Mid-week market update: As President Trump left the hospital and returned to the White House, the message from his doctors was he was doing fine, but he was not “out of the woods”. Numerous outside physicians have made the point that COVID-19 is nothing like the flu. Flu symptoms hit the patient and eventually dissipate and go away. COVID-19 patients often have ups and downs in their infection. They may feel fine, but symptoms flare, dissipate, and return. The process can last weeks, even months. Just because Trump reported feels fine now doesn’t mean that he won’t feel fine by this weekend.

Just like Trump’s COVID-19 infection, neither the equity bulls nor bears are out of the woods. Yesterday (Tuesday), Fed Chair Jerome Powell said in a

speech that it was time to go big on fiscal stimulus:

The expansion is still far from complete. At this early stage, I would argue that the risks of policy intervention are still asymmetric. Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses. Over time, household insolvencies and business bankruptcies would rise, harming the productive capacity of the economy, and holding back wage growth. By contrast, the risks of overdoing it seem, for now, to be smaller. Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods.

The

September FOMC minutes indicated a consensus that fiscal support is forthcoming, and the economy could tank without a rescue package.

Indeed, many participants noted that their economic outlook assumed additional fiscal support and that if future fiscal support was significantly smaller or arrived significantly later than they expected, the pace of the recovery could be slower than anticipated.

Trump tanked the market by tweeting that he was calling off the negotiations for a stimulus package. While he did tweet later that he was in favor of a standalone bill for a $1200 stimulus payment, his chief of staff Mark Meadows confirmed today that stimulus bill negotiations are dead.

Recovery not out of the woods

Trump’s political pivot to spending his political capital to confirm Judge Barrett to the Supreme Court means that, in all likelihood, there will be no stimulus package passed until February, which is after Inauguration Day and the new Congress is seated.

Joe Wiesenthal at Bloomberg observed that the recovery in employment isn’t out of the woods either. He pointed out the recovery in jobs that employees can work from home (WFH) have plateaued, and likened these high paying jobs as a “longer-term bet on future business prospects” and “being akin to a capital investment”.

Looking further under the hood of the labor market reveals some other concerning signs. Jed Kolko, chief economist at at the job site Indeed, has been regularly tracking job openings by sector throughout this crisis. It’s notable which sectors are bouncing back, and which ones remain depressed. In areas like retail and construction, which temporarily were forced to shut down in the spring, positions continue to rapidly open up. But in areas such as banking, finance, and software development, job openings remain extremely depressed.

The split makes sense. A software development job isn’t the type of thing you just post one day because a business reopens after a lockdown. It represents some kind of longer-term bet on future business prospects. You can think of a software hire as as being akin to a capital investment. As such, this should raise some concerns about economic productivity going forward, if companies are spending less on long-term investment and projects now.

The delay in additional stimulus until February, at the earliest, could have a devastating impact on the economy.

Stock market in holding pattern

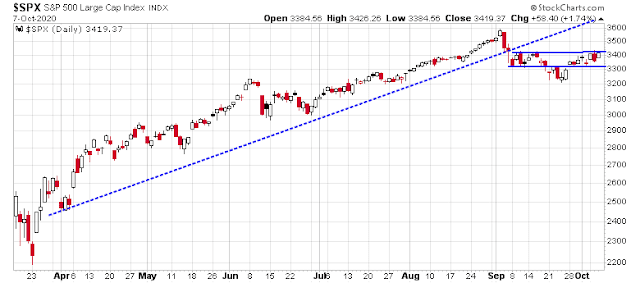

In the meantime, the stock market remains range-bound. The S&P 500 is overbought and testing overhead resistance while stuck in a narrow range. This kind of sideways consolidation pattern is not unusual in light of the the index violation of a rising trend line in early September. I am still waiting for either an upside breakout or downside breakdown.

A House report calling for antitrust investigation of Big Tech was not helpful to large cap NASDAQ 100 stocks either. This index is also testing overhead resistance, while at the same time its relative return is testing a key rising trend line.

The market was on the verge of a Zweig Breadth Thrust buy signal yesterday (Tuesday) until Trump’s tweet tanked the market. There is still a glimmer of hope for the bulls, as the last day of the ZBT window is tomorrow (Thursday).

