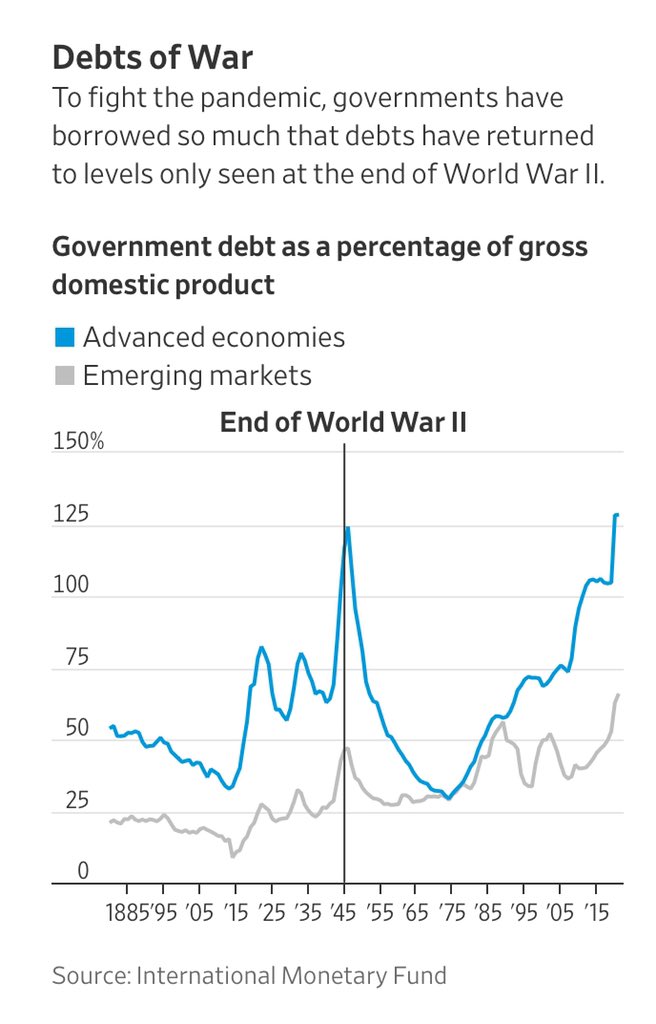

This is war! A global war against the pandemic. Analysis from the IMF showed that government debt levels have spiked to levels not seen since World War II.

How will the world win the peace in a post pandemic era, and what does that mean for investors?

A hopeful view

Morgan Housel at Collaborative Funds recently offered a hopeful and uplifting message. He believes that crises spurs panic driven innovations, and the pandemic provides an environment that sparks new discoveries and breakthroughs.

A broader point that applies to everyone is that the biggest innovations rarely occur when everyone’s happy and safe, or when the future looks bright. They happen when people are a little panicked, worried, and when the consequences of not acting quickly are too painful to bear.

That’s when the magic happens.

In particular, Housel cited the Great Depression as a crisis period that sparked innovation and productivity growth.

The number of problems people solved, and the ways they discovered how to build stuff more efficiently, is a forgotten story of the ‘30s that helps explain a lot of why the rest of the 20th century was so prosperous.

Here are the numbers: Measuring total factor productivity – that’s economic output relative to the number of hours people worked and the amount of money invested in the economy – hit levels not seen before or since:

FDR’s highway infrastructure program was just one example of how productivity soared.

The New Deal’s goal was to keep people employed at any cost. But it did a few things that, perhaps unforeseen, become long-term economic fuels.

Take cars. The 1920s were the era of the automobile. The number of cars on the road in America jumped from one million in 1912 to 29 million by 1929.

But roads were a different story. Cars were sold in the 1920s faster than roads were built. A new car’s novelty was amazing, but its usefulness was limited.

That changed in the 1930s when road construction, driven by the New Deal’s Public Works Administration, took off…

The Pennsylvania Turnpike, as one example, cut travel times between Pittsburgh and Harrisburg by 70%. The Golden Gate Bridge opened up Marin County, which had previously been accessible from San Francisco by ferry boat.

Multiply those kinds of leaps across the nation and 1930s was the decade that transportation truly blossomed in the United States. It was the last link that made the century-old railroad network truly efficient, creating last-mile service that connected the world. A huge economic boon.

