rate, that’s only a matter of time.

The “Liberation Day” Panic

Here is how the bear market turned into a bull market.

Public confidence was similarly shaken. Consumer sentiment had fallen to levels consistent with major market lows and represented buying opportunities.

A “Less Bad” Economy

In the meantime, the right side of the risk distribution began to assert itself. Things started to go right, at least less bad.

The latest NFIB optimism survey shows that hard data (dark line) ticked up, though the soft expectations data (light line) modestly fell. The NFIB survey is useful as small businesses have little bargaining power and they are sensitive barometers of the economy. This is the picture of an economy that’s less bad.

Household finances were becoming less bad. Credit card delinquencies appear to be peaking.

Trump’s tax bill passed and became law. An analysis of the spending shows that the deficits were front loaded while the projected tax savings were back loaded. While the deficits were disconcerting to the bond market, higher near-term deficits translated into fiscal stimulus in the first few years, which is growth positive and welcome news to the stock market.

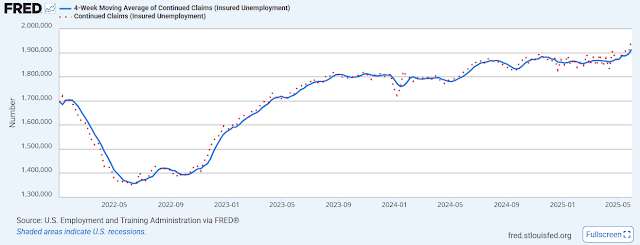

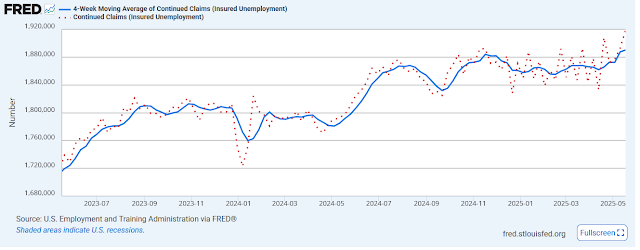

Over in the jobs market, initial jobless claims are declining (blue line) but continuing jobless claims (red line) are steadily rising, which is a picture of employers who aren’t firing but job seekers are having a hard time finding employment. The economy is weak, but there is no downturn. Another sign that the economy is becoming less bad.

The U.S. economy is showing signs of resilience. Real GDP growth historically ranged between 2% and 3% and it remains in that range. Fears of a tariff-induced recession were overblown. Most economic models project negative GDP growth effects of between -0.5% and -1.0%. As one of many examples, the Budget Lab model shows “-0.6% lower from all 2025 tariffs. In the long-run, the U.S. economy is persistently -0.3% smaller”.

A Buying Stampede

The combination of the market panic and subsequent recovery in fundamentals and psychology have resolved in a buying stampede. There are numerous technical signs of breadth thrusts and price surges that have historically resolved bullishly.

Investors have piled into low-quality stocks in a beta chase to play catch-up. The WSJ reported that “Meme Stocks and YOLO Bets Are Back and Fueling the Market’s Rally”. This will not end well, but not until positioning rises from neutral to crowded long readings. At the current rate, I estimate the excessive froth will become a problem in the August–September time frame.

Waiting for Tariff Godot

While a rally into August and September is my base-case scenario, much depends on how tariffs affect inflation and operating margins in the coming months. The June FOMC minutes showed a broad agreement that tariff effects will show up in the inflation data but there was disagreement about the magnitude and timing of the effects.

Torsten Slok at Apollo labeled this the MBA vs. Ph.D. disagreement. Top-down Ph.D. forecasters are expecting a growth slowdown, but bottom-up company analysts with MBAs expect continued earnings growth. The bottom-up view is supported by improvements in company Q2 earnings guidance. The first test of my bullish thesis will occur with the onset of Q2 earnings reporting season.

In conclusion, market psychology panicked and became overly concerned about left-tail risk and sold equities in the wake of the “Liberation Day” tariff announcements. Better, or less bad, news emerged and investors rebuilt the positions from a crowded short to a neutral position. Price momentum is dominant and I expect that the rally will continue into the August–September time frame, which is consistent with the 4-year seasonal pattern of the S&P 500.

Tactically, it isn’t unusual for the S&P 500 to either consolidate or pull back after an upper Bollinger Band ride. The consolidation has so far been mild but one test will appear on Monday after Trump threatened a 30% tariff rate on Mexico and the European Union over the weekend. Keep in mind that the stock market has shrugged off such tariff threats before. The S&P 500 rose the next day after Trump’s announcement of a 50% tariff rate on Brazil, and fell a modest -0.3% on the threat of a 35% tariff rate on Canada. The market just doesn’t seem to take Trump’s economic initiatives very seriously anymore, particularly in light of his demand last week that the Fed should cut interest rates in response to economic strength. Will investors a disorderly risk-off stampede next week, or a TACO-mania?

I believe the main risk to my bullish scenario is the timing and magnitude of tariff effects on inflation and margins, and the first test will become evident with the upcoming CPI report and Q2 earnings season.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

An Update on Gold: Time for a Pause?

The Trend Is Your Friend

Investors shouldn’t give up on the gold bull just yet. For U.S. investors, the trend continues to be your friend. Gold is an inflation hedge and my inflation expectation indicator staged an upside breakout in April. It remains above the breakout level and the trend is rising, albeit in a choppy manner. Much of the realization of higher inflation depends on the effects of tariffs. The June FOMC minutes showed a consensus about higher inflation, though a split is appearing about the timing and magnitude of the effects:

In discussing their outlooks for inflation, participants noted that increased tariffs were likely to put upward pressure on prices. There was considerable uncertainty, however, about the timing, size, and duration of these effects…

Outside the U.S., a World Gold Council survey of central banks shows increasing demand for gold in their reserves.

Central bank reserve accumulation has been so strong that, according to the European Central Bank, gold is now the second latest reserve asset when valued at market prices.

At the same time, data from the New York Fed shows that foreign central banks have been shrinking their USD exposure, which poses a headwind for the USD Index.

The trend is your friend.

The Trend Isn’t Over

The trend isn’t over. Estimates of the allocation in investor portfolios is still low by historical standards. Public sentiment has a far way to go before it’s all-in on gold.

Gold is also holding up on its relative breakouts against the S&P 500 and the 60/40 asset mix. The relative breakout against the 60/40 fund is especially significant as it highlights the metal’s importance in diversification effects and the reduced diversification effect of bonds in an environment of rising inflation expectations.

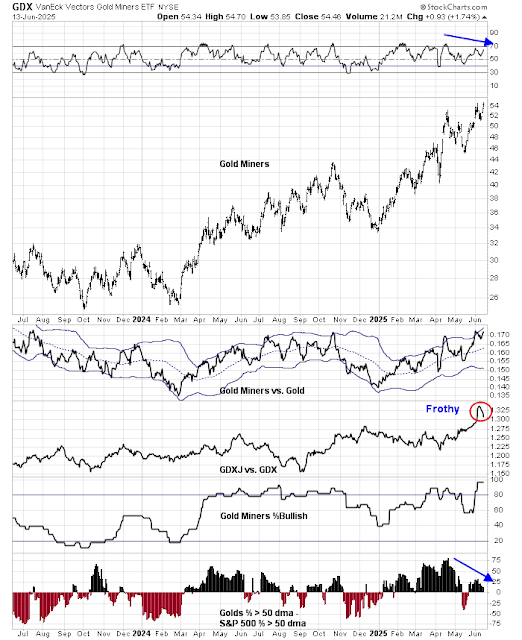

A tactical analysis of gold mining stocks (GDX) shows the group is testing an uptrend, while the 14-day RSI (top panel) approaches the 40 level where these stocks have bounced in the past. The bottom two panels show long-term technical conditions to be overbought, which I interpret as the “good overbought” conditions that accompany a sustained advance.

In summary, gold prices are consolidating after an advance. In the absence of serious technical breaks, I are inclined to give the bull case the benefit of the doubt.

Time for Diversification?

Callum Thomas of Topdown Charts recently suggested that it may be time for investors to diversify into other commodities in light of the relative price performance of gold against other commodities.

