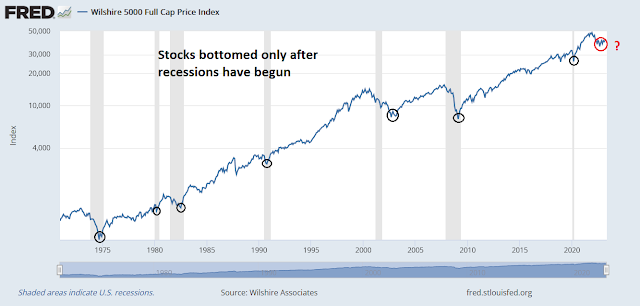

Two weeks ago I highlighted how history shows that the stock market only bottomed after recessions have begun (see

How to spot the stock market bottom) and a recession is likely on the way in H2 2023. If that is the case, U.S. equities should bottom at some point this year and a recovery should be in full swing by 2024.

However, the agenda of G7 Summit in Hiroshima highlights the geopolitical risks to the 2024 recovery and the threat to global growth in 2024 and beyond.

The G7 summit agenda

The G7 leaders of Canada, France, Germany, Italy, Japan, the U.K. and the U.S. will be meeting in Hiroshima, Japan on May 19–21. The White House issued a statement that said the agenda will be the war in Ukraine, global food and climate crises, and “securing inclusive and resilient economic growth”. They will also discuss how they can “deepen their cooperation on critical and emerging technologies, high-quality infrastructure, global health, climate change, maritime domain awareness, and other issues.”

In particular, the Russo-Ukraine war will be a focus of the summit. As the meeting is in Asia, there will undoubtedly be discussions on the geopolitics of managing the relationship with China. The summit communique is expected to address the problem of “Chinese economic coercion”. After the G7, President Joe Biden was scheduled to fly to Australia for a meeting of the Quad, consisting of Australia, India, Japan, and the U.S., which is an informal group focused on regional security but structured as a bulwark against China’s military ambitions in Asia and the Pacific. But Biden was forced to cut short his trip and skip the Quad meeting and return to Washington to focus on the debt ceiling crisis. Nevertheless, the point is clear. China’s adversarial relationship with the West is coming into focus and it will increasingly be a focus for America and her allies.

Keep in mind that the U.S. will hold an election in 2024. Both sides of the aisle agree that China is an adversary and Sino-American relations are becoming more and more chilly. The recent balloon incident is just one of many sources of friction. Directly unrelated to America, Canada recently expelled a Chinese diplomat for interference in the Canadian political process and China expelled a Canadian diplomat in a tit-for-tat retaliation. Both Democrats and Republicans will be positioning themselves on how tough they are on China, and sanctions such as the restrictions on the export of high-end semiconductors are likely to increase in the coming year.

To be sure, investors were encouraged when U.S. National Advisor Jake Sullivan met with senior Chinese diplomat Wang Yi in Vienna to try and defuse tensions. Chinese official media

Global Times described the dialogue as “candid, in-depth, substantive and constructive”. The good news is the lines of communication are still open. The bad news is the U.S. is headed into a political cycle next year that’s potentially toxic for the Sino-American relationship.

From Trade War to Cold War 2.0?

U.S. National Security Advisor Jake Sullivan recently made a speech at the Brookings Institute outlining the Biden Administration’s international economic agenda (link to full transcript). Here are some of the key points he made with respect to American policy on China.

- The U.S. has a robust trade relationship with China. We are not looking for confrontation. We need mature and open lines of communication even as we compete.

- The U.S. is not trying to constrain China’s growth. Its development and that of others is good for the world and stability. But, and this is a big “but”, the U.S. is protecting its critical technologies and its allies are doing the same with targeted measures.

- The U.S. is converging with Europe on derisking but not decoupling.

This is all high-sounding rhetoric, but this is a dual strategy of the combination of a de facto technological blockade of China for national security reasons while trying to reap the benefits of low-tech trade such as the exports of agricultural products and basic materials. In other words, it will be a Cold War 2.0 but not the Soviet-style détente kind of Cold War, but an active effort to confront China in a variety of dimensions.

To reinforce my point, U.S. Treasury Secretary Janet Yellen prioritized national security concerns over economic relationships with China in a

speech on April 20, 2024.

We will secure our national security interests and those of our allies and partners, and we will protect human rights. We will clearly communicate to the PRC our concerns about its behavior. And we will not hesitate to defend our vital interests…We will not compromise on these concerns, even when they force trade-offs with our economic interests.

