The world is changing, but it changed even before Trump’s COVID-19 news.

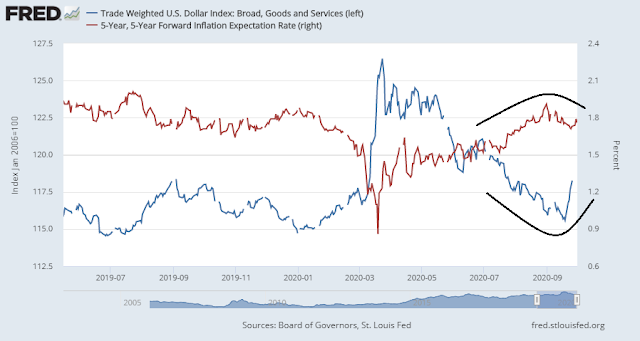

In the past few weeks, a couple of key macro trends have reversed themselves. The US Dollar, which large speculators had accumulated a crowded short position, stopped falling and began to turn up. In addition, inflation expectations, as measured by the 5×5 year forward, stopped rising and pulled back.

These developments have important implications for investors.

Rising USD = Risk-off

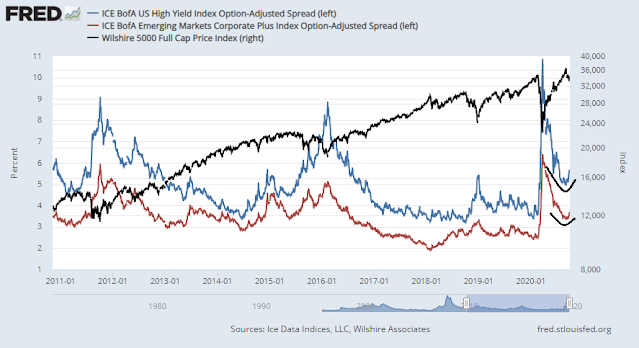

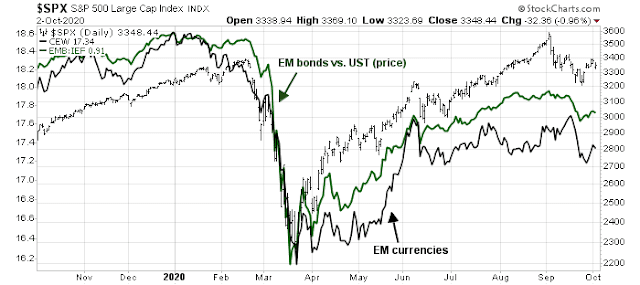

Let’s begin with the USD. The rising USD has put pressure on vulnerable emerging market economies. Indeed, USD strength has coincided with widening junk bond and EM bond spreads, which contributed to the risk-off tone in much of September.

Historically, weakness in EM currencies and EM bonds has been associated with a reduced equity risk appetite.

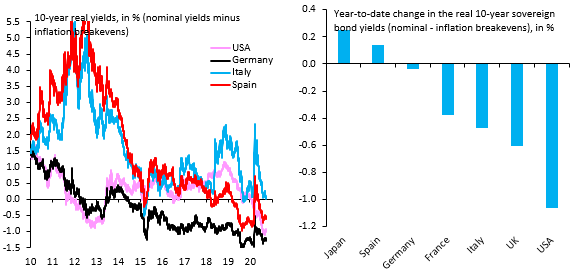

Robin Brooks, Chief Economist at IIF, believes that there are few reasons for the USD to fall further. G10 real rates are already down the most for the US. In addition, the US is reflating the fastest, which should lead to greenback strength, not weakness.

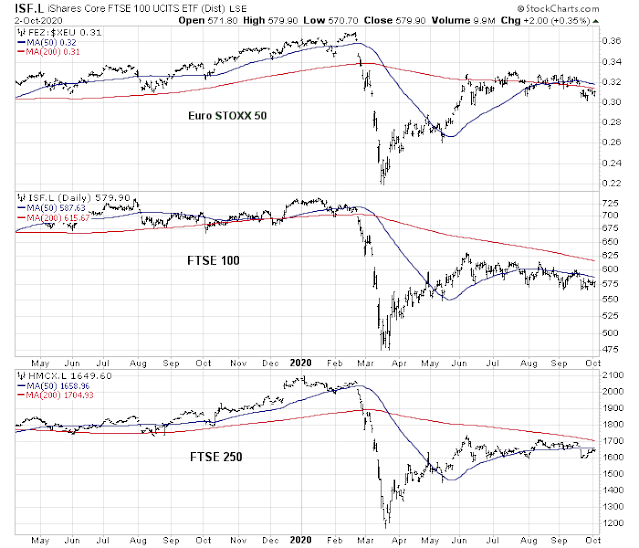

European stocks already look wobbly. The Euro STOXX 50 has violated both its 50 and 200 day moving average (dma) lines. The FTSE 100 and FTSE 200 are also weak, but the UK market is burdened by the latest Brexit drama, where the EU has charged London with violating its Withdrawal Agreement.