Fast forward to 2020. What’s happening in stress induced innovation today?

But think of what’s happening in biotech right now. Many have pessimistically noted that the fastest a vaccine has ever been created is four years. But we’ve also never had a new virus genome sequenced and published online within days of discovering it, like we did with Covid-19. We’ve never built seven vaccine manufacturing plants when we know six of them won’t be needed, because we want to make sure one of them can be operational as soon as possible for whatever kind of vaccine we happen to discover. We’ve never had so many biotech companies drop everything to find a solution to one virus. It’s as close to a Manhattan Project as we’ve seen since the 1940s.

And what could come from that besides a Covid vaccine?

New medical discoveries? New manufacturing and distribution methods? Newfound respect for science and medicine?

A need for institutions

Morgan Housel’s rather optimistic view of the current environment is underpinned by a key assumption. In order for discoveries innovations to occur, a society needs strong institutions to ensure the rule of law and protect property rights. The incentives to bring new discoveries to market are blunted unless you know that what you do won’t be taken away from you.

Consider the following historical period that is within the lifetimes of most investors today. When the Berlin Wall came down, the Soviet Union and the East Bloc economies collapsed, what key innovations emerged from that crisis that are in common use today?

I’ll wait.

To explain the lack of crisis driven innovation during the Soviet collapse, let’s go back to 1865 and track the stock markets of two emerging market economies. The Russian market handily beat the American market for over 50 years, until investors lost everything (and probably their lives) during the Russian Revolution.

The key distinguishing feature is the nature of institutions in Russia. In 19th Century Russia, the tsar owned everything. You could make money by getting a license from the tsar to say, fish in the Baltic Sea, but that license could be taken away at any moment. The “property right” to fish did not exist. Consequently, there were few incentives to invest in new equipment, but to employ a harvesting strategy to exploit as much as you can while you held the license. Fast forward to 2020, the institutions that assure investors of property rights in Russia are still weak. The culture and mindset are not very different from 150 years ago. The primary motivation of Russian oligarchs is to exploit their “license” as much as possible, with minimal incentives to re-invest in the business.

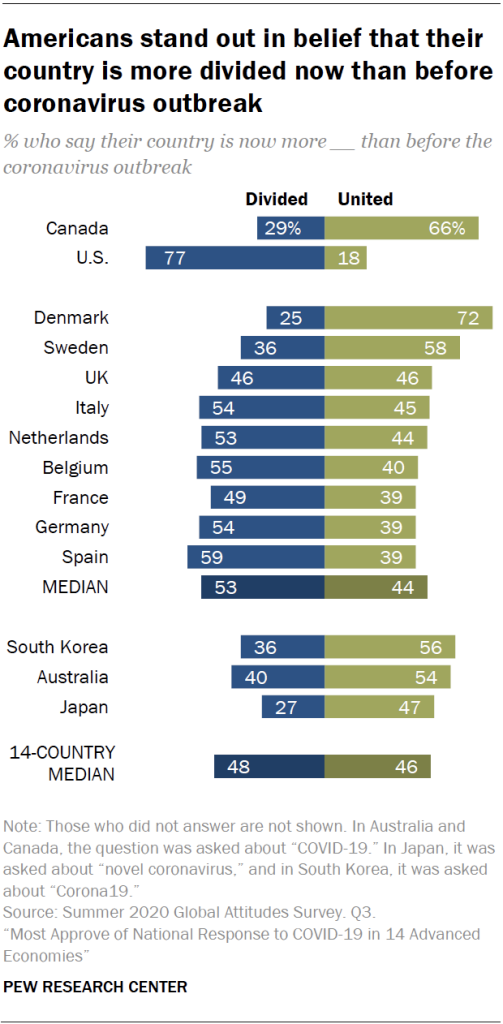

Turning to the US, the key risk for American investors today is the erosion of institutions and trust in US institutions. The protests in Kenosha, Wisconsin are just a symptom of the malaise that afflicts American society. Each side is convinced that a victory in November by the other represents an existential threat to the Republic and American democracy. I have speculated in the past about the possibility of electoral chaos in November if the vote is close, and one side thinks that the election was stolen from them. Kenosha, and Portland before that, are just previews. A Pew Research Center poll found that Americans are unique in how divided and polarized they are in the wake of the pandemic.

