Mid-week market update: You can tell a lot about the tone of a stock market by the way it reacts to news. The 2s10s yield curve just inverted again, which has been a sign of an impending recession. If history is any guide, yield curve inversions have marked major market tops. The exceptions, shown as pink lines, are the instances when the yield curve just missed an inversion and economic growth continued.

Why hasn’t the S&P 500 tanked? The answer seems to be it has become numb to the flood of bad news.

Washed out

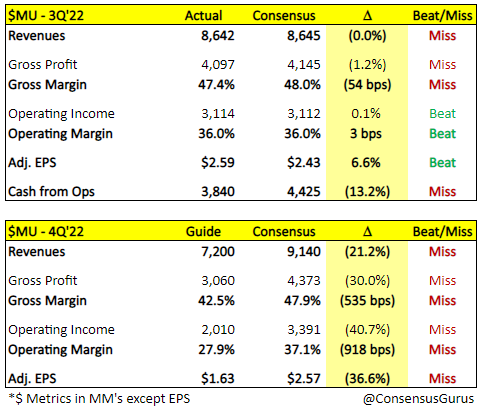

Here’s another example. Micron Technology issued an ugly warning last week. Revenue and earnings guidance was an order of magnitude below consensus expectations.

In more normal times, the stock could have been down 50%. Instead, it fell -3% and it recovered all of the losses this week.

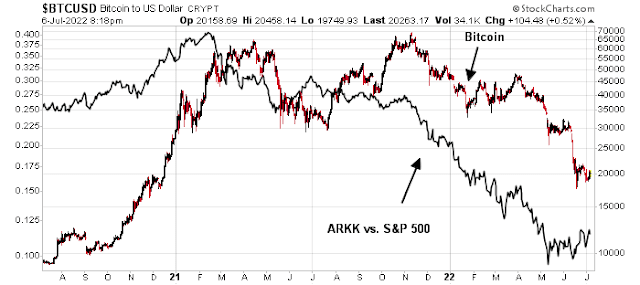

The market’s response on the extreme end of the risk scale is equally illuminating. As more news of platform blowups and withdrawal suspensions emerged from Crypto-Land, Bitcoin should be tanking and trading in the single-thousand level, if not even lower. Instead, it has steadied at around 20,000. As well, the ARK Innovation ETF (ARKK) is exhibiting positive relative strength and beginning to outperform the S&P 500.

Goldman’s sector valuation found that defensive sectors were all in the upper half of relative valuations, which is a sign that the risk-off trade is becoming increasingly crowded.

The market is washed-out and risk appetite is returning.

Upside potential

If the market is undergoing a relief rally, what’s the upside potential? A number of low sample size studies offer some clues.

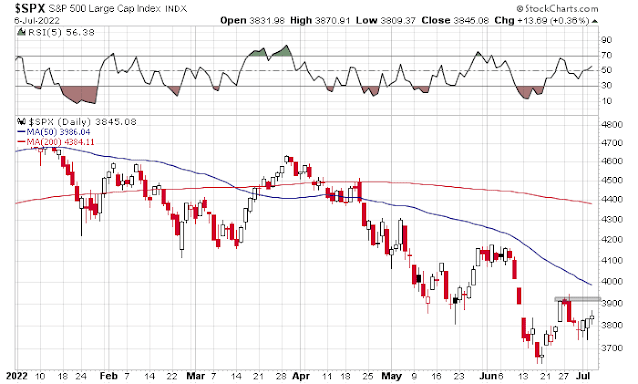

Yesterday’s market action was particularly impressive. The S&P 500 opened up -2% but managed to recover and claw its way to a slightly positive close.

Steve Deppe conducted a study that found some impressive forward returns but warned that the sample size was small (n=7).

Rob Hanna at

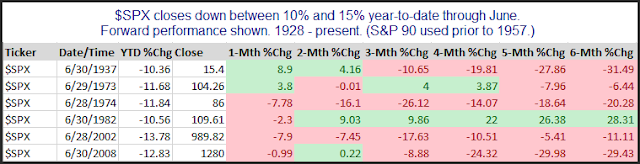

Quantifable Edges studied markets with -15% returns in the first half of the year..These markets also experienced strong positive forward returns, though the sample size is even smaller (n=5) and some of the episodes went back to the 1930’s.

He warned that the results after H1 years that fell between -10% and -15% were uneven.

I conclude from this that historical experiences can only offer a rough guide because of the low sample size of the studies. While market psychology is washed-out and the market is undergoing a relief rally, traders should exercise some caution and refrain from becoming overly greedy. The S&P 500 will see resistance in the 3900-3940 zone. Above that is secondary resistance offered by the 50 dma. If the index reaches those levels, traders should take some profits.

As the trader’s adage goes, “Bulls make money, bears make money, pigs just get slaughtered.”

Perhaps it is because everyone knows the Fed will pivot, only when?

We are so indebted that the only acceptable path is more money and lower rates, until things break totally and something new after a horrible phase comes about, so they push that away as long as they can.

What will we do about Europe and it’s energy crisis?

We are not waiting for Godot but Pivot lol.

Of course, if there is no pivot and at some point we get a real panic look out below! Then we will get a pivot…too late of course…that’s why we have the Fed

Oil is down enough it should help some.

July is traditionally a good month, however, how much of earnings deceleration is already baked in. I am afraid that once the disappointing earnings hit the tape the brief rally we are experiencing will fizzle and the end of July will start the descent to the October lows in the 3400 range.

Upping exposure in the premarket session from 75% to 80%.

Looks as if we have experienced a series of lower highs and lower lows. Classic bear market! Is this a, if not the bottom?

Another downside fake-out. The market continues to take out weak hands on its way higher.