Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Bearish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

What happens after the sell signal?

Last week’s publication generated much discussion (see A bear market is now underway). Some of the questions related to the duration and downside target in a bear market. How far can stocks fall? How long will it last? What might be the trigger for a buy signal?

To reiterate my thesis from last week. Poor technical action and a recession forecast for late 2019 or early 2020 prompted the equity sell signal. The recession forecast stems from the combination of near-recession conditions based on conventional US macro indicators, evidence of global weakness in both Europe and China, and the near certainty of a trade war which would further tank global growth.

What might turn this bear thesis around, or put a halt to the bear market? Here are a couple of possible fundamental triggers:

- An end to the trade war

- More stimulus underpinned by the ascendancy of MMT in fiscal policy circles

The bear market scenario

My base case scenario for the bear market goes something like this. Kevin Muir at The Macro Tourist recently made the case that global investors had been piling into US assets, and the recent strength of the American economy created a positive feedback loop. As more managers bought US equities, they pushed up the USD exchange rate, which resulted in positive momentum and further pushed up the USD and US equity prices. That trade is over, and they are now in a crowded long.

The latest BAML Fund Manager Survey confirms those observations. Global managers believe that the US has the best growth potential of all the regions around the world.

Managers are overweight US equities, while either market or underweight every other region in the world.

The US as safe haven growth trade is now running out of steam. The relative performance of US stocks against the MSCI All-Country World Index (ACWI) has been flat since September.

I made the case that we should start to see evidence of slowing US growth in early 2019 (see 2019 preview: Winter is coming), which would likely start to spark recession fears, and prompt global managers to reduce their overweight positions in US stocks.

How far can the market fall? While I am always “data dependent” and the trigger for a market selloff depends on the actual fundamental trigger, technical analysis can provide some clues. Based on the assumption (and this is just an assumption) that a bear market has begun, as evidenced by the MACD sell signal shown below (red line), the logical initial downside target for the SPX would be 2100, which represents the first Fibonacci retracement level of the move that began in 2009, and a key past resistance turned support level. Such a retreat would represent a peak-to-trough drawdown of 30%, which would be a relatively mild bear market by recent standards.

Here is what worries me. A 2019/2020 recession has become the consensus view. A Duke University/CFO Global Business Outlook survey reveals that 48.6% of CFOs expect one by the end of 2019, and 82% expect a recession by the end of 2020. Many institutions have already begun to de-risk in anticipation of a downturn. What might derail my bearish thesis?

Peace in our time?

A peace accord in the Sino-American trade war could be enough to spark a market rally. While the US economy would continue to slow, the psychological and economic effects of ending protectionist practices might be enough to change what might have been a global recession into a just a mild downturn. It has the potential to become the equivalent of the ECB’s implementation of the LTRO program that put an end to the Greek Crisis of 2011.

Currently, the American side is sending mixed signals. There is some debate as to arrest in the Huawei Affair was just unfortunate timing, or a deliberate signal to the Chinese. In addition, the SCMP reported that the US is proposing further restrictions on the transfer of technology to China, particular in the areas of AI and biotech:

The US on Monday proposed new export restrictions on additional technology sectors considered crucial to national security, furthering the Trump administration’s campaign to crack down on intellectual property theft by foreign nations including China.

In a posting in the Federal Register, the Department of Commerce identified 14 categories of new technologies – among them biotech, artificial intelligence and machine learning, data analytics and robotics – about to be subject to limits on investments by foreign entities.

“This proposed set of rules can potentially be a major change in the tech business,” said Richard Matheny III, a lawyer with the global trade group at the Goodwin Procter law firm in Washington.

“Many biotech companies, for example, that historically haven’t been subject to such controls will need to consider these restrictions, including when taking investments, collaborating with non-US persons on technology development, and exporting products.”

These measures will be interpreted as a direct attack on China’s development strategy, intended to retard China’s future growth path. Them’s fighting words.

