Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

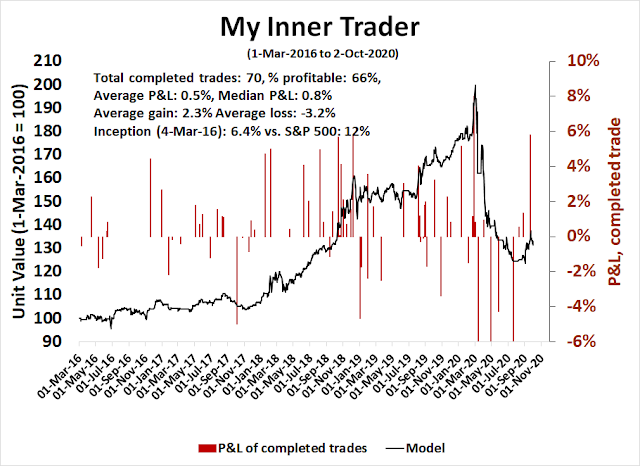

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Bearish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Plus ça change…

The market was subjected to an unexpected shock late Thursday when President Trump announced that he had been diagnosed with a COVID-19 infection. What was unusual was the behavior of many market internals – they stayed the same.

Plus ça change, plus c’est la même chose. The more things change, the more they stay the same.

In light of this development, Trump is forced to quarantine and his campaign activities are suspended or curtailed. This creates a headwind for his electoral chances about a month ahead of the election. The betting odds on a Trump victory fell in the betting markets, but the overall Republican odds of a victory was steady as the odds on the Pence contract rose. Plus ça change, plus c’est la même chose.

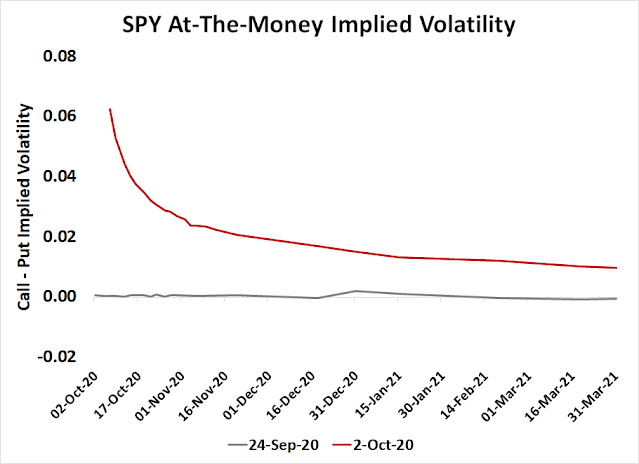

Equally puzzling was the behavior of risk. Prior to the news, the option market was discounting heightened odds of a disputed election. Average option implied volatility (IV) spiked just ahead of the November 3 election, and they remained elevated until mid-December. The shape of the implied volatility curve stayed the same after the news. Plus ça change, plus c’est la même chose.

