Mid-week market update: I am publishing this before the market close on Wednesday because I have an appointment just before the close so many of the charts won’t have Wednesday’s closing prices. The market structure continues to be bearish, and I continue to believe that the intermediate-term trend is down. Nevertheless, it’s too obvious to be bearish, so I’m resisting that urge.

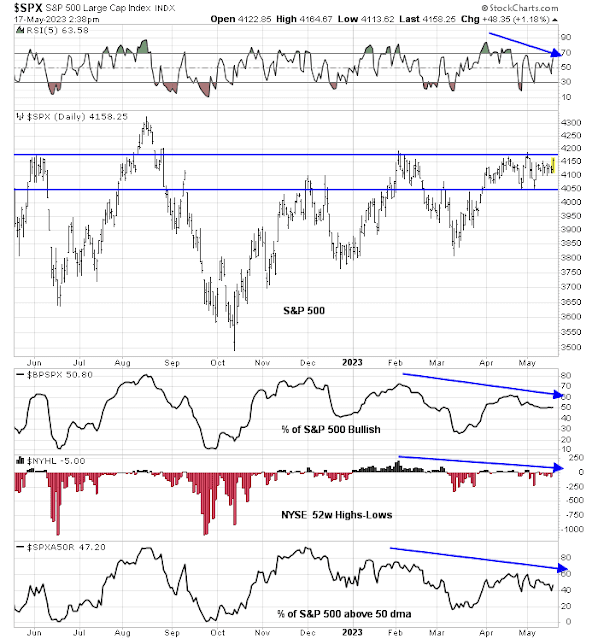

Case in point. Market breadth looks terrible. Even as the S&P 500 remains in a narrow trading range, there are negative divergences everywhere I look.

Bespoke pointed out that leadership has become so narrow that the market capitalization of Apple now exceeds the entire market cap of the Russell 2000.

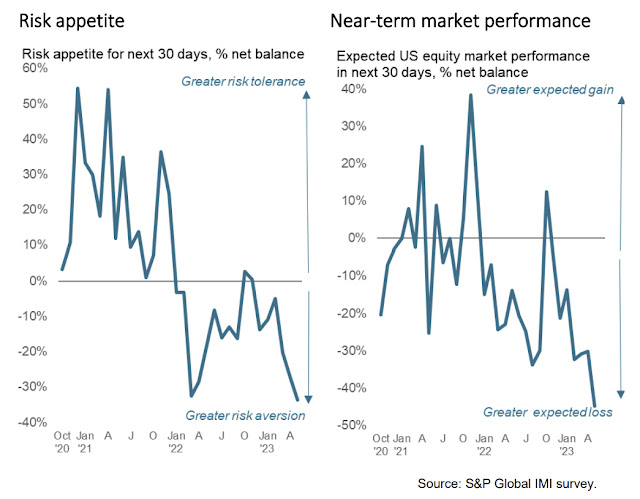

Callum Thomas reported that the latest S&P Global survey of U.S. managers shows excessive levels of cautiousness. He went on to observe that, if history is any guide, these readings should not be interpreted in a contrarian fashion.

For what it’s worth, the latest BAML Global Fund Manager Survey shows a similar level of risk aversion.

What’s the pain trade?

Technical conditions argue for cautious positioning, which I agree with on an intermediate-term basis. The key question for investors is, “If the bear case is so obvious, why aren’t stock prices falling?”

That’s because the pain trade is up, at least in the short run. Here’s why.

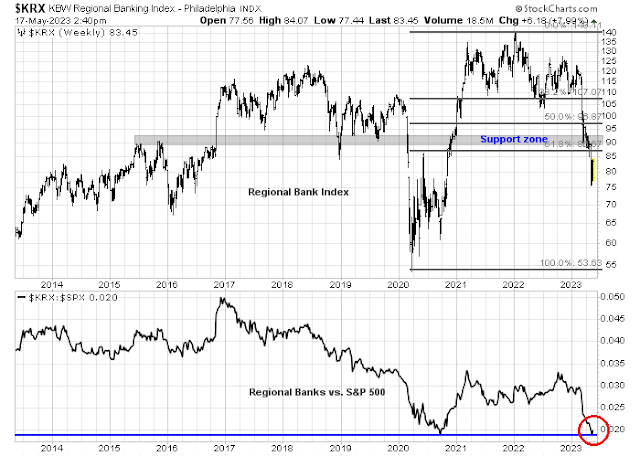

The principal fears that overhang the market are the banking crisis and the debt ceiling impasse. In case you hadn’t noticed, regional banking stocks are finally stabilizing. The KBW Regional Banking Index found some footing at long-term relative support (bottom panel).

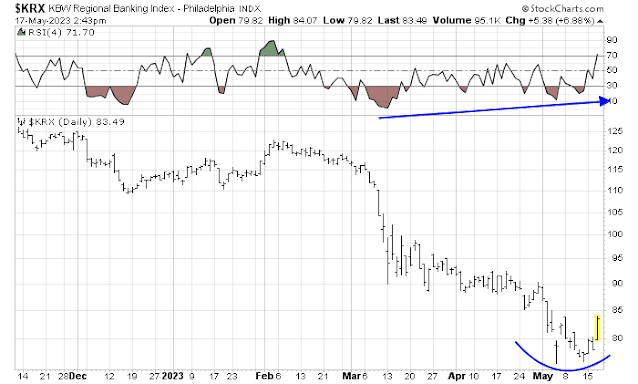

The short-term chart also shows that the index is finding support and attempting to turn up.

With all the bad news, you would think that insiders would be selling. Instead, we are seeing signs of sporadic net insider buying (blue line above red line). This group of “smart investors” have been tactically prescient in the past year in timing short-term bottoms.

Much of the bad news is already in. To be bearish, traders would be betting on the Apocalypse. As for the debt ceiling negotiations, we are in the “trade talks are going very well” phase of waiting for market news. Treasury Secretary Janet Yellen recently reaffirmed her previous estimate of X-Date, the day that the government cannot meet all of its financial obligations, to be as early as June 1. In all likelihood, Washington lawmakers will come to an agreement before the deadline and spark a relief rally in the S&P 500.

My inner trader continues to be bullishly positioned anticipation of the relief rally. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

I was wrong on the Semi’s. NVDA is going to the moon. Luckily, I was not short but flat. Another opportunity cost not being long the Nasdaq and Semi’s. I seriously wonder if the debt ceiling impasse is now priced in. Sell the news?

1. Farrell’s rules would say this super narrow market concentration is not healthy, but it happened before. Despite people’s disbelief market simply marches on. Deemer’s book would say current market positioning is too obviously tilted to the consensus and it usually blows up on the consensus.

2. So we go back to charts and leave all conjectures behind. xlk:spy went up over the 2000 high and became all-time closing high. Bullish, long term.

3. NYSI RSI14 went below 30, a short-term bottoming. Reversal is short-term bullish.

4. Price leads fundamentals, and only price pays.

Multiple asset managers (Northern Trust, JP Morgan, Schwab..) think that markets are either too optimistic about declines in inflation or too pessimistic about economic slowdown to result in interest rate cuts this year. With strong labor markets, Fed will not be in a hurry to do so, historical analogs notwithstanding.

The risk of inflation rising is too great for the Fed.

I agree with Cam’s take on intermediate term but think a debt deal may cause a sell the news event.

It’s been tough trading this market even with options. Keeping size smaller than normal and cutting bait quickly.