Equally worrisome is Trump’s ambiguous answers about whether he would respect the results of the election. Trump is preparing to contest the election, both in the Supreme Court, and in the court of public opinion. Some commentators have felt assured that they expect, in the event of a Trump electoral loss, the military would do their job and escort him out of the White House. These comments open a frightening door. This question of “What would the Army do?” is usually not asked in a stable G-7 country. It’s the sort of question asked in nations with histories of fragile democracies. Has America become Egypt, or Indonesia? Asking “What would the Army do” is another sign of the erosion of institutions.

The events in Kenosha are another example of the disintegration of institutions. In what Western democracy do the police tolerate the appearance of armed civilians in camouflage uniforms in the streets? Does the police recognize that their authority rests on trust in the institution of policing itself?

The erosion of institutions could also have dire implications in the fight against the pandemic. A Bloomberg article raised the question of declining trust in the FDA in light of the politicization of that organization.

In America, whenever you open a medicine bottle, put a pill in your mouth and swallow, you’re engaging in an act of trust. It’s the promise that, thanks to the men and women of the Food and Drug Administration, there’s been a rigorous examination of how safe and effective it is.

That trust isn’t to be taken for granted.

Now, instead, imagine a world where you open that bottle, take out the pill, and before you put it on your tongue, you pause. You question whether you should, because you don’t trust the political party that was in power when it was approved.

The real world consequences of the politicization of an agency like the FDA could manifest itself in the lack of trust in a vaccine. As there is already a part of the population who are skeptical about vaccines, the lack of trust in the FDA is likely to retard the kinds of widespread vaccination that leads to herd immunity. The lack of herd immunity will put downward pressure on the economic growth outlook, which is bearish for equities and other risk assets.

The inequality challenge

Another factor that is slowly gnawing away at the foundation of institutional respect is the growing inequality gap laid bare by the pandemic. For a perspective of the growing inequality between capital and labor, consider this chart of the number of hours an average worker needed to buy one share of the S&P 500. A gap opened in the mid-1990’s during the Clinton years, and continued through both Republican and Democratic presidencies.

A recent paper found that increased corporate power is mainly responsible for all of the negative financial and economic trends of the past few decades, such as stagnant wages, rising inequality, more household debt and financial instability. The source of the paper was a surprise, it came from the Federal Reserve. Here is the abstract from the Fed paper entitled “Market Power, Inequality, and Financial Instability”.

Over the last four decades, the U.S. economy has experienced a few secular trends, each of which may be considered undesirable in some aspects: declining labor share; rising profit share; rising income and wealth inequalities; and rising household sector leverage, and associated financial instability. We develop a real business cycle model and show that the rise of market power of the firms in both product and labor markets over the last four decades can generate all of these secular trends. We derive macroprudential policy implications for financial stability.

Since Janet Yellen became the Chair, the Fed has become increasingly concerned about the problem of labor market inequality. In this paper, the Fed raised the alarm because rising inequality is sparking a “keeping up with the Joneses” effect of credit-driven spending, which creates higher leverage, and raises financial instability risk.

Jerome Powell’s Jackson Hole speech signaled the Fed’s willingness to focus on employment at the price of higher inflation and to address the inequality problem. Powell stated that “maximum employment is a broad-based and inclusive goal” and “this change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities.”

Before the pandemic hit, the economy was experiencing a low unemployment rate, which was bringing most disadvantaged Americans into the labor force. But this was a very inefficient way of addressing the inequality problem. The most marginalized and least paid workers do not find jobs until employers must work hard to get workers. Fiscal policy can play a much bigger role to level the playing field. While serving Fed officials need to couch their words in calling for fiscal support, former Fed Chair Janet Yellen minced few words when she co-authored a NYT Op-Ed entitled “The Senate’s on Vacation While Americans Starve”.

Enter the pandemic, and the job gains by the bottom rung of society have quickly reversed. Job losses have been concentrated among lowly paid workers in the hospitality and services industries. Even worse, the WSJ pointed out that the pandemic is accelerating automation and worsen the job market outlook.

What’s making things worse for these workers and their families is that the pandemic is also accelerating the arrival of remote work and automation. It is a turbo boost for adoption of technologies that, according to some economists, could further displace lower-wage workers. It could also help explain the “K” shaped recovery many pundits have observed, in which there are now two Americas: professionals who are largely back to work, with stock portfolios approaching new highs, and everyone else.