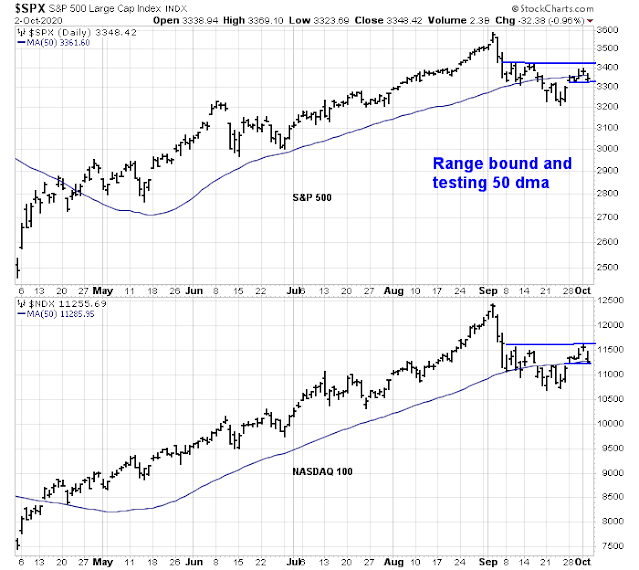

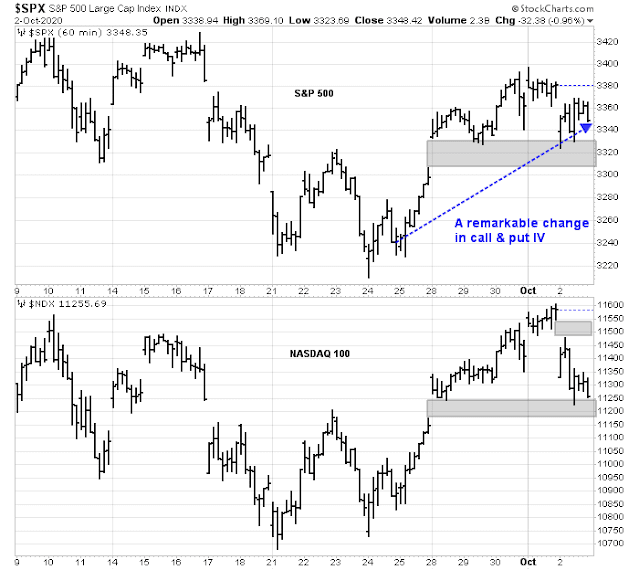

The technical behavior of the market was also relatively steady. Both the S&P 500 and NASDAQ 100 rallied last week and regained their respective 50 day moving average (dma) levels. Both indices remained range-bound for the week, bounded by a band of upside resistance and downside support.

A shift in sentiment

However, there were some key shifts in sentiment. While the shape of the option volatility curve was largely unchanged, there were differences between call option and put option IV. The spread between call and put option IV on September 24, 2020 was roughly zero across the board. Fast forward to October 2, and call option IV was higher (more expensive) than put option IV, indicating greater demand for calls than puts.

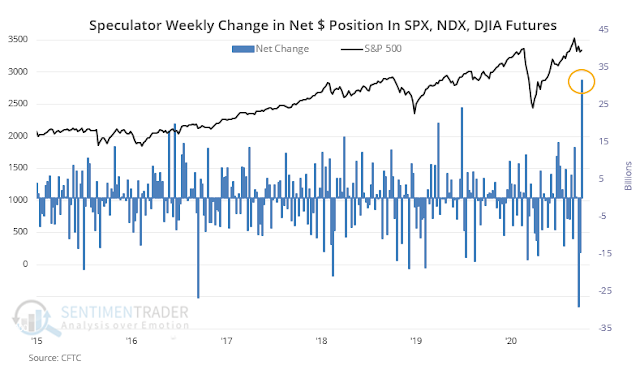

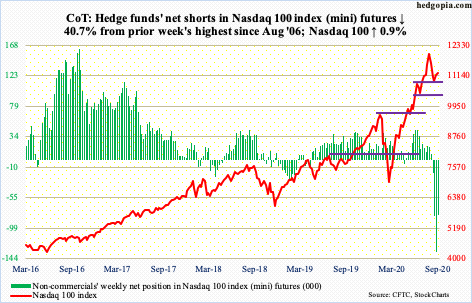

Does anyone remember the crowded short by large speculators in equity futures that everyone got excited about?

SentimenTrader observed that the latest update shows that about two-thirds of the position was bought back last week.

Large speculators are still net short the NASDAQ 100 futures contract, but their exposure has been substantially reduced.

Commitment of Traders data is no longer extreme. The bulls can’t count on the Commitment of Traders data to put a floor on prices should the equity market weaken.

The week ahead

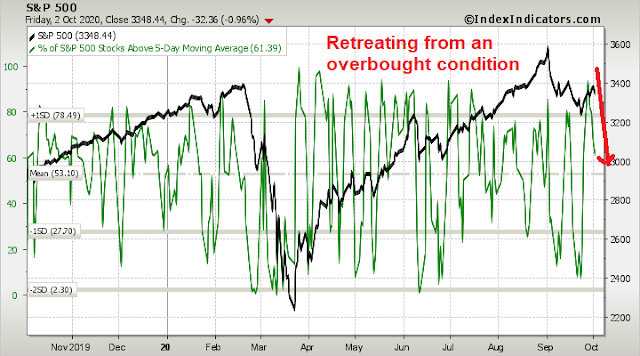

Looking to the week ahead, the market is retreating from an overbought condition. Barring any more unexpected surprises, equities should continue weaken in the early part of the week.

