It’s stunning how market psychology has changed. In the space of a few months, we’ve swung from “everyone is bullish” to “everyone is bearish”. These results from the BoA Global Fund Manager Survey were done in early June and sentiment has likely deteriorated since then.

The good news is the market is becoming numb to bad news. What if the stock market bottomed and no one actually realized it?

The bears throw a party

The bears are throwing a party and there’s no shortage of bad news. From a global perspective, ASR’s New Orders PMI 12-month diffusion indicator, which is composed of 24 country PMIs, is cratering.

In the US, the yield curve has flattened and the 2s10s spread has slightly inverted, which is usually interpreted as a recession warning.

The June Jobs Report solidified the Fed’s tightening path. Non-Farm Payroll came in ahead of expectations at 372K jobs, and average hourly earnings printed a slight beat at 5.1%. This is a picture of a strong labor market. More ominously was the Diffusion Index. While the diffusion index for total private jobs stayed steady, manufacturing showed some signs of weakness.

Other leading indicators of the jobs market is showing signs of deterioration. Temporary jobs and the quits/layoffs rate from the JOLTS report have led Non-Farm Payroll, and both indicators are rolling over. This, along with the Diffusion Index, is pointing to the conclusion that the Fed is tightening into a slowdown.

I recently pointed out that as the macro backdrop deteriorates, the Q2 earnings season will be the acid test for the equity market. As investors await the start of earnings season, FactSet reported that the rate of negative guidance has been steadily rising, though levels are nowhere near all-time highs.

Across the Atlantic, Germany’s vaunted trade surplus has swung into deficit and dragged the eurozone down with it. The chief culprit has been the high cost of energy in the wake of the Russia-Ukraine war.

The French nationalization of electric utility EDF and the German bailout of Uniper are signs of the stresses appearing in Europe’s energy market. European electricity prices are potentially reaching a credit level event, especially if a bank or hedge fund is caught on the wrong side of electricity price hedges.

The credit default swaps of Credit Suisse skyrocketed last week, though the cause is unrelated to electricity hedging. For the uninitiated, CDS contracts are insurance policies that pay out if a borrower were to default on its debt. Arguably, this could be filed under “it’s so bad it’s good”. Central banks tighten until something breaks that threatens financial stability. Skyrocketing CDS rates are warning signs of cracks appearing in the system.

Over in Asia, Fathom Consulting makes the case that China is already in recession, though activity indicators are not as severe as what was seen during the first COVID Crisis.

Keep an eye on commodity prices, which is also tells the tale of a sputtering Chinese economy. Beijing is considering a sale 1.5 trillion yuan (USD 220B) of local government bonds in the second half of this year to fund infrastructure projects. The success or failure of the latest stimulus program will be reflected in commodities.

Where’s the panic?

As the flood of bearish news continues, investors would expect the markets to take a risk-on tone. But market psychology is becoming increasingly numb to bad news.

For example, consider Fed Funds futures, which is discounting a series of rate hikes into year-end, followed by a pause in early 2023 and rate cuts by next summer. If markets look forward 6-12 months, are they anticipating the recession or the prospect of Fed easing?

The 30-year Treasury yield may be peaking. Historically, peaks in the long bond yield has coincided or slightly preceded Fed rate cycle pauses. These readings are consistent with the expectation of a plateau in the Fed Funds rate in early 2023.

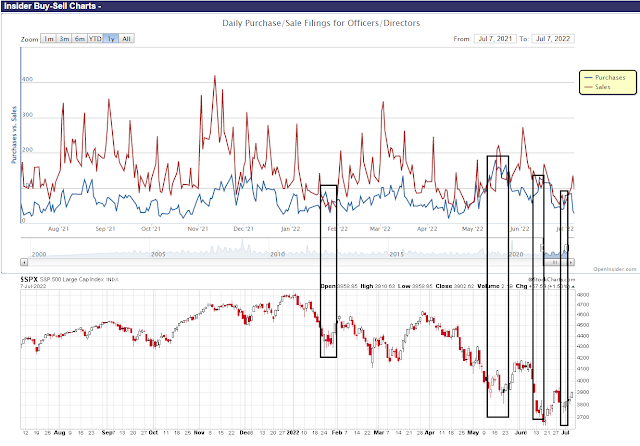

Even as recession fears spike, corporate insiders are stepping up and buying whenever the S&P 500 has weakened. While insider activity isn’t a precise market timing indicator, this group of “smart investors” are signaling that they are willing to look over any recessionary valley.

I previous made the point that the Q2 earnings season could be the acid test for equity prices. As negative guidance rises and growth slows, analysts are likely to cut their earnings estimates, which makes the forward P/E less attractive. While it’s difficult to anticipate how forward 12-month EPS estimates will evolve in the coming weeks, investors can see the relationship between the 10-year Treasury yield and trailing 12-month reported P/E ratio. S&P 500 trailing P/E is roughly in the same range as the last two times the 10-year Treasury yield was at these levels. Downside potential may be limited, especially if the economy either achieves a soft landing or experience a mild recession.

Technical analysis offers some clues about how market psychology has evolved. The percentage of S&P 500 above their 50 dma fell below 5% in mid-June, indicating a panicked extreme, and recycled back above 20%. There have been seven similar episodes in the last 20 years. The market made a V-shaped bottom on two of these occasions. In the other five, these oversold and recoveries were the signs of an initial bottom, followed by a re-test of the old lows within a few months. Only one (2008) saw a significant undercut of the initial low. All of the re-tests were marked by positive RSI divergences. These conditions are consistent with my past observation of a panic low in stock prices (see Why last week may ahve been THE BOTTOM). The odds favor a rally and re-test of the lows, though the historical record indicates that a V-shaped bottom has a probability of about 30%.