Even before the pandemic, “Automation can explain labor share decline, stagnant median wages and declining real wages at the bottom,” says Daron Acemoglu, a professor of economics at the Massachusetts Institute of Technology. “It’s the bottom that’s really getting hammered.”

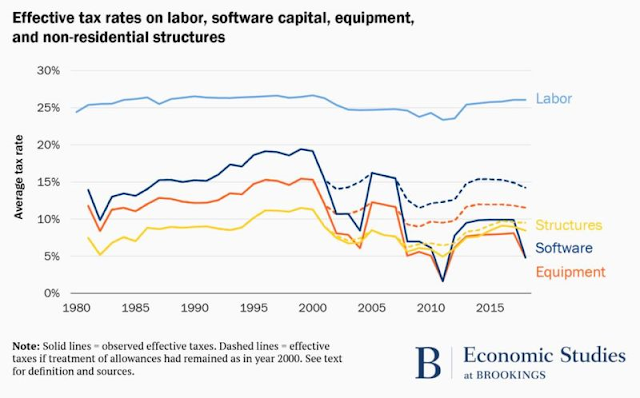

The tax system already has substantial incentives in place for companies to replace labor with capital. This argues for a corporate tax overhaul to address the imbalance between capital and labor, especially if Biden were to win and the progressive wing of the Democratic Party take control of both the House and Senate in November.

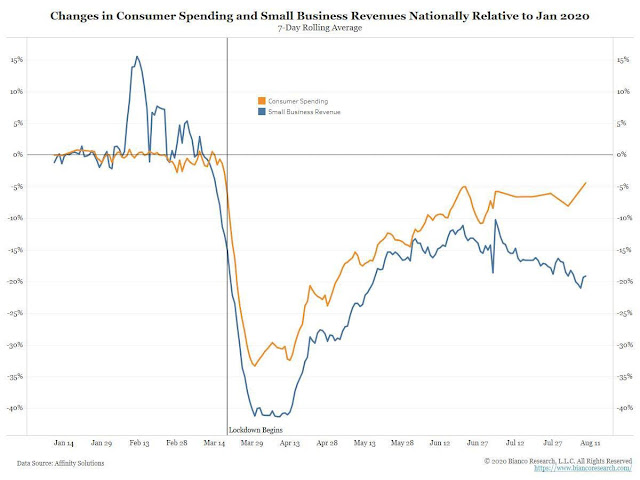

Notwithstanding the simmering class war between the suppliers of capital and labor, the suppliers of capital are also experiencing a stratified inequality effect. Small businesses are bearing the brunt of the pandemic recession. High frequency data shows that consumer spending patterns have flattened out, but small business revenues is declining. The competitive advantages of corporate size and economies of scale are manifesting themselves, and the COVID Crash is increasing big business concentration at the expense of small businesses.

Inequality matters, and at multiple levels. Longer term, it is eroding confidence in institutions.

Investment implications

We began this journey by observing that government debt levels had risen to levels not seen since World War II. While the debts appeared alarming, post-war debt to GDP gradually fell from a combination of real growth and the willingness of monetary authorities to engage in financial repression by capping interest rates. How will the global economy win the Pandemic Peace, and what does that mean for investors?

I don’t mean to denigrate Morgan Housel’s optimistic view of crisis induced innovation and productivity growth. His scenario is very plausible. Even if trust in American institutions is significantly eroded, which is not my base case, Housel’s scenario can be played out in other G-7 countries with well-established institutional stability.

This may not necessarily be bullish for equity investors. Even if Housel’s era of crisis driven innovations were to be realized, it is less clear how the pie from the spoils of productivity growth will be divided. After several decades where the supplier of capital has enjoyed the lion’s share of the gains, it would not be unusual to see some mean reversion of the division between the suppliers of capital and labor.