Tactically, both the S&P 500 and NASDAQ 100 are exhibiting price gaps begging to be filled on the hourly chart. While anything can happen, the aforementioned price differential between call and put options is contrarian bearish – at least in the short-term.

The two wildcards to my forecast are the ongoing negotiations between House Speaker Nancy Pelosi and Treasury Secretary Steve Mnuchin over a stimulus package, and how Trump,s diagnosis affects his ability to govern and campaign.

Pelosi’s negotiation intentions are unclear. Why are they even discussing a standalone airline relief bill, or any relief bill? I find it difficult to believe that it is to the Democrats’ advantage to pass any stimulus package at all. Trump and the Republicans appear to be on the ropes in the polls. The Democrat controlled House already passed a $2.2 trillion HEROS 2.0 Act last week, knowing full well that it would not be given assent in the Republican controlled Senate. The Democratic strategy was for lawmakers to return to the districts and campaign on the premise that they tried their best and blame the Republicans. There is little political incentive for Pelosi to work towards a compromise bill, which would benefit the Republicans if passed. Even if she could come to an agreement with Mnuchin, it is unclear whether the Republicans have the votes to pass such a bill in the Senate. Moreover, the Senate is going on hiatus until October 19 because of a COVID-19 outbreak. Why even make the effort at all? Regardless, a comprehensive rescue package would be a huge bullish surprise.

The other risk is President Trump’s prognosis, which could throw his electoral chances into further turmoil.

Bob Wachter, the Chair of UCSF Medicine, gave a sobering analysis of Trump’s condition in a Twitter thread.

Now we’re down a bad loop of the algorithm: not only with symptoms, but symptoms (such as shortness of breath or cough) or signs (such as low oxygen) bad enough that his docs think he needs to be in the hospital. They wouldn’t do that if he only had a fever & muscle aches…

… It might mean he’s now sleepy or confused (25th Amendment!), or, more likely, short of breath, cough &/or low oxygen level, indicating lung involvement. Yes, the threshold to hospitalize the president is probably lower than for average person, but still – it’s not good.

And that it occurred the day after his first symptoms – whereas patients are often stable for 3-10 days before crashing – is worrisome.

The odds on the chart…are for all comers, not necessarily high-risk patients like Trump. At this point, his risk of death is >10%.

Trump’s symptoms puts him in one of the first two phases of COVID-19 treatment as depicted in the chart below. While he may only be in the first phase and the hospitalization decision is because of his position in the government, he is more likely in the second phase. Patients often show few symptoms when first afflicted, and their condition can deteriorate quickly soon afterwards. UK Prime Minister Boris Johnson was hospitalized as “a precautionary measure”. He went into ICU the next day and eventually came close to death. Even if everything goes well, expect Trump to be sidelined for a minimum of 10-14 days, which is a critical window for his election campaign. Can the Republicans make sufficient adjustments in light of the fact that both Trump’s campaign manager Bill Stepien and the RNC Chair Ronna McDaniel have been diagnosed with COVID-19?

My outlook remains unchanged from last week. My base case scenario calls for near-term volatility and choppiness until the election, with a bearish bias.

Plus ça change, plus c’est la même chose.

Disclosure: Long SPXU

On Friday the FAANG +T stocks were down 2%-7% while economically sensitive GICS; Materials, Industrials, Financials, Energy, were all up big.

This correction is a Beta Crash, a sentiment swing not due to economic stressors. My research shows this type of correction is short and hits overbought favorites while the general market muddles along with no more than a 10% general correction. Big, bad bear markets (20% down or more) come with severe economic stress. I see CCC Junk bond spreads narrowed in last week. This shows FALLING economic stress. Here’s the chart.

https://fred.stlouisfed.org/graph/?graph_id=582384&rn=562

There may be a time in future when government support programs end and economic indicators like junk bond spreads begin to show severe stress. That is when to worry.