On the other hand, Reuters reported that Trump stated in an interview he is willing to intervene in the case against Huawei CFO Meng Wanzhou under the right circumstances (despite her Canadian lawyer’s statement during her bailing hearing that as much admitted that she had a role in circumventing US sanctions against Iran):

When asked if he would intervene with the Justice Department in her case, Trump said in an interview with Reuters: “Whatever’s good for this country, I would do.”

“If I think it’s good for what will be certainly the largest trade deal ever made – which is a very important thing – what’s good for national security – I would certainly intervene if I thought it was necessary,” Trump said.

At the same time, the WSJ reported that the Chinese had tabled a constructive offer with the following features:

- Significant purchases of American LNG and soybeans (an easy step);

- Reduction in tariffs on autos from 25% to 10%;

- Adjustment to equity caps for foreign investments in certain sectors, which would allow foreign firms to take a majority stake in joint ventures;

- The reduction or elimination of Chinese content rules in China 2025; and

- Allow more foreign firms to participate in China 2025.

A key concession under consideration would be dropping the numerical targets for market share by Chinese companies, these people said. Made in China 2025 sets defined goals of raising domestic content of core components and materials to 40% by 2020 and 70% by 2025, an increase that comes at the expense of foreign competitors.

This offer represents substantial concessions, but will it be enough? The devil is in the details, and US trade representative Robert Lightizer has stated that he does not just want to see proposals, but verifiable steps that changes are being made. In other words, he is approaching the trade deal like an arms reduction treaty.

Is there a trade deal in the cards?

Trade negotiation analysis

Here is my take. A recent podcast interview by Axio’s Jonathan Swan’s interview with New York Times White House reporter Maggie Haberman is highly revealing about Trump’s decision-making process.

First of all, Trump keeps his views close to his vest, even to staff. He loves suspense, and can reverse his decisions on a dime. Haberman has learned not to write “Donald Trump has decided…” Here are the key excerpts from the transcript:

I’m now hedging in a way that is almost comical. So like, I recently broke the story that Trump had settled on Pat Cipollone for his White House Counsel. And when I wrote that story, I think I published it on a Saturday afternoon, I knew that Pat Cipollone … The fact I had was that Pat Cipollone had started filling out his paperwork. So I didn’t write … My lead sentence wasn’t … you know, I could pull it up now … but it wasn’t, “Donald Trump has decided …” It was, I literally wrote, “Pat Cipollone has begun filling out his paperwork for this,” because I knew that that was a fact.

The sentence, “Donald Trump has decided …” I made a big mistake early on. My story was correct. I broke the story that he was pulling out of the Paris climate deal. But I made the big mistake of saying, “Donald Trump has decided,” because, yes, he told people he decided. But then after I published my story he spoke to a White House official and he said, “What do you think I should do?”

But it doesn’t mean he hasn’t made up his mind. He’s just always polling people, even … I knew that they were scheduling the event for the next day. The speech was written. They were calling surrogates. All of these things were happening in the afternoon, so it wasn’t correct to say, “He’s on the fence.” But you need to find new language. Because there is no such thing as, “Donald Trump has decided.” It’s not a verb that you can almost use with this guy. Because he loves to create misdirection. He loves to keep flexibility open. And he loves to reverse himself. So it’s very, very challenging.

Another recent example: I broke a story that Nikki Haley was resigning as U.N. Ambassador. And I knew that it was right. I knew, I had incredibly good sourcing on it, and I knew it was happening. I still felt this little thing in my stomach when we published. I was like, “Shit, maybe this guy’s going to screw me.” You know, “Maybe he’s going to pull the rug out and say, ‘Guess what? It’s not happening. She’s U.N. Ambassador for life,’” or something. So it’s nerve-racking. And I’ve started to find ways to hedge that I would probably never do in any normal circumstance.