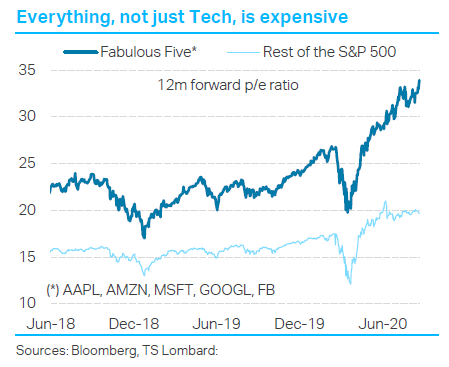

This would have negative implications for equity prices. In addition, US equities have a valuation problem. Big Tech is dominating the US equity market, but the rest of the index is not exactly cheap on forward P/E even if we exclude the top five stocks. Some other options on raising expected returns are value stocks, gold, and non-US equities, as well as the use of tactical asset allocation (see A bleak decade for US equities).

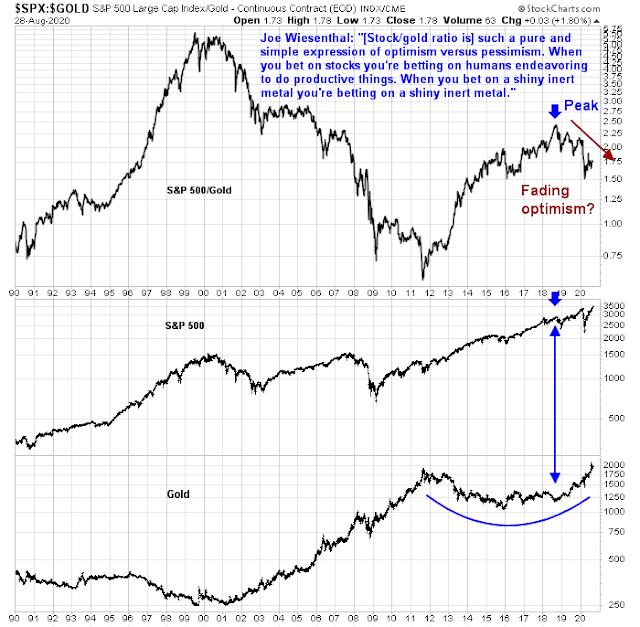

If the monetary authorities were to continue engaging in financial repression, it should be bullish for gold and other commodities. I have highlighted the stock to gold ratio, and a comment by Joe Wiesenthal of Bloomberg of how the ratio is a measure of confidence in the markets and the economy. This ratio is falling, and argues for a higher than normal position in gold and commodities in asset allocation.

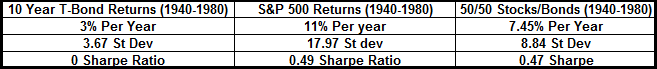

Despite my long-term bullish view on gold and commodity prices, I believe a well diversified portfolio should still consist of some stocks, and bonds. Cullen Roche at Pragmatic Capitalism demonstrated that bonds still provide important diversifying characteristics in balanced portfolios.

This era of high bond returns is over. But it doesn’t necessarily mean that bonds are a bad diversifier. For instance, from 1940-1980 interest rates rose steadily from about 2.5% to 15%. This seems counterintuitive to what most of us are led to believe about rising rates, but your average annual return over this period was 3% in a 10 year T-Bond. Bonds weren’t nearly as beneficial to a portfolio as they have been in recent decades, but that doesn’t mean they weren’t a good diversifier.

In short, go ahead and hold some gold and commodities, but don’t go overboard and forget the role of bonds for diversification.

Great article, Cam! I’m reminded of the quote in times like these:

There are decades where nothing happens; and there are weeks where decades happen.

Vladimir Ilyich Lenin

I would like to second that. A great article, Cam. Very thought provoking.

As for all the political stuff, I think Matt Taibbi has summed it up perfectly here:

“….You can tell a lot about a country by how boring its media is.

If you turn on the TV and immediately feel like going to sleep, it generally means the political class feels secure.

In the Soviet Union of the seventies, a person with the misfortune to turn on the television might be treated to pulse-pounding content like Rural Hour – or a tourism show like Explorer’s Club, which showed Soviet citizens the amazing destinations they could legally visit, like Kiev, or Kiev. …” 😉

Source: https://taibbi.substack.com/p/turn-it-off

Don’t forget, Cam, that it was Hillary Clinton who told Joe Biden not to concede the election under any circumstances. And it was Nancy Pelosi who told Joe Biden not to show up to any debates. And it is the left burning down our cities and wanting to create mass vote chaos by mailing out millions of votes to anyone and everyone.