I am sympathetic to the long-term case for diversification, but I believe it may be too early from a tactical trading perspective. In order for gold to lag other commodities, the global economy needs to see a cyclical rebound, whose signs are not evident.

Similarly, a review of the performance of selected cyclical industries shows that most cyclical groups are tracing out relative bottoms against the S&P 500. With the possible exception of infrastructure stocks, none are showing signs of sustainable market leadership.

In conclusion, I remain a gold bull. Gold prices are consolidating after strong gains in H1 2025, but the trend is still up. Bullish sentiment isn’t stretched and central bank buying provides long-term demand. I am sympathetic to the suggestion that it’s time to diversify into other commodities, but the idea is only a trade set-up as commodity outperformance of gold requires a cyclical rebound, which is not evident at this time.

Tariff Man Returns

What’s Next?

Momentum Support

That’s where we are. If the current market rally were to follow past momentum examples, a useful template might be the 2011 recovery experience when the S&P 500 went on several upper BB rides after it recovered and broke up through resistance in early 2012. In those cases, the pullbacks after upper BB rides tended to be relatively shallow, which is my base case scenario.

Other historical studies are supportive of the price momentum bull case. Wayne Whaley observed that “the S&P has now advanced 26.0%, doing so in less than a Quarter, 86 calendar day (April8-July3) to be precise…Looking back through post 1950 history, I can only find five prior occasions in which the S&P has advanced 25% in less than a Quarter and none of those five occasions were anywhere near an impending top.

Should You Embrace the Melt-up?

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The Return of Irrational Exuberance

The bank noted that the measure, which is calculated from derivatives metrics, volatility technicals and sentiment signals inferred from options markets, has historically averaged around 7%, but occasionally it peaks above 10% as during the Dotcom era of the late 1990s, and the meme-stock frenzy of 2021. The gauge currently sits around 10.7%, data compiled by Barclays show.

A Sustainable Advance

To make a long story short, the odds favour further gains in the next few weeks. For some context, I use RRG charts to tell the story. Relative Rotation Graphs, or RRG charts, are a way of depicting the changes in leadership in different groups, such as sectors, countries or regions, or market factors. The charts are organized into four quadrants. The typical group rotation pattern occurs in a clockwise fashion. Leading groups (top right) deteriorate to weakening groups (bottom right), which then rotates to lagging groups (bottom left), which changes to improving groups (top left), and finally completes the cycle by improving to leading groups (top right) again.

The high-octane rally didn’t just appear overnight, factor rotation analysis showed that it had been developing for some time.

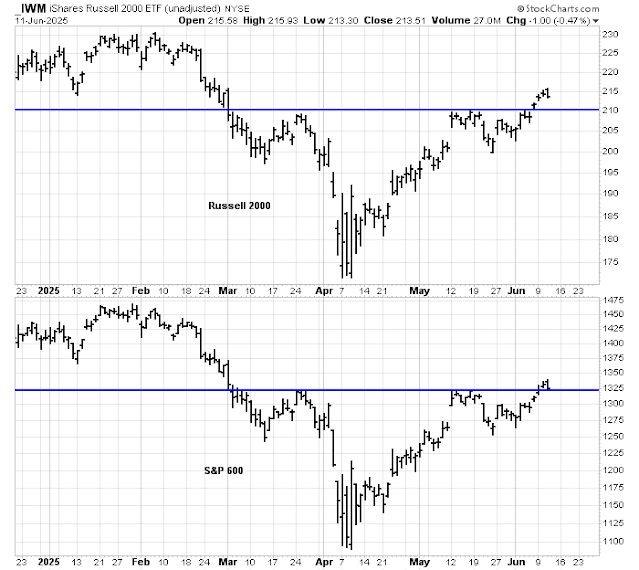

Another element that’s supportive of further market strength is evidence of broadening breadth. Market leadership is widening to small-cap stocks. The Russell 2000 staged an upside breakout of an inverse head and shoulders pattern, with a measured objective of about 250. In addition, the bottom panel shows that small caps are on the verge of a relative breakout.

All Systems Go

Other market internals are supportive of further gains. My technical dashboard is blinking mostly green.

Risk appetite indicators are confirming the stock market’s strength. Both equity risk appetite, as measured by the ratio of high beta to low volatility stocks, and credit market risk appetite, as measured by the relative price performance of junk bonds to their equivalent-duration Treasuries, are rising in lockstep with the S&P 500.

Option sentiment is not stretched. CBOE put/call ratios are in neutral, indicating a lack of exuberance despite the recent market rally.

Neutral Positioning

Estimates of market positioning are in neutral. If momentum continues to dominate, there is additional buying power for stock prices to run.

Similarly, Goldman’s estimate of CTA global positioning tells the same story of a recovery from a panic low to neutral levels.

The AAII monthly asset allocation survey measures retail sentiment and indicates what respondents actually do with the funds, which is different from its weekly opinion survey of respondents think, shows rising of equity allocation after the recent market panic. However, readings are not excessive and have more room to grow.

Time for a Breather?

It’s impossible to forecast how the far the latest rally can last. I can point to some clues and risks that equity investors bear in the current environment.

Already, the Trump Administration announced that it would be sending out letters in the next few days to countries detailing their tariff rates that range from 10% to 70% after the 90-day pause on the “Liberation Day” tariff rates expire. Equity futures and the USD weakened after the news hit the tape, but trading was thin during the holiday hours and the market reaction next week will be a test of risk appetite.

The recently passed budget bill also contained hidden elements of a short Trump Call when it raised the debt ceiling by $5 trillion. The increase of the debt ceiling will mean that the U.S. Treasury will start to sell debt to finance the deficit and cease its previous extraordinary measures to avoid reaching the government’s old self-imposed debt limit. In practical terms, the government will reverse the drawdown of the Treasury General Account at the Fed, which supplied liquidity to the financial system, and drain liquidity by selling debt into the market. The withdrawal of liquidity will pose a short-term headwind to equity prices.

It’s time for a breather. The stock market is overbought in the face of growing risks. If stock prices were to wobble because of either of these two conditions in the coming days, I will be monitoring how risk appetite behaves under those conditions. Will the market pull back and correct, or will it shrug off these potential potholes and continue to advance? Stay tuned.

In conclusion, the market is taking on bubbly characteristics. However, momentum is still strong and sentiment is not excessively stretched. The market is due for a short-term pullback or consolidation. I believe traders should buy the anticipated weakness next week and embrace the bubble conditions as the melt-up has further room to run.

Can a New Bull Begin at a Forward P/E of 22?

In my discussions with investors, one key question keeps coming up. The S&P 500 is trading at a forward P/E of 22. Can a new bull truly begin at such elevated valuations?

Reasons for Caution

There are good reasons to be cautious. The S&P 500 is trading at a forward 12-month P/E ratio of 22. Investors have seen such valuation levels in the last 30 years on only two occasions, the COVID era and the dot-com era.

Can stock prices advance from here? The answer is a qualified yes, though there are reasons to be cautious.

The last time the S&P 500 reached a forward P/E level of 22 was in 2020 during the COVID era. Then the E in the P/E ratio was falling dramatically, which elevated the forward P/E ratio. Earnings estimates recovered soon after, and stock prices advanced because the E in the P/E did most of the heavy lifting.

Fast forward to 2025. Earnings estimates saw a minor setback during the latest trade war tantrum and began to recover. Though the drop in earnings was less dramatic than 2020, the market’s forward P/E is nevertheless lofty by historical standards.

There are two ways stock prices can rise. Either the E in the P/E rises or the P/E ratio rises further.

Strong Momentum

Street analysts are forecasting a bottom-up aggregated annual S&P 500 growth to be 9% in 2025, 14% in 2026 and 12% in 2027. As they stand today, those figures should translate into healthy stock price returns, as long as the forward P/E multiples hold at current levels.

The P/E Outlook

For the longer-term outlook, investors need to consider how P/E multiples will evolve. The P/E multiple is a function of interest rates and bond yields.

The internals of the report came in on the weak side. Most of the job gains were attributable to increases in healthcare and government jobs. The diffusion rate of job gains was below 50, which indicates a negative breadth in employment increase. Take together, this is consistent with the SEP projection of a gradual weakening in the jobs market.