What about the trade war with China? She starts with analyzing the background on his accomplishments so far and what other signature initiatives are unfinished:

I think we’re at a pretty pivotal moment right now for the president. If you look in the rearview mirror, the stuff he’s accomplished is not nothing. I mean, he’s passed a big tax bill, and he’s done a ton of deregulation. He’s confirmed two Supreme Court Justices and a lot of judicial nominees. That’s all in the bucket of conventional Republican president, any other Republican president would’ve pursued those goals.

But the two goals that are definitional Trump goals, which is to change China’s behavior and to build the wall, they were two issues that defined him as a politician. He’s in a really tough spot right now. He’s kicked the can down the road on both issues. He’s signed a short-term continuing resolution to defer the shutdown fight over the wall. And he’s had this dinner with President Xi in Buenos Aires on the weekend, which resulted in, effectively, a 90-day ceasefire of this trade war and this confusing mess of competing statements that came out of both camps afterwards.

So there’s a huge TBD next to these two issues. And I find it very hard to see how he gets the money to pay for his wall. And I find it very hard to see how he gets China to do any of the really big important stuff, like change their industrial theft practices and these issues that are really, really systemic. So the question then becomes: Okay, if Trump can’t get those things done, and then he has Mueller coming down his neck, Democrats taking over the House and a blizzard of subpoenas, and a wobbly stock market, how does he respond to all of those pressures?

China is one of the key bogeymen to his political base, and Haberman doesn’t think he will back down (paragraphs in bold are questions from Jonathan Swan):

But do you expect that he has it in him to modulate some of his own behavior, or do you think it’ll be some continuation of what we have seen in recent days with the muddled messaging on China?

I don’t think he thinks it’s in his best interest to modulate. I mean, he even basically said that to us when we talked to him a few weeks ago. We said, “You keep calling the press the enemy of the people. You know that that could have consequences, that crazy people could actually …” I think Jim even said someone could die?

He did.

And Trump said, “My people like it. I go to the crowds and that’s what they like.” You take the wall as an example. There were advisers telling him, “Please talk about the economy”; Republicans on the Hill, “Please talk about the economy.” And Trump would say, “When I talk about the economy, people get bored.” They want to hear about these inflammatory issues and these really hardcore base issues.

So I don’t think he sees it in his political interest to modulate. And I expect that he would respond in the way he usually does, which is by picking a foil, which will probably be a Democrat or maybe even an establishment Republican, and hammering them in a pretty savage way; blaming others, lashing out, and creating the idea for his base that he’s fighting for them and being foiled by XYZ bogeymen.

Of course, that’s just one reporter’s opinion, but it does open a very different kind of window into Trump’s decision-making process. The market will undoubtedly oscillate between risk-on and risk-off as news on the trade negotiations hit the tape.

I am open minded about a potential deal, but remain skeptical. The most revealing market signal may come from soybean prices. Despite the news about renewed Chinese buying, soybean prices halted at key resistance level and just below its 200 dma.

The MMT recovery?

A second possible source of fundamental support for economic growth may come from the possibility of Trump and the Democrats finding some common ground to avoid a recession. As the Democrats take control of the House in 2019, it would be easy to sketch out a scenario in which House committees overwhelm the White House with investigations and subpoenas in an uncertain political environment where the Mueller has not even tabled his report.

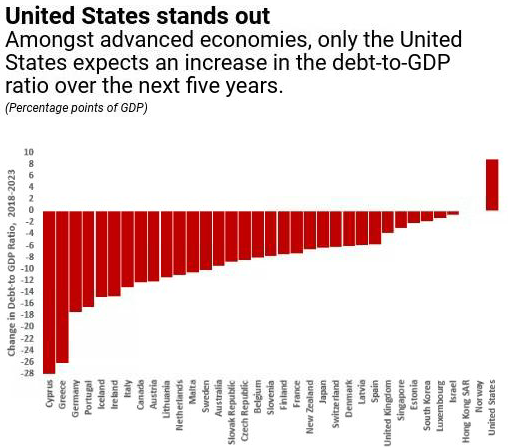

On the other hand, both side could find some common ground. How about more government debt and spending? To be sure, the IMF has pointed out that the US is the only advanced economy that is expected to increase its debt-to-GDP ratio in the next five years. But Trump is a “debt guy”, and the Democrats have their own spending priorities, such as universal healthcare. Why not more debt-driven fiscal stimulus?