With this sort of rhetoric I expect there is a good chance we will see much, much more civil war type shootings and cherishes between liberals and conservatives after the election. It is going to be contested by both sides if Pelosi gets her way.

I only bring this up because of you political comments in this newsletter.

Where is our editor? LOL Change

votes > ballots

cherishes > clashes

Good analysis Cam as always. Except, seriously, Today’s Democrats have never seen an institution that don’t want to burn to the ground. Having largely succeeded, they’re turning to any handy business, lol. And, I’m pretty much a life long Democrat!

Trump is… corruption fighting corruption. A symptom of Democrat’s problems.

Not sure what institutions you believe the Democrats are tearing down but Trump has dismantled key post War institutions that have kept the peace like NATO, WTO, and other alliances in the Pacific. As well, he has ignored other norms. Imagine if Clinton or Obama held a political rally on the WH lawn, how long would they be talking about that on Fox?

Nonsense. It is about time NATO countries pay or their own defense. The U.S. has been footing the bill since 1945 and we are broke.

And, Obama used the White House for many of his campaign events and staff. Don’t try that democrat double standard with me.

Not sure what institutions….Yes, I know.

The special mark of the modern world is not that it is skeptical, but that it is dogmatic without knowing it. The moderns believe without knowing what they believe—and without even knowing that they do believe it. — G.K. Chesterton

And I’m little inclined to defend Trump. If he is so, so terrible, it should be very easy to find a convincingly better candidate.

Norms are established to guide our behavior. Clinton violated many norms of his time. So did Kennedy. It’s objectionable only when someone we oppose does it.

I do think using WH for political campaigns is beyond the pale. Should that disqualify Trump from being elected? We have far more serious issues to worry about.

I believe the Clintons rented out extra bedrooms in the WH like an Air BNB. They were ahead of the times. The Obama’s have Hollywood stars, rappers, sports superstars constantly partying in the WH. I don’t have any problems with either; so if Trump wants to accept the nomination in the WH; you can put that on Covid19.

BTW, Fox News has moved a lot to the left. I don’t watch them except a few commentators.

Trump is the master in getting under the skin of the left. A true master!!

“Trump has dismantled… and other alliances in the Pacific.”

I’m not sure what alliances you have in mind, but I do government funded research and there is a lot of new talk, encouragement, policies, and programs aimed at strengthening “our traditional alliances” in the Pacific and elsewhere. This is aimed at curbing China of course.

One of Trump’s achievements, in my opinion, is changing the perception for China from that of a trading partner to a competitor for global domination.

The US has always ignored norms. The difference is that Trump is doing it openly without pretending. He is yet to do anything as horrible as some of the previous administration’s “accomplishments,” e.g. turning a relatively prosperous country, Libya, into a failed state with slave markets.

And this will remain my only comment on politics here.

Great post Stan, and on the topic of policies/programs/government funded research with a tilt towards the topic of the USA’s trials and tribulations.

Americans who watch too much media might think that it’s only their country that is “under-performing”.

It’s no bed of roses down here in New Zealand, either.

By way of example:

I came across this alarming report from June 2019 by our Ministry of Health on food security…this was BEFORE covid, obviously:

“…The New Zealand Health Survey estimates … in 2015/16, almost one in five children (19.0%) lived in severely to moderately food-insecure households. This is an important public policy concern, both from the perspective of the rights of children and potential adverse health, development and education consequences…”

https://www.health.govt.nz/publication/household-food-insecurity-among-children-new-zealand-health-survey

We don’t even have an organisation like the US CDC that can marshall the resources to produce information like this: https://www.cdc.gov/nchs/nvss/vsrr/covid19/excess_deaths.htm

For example: https://imgbox.com/xEl2BW9d for California. It would be super useful to have something like that for North Island vs South Island, so we could protect our South Island tourism industry.

So, for all it’s troubles, the USA still has some positives, IMHO 😉

As for corruption, consider how much leverage China has because of Ivanaka’s trademarks. Also imagine what a fuss Fox commentators would make if the US ambassador lobbied the UK government to hold a meeting on a property that belongs to the president

Ivanka’s trademarks gives China leverage? Over whom, what, how, where? This implies Biden would be stronger in dealing with China. I don’t think so.