Cyclical rebound doubts

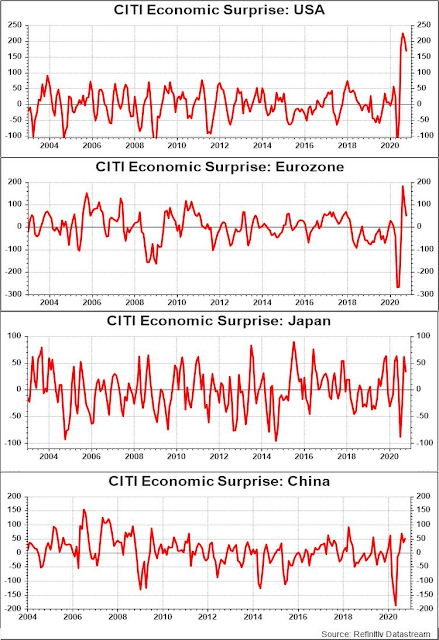

The second important global macro factor to consider is the retreat in inflation expectations. Implicitly, the market is pulling back on the consensus of a robust cyclical rebound. The Citigroup Economic Surprise Indices, which measures whether economic data is beating or missing expectations, are weakening from high levels in all major global regions.

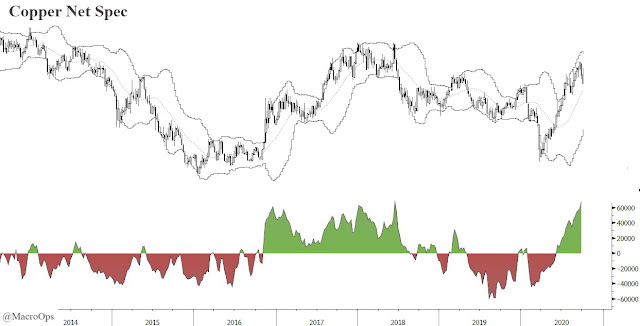

The all-important cyclically sensitive industrial metal prices is also showing signs of weakness and they are pulling back.

Equally ominous is the behavior of copper, which is weakening in the face of a large speculator crowded long in the futures market.

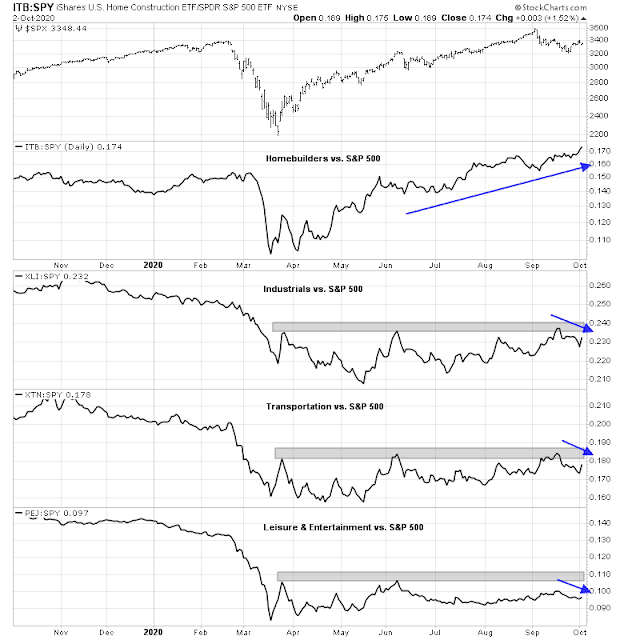

In the US, the relative performance of cyclical industries presents a mixed bag. Homebuilding stocks are on fire, which is reflective of the strength in housing. However, other cyclical groups such as industrial, transportation, and leisure and entertainment stocks, are stalling at relative resistance zones and exhibiting signs of relative weakness.

