I am not always right and financial markets are facing many uncertainties, but last week’s market action may have marked the bottom of this market cycle.

It isn’t just the extreme level of the BoA Bull & Bear Indicator. though that is one piece of the puzzle. This indicator turned prematurely bullish by falling below 2 in March, but readings have declined to the extraordinarily low level of 0.

Marketwatch reported that the index last reached 0 only on a handful of occasions: in August 2002, July 2008, September 2011, September 2015, January 2016, and March 2020.

Extreme technical wipeouts

Many technical conditions are at levels seen at past major market lows.

- NYSE 52-week lows reached levels last seen during the GFC bear market. Readings were higher than the COVID Crash, the 2011 Greek Crisis, and the 2002 post-NASDAQ Bubble low.

- The ratio of S&P 500 stocks above their 50 dma to S&P 500 stocks above their 150 dma, which is an intermediate-term oscillator, reach levels last seen during the COVID Crash, the 2011 Greek Crisis, the GFC, and the 2002 lows.

Other breadth indicators are also signaling oversold extremes seen at major market bottoms.

I previously highlighted the “good overbought” condition exhibited by the market based on the percentage of S&P 500 stocks above their 200 dma rising above 90% in mid-2020 after the COVID Crash (top panel, shaded areas). Such “good overbought” readings are indicators of strong price momentum that allow stock prices to advance steadily. Momentum faltered in mid-2021, which was an early sign of a market top. Past episodes have resolved in market bottoms when the percentage of S&P 500 above their 50 dma falls below 20% (bottom panel). This indicator reached 2% last week, which is an extreme level indicative of stock market panic. As well, the percentage of S&P 500 above their 200 dma fell to 12.8% last week, which is another extreme reading.

The BoA Global Fund Manager Survey showed that institutional managers have de-risked to levels comparable to the GFC.

From a technical and sentiment perspective, these are all signs of the blinding fear and capitulation seen at major market bottoms. The only glaring exception was 2008, but 2008 saw a major financial crisis that shook the global banking system. This is not 2008. Today, we have coordinated global central bank tightening that raises recession risk, but no signs of a financial collapse. Arguably, the crypto craze served a useful purpose inasmuch it channeled many of the excesses into non-systematically important parts of the economy.

Valuation support

I recently wrote that the S&P 500 forward P/E is 15.2, which represents roughly fair value (see

The Fed braces for a harder landing), but markets often overshoot fair value when it panics. However, other pockets of the stock market appear to offer compelling value.

The S&P 600 is trading at a forward P/E of 11, which is a level last seen during the GFC. The S&P 600 represents a better way of measuring valuation for small-cap stocks than the Russell 2000. The S&P 600 has far fewer unprofitable small caps than the Russell 2000 because of the stricter profitability inclusion criteria of S&P. Consistent with my observations about the number of NYSE 52-week lows, these readings exceed the market bottoms seen during the COVID Crash, the 2011 Greek Crisis, and the 2002 post-NASDAQ Bubble lows.

Tobias Carlisle of Acquirer Funds recently screened for companies trading below a trailing EV/EBIT ratio of 3 in the Russell 3000. He found 905, which is an all-time high.

Another indirect signal of value in the stock market is insider buying. Insiders tend not to be short-term traders in their own stocks. They prefer to focus on capitalizing on the lower long-term capital gain tax rate by holding their positions for a year or more. It is therefore constructive that this group of “smart investors” believe that the valuation of their companies relative to publicly available fundamentals are compelling enough that purchases outnumbered sales during the latest downdrafts.

A gift horse?

In short, both technical and valuation conditions indicate that the market gods are offering a gift to equity investors. But should investors look the gift horse in the mouth, just as the defenders of Troy should have?

The key risk to the market bottom narrative is a recession that sends earnings estimates skidding.