If it isn’t clear yet, there’s hundreds of millions of dollars being funneled into this upcoming election by groups that no longer have to show any transparency on their sources of funding. This is the third presidential election since Citizen’s United. I wouldn’t be surprised if a lot of the protests and media coverage was influenced by state actors at this point.

https://www.yahoo.com/news/dangerous-greece-turkeys-mediterranean-standoff-143802577.html

American MSM is focussed on what happens in South China Sea. That said, the more near term hot spot is in the Mediterranean.

This may be more significant as it is in Russia’s backyard. Germany may be seen as a Vanguard of Europe but has no military as such. Is the rest of EU going to be able to deal with this looming crisis?

Let us watch this potential powder keg. I am sure China is keenly watching these developments, as the US increasingly weakens Nato.

This has bearish implications for equities. It is hard to discuss stock markets without geopolitics.

Is it possible to have US Bills and Bonds other than Fed Funds in the negative territory? If yes, can someone explain how?

They may be close to zero, but how can they be negative?

I suppose, the US Fed may start charging for Fed funds, ever increasing interest that may push the entire yield curve below zero. That is the only way it can be done. Is there any other mechanism?

German rates went negative, why not US rates?

But the 10 year Treasure rates have gone up about a quarter percent since early August and the 30 year about 0.30 percent.

https://www.yahoo.com/finance/news/big-companies-unleash-a-wave-of-pink-slips-as-coronavirus-keeps-hammering-jobs-market-141401529.html

Whilst the above may shore up balance sheets, in the near term, it is a negative, as consumers run out of cash that power these businesses. Another negative for the market (unless we get a Covid treatment or vaccine in a rush).

I’m with you Wally! Trump is NOT my favorite person, but I just cannot understand how voters can vote FOR open borders, free health care, student loans forgiven, the anarchy that we see in our streets, weaken our police and military, not to mention the leftist pull toward Socialism. Sorry, I did not intend to be political, but I just don’t see how a Biden presidency can be GOOD for markets.

I just can’t see America going down that path with Biden. From what I can ascertain there is about a 10% bias built into most polls for Biden. Two polls show Trump with a 10% advantage among independents. It is still early but I think Trump will win in a landslide unless this mail-in voting scam goes through where they mail out ballots to everyone. Then Pelosi becomes President on January 20th while the lawsuits rage.

My take is the RNC narrative was intended to shore up the soft Republican support that had been wavering on Trump. On the other hand the “Trump is not a racist” story, for example, will trigger all the BLM supporters to out to vote against him.

The Republicans are getting a convention polling bounce, which is common. We won’t know how this settles for a couple of weeks when opinion levels normalize.

But Biden didn’t get a convention bounce. There aren’t that many BLM supporters either, IMHO. And the policies he has put out are turning off millions of voters. Besides, Biden cannot run a Presidential campaign from his basement and he can’t get out and talk with screwing up. And the debates – he loses if he doesn’t show up and he loses if he does. I just see a huge Trump lead ahead.

Biden could withdraw and let the DNC chose a candidate but who? Hillary? Cuomo? Michelle might have a chance but she doesn’t want it.

The RNC was the week after the DNC, so any convention bounce would have been swamped by RNC effects.

Swamped?

Cam, I don’t know of any soft Republicans. The Trump train is as strong as ever; especially all the rioting, burning, and civil unrest that the Dem majors and Governors refused to stop. I don’t recall a riot in a Republican town that has lasted more than one day.

Cicero wrote ‘one falsehood easily leads to another falsehood ‘. That is what we must guard against.

All institutions need to evolve and change to become stronger and stay relevant. NATO, WTO, WHO, and global alliances are undergoing change. To imply they are being destroyed is to argue for them remaining the same. The fight is over what should they be in the future?

The dangers in our country are due to suppression of opposing views(college campus, cancel culture). To cite Cicero again- ‘for discovery of truth it is necessary to argue against all things and for all things’. MSM has become complicit in taking ideological positions (MSNBC, FOX, CNN etc.). Reporter at NYT resigned feeling pressure to confirm to the editorial views.

This dogmatic and ideological drive has led to intolerance. The racial bias and injustice has caused ‘civil unrest ‘. Left unresolved, it will lead to lack of faith and trust in our society and institutions.

I am a strong proponent of freedom of expression and choice. My vote will be to uphold such ideas.

Our Constitution guarantees those ideals, Ravindra. A vote to uphold those ideals is a vote to uphold our Constitution rather than to weaken it.