The rally and re-test scenario is consistent with the midterm election year seasonal pattern of a strong July followed by weakness and a low in September.

Trend Model

Finally, some readers have asked why the Trend Asset Allocation Model remains in a bearish signal if my analysis has become more constructive on the stock market. The Trend Asset Allocation Model is a model based on the application of trend-following principles on a variety of global stock markets and commodity prices, most of which are in downtrends. Trend following models are designed to spot durable trends and they are by design late at major tops and bottoms. Even if I am right about a market bottom, I don’t expect the Trend Model to turn more positive until a turnaround is more established. That’s a feature, not a bug.

This model has beaten a 60/40 benchmark during this latest bear episode, even though stock and bond prices have fallen together (detailed track record here).

In conclusion, market psychology has taken a sudden shift from bullish to bearish as recession risks have surged, but the stock market has become increasingly numb to bad news. I interpret this to mean that equities are undergoing a bottoming process. Downside risk is limited and upside potential is high, though investors should be prepared for some short-term bumpiness.

Recency bias. No shortage of bulls at the top predicting new highs, and no shortage of bears at the bottom predicting new lows. That’s just the way it is. We may be on the cusp (or even in the midst) of a recession right now – whereas from the market’s vantage point ‘[but] that was yesterday, and yesterday’s gone.’

Is it different this time? ‘Vanity of vanities, all is vanity. There is nothing new under the sun.’

While one swallow does not bring spring to Capistrano I am seeing early green shoots. The Bio-Technology Index has bottomed and has started an uptrend. TSLA has also started trading well. The QQQ may be intriguing here and maybe starting an intermediate rally which can last for a few weeks.

sorry sparrow. Its early in the morning…..

You had it right the first time. Swallows, April 19th I think.

Maybe what causes the real panics is when the unexpected happens. In 2008 when Lehman happened and there was no bailout, and Covid of course nobody expected a pandemic and lockdowns.

Currently, the rate hikes are telegraphed, and breaking something is anticipated and then a pivot.

Maybe we grind along and eventually recover so long as nothing unexpected happens

What happens if cryptos go to zero and this spreads and the Fed does not bail out crypto addled institutions? as an example of unexpected

In Czechia the saying is swallow…. 🙂

Each day that passes in July without negative earnings preannouncements is potentially bullish, it is not uncommon for the market to make a risk-off low shortly before earnings season in fear of negative news – and I believe it shows that the focus right now is on earnings and company guidance and less on macro factors. The market may have “processed” all the macroeconomic news and is now eager to hear how this is going to play out in terms of earnings. What happens in September/October is a different story.

In my opinion, the most likely scenario is Cam’s rally/retest/basing thesis.

The ideal trading scenario would be to sell into a double-digit rally, reposition on a retest of the lows, and continue ad nauseum through a multi-month basing pattern. Not saying it would be easy to do – but that’s why we rely on Cam’s inner trader.

No mention of high inflation in recent posts as if the issue is well on it’s way to getting resolved. Fed has clearly communicated their plan to bring it down. Not to 7 or 6 or 5 but clear and convincing evidence of its path towards 2%. I find it difficult to believe that they will stop and start like in the seventies. Recession is acceptable in the process.

Currently the market believes that a recession will be mild. It maybe happening now or may happen in 2023. Too much macro uncertainty and minimal chances of monetary and fiscal rescue.

So, I believe the risks remain to the down side. However, we can make money with Cam’s inner trader calls.

I find it hard to believe that the lower 2Q earnings and guidance have already been incorporated in the markets.

The USD has been so strong that it will drive the topline and the bottom line for multinationals from overseas to the ditch. With energy prices so high and a weak Euro, the contribution from Europe will be even worse.

China is in recession. Europe will soon be if already not in one. There is likely a rationing of energy in Germany and possibly other countries which will seriously damage the GDP, consumer sentiment and consumer spending in coming quarters. Some energy intensive industries just might be shut off.

To make it worse, there is no light at the end of the tunnel. There is no resolution to either the military or economic war in sight. To quote Ken, there is winter coming, literally, in Europe.

Having said that, there will be bounces along the way, some quite vicious. Hope we can be on the right side of those bounces and dips.

Sanjay, good post.

I believe the earnings may be not that bad but the guidance will be. If CEOs look at Micron as a guide, they will kitchen sink it and lower the expectations bar. How the market reacts is cruciaL. They gave a pass to Micron. Will they do it for 500 companies? I don’t think so.

Supply chain issues at ports and rails are not getting better, let alone at manufacturers. We have a long way to go.

I believe it will take time to get through. More than a quarter or two.

I agree with you. It is the guidance and the market’s reaction to them, that is key here.

Here is a taste of things to come…

UPHEAVAL IN MACEDONIA AND BULGARIA

https://twitter.com/The_Real_Fly/status/1545895488272171011

Protesters broke through the front gate of Sri Lanka’s Central Bank

https://twitter.com/PN_News_EN/status/1545797881344540672

What’s throwing me off this time is that I’m still as cool as a cucumber and never panicky. As of now it’s easier to regurgitate the bullish case than the negatives. Had to exert more conscious effort to recall and explain to myself the negatives. Some watching of CNBC and Bloomberg gave me a sense that commentators are in general mildly bullish. But maybe by chance I consumed all the right analysis so far.