In 2019, expect more discussion about the Modern Monetary Theory (MMT), which holds that policy makers should not be too concerned over fiscal deficits as long as the debt is denominated in its own currency. Here is a defense of MMT from the Roosevelt Institute:

They insist that the notion of “fiscal sustainability” or “solvency” is not applicable to a sovereign government — which cannot be forced into involuntary default on debts denominated in its own currency. Such a government spends by crediting bank accounts or issuing paper currency. It can never run out of the “keystrokes” it uses to credit bank accounts, and so long as it can find paper and ink, it can issue paper currency. These, we believe, are simple statements that should be completely noncontroversial. And this is not a policy proposal — it is an accurate description of the spending process used by all currency-issuing sovereign governments.

And, yet, there are a number of misconceptions circulating that need to be addressed. Many (often of the Austrian persuasion) interpret this simple statement as a Leninist plot to destroy the nation’s currency by flying black helicopters dumping an infinite supply of bags of money all over the planet. This is usually accompanied by a diatribe on the evils of fiat money, with a call to return to “sound money” based on shiny yellow metal. Others suggest that we are instead proposing to ramp up the size of government, until it completes Obama’s plan to gobble up the whole economy. Almost all critiques eventually produce a lecture on the lessons to be learned from Weimar Germany and from Zimbabwe.

The strangest criticism of all is that we MMT-ers argue that “deficits do not matter”. In a recent exchange in the New York Times, Paul Krugman put it this way: “But here’s the thing: there’s a school of thought which says that deficits are never a problem, as long as a country can issue its own currency.” In that piece he took Jamie Galbraith to task for arguing that “Insolvency, bankruptcy, or even higher real interest rates are not among the actual risks” facing a sovereign government. I won’t go into the details, but Krugman produced a simple model in which ever-larger budget deficits generate ever-rising prices. You can see the rest of that back-and-forth here. But the strange thing is that Krugman never actually addressed Galbraith’s points that insolvency, bankruptcy, or higher interest rates are non-issues for a sovereign government. Nor did Krugman even try to justify his claim that MMT-ers “say that deficits are never a problem”.

Deficits don’t matter inasmuch as they will not force the government into insolvency, but they do matter as long as they don’t produce inflation, or inflation expectations, that raise the funding cost of debt:

In fact, MMT-ers NEVER have said any such thing. Our claim is that a sovereign government cannot be forced into involuntary default. We have never claimed that sovereign currencies are free from inflation. We have never claimed that currencies on a floating exchange rate regime are free from exchange rate fluctuations. Indeed, we have always said that if government tries to increase its spending beyond full employment, this can be inflationary; we have also discussed ways in which government can cause inflation even before full employment. We have always advocated floating exchange rates — in which exchange rates will, well, “float”. While we have rejected any simple relation between budget deficits and exchange rate depreciation, we have admitted that currency depreciation is a possible outcome of using government policy to stimulate the economy.

Stephanie Kelton is a leading advocate of MMT, and she was an advisor to Bernie Sanders in his failed presidential campaign. Kelton has stated that deficits have been a political football for Republicans as long as they don’t interfere with GOP priorities. No one asked “how will you pay for it” during the last two rounds of tax cuts when it was clear that tax cuts did not pay for themselves in the Reagan era, nor the Bush II era. No one asked “how will you pay for it” about the post 9/11 Iraqi invasion, or Trump’s “space force”. It is only a priority when Republican priorities such as cutting Social Security and Medicare arise, see Kelton’s Bloomberg essay “Republicans Want To Make Social Security the Next Caravan”.