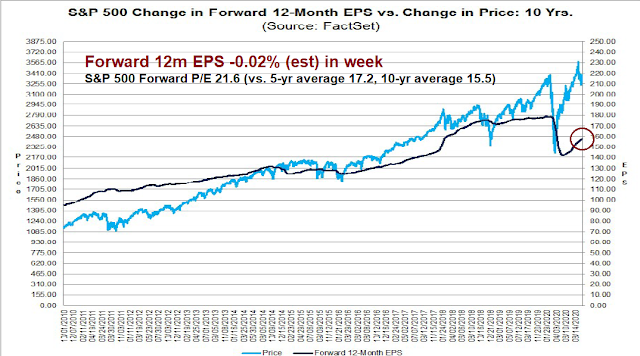

Another sign of a stalling or flattening recovery can be found in earnings estimate revisions. FactSet reported that forward 12-month estimates edged down last week. This may be just a data blip, but it’s something to keep an eye on.

The Trend Model is bearish

Putting it all together, I interpret these conditions as signs of caution. There are three major trade blocs in the world. US growth is starting to stall as there are limits to what monetary policy can accomplish. The lack of further fiscal stimulus has the potential to snuff out a recovery. Across the Atlantic, the latest inflation figures came in below expectations. The ECB’s monetary policy response has not been as assertive as the Fed’s. In China, the recovery has been uneven and driven by the production and export sectors. The sustainability of China’s recovery is hampered by a lack of global demand. In addition, Chinese households have not participated in the recovery and their finances are strained, which is proving to be a drag on any consumer driven growth.

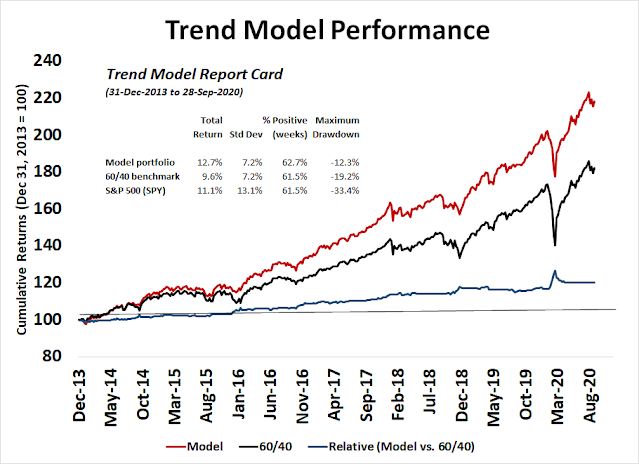

As a consequence, my Asset Allocation Trend Model signal has been downgraded from neutral to bearish. A simulation of actual Trend Model signals as applied to a simple over and underweight rules of 20% against a 60/40 benchmark has yielded equity-like returns with balanced fund-like risk.

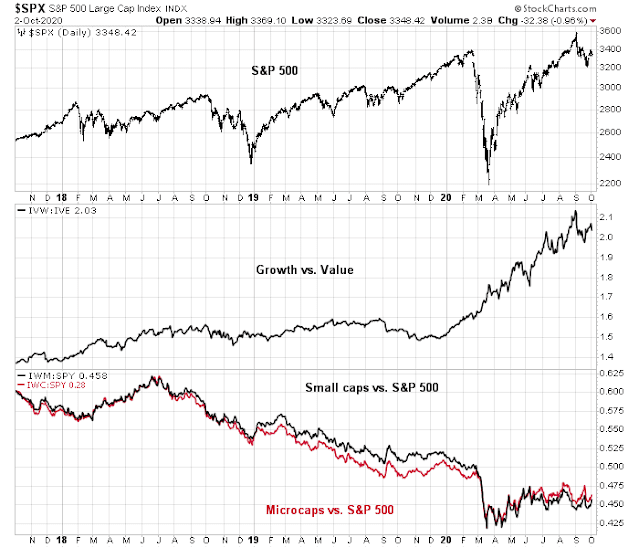

For US equity investors, this suggests that growth stocks will continue to dominate value stocks, at least until the growth and cyclical jitters are over. In a growth starved world, investors tend to flock towards established growth names. Expect growth to dominate value, and large caps to dominate small caps.