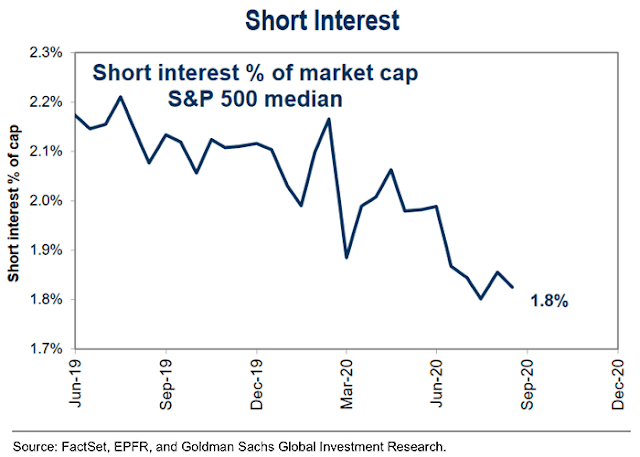

The bears can point to continuing low short interest levels, which will not put a floor on the market should it weaken.

More choppiness ahead

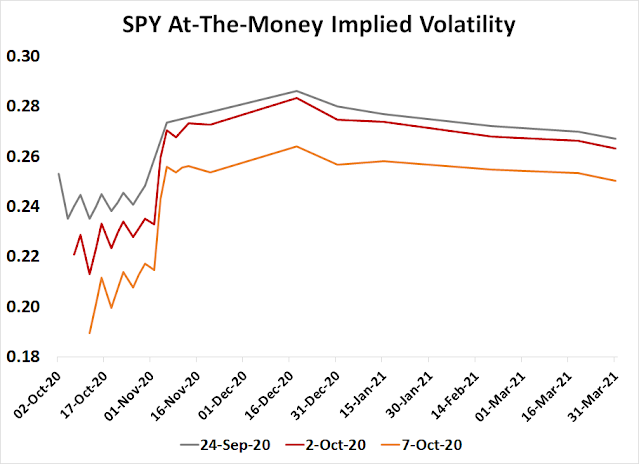

Investors should brace for more choppiness and volatility. The latest update of option implied volatility is telling the same story of election anxiety. Implied volatility spikes in early November, and remains elevated until mid-December. The market is still anxious about the prospect of a contested election and post-electoral uncertainty.

While I am not fond of historical analogs, but this one opens the door to a test of the March lows in the near term.

There will undoubtedly be more October surprises. Prepare for more volatility.

Disclosure: Long SPXU

Hi Cam

I’m not sure it is entirely to correct to say the process can last weeks, even months.

For example: https://gbdeclaration.org/#read looks to differ.

3,660 can’t all be wearing tin-foil hats 😉

Over in the UK, this is looking like a more plausible explanation of timing, though in a rather satirical way:

https://www.youtube.com/watch?v=K_pFoaUiZoE

(A video suggesting the UK needs to manage the political fall-out of over zealous use of quarantines)

Despite today’s rally (the strongest since July), Hulbert’s Sentiment Index drops by ten percentage points. Perhaps a sign there aren’t many believers.

Is this updated daily after Market Close? What is it’s predictive record?

Yes. I don’t use it to predict price movements – it’s simply another sentiment measure. I find tracking the numbers over time to be a helpful contrarian indicator.

Thanks!!

Without a context to how the Fed responded to 1929 depression and how the Fed is responding now, it is a misleading comparison (unless in jest). They could not be more different (other than chart shape resemblance). I hope we get a robust rationale for visiting March lows!!

Trump is starting to lose his mental balance as he is losing the vote and⅘ sick among WH sick staff and FLOTUS.

From a CNN post; Here’s how you know Donald Trump is panicking about the 2020 election

https://www.cnn.com/2020/10/07/politics/donald-trump-twitter-2020-election-coronavirus/index.html

There is more than a small chance that he could do something very unbalanced here as things crash around him.

I’d expect nothing less from CNN. And quoting Chris Cillizza? AYFKM?

I believe CNN has been saying this for the last 4 years and that he is racist. Tuned out CNN even in the airports.

Hulbert bottom is in?

“There are 11 bear markets in the Ned Davis calendar in which the Dow fell by more than the 37.1% loss it incurred between its February 2020 high to its March low. On average across those 11 … the final bear market low came 137 days after first registering such a loss. If we add that average to the day of the March low, we come up with a projected low on Aug. 7.”

https://www.marketwatch.com/story/stocks-will-revisit-their-coronavirus-crash-low-and-heres-when-to-expect-it-2020-04-09

Ofc market never took out March lows, so…

Ignore the above, read ‘Aug. 7’, as ‘Oct. 7’, delete delete delete.

len g, for the record, the article you referenced was published on 4-11-2020, to put the article in perspective.

I quote from the article;

“One way of summing up these historical precedents: We should expect a retest of the market’s March low. In fact, according to an analysis conducted by Ned Davis Research, 70% of the time over the past century the Dow has broken below the lows hit at the bottom of any waterfall decline”.