Combine that with Donald “the debt guy” Trump, who the Washington Post reported told his former economic advisor Gary Cohn to just “print more money”:

Trump reported told Cohn to print more money, according to three White House officials familiar with his comments.

“He’d just say, run the presses, run the presses,” one former senior administration official said, describing the president’s Oval Office orders. “Sometimes it seemed like he was joking, and sometimes it didn’t.”

Are the MMTers right? Here is the actual interest expense of federal debt, normalized by GDP. Even if rates were to rise, interest costs are in the lower range of the historical experience. The MMT debate therefore hinges on at what price the bond market will finance any debt surge.

For some perspective on the price of a potential debt surge, the chart below approximates incremental deficit financing costs, assuming that each year’s deficit is half financed with 2-year debt and half with 10-year debt. The blue line depicts the absolute dollar costs, and the red line depicts costs as normalized by GDP. From this perspective, incremental debt costs are well under control, and they have actually improved since the deficits from the Reagan years.

Whatever you might think of MMT, Trump and the MMT crowd are likely to find some common ground. The open question is whether both sides can come together to craft a deal for further fiscal stimulus, such as an infrastructure bill.

Can another massive fiscal stimulus save the American economy? Possibly. Much depends on the degree of cooperation between the White House and the Democratic controlled House, and any ultimate agreement on a bill.

At a minimum, investors should expect more discussion of MMT in 2019.

In conclusion, stock market fundamentals are under the threat of rising recession risk, and I have penciled in a 30% drawdown for US stock prices. There are two possible factors that could either mitigate or halt the decline, namely the reversal of the trade war, or further fiscal stimulus supported by the theories of MMT. The jury is out as to whether these positive catalysts can actually happen, so I remain “data dependent”.

The week ahead

The technical conditions of the stock market continues to show the pattern of a bear market. The chart below shows the 20 dma of the new low/new high ratio. Past spikes have generally been seen in bear phases, and not corrections within a bull move.

Deteriorating long-term breadth is another sign that the market is in a major bear phase. In the past, the bulls have taken begun to take back control of the tape when % bullish (black vertical line) have violated its downtrend, followed by % of stocks above the 200 dma (blue line).

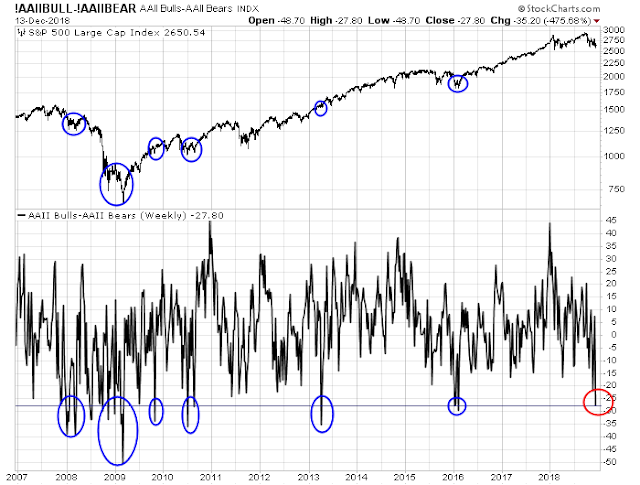

Bear markets are also marked by higher levels of volatility. Sharp drops are often followed by sharp rallies. We have recently seen a sharp drop, and sentiment certainly looks washed-out. The most recent AAII sentiment survey showed a dramatic rise in bearishness, indicating possible capitulation. Past readings at these levels have tended to be contrarian bearish.