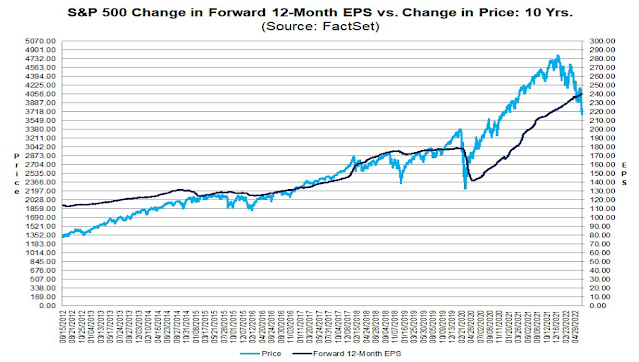

FactSet reports that bottom-up forward 12-month EPS estimates are still rising in the face of an above average level of negative earnings guidance.

More S&P 500 companies have issued negative EPS guidance for Q2 2022 compared to recent quarters as well. At this point in time, 103 companies in the index have issued EPS guidance for Q2 2022, Of these 103 companies, 72 have issued negative EPS guidance and 31 have issued positive EPS guidance. This is the highest number of S&P 500 companies issuing negative EPS guidance for a quarter since Q4 2019 (73). The percentage of companies issuing negative EPS guidance for Q2 2022 is 70% (72 out of 103), which is above the 5-year average of 60% and above the 10-year average of 67%.

Furthermore, the number of buy ratings remains highly elevated.

Recession risk is rising. New Deal democrat, who maintains a discipline by monitoring a series of coincident, short-leading, and long-leading indicators, has documented the deterioration of his long-leading indicators for several months. His

latest update shows that the weakness is spreading to his short-leading indicators, which are designed to spot economic weakness six months ahead, indicating a possible downturn that begins in Q1.

The

Wall Street Journal conducts a regular poll of economists to determine the probability of recession within 12 months. The latest reading is 44%, which is a level seen during or on the brink of actual recessions.

Recessions are normally thought of as two consecutive quarters of negative real GDP growth. Q1 real GDP was already negative, though the figures are distorted by inventory adjustments and final demand told a stronger story. The Atlanta Fed’s Q2 nowcast is now zero, which raises the risk of two consecutive quarters of negative GDP growth.

For the record, the National Bureau of Economic Research (NBER) is the official dater of recessions. It defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months” and focuses on “three criteria—depth, diffusion, and duration”. This is a slightly more complicated metric that the simple two consecutive quarters of negative real GDP growth.

Wait for the retest

I resolve the bull and bear debate this way. The base case scenario is a double or triple bottom. Extreme oversold conditions were observed during past market panics in 2002, 2008, and 2011. The S&P 500 rallied and went on to retest the old lows several weeks or months later.

The lack of earnings downgrades is troubling in the face of growing recession risk. While the market recently went bonkers over the hot CPI print, a little-noticed effect of CPI is it tends to lag PCE, which is the Fed’s preferred inflation metric. That’s because the higher weight of shelter in CPI and rents and property prices, which affect rent, are lagging indicators. Historically, headline CPI-PCE (blue line) has risen strongly ahead of recessions. Both headline and core PCE appear to be topping out, which may foreshadow less aggressive Fed tightening.

Here is a closer look at core PCE, which peaked in February. The combination of strong CPI and tame PPI has led to a tamer May core PCE estimate.

How will the market react if earnings estimates decline while the Fed pivots to an easier monetary policy? There are too many moving parts to tell how this all plays out.

If there is a recession, it should be mild because of a lack of excessive leverage. In the mild recessions of 1990 and 2000-2002, forward EPS estimates fell by 10-15%. Keep in mind, however, that actual earnings didn’t fall in the 1970’s in nominal terms. It’s therefore possible during the current episode of elevated inflation that EPS estimates stay flat while interest rates decline.

One possible template for current market and economic conditions is the double-dip recession. GDP growth turns negative in Q2, which raises concerns that the economy has entered a recession, though it doesn’t get confirmed by NBER. Earnings estimates continue to rise, inflation begins to ease and so do Fed Funds expectations. The stock market rallies, only to meet the actual recession which begins in early 2023, which is the time frame forecast by many top-down models.

Double-dip recessions are rare. The last one occurred in 1980-81. The Dow first bottomed in April 1980 and rallied into early 1981 by breaking through the psychologically important 1,000 mark. It began a bear market that ended in August 1982 when the Fed eased in response to the Mexican Peso Crisis which threatened the US banking system.