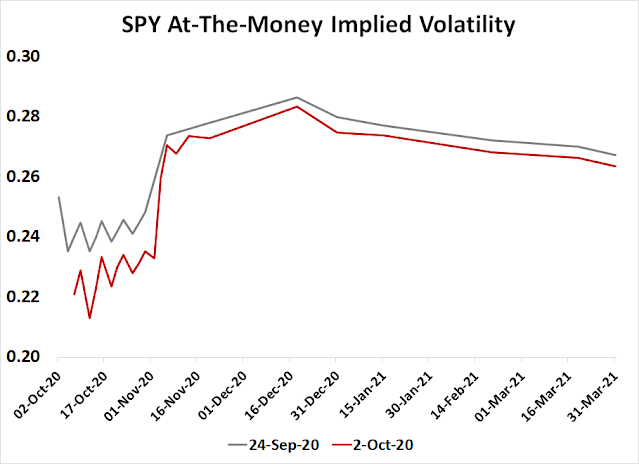

I would be remiss without a discussion of the market’s anxiety over the prospect of a contested electoral results after the November 3 election. In the wake of Trump’s diagnosis, the betting odds of his victory fell on PredictIt, but the Pence odds rose about an equal level to compensate. As a consequence, the Republican odds of winning the Presidency was largely unchanged. What is remarkable is the market’s perception was also unchanged compared to readings from the previous week. Implied option volatility spikes in early November, and peaks out mid-December, and slowly falls afterwards.

While markets usually welcome divided governments, this may be an exception under the current circumstances. The Fed has made it clear that there are limits to what it can do, and monetary may be pushing on a string. Numerous Fed speakers have pleaded for a strong fiscal response. An electoral sweep by either Party can focus Washington on passing a stimulus package, while divided government has the potential to result in weaker fiscal action.

Investors should be cautious, until the results of the election become clearer.

I don’t believe that ratio analyses on equities provides convincing evidence for this kind of analysis. Taking various indexes against an average (S&P 500) should yield that under- and over-performers cancel out. In fact, the S&P over-performs the average because of tech, leading to a pessimistic result. The equity analyses should be on trends. Here the problem is when does a cycle become a trend? There should be consistency about this. (Length of blue arrows in the US portion.)

My summary of the post today, as I understand it.

Based on the analysis and information, one should think of:

1. Reducing equity exposure from 60/40 to 40/60 ( sell one third of the equity positions)

2. Remaining Equity exposure should be in large cap growth and may be home builders. Reduce exposure to cyclicals

3. This should be good till after the elections

4. It will be better for the economy to have a Blue sweep since Biden odds have improved

Quite a dramatic move to make for 4-6 weeks of uncertainty!

I am some what surprised that there has been no discussion of credit markets(most important indicator), health policy, and implications of a blue sweep.

Since Powell stated the Fed’s new inflation policy, commodity oriented sectors ex-energy have outperformed. Here is one of my momentum set of charts on the Mines and Metals GICS ETF

https://product.datastream.com/dscharting/gateway.aspx?guid=0a190c34-7488-4676-a4de-fa2e2113f0a0&action=REFRESH

Inflation policies that will lead to a boom in commodities (ex-energy) will happen after the pandemic that is currently suppressing demand. All the Central Bankers are following the flawed policy of wanting a 2% inflation rate. This will lead to cyclical industries leading with monetary policy money printing . Here are momentum charts on the Industrial GICS ETF;

https://product.datastream.com/dscharting/gateway.aspx?guid=6e07715d-de75-4f26-a956-7cc6547c65de&action=REFRESH

And here is the Agricultural Sector ETF another inflation oriented area;

https://product.datastream.com/dscharting/gateway.aspx?guid=552a4217-593a-40b3-8ddc-047fe837616a&action=REFRESH

These all started to outperform on a momentum basis in September around the Fed new policy announcement.

Also note that during the current general market pullback with the growth stocks leading the fall, the long bond ETF TLT has fallen in price (higher rate). Usually with risk-off markets, it goes up. With the new inflation friendly FED policies, have money managers started to position away from inflation hating long term bonds and towards inflation friendly industrial and commodity sectors?

In the sixteen high inflation years from 1966 to 1982, the DJII went sideways from 1000 to 1000 on the index. During the same sixteen years, the Canadian stock market quintupled, yes up five times because it was filled with inflation loving stocks.

In my opinion, the inflation/deflation question will be the big question to drive investment returns in the next decade. Most investors and advisors have no inflation experience. They will be sideswiped. Momentum investing in a new trend is often the only way to get on board to capitalize when the situation is uncertain.

Also a Dem sweep (now more likely) will lead to strong fiscal spending especially in clean energy (note extreme ICLN ETF move up the last two weeks) that is very economic and hence commodity friendly.

If polls turn extremely in the next period toward Biden/Dem sweep, markets might start discounting strong Dem fiscal spending with high borrowing. Waiting until the election day may be too late. A drop in markets next week related to Trump’s health may be the last good buy point.

Dilemma for me is when the reflation investments (metal and commodities) start to outperform, how does the current level of indebtedness corporate, household and govt can sustain higher interest rate under higher inflation.