The 2003 and 2007 lows are recent events that confirm the above. Furthermore, despite persistently elevated VIX, the bullish underlying sentiment is all pervasive amongst small account holders.

Cam, it is time tie to visit the dumb money smart money indicator from Ned Davis Research (Liz Ann Saunders quotes this frequently).

Bear markets generally do not turn around quickly, are quite persistent in their tenor. I find it very difficult to believe that March 2020 was the final low of the market. The bear market in oil is a tell of no demand. Markets are rallying, but oil does not. I simply find it hard to buy the whole argument that we are in a new bull cycle.

Polls look really bad for Trump. But the strong market seems to be telling a completely different story….

Usually the market would be seasonally weak here due to election uncertainty, but the polls are speaking a clear language.

Ah. You mean the strong market is suggesting little uncertainty regarding the election result (ie, a clear Biden win/advantage). Could be, I could see that.

If so, how does that jive with Cam’s previous writing that a Biden admin would be less friendly to markets due to higher taxes. Or was that assumption mistaken?

The assumption is not mistaken. A Biden Administration, assuming that the Democrats have the House and Senate, will be less friendly to the owners of capital than a Trump Administration.

However, we can expect fiscal stimulus and lower inequality. As Ken so eloquently put it, we think of Democrats as tax and spend lawmakers. But we often forget the “spend” part of the equation, especially if the spending is more distributed to poorer Americans who have a greater propensity to spend, rather than the wealthier ones who have a greater propensity to save. This will spur economic growth, though it is difficult to know exactly how much investors gain or lose when it’s all netted out.

I would also suggest that the Biden administration is unlikely to raise taxes right out of the gate in 2021 as there are more pressing issues (virus, economy, stimulus bills, trade issues) to deal with. Also raising taxes, even on just those making over $400K annually, won’t be viewed positively while the economy remains in shambles.

In addition, the Biden administration will institute much-needed discipline and process to policy-making including trade relationships with China and allies. Stability is essential for private businesses to forecast and plan investments in their businesses.

https://www.predictit.org/markets/13/Prez-Election

The market is not falling even though the odds of a Biden victory continue to rise.

Something really interesting here in America.

1. Big Techs are overwhelmingly voting D. But D is dead set on breaking Big Techs.

2. Jews are overwhelmingly voting D. But D runs a sub-platform of anti-semitism.

3. Unions have always been in bed with D. But D is always very quick to throw them under bus when things get rough. Like human bodies would start to eat themselves during starvation.

4. Blacks still vote overwhelmingly D fifty plus years after Great Society, and still live in slums across the country and still the poorest ethnic groups. Even African Americans (recently from Africa) don’t want to be associated with American blacks.

These are interesting conclusions you have posted. Can you post some evidence to support your conjecture(s) for your point #2, 3 and 4? Thanks.

You can add Chinese to your list. In San Francisco and Oakland chinatown, the store windows are all boarded up and workers make sure they leave work before dark because it is very dangerous after dark. Asians are told Dems are for the working class and they have been voting mostly for Dems. No more, they are pissed.

It kind of feels like buying exhaustion – just an opinion.

Thus far Rob Hanna’s ‘first Friday down, second Friday up’ in October scenario is playing out.

Keep in mind it’s also ‘third Friday down, fourth Friday up.’

Stock ‘tip.’ (I know that usually goes.) We have a friend who works for CloudFlare in SF. Consider a position in NET.

‘HOW that usually goes.’

If you bought the morning pullback – it’s definitely breaking out now.

I should clarify. The above is not (at least IMO) inside info, anymore than learning from an Amazon warehouse guy at the dinner table that items are flying off the shelves and hiring has accelerated. We first learned about NET in June, when it was trading in the thirties. That’s the last conversation we’ve had – and I’ve been trading in/out of the stock.

I noticed the bullish setup this morning (high odds of a breakout to new highs), and bought back in. That’s really the extent of my alert – a chart pattern for a stock that I’ve been following/trading since learning about the company.

I fired off the morning comment quickly while at work, and probably should have held off until I had the time to add context. But then, I’m also a guy who likes to point things out in real time.

I haven’t heard from Cam – but I should apologize to him as well for a badly-worded comment that could easily be miscontrued.

In any case, I began buying in when the stock price cleared Thursday’s high and plan to trade around a core position. It’s a beautiful chart pattern!

Glad you made the clarification.

We all know about what happens when you trade on material non-public information.

Hulbert’s Sentiment Index now back in the sixties. IMO, it’s a shot across the bow – a rise in sentiment almost as rapid as the decline Hulbert noted not that long ago.