In addition, the Fed is hesitant about cutting rates because it doesn’t know the full effects of the tariffs. Will tariff-induced price increases be a one-time shock or will the Trump Administration continue to rachet them up over time? The current environment raises stagflation risks of weakening growth and rising inflation.

Consider how market expectations have evolved in the last year, from the Fed’s perspective. The 2-year Treasury yield, which measures the market’s expectations of the long run Fed Funds rate, fell after the tariff wars began in late January after Trump took office and it’s been in a narrow range since early March. By contrast, the 10-year Treasury yield has been range-bound since Trump’s Inauguration. The 2s10s yield curve rose sharply after the “Liberation Day” announcements and it’s been relatively steady since, which is a signal of elevated inflation expectations.

Having addressed the issues surrounding the Fed Funds outlook, investors also have to consider how the 10-year rate will evolve, which is a function of White House policy on the budget and the trade war.

One wildcard is the budget bill that’s making its way through Congress. The non-partisan Congressional Budget Office estimates the Senate version of the bill passed last week will add $3.3 trillion to the U.S. deficit over 10 years, compared to the House version, which would only raise the deficit by $2.8 trillion over the same period. The bill that eventually passed in the House on July 3 was the higher-deficit Senate version.

The one piece of good news is Section 899, the so-called “revenge tax” that penalizes foreign investors domiciled in countries judged to have unfair tax regimes, was eliminated from the final version the bill.

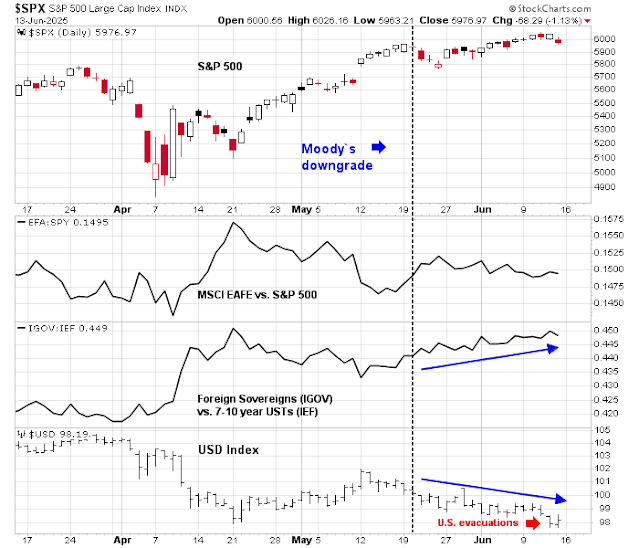

In the meantime, global markets have become increasingly nervous. While the 10-year Treasury yield has fallen in absolute terms, a basket of foreign sovereign bonds is outperforming Treasuries on a USD and equivalent-duration basis. As well, the USD Index is weakening. While the reduction in 10-year yield represents good news for the P/E ratio as lower yields represent less competition for stocks, worsening relative bond performance and USD weakness are concerns for the relative competitiveness of U.S. stocks compared to global equities.

Interpreting the Buy Signal

Putting it all together, where does that leave us? Can stock prices advance when the S&P 500 is trading at a historically high forward P/E of 22?

While U.S. equities are expensive by historical standards, the valuation of other regional markets is far more reasonable.

Macro conditions may be setting up for a cycle of superior non-U.S. equity outperformance. Investors are already seeing preliminary signs of the “Sell America” trade by the bond and currency markets. If history is any guide, persistent USD weakness has led to non-U.S. stock outperformance.

In conclusion, I interpret the buy signal from my long-term market timing model as a buy signal for global equities, and not just the U.S. market. While the U.S. stock market faces a number of macro and valuation challenges, non-U.S. stocks enjoy cheaper valuations and more earnings growth tailwinds compared to the S&P 500.

Broadening Breadth?

A Risk-on Stampede

The buying stampede doesn’t look like it’s over just yet. The BoA Bull & Bear Indicator has risen sharply, but readings are still neutral.

Deutsche’s estimates of aggregate equity positioning tells a similar story of a recovery off a panic bottom, but readings are in neutral territory.

More Room to Rally

A “rally now and correct later” scenario is consistent with what happens when the S&P 500 undergoing an upper Bollinger Band ride, as it is doing now. In the past, the market has either consolidated or staged minor pullbacks once the upper BB ride is over.

The Animal Spirits are Back in Charge!

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 27-Jun-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Speculative Breakout

The animal spirits are back and the market is becoming frothy.

Animal Spirits Take Control

I am seeing numerous signs of speculative fever that’s supporting high stock prices. The Goldman Sachs “retail favourite” basket recently reached a fresh high since 2021. The title of a recent Bloomberg op-ed speaks for itself: “SPACs Are Back. What Could Go Wrong This Time?”

MarketWatch reported that the JPMorgan strategy team unveiled a model to determine the probability of stock market direction. The model is based on a combination of volume, value, positioning, flows, economic momentum and price momentum relative to their own history. The model concluded that there is a 96% chance that stock prices will rise in the next six months.

Ed Clissold at Ned Davis Research found that low-quality stock rebounds are not unusual after 15-20% bull corrections. What is unusual is the magnitude of the low-quality recovery.

I highlighted last week several bullish tripwires. My long-term market timing model based on the monthly NYSE Composite is on the verge of a buy signal. This model presciently flashed a sell signal at the end of January when the 14-month RSI exhibited a negative divergence. Now it’s on the verge of a buy signal as its monthly MACD will turn positive for June, barring a major market downdraft on Monday.

A Trend Model Upgrade

I am upgrading my Trend Asset Allocation Model signal from neutral to bullish. As a reminder, the Trend Model employs trend-following techniques on global stock markets and commodities to form a composite score.

In the U.S., stock price strength is supported by improving fundamentals. FactSet reported that the number of S&P 500 companies issuing positive EPS guidance has been rising and readings are above average.

Key Risks

Investors should be warned that this is no textbook buy signal. Ideally, a Trend Model buy signal would be accompanied by commodity strength, which would be a sign of a global cyclical upturn. However, noise from an energy price spike attributable to geopolitical tensions masked the commodity price signal. In addition, cyclically sensitive copper/gold and base metal/gold ratios are not giving signs of a cyclical rebound. I would be more comfortable with a bullish thesis if I was seeing market signals of a global cyclical recovery.

As well, the technical behaviour of gold mining stocks is also signaling bullish caution. If the S&P 500 is breaking out to fresh highs, why are gold miners in an uptrend, and why is the relative performance of these stocks to the S&P 500 trading sideways since April? Relative breadth of the gold miners (bottom two panels) is still positive, which is a signal of consolidation. Gold mining stocks are regarded as safe-haven risk-off assets, and they should be exhibiting greater weakness during an equity bull phase.

A review of leadership of the top five sectors which comprise over 75% of S&P 500 weight shows that the advance has entirely been driven by technology stocks. Narrow leadership and signs of market froth should be interpreted as a warning, but not a sell signal. Just don’t overstay the party.

In conclusion, the market’s animal spirits have taken control of the tape and U.S. equity prices appear to be headed for further highs. Medium- and long-term indicators have improved sufficiently that I am upgrading my Trend Asset Allocation Model from neutral to bullish. However, investors should monitor non-confirmation patterns from commodity prices that may be signs of signal reversal in the coming weeks.

Putting it another way, Societe Generale found that the three-month trailing fund flows are higher for non-U.S. than U.S. equities. As long as U.S. equity fund flows remain positive, the U.S. bull should stay intact.

The Surprise Victor of the Israel-Iran War

I assess the current situation in the Israel-Iran conflict and its implications for investors.

The Iranian Nuclear Program

A Geopolitics Decanted podcast with Dr. Jeffrey Lewis, professor at Middlebury Institute and a nuclear non-proliferation expert, outlined the issues surrounding the Iranian nuclear program, assessed the possible damage of the bombing campaign and the steps Iran can take to reconstitute its program.