Tensions are rising. The EU has also proposed imposing sanctions on a number of Chinese companies selling dual-use goods to Russia that can be used for both civilian and military purposes. Viewed in such a context, the implicit message from scheduling a meeting of the Quad after the G7 summit takes on a heightened level of importance.

The Cold War 2.0 animosity isn’t just one-sided.

The Economist documented how the release of a new “Top Gun” style film in China called

Born to Fly has demonized America and normalized the idea of war with the U.S. The plot line focuses on a brash young test pilot in a group of test pilots that’s reminiscent of the American Top Gun films. Because the technological blockade of the West has left China’s military severely handicapped, the test pilots’ task is to test China’s latest generation of fighter jets in order to catch up with an unnamed and aggressive adversary, which is clearly the U.S. in the film. While

Born to Fly depicts a China that’s under siege, a similar jingoistic and militaristic film released in 2017,

Wolf Warrior 2, painted a very different picture of an internationalist China that’s respectful of international norms. The plot of the 2017 film involves a Chinese commando who rescues Chinese medical workers and civilians from a civil conflict in an unknown African country. In a key scene, a Chinese warship is itching to fire missiles against the villains but was forced to wait for clearance from the UNSC before it could fire.

As well, China’s new anti-spy campaign that caught a number of foreign consulting firms in its national security dragnet must have had a chilling effect on Western firms doing business in China. The Beijing government last month passed a new counter-espionage law that expanded the list of activities that could be considered spying. The recent life sentence handed to a 78-year-old American citizen living in Hong Kong for spying is certain to be another irritant between the two countries.

The Trump Administration imposed a series of tariffs on China. When Biden occupied the White House, most of the tariffs have remained in place. Now Biden has gone further to restrict the export of key technologies to China. The Sino-American relationship has deteriorated from a simple trade war to a sanctions war. An election is coming in 2024. Both Democrats and Republicans generally agree that China is more of an adversary than a trade partner. At worst, more sanctions or over-eagerness by U.S. lawmakers to demonstrate support for Taiwan will encourage the decoupling of China from the global economy, the near-shoring of production and the formation of two distinct trade blocs in the world.

Stephen Roach, in a

Project Syndicate essay, outlined what he believes to be “The Economic Costs of America’s Conflict’ with China”. Roach highlighted an

IMF study which “estimates that the formation of a U.S. bloc and a China bloc could reduce global output by as much as 2% over the longer term” and “America will account for a significant share of foregone output”. Roach also pointed out the results of an ECB study which concluded that “geostrategic conflict could boost inflation by as much as 5% in the short run and around 1% over the longer term. Collateral effects on monetary policy and financial stability would follow”.

In other words, stagflation.

Investment implications

The decoupling scenario that I have outlined is highly speculative and difficult to chart without knowing the level of friction that may exist between China and the West, as well as the degree of retaliation each side may undertake. Also, the timing of any sanctions or counter-sanctions is impossible to predict this early in the political cycle. It’s entirely possible that while the effects of Cold War 2.0 come into view in 2024 the effects aren’t felt until 2025 and beyond.

That said, the current picture of global market leadership shows European equities in the lead, while Asia and emerging markets are trading sideways with global stocks, and the U.S. is showing signs that it is starting to roll over on a relative basis.

How might the decoupling of the world into China and U.S. trade blocs and the stagflation scenario play out? While it’s difficult to predict specifics, here are some milestones to watch for:

- New leadership from emerging market countries, especially commodity-producing countries that China pivots to for inputs, such as Brazil and Indonesia.

- A loss of European equity leadership. China is a very large customer of European exports, Germany in particular.

Watch for a possible repeat of the stagflation 1970s in U.S. equities. U.S. stocks traded sideways in a broad trading range for that decade and dismal bond market returns owing to inflationary pressures. The valuation of the S&P 500 is elevated and Shiller CAPE modeled 10-year return is about 5%. With the 10-year Treasury yield at about 3.5%, the equity risk premium is a miniscule 1.5%, which is hardly enough for investors to assume equity risk.

What are the chances of a Cold War 2.0 scenario? It’s far too early to guess at this point, but the political backdrop in Washington suggests that the odds will rise in 2024.