The markets are floating on a sea of Central Bank liquidity. With short term interest rates locked at near zero for the next three years and a fire hose of QE ready to flow, valuation is distorted above any experienced investor’s comfort zone. The choice is to be uncomfortable in stocks or uncomfortable out of them.

Yes, we have a distortion of price discovery, and it will continue for a long time I think. But I wonder about bonds because the Fed is backstopping some, and I worry if this suddenly becomes false.

My take on it is that this has allowed corporations to bring more bonds to market in order to weather the storm.

Fed keeping rates low allows mortgages to be refinanced at lower rates so home owners have less debt payments and maybe more to spend, and home building makes for credit expansion, but it can’t go on forever.

I worry too much I guess

What the past has taught us is that all attempts to „normalize“ or tighten monetary policy so far have failed.

The markets scaled a steep wall of worry in record time on Friday.

https://twitter.com/facethenation/status/1312771641051697154?s=21

I hope everyone can join in wishing the President a full recovery and return to full health.

There will be political and economic affects but we must be all united in our goodwill towards him.

Thank you Ravindra, agree 100%.

I thought when the heads of a faction die or are in ill health, their faction usually does well in the upcoming election.

JFK in 63, D swept in 64.

Reagan got shot in 81, held on the Senate despite the recession deepened in 82.

Jack Layton looked like death at the 2011 debate, NDP surged right after.

Boris Johnson went into ICU, support skyrocketed (6 pt bump per YouGov).

https://twitter.com/YouGov/status/1311977426923261952

I think the betting odds could be massively “mispriced” at the moment.

The presidential election is going to be decided by a few swing states. That’s if the candidates don’t die before then.

At this point, knowledge about treating the disease is much more widespread. I don’t think Trump is at risk of dying, but whether he makes a full recovery is a completely different matter.

Tonya Harding could save America (just kidding).

I try to keep it simple. We had a very sharp drop from the top of September 2. About 10 to 15% depending on the index. A rally from the bottom of September 21 which has not taken out the previous high and is now rolling over. If the last low (September 21) is taken out we are in for big drop. In my opinion, the intermediate trend is now down and all short term rallies should be sold by traders. How far we go down is pure conjecture. Ken feels it will be 10%. He might be right.

A moral question with no political bias.

A person who is not mad tries to cross an autobahn blind folded and gets hit by speeding cars. How sorry should you feel for him? More so, when it affects the well being of his children.

The clearest sign yet that things are slowly returning to normal-> in the outdoor basketball courts of the local high school, nets have been reinstalled on the hoops.

I wonder some times why the market did not drop more in September. The risks were all known. It could have dropped a lot after Trump news broke but did not. Is it that traders are already hedged, risks are not as elevated, sidelined cash comes in, or something else?

Market Leaders Appear Vulnerable to Biden’s Tax Plan

Major U.S. technology sectors could take a disproportionate hit to earnings from Joe Biden’s tax proposals, analysts say. Wall Street Journal

I think the market has now started pricing in that Biden will win the election. That is the reason as Ken stated the FANG stocks were down sharpy Friday. In any case in mind the intermediate trend is down and any rally is a gift that should be sold. Caveat Emptor!!

But Rajiv remember the phrase “Tax and Spend”. You have the negative reaction to the tax part BUT let’s not miss the positive Spend part. That is why the cyclical sectors went up. Democrats have always produced better stock markets because they produce better outcomes for lower wage workers who spend in the economy. Just think of the impact of a $2 trillion green energy plan. They will be less focused on the stock market and yet send it higher with corporate profits rather than artificial props.

I think if I understand correctly what Ken is saying (my interpretation) that certain sectors will do well i.e. infrastructure. I don’t disagree. Makes sense as the average American worker has not seen any increase in wages for a long time. So we can have a shift leadership where the fang stocks under perform and cyclical stocks take over. However, the central issue I am trying to resolve is: is the there a change in trend? Is Cam seeing something in the big picture that I am missing. My position as stated earlier is that rallies should now be sold till the high that was made on September 2 is taken out.