There were also deep underground facilities at Fordow and Isfahan, which were hit by massive American bunker buster bombs. At this point, it’s impossible to assess the damage at those facilities. The 60%-enriched uranium was stored deep underground at Fordow, which was hit by U.S. bunker buster bombs.

The Israeli and U.S. Perspective

From the Israeli and U.S. perspective, the conflict isn’t without cost. The WSJ reported that “Israel’s War on Iran Is Costing Hundreds of Millions of Dollars a Day”:

The biggest single cost are the interceptors needed to blow up incoming Iranian missiles, which alone can amount to between tens of millions to $200 million a day, experts say. Ammunition and aircraft also add to the price tag of the war, as does the unprecedented damage to buildings. Some estimates so far say that rebuilding or repairing damage could cost Israel at least $400 million.

“Precision-guided, long-range munitions like Tomahawk, Long Range Anti-Ship Missile, the heavyweight torpedo, all those ammunitions we need to increase production on,” he said. “But I’m also of the mind that we need to look at other vendors. They may not be able to produce the same exact specifications, but they might be able to produce a missile that’s effective, which is more effective than no missile.”

While the Iranian bond market isn’t easily observable, a Bloomberg podcast with Maciej Wojtal, of AmtelonCapital, an Amsterdam-based fund that specializes in Iranian stocks provides some perspective. Wojtal revealed that Iran is roughly the same size as Turkey in geography and population, but the size of its economy is about one-fifth the size. While the stock market was closed during the period the attacks, he pointed out that market signals were nevertheless available by observing the exchange rate against cryptocurrency stablecoins. Before the attack, one Iranian rial was trading at about 830,000 to the USD. It shot up about 15% to 950,000 after the attack, and returned to 850,000 as the ceasefire took hold.

One key unknown is the length of the conflict. It’s unclear what the U.S. policy toward Iran is. On one hand, President Trump has hinted at regime change in his social media posts. On the other hand, he gave the green light to China to buy oil from Iran, which translates into lifting sanctions and helps the regime. He sent out a social media post last Friday suspending plans for sanctions relief after Ayatollah Ali Khamenei issued a defiant message that downplayed the success of the bombing campaign.

Trump’s desire for regime change in Iran is a difficult proposition. The Iranian opposition is poorly organized and fragmented, and any effort to bring about regime change will result in a protracted conflict. As an example, protests erupted over women’s rights in Iran in 2022, but the authorities clamped down and the protests, which could have been the basis of an anti-government movement, fizzled.

What happens next to U.S. policy? If Trump opts for a containment policy, the diversion of military resources to the Middle East from Asia will weaken the deterrence of a Chinese attack on Taiwan. Moreover, it will bloat the budget – and the bond market vigilantes will rebel. Arguably, the market is already signaling its unease with the Treasury market. Foreign sovereign bonds are outperforming Treasuries on a USD-denominated duration-equivalent basis, and the USD is in a downtrend and broke a key support level.

Investment Implications

The length of the war, even if hostilities were to subside and the level of conflict simmers, matters to the markets. The bombing campaign has set back Iranian efforts to acquire a nuclear device for an unknown period, but the regime is still in place and it’s unclear whether the Tehran leadership will try to reconstitute the program in the near future.

For trade policy uncertainty (TPU) and geopolitical risk (GPR), the drop is sharp but short and smaller, which may reflect the fact that these shocks usually hit smaller segments of the economy and, in the past, may have been resolved more quickly. For economic policy uncertainty (EPU) and financial uncertainty (VIX), the drag on investment is more sizable and longer lasting, possibly reflecting the broader nature of the uncertainty and more sustained caution given shocks to financial markets. The largest and most prolonged effects on investment come from shocks to the predictability of the economy (REU), particularly inflation (Inflation U). These shocks may hit broader portions of the economy, and it may take more time for confidence in the predictability of the economy to return for all economic agents.

What happens if the markets are subject to a rolling series of shocks? I have argued before that Trump’s chaotic decision process has shown itself to raise the level of uncertainty. The VIX Index rose to elevated levels after the trade wars began under Trump 1.0. I expect a similar pattern to hold under Trump 2.0, which will raise the risk premium on financial assets.

In conclusion, the surprise victor in the Israel-Iran conflict may be the bond market, which will exact a cost by imposing a fiscal discipline on the combatants. Foreign policy objectives are likely to lead to a protracted and simmering conflict that raises an uncertainty premium on asset prices. The markets experienced elevated levels of uncertainty and volatility under Trump 1.0, and I expect a similar environment under Trump 2.0.

- Geopolitical uncertainty

- Uncertainty of the economic effects of the trade war

- Uncertainty of the budget bill

- Uncertainty over Fed policy direction from tariff inflation effects and the appointment of a new Fed Chair

Investors are advised to hold a diversified portfolio of global assets as a way of reducing U.S.-specific risk.

A Forthy Breakout

Return of the Animal Spirits

Indeed, the advance was led by the high beta and high octane stocks. Both the NASDAQ 100 and the ARK Innovation ETF (ARKK) made all-time highs.

Key Risks

Buy the Cannons: Exploring the Bull Case

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bearish” on 16-May-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The Minority Report

As I write these words, the U.S. has chosen to enter the war against Iran. The extremely thin contract-for-difference trading for the Dow is down about -1%. Is this a time to embrace the contrarian adage of “buy on the cannons, sell on the trumpets”?

I have been fairly cautious about the U.S. equity market, but like all good investors, I would like to consider the bull case. While my base case still calls for a trading range for the S&P 500 for the remainder of the year, and the index is still flashing a negative RSI divergence warning, I am open to the possibility that stock prices could break out to all-time highs. I estimate the odds of that bullish as one-in-three or four.

Here are my reasons to be bullish.

The Zweig Breadth Thrust

The market flashed an extremely rare Zweig Breadth Thrust buy signal, which is a sign of extremely strong bullish momentum, on April 24. ZBT buy signals are rare. There have only been nine out-of-sample signals since Marty Zweig outlined his technique in 1986. The market has advanced 6 and 12 months later every time. The breadth thrust fizzled on three occasions, when stocks failed to rise immediately after the buy signal. In each of those occasions, the Fed was raising rates, which is not the case this time.

A Liquidity Tailwind

Fading Recession Fears

In addition, the latest BoA Global Fund Manager Survey shows that recession fears are fading. This reduces the left-tail risk of a catastrophic recession bear market and boost expected returns. Combined with light to neutral institutional positioning, the higher expected return should boost risk appetite and equity allocation.

We can see a similar effect by analyzing the evolution of forward 12-month EPS estimates. Earnings estimates are rising again after a brief pause, and the increase provides some degree of valuation support to equity prices.

Semiconductor Leadership

From a technical perspective, semiconductor stocks, which have been the leadership in much of the latest bull phase, are flashing a buy signal. Not only did the Semiconductor Index stage an upside breakout, it staged relative breakouts against the S&P 500 (middle panel) and Utilities (bottom panel). The semiconductors to utilities ratio is a useful indicator of risk appetite, and its upside relative breakout is supportive of the bull case.

Positive Seasonality

Another tail-wind for stocks is seasonality. The S&P 500 was up an average of 3.6% in July in the last 16 years.

Bullish Triggers

Here is what I am watching as triggers for a bullish revival and an upside breakout to new all-time highs.

The Russell 2000 is tracing out an invested head and shoulders pattern, but the breakout above the neckline failed. The relative strength chart (bottom panel) is showing a constructive saucer-shaped bottoming pattern. Should the small-cap Russell 2000 convincingly strengthen above neckline resistance, it would be a signal that the bulls have taken control of the tape.

Finally, my long-term timing model flashed a sell signal in late January when the 14-month RSI of the NYSE Composite flashed a negative divergence. This model will turn bullish once the monthly MACD turns positive, which it did earlier in June on an intra-month basis, indicating that this model is on the verge of a buy signal. Should the market strengthen sufficiently for MACD to turn positive, it would be a sign to sound the all-clear for long-term equity investors.

Forecasting Fed Policy: Hints From Hard Data

It is not surprising that Fed policy makers have adopted a wait-and-see attitude as they watch for clues from the hard economic data.

