Preface: Explaining our market timing models

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Neutral (Last changed from “bullish” on 11-Oct-2023)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

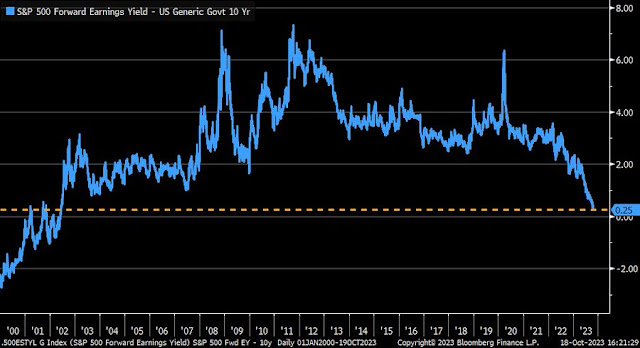

Valuation pressures

Technical analyst Helene Meisler aptly characterized this market last Thursday as “Stocks want to go to the party. But the bonds won’t get in the car.” I agree.

Will these valuation pressures sink stock prices? What about the bond market?

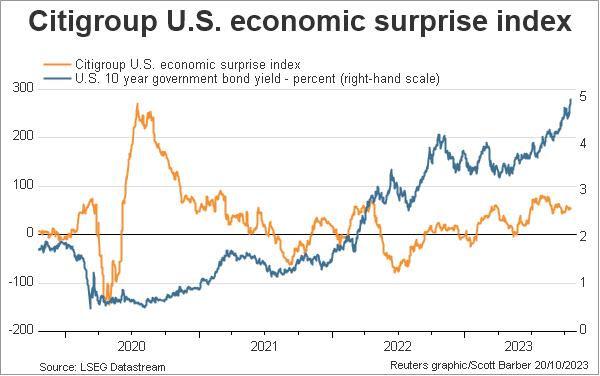

A bond market tantrum

The U.S. Treasury is throwing a tantrum. How much of one? The 10-year yield of Greece (yes, that Greece), which is just returning to an investment grade credit, is trading lower that the 10-year Treasury.

A number of explanations have been advanced for rising bond yields. None of them are especially satisfying.

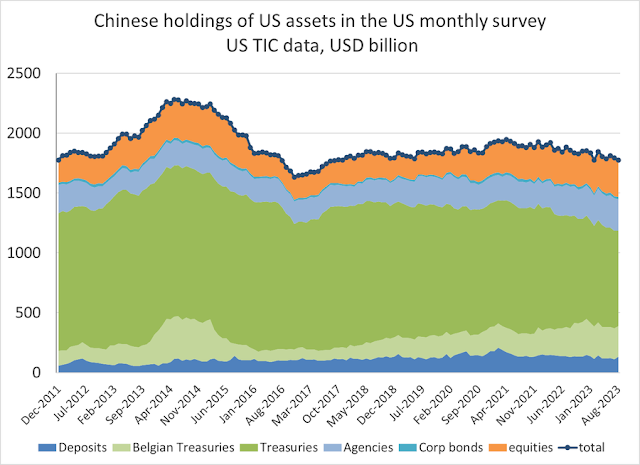

The market became excited last week with the release of the TIC report which showed that China was selling its U.S. holdings. Analysts seized upon this as the reason for the upward pressure on Treasury yields.

The “China is selling story” is less bearish that it sounds. While the narrative of a modest Chinese reduction in Treasury bonds and Agencies is true, Council for Foreign Relations senior fellow Brad Setser found that China’s overall USD holdings after accounting for direct and indirect custodial accounts were broadly stable. Maturing Treasuries were rolled into T-Bills and bank accounts, which is far less ominous from a geopolitical viewpoint.

Fed Chair Jerome Powell’s speech last Thursday took a slight dovish tone and should be supportive of lower yields. Powell opened his speech to the Economic Club of New York on a constructive tone.

Incoming data over recent months show ongoing progress toward both of our dual mandate goals—maximum employment and stable prices.

Indicators of wage growth show a gradual decline toward levels that would be consistent with 2 percent inflation over time.

He also gave a nod to higher bond yields and their effects on monetary policy. Translation: The market is tightening monetary conditions for the Fed. This is as clear a signal a central banker can give that there will be no more rate hikes, at least in the near term.

Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.

From a technical perspective, Treasury prices look washed-out and appear to be ready to bottom. The 20+ Year Treasury ETF (TLT) fell to multi-year lows on enormous volume last week while exhibiting positive divergences on the 14-day RSI and money flow indicator.

Stocks ready to party

Over in the stock market, equities are ready to party. Even though valuation appears to be under some pressure, the reaction from Q3 earnings season is encouraging and estimate revisions are exhibiting positive fundamental momentum.

Jurrien Timmer at Fidelity pointed out that the global earnings cycle is turning up, which is another sign of positive fundamental momentum.

From a technical perspective, the VIX Index has spiked above its upper Bollinger Band, which is a signal of an oversold market as the S&P 500 tests support at its 200 dma.

The analysis of the weekly S&P 500 chart is equally revealing. The index is testing a long-term uptrend that stretches back to the 2020 bottom as its 5-week RSI has become oversold.

Your recent newsletters have been mostly positive about the stock market. What is the trading model looking for before issuing a buy signal?

Market oversold. Bottom Spotting Model nearing a buy signal. May need one final flush.

About a year ago, I opened positions in 1-yr Treasuries and 1-yr CDs. Early in 2023, I opted to reposition into 2-year CDs @ 5% – they will mature in 2025.

My rationale was based on years of thinking if/when the opportunity arose to earn 5% with near zero risk (which is what the company virtual pension plan offers), I would take it. So I did.

Now my dilemma is the possibility of high inflation for an extended period of time.

In anticipation of a new move higher in the market, I could sell the CDs on the secondary market – but currently it would entail accepting about a -1% loss.

Unless we’re OK with buy-and-hold (with the prospect of enduring painful drawdowns), there’s really no way around the problem of market timing.

I should clarify that the CDs are priced in the secondary market at a -% discount to face value. Having opted for monthly interest payments, if I were to sell today I will retain the interest payments collected thus far.

The site experienced some instability and I had to run a restore from backup. Some comments may have been lost.

I apologize for any inconvenience.