In conclusion, technical and valuation conditions are consistent with past major panic lows. The key risk is a lack of earnings downgrades in the face of growing recession risk.

Despite the strong technical evidence of a panic bottom, I am taking a more nuanced view. My base case scenario calls for a double or multiple bottoms in stock prices and a possible double-dip recession. History doesn’t repeat itself, but rhymes. Q2 earnings season will prove to be a key test for market expectations. Stay tuned.

Hi Cam,

Is your inner investor doing anything based on this information?

Thanks

My inner investor is nibbling away at some positions.

Cam, I haven’t been here for quite a while but I have a couple concerns about the conclusions you draw from the data in this post and I think your responses would benefit many here who, like me, have been in cash for months and are concerned about moving back into the market too soon.

Although the data you present certainly fits the what you (we) look for to call a bottom but something doesn’t seem quite right to me to make that call yet. Could you examine the two concerns below and comment? Thanks.

1. I believe we are in or heading to recession because the Fed isn’t going to relent on Fed Funds increases, QT and Biden isn’t going to budge from his plan to keep energy prices sky hight. So, in light of that, I can’t quite get my head around your earnings and P/E analysis that earning and P/E are not going to contract. We haven’t seen any forward earnings projections, YET, that show contraction. But if you look at the 3rd chart down on this page you will see that earnings have contracted at almost every major and minor economic disruption. And this chart shows that the market doesn’t bottom until well after earnings contractions have started. https://stockcharts.com/public/3421479/tenpp/2

2. My second concern is the Fed Funds rate. In every past period where the Fed went on a period of Fed Funds increases the market didn’t bottom until AFTER the Fed Funds had peaked. We all know that there are at least 3 and probably more rate hikes coming from the Fed in this cycle. The chart here shows that never has the market bottomed until after the Fed has started dropping rates. https://en.macromicro.me/collections/9/us-market-relative/91/interest-rate-sp500

Thanks in advance for your analysis.

I agree with you, but as I pointed out, we are on the verge of a tame inflation surprise. Also don’t be surprised if NFP surprises to the downside.

Cam, I guess my only question boils down to something simple. Supply chains can improve but everything we buy is effected by the price of oil.

So, can we really expect much of a tame inflation surprise with oil over $100?

Thanks for mentioning some good milestones to watch out for. I’m also wondering about oil and gas prices and if they are the ultimate arbiter of when the market bottoms.

Welcome back, Wally. The rest of the gang is still here, where you left. 🙂

Maybe this chart shows better how often earnings contract although it isn’t paired against the S&P 500 chart. https://www.multpl.com/s-p-500-earnings

Thanks for this piece Cam. I am nervously very high cash right now for an intermediate term investor. Not sure how long the bottoming process will take but in terms of the duration and magnitude of the selloff a meaningful rally, perhaps even rip your face off, seems due. Also interesting our discussion threads have become increasingly negative, myself included, perhaps a sentiment indicator on its own!

Major market bottoms don’t happen on triple witching and rarely happens in June, at least not after the CBOE was established in 1973. Triple witching options expiration has a way of making the market look more bullish than it is.

The market action last Friday had little to do with my call. It was the two instances of “pukes” were signs of capitulation. TRIN spiked to 5 on Monday, indicating price-insensitive selling. Then we had the SNB surprise on Thursday and another big down day with anoterh day of off-the-charts negative breadth readings.

Classic signs of panic, and twice in a single week.

HOW DO YOU MAKE MONEY IN MARKETS?

Every successful investor/trader knows that in Bull Markets we are supposed to buy corrections (pull backs) which are against the primary trend. In Bear Markets every sharp rally which reaches an area of resistance should be sold. Now days investor/traders can buy inverse ETFs to participate in markets going down.

The fact is that there have two major trends in the market which have been great money making opportunities. We have had a great bull market in Oil and a bear market in the S&P and Nasdaq. The obsession to call the bottom has made most investors and traders miss the trends. In fact, like Cam have fought the trend taking positions against the primary trend -buying in oversold markets which fizzle out.

I am sure like a broken clock at some point one will be right in the calling the turn. In the meantime 6 months

have passed with nothing to show but trading losses without the discipline of stops or loss control.