Hints from Hard Data

Now that we have had a decent interval since the “Liberation Day” announcement, investors are starting to see hints of how the economy is evolving from the hard data. Generally speaking, the economy is experiencing some softness. The Economic Surprise Index, which measures whether economic data is beating or missing expectations, is falling.

Let’s start with the weakest and most cyclical part of the economy: housing. The housing sector has been extremely weak, according to New Deal democrat:

Permits (gold) declined -29,000 annualized to 1.393 million, the lowest number since June 2020. Single family permits (red) also declined, by 25,000 annualized, to 898,000, the lowest in 2 years. Starts (light blue) declined -136,000 annualized to 1.256 million, the lowest since May 2020.

Employment is also showing signs of stalling. Initial jobless claims (blue line) rose sharply recently, though levels are still holding within a historical range. Continuing claims (red line) has increased to a new cycle high, indicating that job seekers are finding it increasingly difficult to get jobs.

Real-time indicators of employment are also weakening, as evidenced by a decline in individual income tax withholding.

On the other hand, the American consumer is showing no signs of weakness. Numerous credit card surveys attest to the resiliency of consumer spending. The Redbook Index of same-store sales of U.S. general merchandise continues to grow steadily.

To be sure, some of the consumer spending could be attributed to households front-running tariff increases. The negative surprise in the May retail sales report is an indication that any front running is over.

Investors are about to find out how the economy is progressing now that the tariff-related noise has passed. The hard data in the coming months will tell the story.

The Stagflation Question

In summary, investors are starting to see preliminary signs of economic weakness. However, there is no need to panic because, as the FOMC statement correctly states, “economic activity has continued to expand at a solid pace”. In the absence of the tariff-related price increases, the economy could be described as undergoing a soft landing and it would be entirely appropriate for the Fed to cut rates.

She attributes the decline to a combination of factors. One is price reductions by the foreign manufacturer as the “longer production cycles may have given US apparel importers more leverage than importers in other industries”. Another is the phased implementation of tariff collection, which hasn’t fully affected prices yet. Importers could also choose to absorb some of the price increase, which is reflected in the most recent compression between CPI and PPI.

With the caveat that the apparel price data is highly preliminary, Sahm concluded:

The declines in apparel consumer prices in recent months also suggest greater demand sensitivity and some tariff cost sharing by foreign producers. That would imply a smaller boost to inflation from tariffs, as opposed to simply a delay in the boost.

As the accompanying chart shows, oil prices rose sharply as Europe experienced a sudden catastrophic shortage of natural gas. The prolonged nature of the conflict boosted the relative performance of energy stocks (top panel, dotted red line). Food prices, as proxied by agricultural commodities, also rose. As a reminder, the increase in food inflation was a key issue in the last U.S. election. The Fed had started to raise rates and move off ZIRP when the invasion began. The 2-year Treasury yield, which is a proxy for the terminal Fed Funds rate, increased steadily.

The Three Most Important Words in Investing

Technical Confusion

Market cap leadership isn’t providing any definitive clues on direction. NASDAQ 100 stocks are still the leadership, but momentum is waning. While the relative of mid- and small-caps are starting to bottom and turn up, evidence of transition isn’t definitive.

Wars Are Roach Motels

- Slower Global Growth as mounting geopolitical uncertainty dampens business investment and consumer confidence.

- Inflationary Pressures in the context of uncertainty about shipping lanes and, more broadly, global supply chain vulnerabilities.

- Reduced Policy Flexibility for some countries, including the UK, as central banks face harder choices between fighting inflation and supporting growth, and fiscal space tightens.

- Further Gradual Erosion of the Global Order, including America’s role at the core of the trade and payments systems.

There are two pillars to Mr Trump’s dislike of regime change, suggests Elliott Abrams, a veteran of several Republican administrations who served as special envoy to Venezuela and Iran during the first Trump presidency. First, Mr Trump is responding to policy failures in Afghanistan and Iraq. Second, Mr Abrams believes that Mr Trump is influenced by Henry Kissinger and other cold war practitioners of realpolitik. According to that school of statecraft: “all of these countries, Iran, Russia, China, North Korea, are black boxes and they have a person at the top, and you must negotiate with that person.” Mr Abrams calls this a “club of leaders” view, which attaches little significance to ordinary citizens’ wishes. In this worldview: “We deal with people who’ve risen to the top of the greasy pole no matter how they got there: by winning elections, by murdering people. It doesn’t matter.”

What Trump decides will affect the short-term outlook. A Reuters report revealed while Trump called for Iran’s unconditional surrender, his honest desire is for “a ‘real end’ to the nuclear dispute with Iran and indicated he may send senior American officials to meet with the Islamic Republic”.

Trade War Risks

Fed Uncertainty

In conclusion, the market is facing a high degree of uncertainty. While technical analysis can be helpful, they cannot forecast event risk that can have binary outcomes. While I am inclined to lean slightly bearish based on the belief that the S&P 500 is near the top of its trading range, my view isn’t held with high conviction. Under such circumstances, it would be prudent for traders to step aside and say, “I don’t know”.

How to Capitalize on Narrative Volatility

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bearish” on 16-May-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Waiting for the Next Shoe to Drop

Michael Kantro at Piper Sandler recently highlighted the unusual elevated levels of narrative volatility in AAII sentiment. As a consequence, the volatility has created “a lot of false-start leadership moments for rate-sensitives and small caps”.

In other words, when does the next shoe drop and how can traders capitalize on the break?

An Iranian TACO?

The headline of the week is the Israeli attack on Iran. Undoubtedly, there will be more strikes and counter-strikes in the days ahead. Energy and gold prices have already spiked and altered the global economic outlook in different ways. A BBC article succinctly summarized the worst-case scenarios of this conflict:

- America gets dragged in

- Gulf nations get dragged in

- Israel fails to destroy Iran’s nuclear capability

- There’s a global economic shock

- Iran’s regime falls, leaving a vacuum

While the attacks were conducted without U.S. participation, they could have been done without American acquiesce. It is known that Trump doesn’t like war and would prefer to conduct business deals instead. Even his social media threats offer the exit ramp of an agreement. How long before the TACO (Trump Always Chickens Out) trade manifests itself and he orchestrates a truce or peace deal?

Here is how I would position myself. Energy stocks have been depressed and become a value play. Geopolitical tensions have provided a bullish catalyst to the sector and the conflict is likely to be extended, which will put a bid on energy prices for several months. The sector has staged an upside breakout through resistance and relative strength is improving.

By contrast, gold stocks appear extended and due for a pause as short-term geopolitical tail-risk fades. While the timing of the TACO trade is fraught with risk and I am a long-term bull on gold, market internals are signaling a frothy group ready for a breather. The new highs in the GDXJ to GDX ratio, which measures the performance of junior to senior golds, already looks frothy. Relative breadth indicators (bottom pane) are already rolling over.

From Growth to Value

Another possible source of narrative volatility could be a rotation from growth to value stocks. Growth stocks have outperformed value stocks since the “Liberation Day” panic bottom, but that seems to be mainly restricted to the U.S. Outside the U.S., value and growth have been choppy but flat during the same period. Catalysts like the Israeli attack could spark a leadership rotation from growth to value.

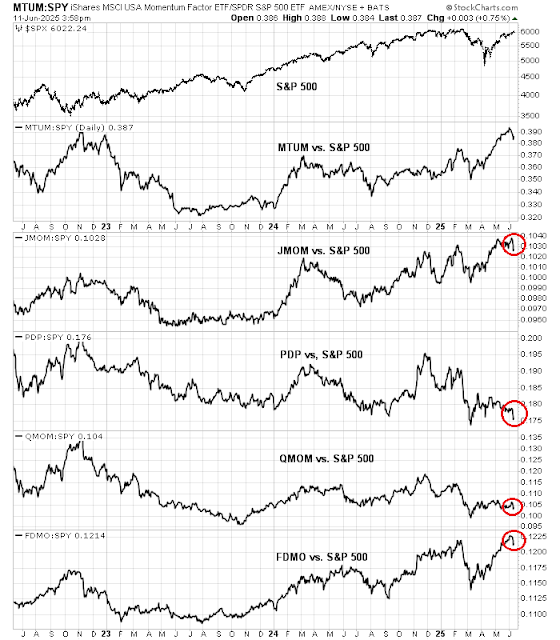

Even before the attack, investors already saw incipient weakness in the price momentum factor, which is mostly dominated by growth stocks.