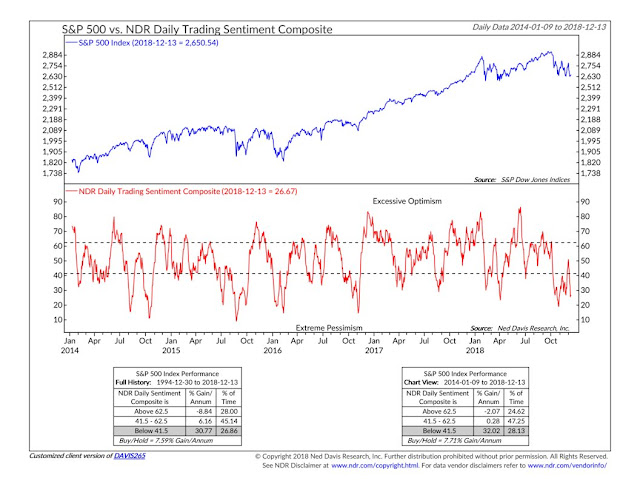

Other short-term sentiment indicators are also supportive of a bounce (see Good news and bad news from the sentiment front). The NDR Daily Sentiment Composite is in the “extreme pessimism” zone, where the historical annualized gain stands at 32%.

The latest update from Open Insider shows that this group of “smart investors” are buying the latest dip in the market.

Next week is option expiry week, and Rob Hanna found that December OpEx has historically shown the best risk/reward ratio for the bulls.

In a separate post, Hanna observed that December’s positive seasonality isn’t just restricted to OpEx week, but it has persisted for up to three weeks.

From a technical perspective, the roof hasn’t caved in on the bulls despite all of my talk of a bear market. The market tanked Friday, but the decline was insufficient to set of a Dow Theory sell signal, though the recent Dow Theory buy signal came to nought.

Longer term breadth indicators from Index Indicators show a positive divergence that has been observed in past market bottoms.

Short-term breadth is oversold, with the caveat that oversold markets can become more oversold.

There has been some analysis floating around the internet that highly negative Fridays have tended to see bearish follow-through on Mondays. My own investigation of data of SPX returns shows that there were 60 instances where the SPX fell by -2.0% or more on a Friday. The subsequent median return was 0.07%, with a batting average of 55.0%, compared to 0.05% median return and 53.4% batting average on all days. In other words, there may be a minor rebound effect, but Monday returns are virtually indistinguishable when the market tanked the previous Friday.

In summary, major bear legs simply do not start with technical and sentiment so stretched on the downside. Even if you are bearish, which I am, traders would be well advised to wait for a rally before going short.

That said, there are still some near-term risks. The latest update from FactSet shows that forward EPS estimates fell last week. As estimates have moved coincidentally with stock prices, further erosion in EPS estimates could prove to be a headwind for the market.

In addition, next week`s FOMC meeting could be a source of volatility.

My inner investor has already de-risked his portfolio to his minimum equity allocation. My inner trader remains positioned for a rally into year-end.

Disclosure: Long SPXL

Politicians want to stay in power, this has been the case since forever. They don’t like rioting or disruptions, only those who are trying to gain power benefit from chaos. If there is a shock from the market it could be the trigger for something like a huge infrastructure project.

When there are credit defaults I understand that money is destroyed, so if the government prints and creates money the net effect may be small. If there is a lot of money printing that goes to entitlement programs does not strike me as wildly inflationary, especially if a lot of high risk bonds default at the same time. My concern about inflation is when the USD loses it’s reserve currency status. Every year that the balance of trade is negative means more dollars in a reservoir of dollars that could come flooding back, when that happens.

There are 2 gaps above in the spx – 2921.36 and 2874.27 – I wonder if these will get filled?

The previous 2 bear markets – oct 9 2007 high the vix closed at 16.12 and the march 24, 2000 high the vix closed at 23.31 while our high on sep 20, 2018 the vix closed at 11.8 – which makes me wonder if we have one more high in store at a high vix level?