One of the more reliable signs of a true reversal might be the extent to which the market disallows easy boarding. Since most 401(k) plans are limited to a handful of mutual funds that trade only end-of-day, it will be the closing price(s) over the next few days that provide the kind of information I’m looking for.

Ideally, we might see a +5% close today – that’s enough to dissuade 90% of sidelined investors from chasing – followed by positive closes again on Wednesday and Thursday. A partial retrace on Friday to set a bear trap which then closes with a spike up in prices over the last thirty minutes. Just thinking aloud.

Cam

This is an interesting call, based purely on technicals, sentiment but not on macro.

Macro concerns of high inflation and the Fed trying to break the back of demand and bullish sentiment does not appear to be consistent with what you have posited. Bear market bottoms usually inflict a lot of pain, much more than what we have so far, IMHO. I just don’t see Joe six pack cashing out so far. Perhaps this time is different. May be Joe six pack is holding on and adding to positions (we have seen this in recent years).

We still have not seen VIX cranking higher, past 38, into the 40s and 50s and beyond, and may be, this is different this time (?), because everyone, who needs to hedge, is already hedged?

If you are suggesting a tame inflation picture, that surely IS a mega call on macro. Yes, core PCE has rolled over, but it probably requires a few more reads to decline significantly; supply chains may help.

Earnings is another wild card, with lot of macro analysts expecting a cut back in Q2 earnings, here, soon, mid July.

Having lived through all the recent bear markets, I agree with you that we may go through a series of retests of the 3700 level, perhaps, all the way into fall this year and March next year. March has a weird tendency that marks bear bottoms.

As you can see, lot of readers are skeptical of your call, but that is a tell in of itself, that you are making the correct call.

Thanks Cam for your inner investor feedback.

My work corner of the macro world is IT data center gear – network, servers, storage, etc. what we are seeing is customers buying ahead of demand (into 2023) to get ahead of inflation and supply chain. C level folks, at least in our customers, seem to believe this will continue for a while by making these large capital investments. On the upside, this also looks to confirm the belief that any recession will be mild, otherwise they would be cutting spending. A soft landing? We’ll see.

For an alternative viewpoint, check out midyear market update (6/18/2022) from Dan Niles, Satori Fund. Packed with great info / analysis.

Note he is quite bearish.

https://www.danniles.com/articles

Dan does see major bear market rallies on its way to the bottom in 2023.

Cam,

This is a bold call indeed assuming you are expecting a rally that lasts beyond a simple bear market rally.

Just curious! What changed in-between your Sunday and Monday posts that caused you to call The Bottom on Sunday? Did you see some more data?

Uncanny how today 06/21/22 is mirroring the 05/20/22 options expiration and the rally on May 23. Beware that the 5/23 rally had a gap fill the following morning on 5/24 back to the 5/20 close.

Is this what we have to look forward to monthly? The bears covered by the monthly options expiration, the bulls manage to run it up 5 to 8 % after OE and then lose about 13 % following the short run up.

And don’t forget the low volume, the SPX volume looks like it will be lower than that of 5/23/22. If this is near the bottom, shouldn’t there be a flood of volume to accompany the +2% gain?

https://twitter.com/WalterDeemer/status/1539264715305762816

Another perspective from LPL Financial juxtaposed to Dan Niles views using the same historical data. Interesting that they have 62% equity allocation.

Key factor is inflation and how it behave in the coming days and months. UK reported another record headline number though they are more affected by the war. In the meantime, markets are in a mood to sell even a 2% rally.

Cam may be right. But recency bias doesn’t allow us to accept it at the moment.

I am working on the premise ( for now) that we have a recession in Q1 ‘23. Probably milder variety. Stocks go down another 10% from peak putting us around 3200. Start nibbling at 3500. Till then enjoy the summer. This too shall pass.

https://www.lpl.com/newsroom/read/weekly-market-commentary-bear-market-q-and-a.html?utm_medium=social-organic&utm_source=twitter&utm_campaign=newsroom&utm_content=market-signals&utm_term=bear-market-q-and-a&utm_type=link&utm_postid=b4682