The Sell America Equity Trade

I am also reiterating my Sell America trade of avoiding U.S. equities in favour of non-U.S. markets. The Sell America equity trade has been successful since Moody’s downgraded U.S. debt in bonds, when non-U.S. sovereigns have outperformed duration-equivalent Treasuries in USD, and in USD weakness. The relative performance of the S&P 500 against MSCI EAFE has been flat over the same period. I expect non-U.S. equities to exhibit superior performance in the future, especially if U.S. growth stocks weaken against value stocks, as much of S&P 500 leadership was provided by large-cap growth names.

The weakness in the USD Index is especially disconcerting for two reasons. First, it has decoupled from the 10-year Treasury yield. As well, it usually rallies during periods of global stress, but it was only roughly flat from the time news of U.S. Mideast evacuations hit the tape. These are all signs of a loss of confidence in the greenback.

The thesis for the Sell America equity trade is also supported by the behaviour of the trade war factor, which is trading flat but exhibited minor strength in the wake of the London handshake agreement between U.S. and Chinese negotiators. This is a signal of rising trade tensions, which is likely to be more bearish on U.S. stocks than non-U.S. stocks. Trump’s efforts to isolate China has failed. Instead, his trade war with the entire world has isolated America on trade instead.

Cautious on S&P 500

Finally, I would be cautious on the S&P 500 and a reversal of its recent bullish trend could be another source of narrative volatility. The S&P 500 advance was accompanied by a negative RSI divergence and a failure by the equal-weighed S&P 500 to stage an upside breakout.

In addition, a spike in the 5-day correlation of the S&P 500 and VVIX, or the volatility of the VIX Index, has been a warning of a bearish reversal.

As well, keep an eye on small cap stocks for bearish confirmation. The Russell 200 staged an upside breakout from an inverse head and shoulders pattern with bullish implications last week but it retreated below the neckline. Continuing weakness would be an indication that the bears have taken control of the tape. There is nothing worse than a failed breakout.

In conclusion, the current market environment is characterized by high market volatility, which has manifested itself as narrative volatility. I offer four ways to capitalize on the short-term volatility for traders. The suggested trades are the combination of identifiable underlying trends and a technical breaks as signals for short-term profit.

- Iranian TACO: Long energy, cautious on gold.

- Rotate from growth to value.

- Sell America: Rotate from U.S. to non-U.S. equity exposure.

- Cautious on S&P 500

Disclosure: Long GDX

A Preview of the Trump Fed

No serious economist takes Trump’s desire to cut rates by 1% seriously. However, as Jerome Powell’s term as Fed Chair nears its end, it is useful to consider how a Trump-dominated Federal Reserve might affect future policy in the future.

The Fed’s Dilemma

The Fed’s policy dilemma can be summarized by the accompanying chart. In the past, recessions have followed whenever the annual change in nonfarm payroll employment has fallen below 1.2% (blue line). On the other hand, the term premium on a 10-year Treasury (red line) has been slowly rising, which reflects growing bond market unease. The rising term premium can be attributed to a combination of rising inflation expectations and falling confidence in the U.S. fiscal picture.

A weakening employment picture focuses the Fed’s attention on its full employment mandate and argues for monetary easing. On the other hand, rising term premium focuses attention on the Fed’s price stability mandate, as well as the problem of fiscal dominance, or the uncomfortable situation where a government’s high debt starts to dictate monetary policy.

Signs of Weak Employment

Turning to the Fed’s full employment mandate, the latest NFIB monthly survey summarizes the situation. The NFIB survey is valuable because small businesses have little bargaining power and therefore they are sensitive barometers of the economy. First, the NFIB survey sample leans small-c conservative and Republican, and its responses need to be viewed in that context. Here are the main takeaways:

- Opinion-based soft optimism rebounded, but hard data optimism did not.

- Uncertainty remains elevated: “It’s hard to steer a ship in the fog”.

- The job market is soft: “Labor market is softening, including compensation pressures”.

George Pearkes at Bespoke took a closer look at the NFIB survey and found a trend of labour market weakness, while capital expenditure indicators moved sideways.

The latest release of continuing jobless claims rose to another cycle high. On the other hand, initial claims rose, but levels are not excessively alarming. The combination of anecdotal evidence of management caution of expansion paints a picture of growing weakness in hiring, but not layoffs.

Signs of Tame Inflation

Turning to the Fed’s price stability mandate, the market received welcome news when both the May CPI and PPI came in below expectations.

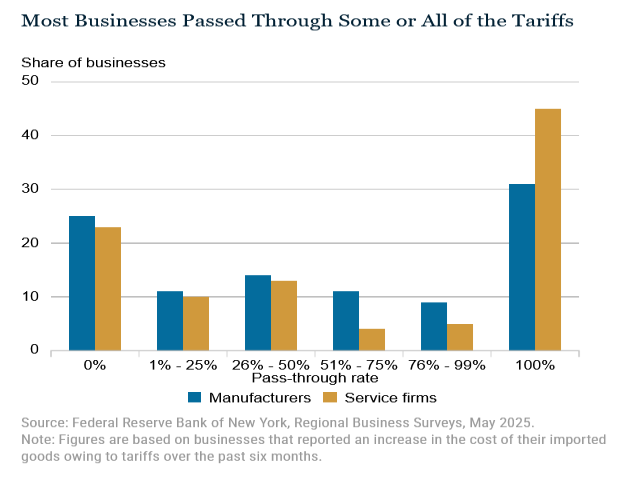

Even though CPI was tame, different surveys revealed the extent of tariff pass-through to end-users. A New York Fed survey found that roughly three-quarters of firms passed through tariff increases to some degree.

The RSM U.S. Middle Market Business Index, which measures the business confidence of middle market firms, fell sharply in Q2, though readings remain in expansion territory. This survey is important because “unlike large multinational businesses, small and medium-sized enterprises simply do not have the financial depth to absorb the increase in costs”. Middle market firms are therefore more sensitive barometer of o economic and financial stress. As a reminder, tariff price pressures didn’t rise sharply under four months after the tariffs were implemented under Trump 1.0.

In summary, middle market firms are struggling with the Trump tariffs, as “executives reported declines across a range of categories, with 20% reporting lower capital expenditures, 24% citing reduced gross revenues and 26% reporting lower net earnings”.

The inflation bears and bond market bulls shouldn’t celebrate just yet. The Cleveland Fed’s trimmed-mean CPI, which excludes outlying components, (blue line) edged up in May, and the Atlanta Fed’s sticky price core CPI (red line) has been falling very slowly.

An Atlanta Fed post in the wake of the soft inflation figures threw cold water on the notion of any urgency to cut rates, though it cannot be interpreted as a statement of official Fed policy. This argues for a continued go-slow and wait-and-see approach to monetary policy.

The market will be watching closely to see how the Fed’s staff forecast has changed in the wake of the upcoming FOMC meeting, as well as the evolution of the dot-plots.

Trade War Wildcard

The greatest unknown that the Fed is struggling with is the effects of Trump’s trade war.

By launching trade wars with all countries, Trump may have succeeded in isolating the U.S. on trade instead of isolating China.

Investors will have to weigh President Trump’s next move. My trade war factor has traded sideways in the last month and actually rose in reaction to the London accord, indicating renewed trade tensions.

The Fed will have to struggle with the prospect of stagflation as the already high tariff rates put upward pressure on prices while reducing growth potential. Further escalation in the trade war will exacerbate stagflation effects.