Agreed. It is a battle of ideas. Biden and Trump may be imperfect messengers but I do not support the ideas of ideological purity, disregard of our laws in various areas.

I think that MANY Trump supporters are being silenced by the very Cancel Culture that you mention. Even polling, many will not publicly (electronic or social media), endorse Trump for fear of the backlash from the left. To be the party that touts tolerance, the left is radically intolerant, of anyone that does not acquiesce to their agenda.

It is odd that the Dems tout tolerance, but only if one adheres to their agenda.

Cam, I get the distinct feeling that you enjoy these little bouts of political discussion so long as everyone is truthful and polite. With that:

“I disapprove of what you say, but I will defend to the death your right to say it.”

~ Commonly Attributed to Voltaire but the words themselves were never said by him—they were said about him, in a 1906 biography called “The Friends of Voltaire.” English writer Beatrice Evelyn Hall published the book under a pseudonym, S. G. Tallentyre, and intended for the line to be a reflection of Voltaire’s attitude towards Claude Adrien Helvétius, another French philosopher.

WSJ has a series on COVID-19. The latest is on how WHO bungled the response and it’s structural inadequacies. Worth reading.

The response worldwide was affected by availability of good information, resources and leadership. Only in hindsight can we judge who handled it best. And the game is not over yet. Europe won praise in these pages but Spain is again becoming the hotspot.

Let’s not rush to judgement. Yet.

Spain also comes in at #2 in the Pew Research poll in Cam’s newsletter of which countries populations feel they are the most divided (presumably in political/social policy).

As a Canadian I never will understand American politics but when I listen to Jeff Flake a lifelong Conservative and GOP Senator explain why he is voting for Biden on the Anmanpour show, it makes me wonder. He says the GOP long term true

Conservative doctrine has been preempted by Trumpism and that is a real danger. Then we see good GOP folks (my Canadian viewpoint) like Kaisuch (SP) and Colin Powell plus large high profile Conservatives doing the same. They seem wise and trustworthy or aren’t they? Comments?

One can find a few oddities in any party. Colin Powell lost his credibility with weapons of mass destruction presentation at the UN. Kasich and Flake are independent thinking conservatives. But voting with the ideas that run totally against basic conservatism does not confer any credibility to them either. Why not switch parties? Those who claim to be conservatives and vote for liberal agenda are suspect at a minimum.

Uhhhh, I wouldn’t put a lot of stock in what Jeff Flake has to say, Ken. There are a hand full of ex-Gopers (RINOs) who never really embraced Republican values but couldn’t come to grips with what Democrats were offering. It seems when they were pushed to really join the club they couldn’t and thus became the excommunicated crying child.

For instance, I remember Colin Powell speaking before the U.N. security council showing them video of an Iranian nuclear site with a monitoring vehicle that continually circled the facility supposedly monitoring for radiation leaks. Since after the war we never found that facility where was it? He has NEVER explained where he got that video or the truth behind his statement that this was a nuclear facility. Prying minds want to know and want to know why he abandoned his conservative thinking. What is he covering up?

Oops. Make that an Iraqi nuclear site.

Interesting chart courtesy of Bespoke:

https://twitter.com/bespokeinvest/status/1299841765839642624?s=21

Hi Ravindra…There’s some discussion of that topic and some pretty cool graphs here: the European “pandemic of cases”: https://youtu.be/FU3OibcindQ?t=101

Thanks, Donald. That was informative.

Thanks…I love his Irish accent…reminds me of Roy from the I.T. Crowd comedy 😉

It seems to me most unusual that government departments are cranking out detailed research of great value, for example: https://wwwnc.cdc.gov/eid/article/26/5/19-0994_article but the general population doesn’t get to see it.

Very strange times indeed!

I don’t know if any of you guys follow betting odds, but on RCP Trump is about to overtake Biden to become the fav.

https://www.realclearpolitics.com/elections/betting_odds/2020_president/

This is despite him still being behind in polls sometimes by double digits. I find this very interesting because in 2016, the scenario was almost the opposite.

The day of the election he was behind by ~3pts in the last polls, but the odds on him was +500 with HRC being -800. Of course that all changed very quickly once the polls closed. I am just wondering if someone with exp could give some comments on this, thanks.