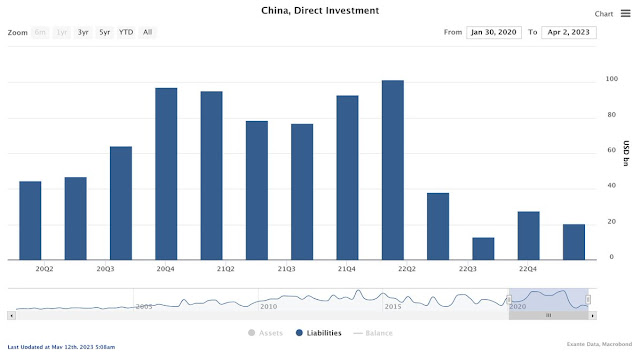

Here is what I am watching for signs of decoupling and Chinese retaliation to any U.S. measures. FDI into China has collapsed. Is this the start of a trend or a temporary aberration?

How will U.S. soybean prices react, especially if China shifts demand to Brazil? Remember the depressed level of soybean prices during the Trump trade war era?

As well, keep an eye on rare earth mining stocks. As much of the rare earths are sourced from China, the imposition of Chinese export controls would have a chilling effect on the semiconductor industry, among others, and crater global trade. It would also set off a scramble for rare earth mining capacity outside of China. Don’t forget to disentangle the returns of rare earth mining stocks from the global materials sector, which is currently in a relative downtrend (bottom panel).

In conclusion, the agenda of the G7 and the subsequent but cancelled meeting of the Quad in Australia highlight the rising risk of a new Cold War 2.0 that decouples China from the West. Tensions are likely to rise in 2024 as U.S. electoral politics will encourage both sides to show how tough they are on China. Under such a scenario, the global economy would be split into a China bloc and a U.S. bloc that resolves in global stagflation, with the U.S. bearing the brunt of the growth reduction.

Super post. Thanks

This confirms my decision to now treat China as uninvestable. In hindsight I should have listened to Cam’s caution towards it.

Its market may go up or down but not with normal ‘Big Picture ‘ dynamics. Those are what I monitor. Geopolitical forces are now at play that make outcomes random.

BTW there was a second TWIST with US Financial sector on Thursday after one two Friday’s ago. It failed on Friday but we might be getting closer to an intermediate low.

I’ve been leery of GOP intentions around the debt ceiling and on Friday out of the blue, McCarthy was told to stop negotiating by the fringe element. Markets fell immediately. Not a good sign for passage of anything before the wheels fall off.

I saw an interesting inflation statistic that highlights Cam’s piece. Over the last decade or two (don’t remember exactly), goods inflation was zero per year on average while services was 3.6% to net out below 2%.

So services were already very inflationary before the latest surge in wages and will likely stay high. The goods inflation as per Cam’s analysis is now heading higher for longer. So combined we have many experts new range of 3-5% up from the 1-3% before. Make sense to me.

This means the bond market might do well temporarily during a recession but fall later when the negative inflation outlook asserts itself.

Very interesting analysis! I’m curious why Tesla and Apple in particular, and investors in those businesses, are not worried about the geopolitical risks. They should be hastening their exits out of China ASAP.

The French luxury goods (LVMH) have done very well. Worth keeping an eye on LVMH among others.

The ETF REMX sounds like a misnomer to me. There are very few RE businesses in there. It mostly consists of lithium miners. Lithium prices and lithium miners have come down a lot in recent months.

I’d keep an eye on $MP, the largest rare earth miner in the Western Hemisphere. If there is a genuine decoupling, it will skyrocket. Right now, it is trading near the 52-week lows.

I don’t get how the US will bear the brunt of the growth reduction. If it is because of Ag exports, I doubt it. If China begins to buy soybeans (and corn) from Brazil, Indonesia and Argentina, you are merely reconfiguring the trade routes. Whoever was buying from these countries will need to find a new seller. That’ll be the US now.

If there is decoupling, the US will accelerate the pace of near or onshoring, and build new factories. That’ll boost the US industrials and materials (in emerging markets, Canada, Australia) in a big way.

After Russia and Ukraine (and some countries because of higher costs of food), Europe has suffered the most from the war. I won’t be surprised if Europe again suffers the most from dwindling exports to China, higher basic material costs, sustained elevated energy costs and migration of humanity.

Many European chemical companies are now building plants in the US owing to low costs of natural gas and electricity.

There is a reason Macron is calling for strategic autonomy.

There is an increasing focus and scrutiny of the nexus of CCP and American business interests. There is now a bipartisan

“Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party’’ that is essentially telling American businesses to be more American.

American polity and business complex are facing new challenges.

Good post to highlight this crucial area of conflict between two superpowers and its potential impacts. Mr. Xi is 70 years old with no heir apparent, could lead to miscalculations.