The Future of Fed Policy

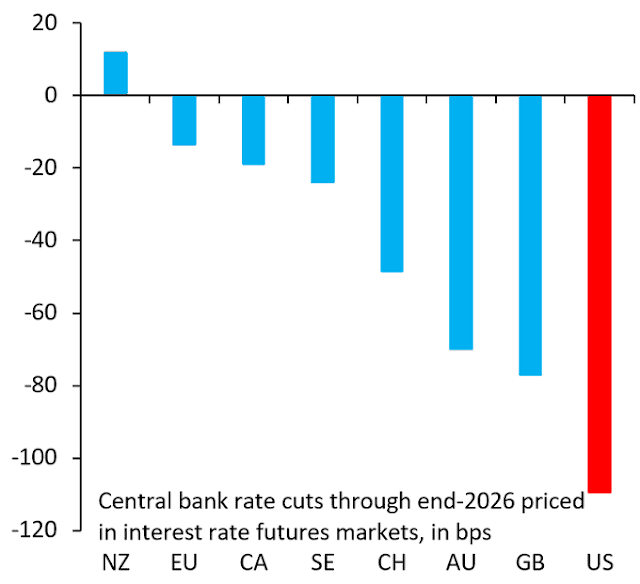

In summary, the Fed is in wait-and-see mode to observe how the price effects of tariffs flow through to inflation and inflation expectations before cutting rates. Global monetary policy is already stimulative. All else being equal, the Fed is behind other central banks in its easing path. The key question for investors is how quickly the Fed will cut rates in 2025 and 2026.

The market is discounting two quarter-point rate cuts in 2025 and a more aggressive rate cut path compared to other central banks in 2026. I find it difficult to square the circle between rate cut expectations and the realities of trade war. The U.S. is a large importer and trade deficit country while most other countries are net exporters and trade surplus countries. If tariffs are inflationary for the U.S., they will conversely be disinflationary for the exporters. How can the Fed cut so aggressively in 2026?

The only answer is Trump’s choice of Fed Chair to replace Jerome Powell, whose term ends in May 2026. The market is discounting the appointment of an uber-dove to the Chairmanship. Such an outcome would erode Fed credibility and put downward pressure on the USD.

In conclusion, the Fed remains on hold and in wait-and-see mode as it assesses the inflationary tariffs against the backdrop of a weakening labour market. The market is discounting two quarter-point rate cuts in 2025 and a rapid pace of cuts in 2026. Future Fed policy will depend on how the market perceives the new Fed Chair’s affects the Fed’s inflation fighting credibility.

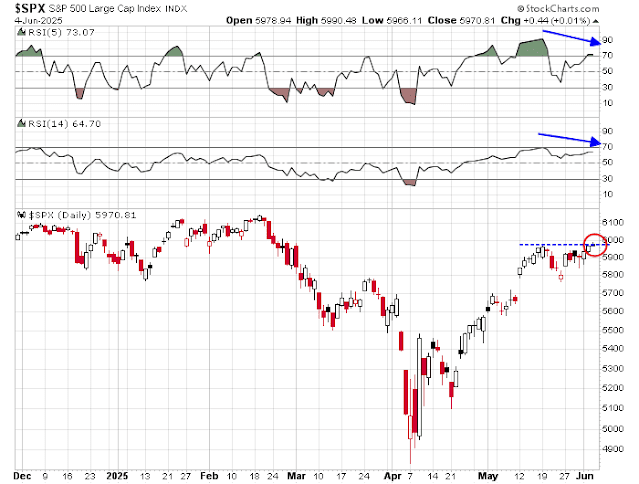

I want to believe

As the S&P 500 breaks out at the 6000 resistance level and Street strategists scramble to their index targets, I also want to believe in that stocks can go higher, but I have my doubts.

The Bull Case

The S&P 500 and the NYSE Advance-Decline Lines are staged upside breakouts to all-time highs, which is bullish. However, the lagging nature of the mid-cap S&P 400 and S&P 600 A-D Lines does serve as a warning that not breadth indicators are participating in the rally.

Both the Russell 2000 and S&P 600 also staged upside breakouts, which are positive signs of small cap strength.

Nagging Doubts

Michael Howell of Crossborder Capital, who keeps an eye on global liquidity, observed in his newsletter a positive liquidity backdrop in the short-term, but potential struggle in Q3.

Global liquidity edged higher last week to US$176.6tr, according to measures derived from the weekly balance sheets of the major Central Banks and collateral values. Still, the slowdown in global liquidity growth continues. Central Banks – particularly the Fed – need to step up to avoid a liquidity shortfall in Q3 when the debt refinancing season comes around. If the current slowing trend continues through June, risk assets and liquidity-sensitive cryptocurrencies will struggle in Q3.

From a technical perspective, the S&P 500 upside breakout leaves nagging doubts. Even as the S&P 500 breached the 6000 level, why is the equal-weighted S&P 500 struggling below resistance? Why is the 14-day RSI flashing a negative divergence signal? Why are gold miners, which is regarded as a safe haven asset, performing so well? The bottom panel shows that gold miners have performed roughly in-line with the S&P 500 during the rally off the April bottom.

Do You Want to Believe?

A cresting tide?

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “neutral” on 16-May-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Weak Breadth and Narrow Leadership

As the S&P 500 tests a key resistance level, the underlying market action is starting to feel like a cresting tide. Beneath the surface, the equal-weighted index has yet to reach its own resistance level, indicating poor breadth and narrow leadership.

Growing Valuation Risk

First, the S&P 500 faces valuation risk. The CAPE earnings yield to cash yield spread is flashing a warning sign. While this isn’t an exact market timing indicator, relative valuation poses some downside risk to stock prices. I don’t expect a major bear market, as recession risk is relatively low. However, a growth scare wouldn’t be surprising as the full economic effects of the trade war become evident.

Challenging Trade Negotiations

China’s readout of the call was more detailed and nuanced. While the tone was constructive, it did highlight sources of friction that have yet to be resolved. China acknowledged that the Geneva meeting “marked an important step forward in resolving the relevant issues through dialogue and consultation, and was welcomed by both societies and the international community.” But asserted that China “has its principles” and “always honor and deliver what has been promised”, which it interprets as there was either no agreement to end the rare earths export curbs or Beijing’s practice of slow walking approvals of the critical minerals conformed to the terms of the deal. Further, it said that the U.S. should “remove the negative measures”. In addition, China revealed that there was movement on the U.S. side on the Chinese student visa ban, as Trump promised that the “U.S. loves to have Chinese students coming to study in America”.

A Softer Jobs Market

The May Payroll report headline beat expectations, but it was weaker on an overall basis. The economy added 139,000 jobs, which was ahead of the consensus forecast of 126,000. However, combined job growth in March and April was revised down by a net of -95,000. The unemployment was steady at 4.2% and would have risen had the participation rate not retreated from 62.6% to 62.4%.

Even before the publication of the May Payroll report, continuing jobless claims rose to a 3.5-year high, and so did the category of “not in labor force but want a job”. These are signals that the jobless are experiencing growing difficulty in finding new employment.

Analysis from Renaissance Macro highlighted other signals of job market weakness from the NIFB small business survey. Compensation pressures are down and so were “labour quality” concerns, indicating that bargaining power is shifting to employers.

The May report was the worst of all worlds for Trump and anyone expecting the Fed to cut rates soon. It as mildly expansionary but soft beneath the surface. However, it’s not soft enough to warrant the Fed to cut rates. Instead, this data point is likely to reinforce Fed policy makers’ view of taking a wait-and-see attitude by focusing on the inflation fighting part of the Fed’s mandate. Such a policy path also raises the risk that the Fed will be behind the curve should growth sputter later in the year. Keep an eye on the inflation prints next week, which may shed more light on the Fed’s reaction function.

Signs of Froth

One of my concerns is that the recent advance was mainly driven by retail buying, which correctly bought the dip. MarketWatch reported that retail buyers have mainly been chasing price momentum, which is a sign of a frothy market.

Panmure Liberum analysts Joachim Klement and Susana Cruz, say the recent U.S. stock rally is standing on shaky ground. “While retail investors are becoming more bullish in U.S. equities again, hedge funds continue to increase their bets against U.S. markets and in favor of international stocks. Historically, this was the worst time to invest in U.S. stocks,” they wrote.In emailed comments, Klement as retail investors tend to follow past performance rather than the fundamentals when it comes to fund flows, their excitement is often viewed as a “good contrarian indicator.”“When hedge funds and retail investors disagree, it is usually the hedge funds that win in the end,” he said.