When Dems ‘Tax and Spend’, they tax many things and spend on many things. Green infrastructure is just a big one. Think of schools, roads, bridges, on and on. Mistrust of government makes us think anything initiated by government will be bad but maybe not.

Trimmed 65% of positions opened on Friday into the gap-up open.

AMZN/ TLSA off.

Adding to AAPL/ XLE XLF.

Who remembers Obama’s ‘shovel ready’ jobs? How big a contributor were they to the post-2009 recovery? I don’t know, but my impression is this was mostly empty talk.

Who remembers February? The unemployment rate was 3.5% The tight labor market was producing wage gains for those at the bottom outpacing all others. Now, the ‘travel and leisure’ sector, typically lower-paying jobs, is by far the worst hit by covid. A ‘K’-shaped recovery, so far.

The most important near-term jobs program is the roll-out of a vaccine.

Short term (ST) model is taking profit at 11:00 ET 10/5/20 and initiating a short position – but note that ST model is often wrong (42% time profitable) on short trades while keeping long trades at 100% time profitable – the result of a 100% in the market model. The medium term (MT) model is long and adding some positions. The Zweig breath thrust looks to be continuing. In situations like these in the past, the rally could continue for another 10 days or so based on MT model with 75% profitable trades.

I have it exactly the other way around, short until Powell speech and then switch long. At least this has been the pattern in the European trading session today.

Stop loss on SPXU around 3430?

You can view breadth thrusts as a process over 10 days as Zweig described for the advancing issues or you can look at them individually and parse them to examine their values. In most cases they will lead to a bullish thrust and today is an affirmation of the thrust that began on 9/28. The last time we saw this was a rally from 5/18 to 6/08 where every pull back to the 5 day MA was a buy. Today we are having a advancing issues thrust as well as an up volume thrust. Either way, if you are a bull, you don’t mind seeing these at all – unless the market is really peaking as in 6/08 or 9/02 which we are not as determined by the relative position of where we are to other breadth indicators such as the summation indices or IssuesAbove50 dayMA.

https://justpaste.it/ls/78vvm/60ibkgrdv19vnqga

Impressive move by the bulls today.

Thought about trimming further into the close – but IMO it’s 50/50 as to whether we gap up again on Tuesday.

Hulbert’s Sentiment Index back in the forties.

That Bob Wachter guy really nailed it. He looks terrible.

https://twitter.com/realDonaldTrump/status/1313267615083761665

Closing all remaining positions this morning.

I’m turning bullish on XLE/XLF – but I wouldn’t trust either sector farther than I could throw ’em right now.

Taking a swing @ SPXU.

Closing SPXU here.

Reopening positions in XLE/XLF/AAPL/AMZN.

Adding QQQ/ SPY/ IWM.

Adding DIA.

Adding a little BA.

So far – I’m wrong. Will have to see how it plays out.

It helps that for the most part I’m simply reopening positions I closed yesterday or this morning for gains. That provides a financial/mental buffer.

fwiw, it feels like the bull move will continue.

On the other hand, my take lacks confidence. But isn’t that always the case? The best we can do is watch the tape each day and decide how to play it.

I’m preparing to trim positions into a strong open – but unlike Monday I’m not in a hurry. I think the back-to-back selloffs on Friday and Tuesday were sufficient to reset sentiment to levels that should support further upside.

Trimming back on XLF/ IWM/ QQQ/ AMZN/ BA.

Closing SPY.

Opening a position in JETS.

We had an interruption of the Zweig breadth thrust yesterday afternoon by erratic political leadership but the market keeps on ticking, the 5 day MA continues in an uptrend and so far buying on pullbacks on the 5 day MA has been working. When the markets behave like this with bad news, you have to ask yourself – do you want to take a position and if you do, in case you get stopped out, do you want to be stopped out going long or going short?

https://justpaste.it/ls/7vk0l/0zn91ledm2bziatc

Trimming further-> QQQ/ DIA/ XLF.

XLE off completely.

All positions off at the close.