Tax loss selling at year end might be a factor. If memory serves us right, another psychological factor might go like this: Fool me once (2000-2003), fool me twice (2008-2009), fool me three times (2018-2019). Factor 3: large numbers of stupid hedge funds blow up and sell. Into early next year, capital gain tax procrastinators get out and sell. These are adverse factors. But curiously, HYG and JNK do not seem to be too concerned. Perhaps they are next.

Dear Cam, may I suggest to begin a framework for the next earnings report season? Amid all the chaos, what sort of market reactions might ensue? I believe the reactions will tell us a lot of info regarding future market directions. We are currently in a earnings info vacuum, so all sorts of emotions are taking over the tape.

Another interesting reading from my options sentiment indicators this weekend. Seeing retail trader put buying at extremes that have historically produced an intermediate-term low and multi-week rally starting within 0-8 trading days. The only exceptions to this have been in the final washout (puke) phase of bear markets in which case about a 1 month long meltdown into the momentum low of the bear market takes place. It seems far too soon to be starting the final washout phase of this bear, since it really just got started a couple months ago, but who knows as fragile as sentiment is it may not take much as much time to culminate as in past bear markets. Time will tell.

Let me explain how I was able to pinpoint the end of the global bear market in January 2016. Sorry to show off but I made a major shift from bear-mode to bull on January 21, a day after the low point. This is my specialty as I’ve missed every bear market since the early 1980’s because I study this area.

This blog post will explain how I believe the current bear market will end.

Most important is to view things globally. Most investors are very U.S.-centric and miss the big picture of stress and strains.

Of course, American markets can have a bit different timing because of their size and particular economic situation of the companies in their index. For example, the S&P 500 and NASDAQ bottomed in February 2016 a month after the rest of the world since the bear market was most associated with cyclical companies and growth stocks that comprise more of US indexes, bottomed a bit later in February.

Recently, global markets peaked in January 2018 and are well advanced in bear markets. American markets have had a series of shakeouts but haven’t until recently exhibited the bear market characteristics of global markets. The US outperformance is due to tax cuts boosting earnings and resulting company stock buy-backs (one $trillion).

The 2015-16 bear market ended with massive Chinese stimulus that turned around commodity markets, especially oil that had been hurting junk bond spreads in America as well as international corporate earnings.

So what’s happening now on the international front that U.S. -centric investors are missing? China has been slowing a bit but the government has responded with mild stimulus in the banking system and personal tax cuts. This has stabilized their market but no end in sight for the global stock market.

The key this time is Europe. Their banking system is imploding. One day last week, 80% of their bank stocks hit a yearly low on the same day. Deutshe Bank is hitting long term lows. This is happening as ECB stimulus is ending and a new, likely German, head of the ECB will be appointed. The finances of France are in bad shape and riots have stopped a gasoline tax. That success by citizens sick of high taxes will embolden future protests of taxes elsewhere. Populist parties are winning support.

The Euro is likely to fall, likely surprisingly hard.

So, my advice is to watch European markets both stock and currency for signs of the global bear market to end. Expect pockets of weakness in the US until they turn around.

One concept that I would like to dispel is the notion that a bear market has to be huge, down 40-50%. Wrong. The vast majority of bear markets are in the 20-35% range. We simply had two big ones in 2000 and 2008 that have distorted investors perception. They were unique, not in any way normal. That’s another reason Americans missed the fact that a bear market actually happened in 2015-2016 even though the Russell 2000 index fell 26% and many cyclical subgroups went down much more.

In fact, after the 1930s extremes, market swings were very benign for decades as the Fed and government were overly cautious.

As I said in a recent post, if there should be a U.S. recession in 2020 because of all the currents signs, there won’t be. Sorry, won’t happen.

That’s because of the presidential election cycle. All the bad U.S. economic/political news will be bulked up and finished by mid-2019. From there, expect a positive momentum into 2020.

Ken appreciate the insight.

Cam, you ready to reverse course on that buy signal?

Very near the stop loss point, but would you want to short an oversold market like this?