Other signs of froth can be seen in the performance of small cap speculative stocks, as measured by the ARK Investment ETF (ARKK). The relative performance of ARKK is historically correlated with Bitcoin. While Bitcoin has pulled back, ARKK has surged, indicating speculative behaviour.

As well, keep an eye on small cap stocks. The Russell 2000 staged an upside breakout of the neckline out of an inverse head and shoulders pattern, which is bullish. However, the S&P 600 remains below its neckline. S&P has a profitability inclusion criteria for its indices while Russell does not, which is an indication that lower quality stocks are leading the small cap rally.

In addition, risk appetite indicators of the market’s animal spirits are rolling over even as the S&P 500 advanced. The relative performance of IPOs is flagging, and so is the relative performance of equal-weighted consumer discretionary stocks, which minimizes the large weight of Tesla in the sector, has followed a similar pattern of weakness.

Klement and Cruz pointed out that retail investors are chasing price momentum. There are many ways of measuring the price momentum factor, which is based on the thesis that stocks which outperform continue to outperform. Of the five momentum ETFs that I monitor, the relative performance of some continue to rise while others are stalling. I interpret this to mean that price momentum is starting to falter — another possible sign of a cresting tide.

Why “Sell America” isn’t equity bearish

The top panel of the chart shows that S&P 500 has handily beaten global markets since the GFC and it has retreated back to the rising trend line. Conventional technical analysis calls for investors to buy the dip, with a stop loss just below the trend line. I argue for the Sell America trade of minimizing exposure to USD assets in a broadly diversified portfolio.

Reasons to Should Sell America

I have numerous reasons to Sell America, largely owing to a regime change in market character.

One disturbing development is the rise in yields was mainly attributable to an increase in term premium, or the rate investors demand to hold longer maturity instruments. While the term premium isn’t excessively high, it does show an increasing discomfort that the Fed and the U.S. Treasury may be losing control of the long end of the yield curve.

In addition, there is growing unease over the U.S. fiscal position. The WSJ reported that JPMorgan Chase CEO Jamie Dimon recent warned about a “crack in the bond market”, and “And I tell this to my regulators…it’s going to happen, and you’re going to panic. I just don’t know if it’s going to be a crisis in six months or six years.”

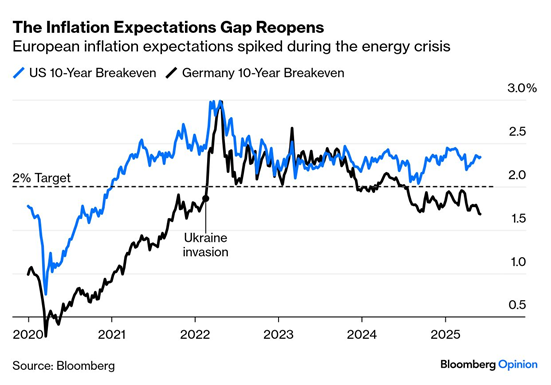

The growing yield gap is attributable to a bifurcation in inflation expectations.

The difference in yields and inflation expectations can be attributable to U.S. tariff policy. The U.S. is a significant importer, while the Eurozone and other regions tend to be net exporters. Tariffs represent an inflationary shock to the U.S. and a deflationary shock to the rest of the world. This is starting to show up in the PMI data.

The bifurcation in inflation expectations explains why the Fed is on hold in its easing policy while the rest of the world are cutting interest rates.

In summary, the combination of deteriorating U.S. fiscal position and the trade war policy pivot is contributing to falling confidence in the USD and USD assets. A CFA Institute survey conducted 15–31 July 2024 found “that the dollar remains entrenched as the dominant reserve currency…[and] growing concerns among investment professionals about the long-term sustainability of US fiscal policy”.

Better Non-U.S. Equity Bargains

Now that we have established that USD assets are likely to come under some downward pressure, what about the stock market?

Non-U.S. markets present cheap valuations by historical standards. U.S. forward P/E ratios are off the charts in comparison to other markets.

There are reasons why some markets are cheap, but a simple comparison to the Eurozone shows better growth expectations across the Atlantic. The Economic Surprise Index, which measures whether economic data is beating or missing expectations, is rising in the Eurozone while falling in the U.S.

Turning to Asia, a comparison of the subcomponents U.S. and China PMIs shows that while both plunged initially, China recovered but U.S. PMI subcomponents continue to fall.

U.S. Technology Leadership

I began this publication by arguing it’s time to underweight U.S. assets and the S&P 500 in favour of non-U.S. equities, but one key risk to my investment thesis is the sustainability of U.S. technology leadership. U.S. equity dominance since the GFC was mainly attributable to technology leadership, first by the so-called FANG names, which later became the Magnificent Seven. A bet against U.S. stocks is a bet against the Magnificent Seven.

A Bloomberg podcast with JPMorgan Asset Management strategist Michael Cembalest which argues that AI is the stock market bet of the century may shed some light on the issue.

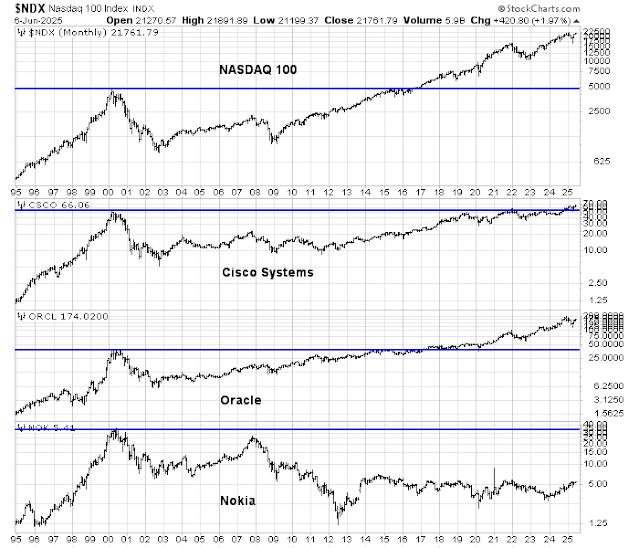

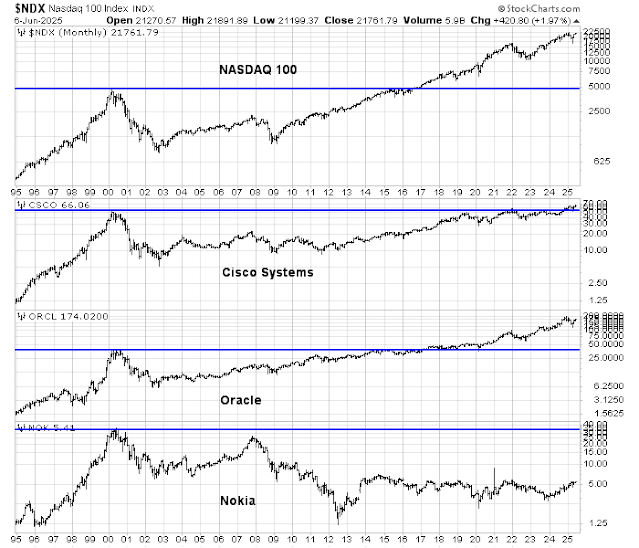

The experience of the internet bubble was instructive inasmuch as much of the value derived from widespread internet adoption accrued to the end-user. While equipment manufacturers and telecom distributors did earn some profits, eventual excess capacity cratered NASDAQ stocks. The NASDAQ 100, along with leading names like Cisco and Oracle took over a decade to regain their 2000 highs. Other crowd favourites such as AOL and Lucent were merged out of existence, and others, like Nokia, never regained their bubble highs.

Related to AI and the question of U.S. technology dominance is an investment opportunity highlighted by James van Geelen, who was early to spot the trend in weight-loss drugs and AI. Van Geelen believes that we are early in a 10-year growth opportunity in household robots, as reported by MarketWatch.

Discussing his “aha” moment on robots, van Geelen said he was speaking with an engineer friend who had been buying robot dogs from China, sticking a chip on the back and finding they could function like a guard dog. “He said ‘If you give me 15 grand, I will make you a fleet of robot dogs and guard your property right now.’”