I have pointed out before that the last time the 10-year Treasury yield was at these levels, the S&P 500 was trading at a forward P/E of 14-16. The current forward P/E is 16.8, which is slightly above that range. In order for stock prices to rise, at least one of two things has to happen. Either the discount rate has to fall, which expands P/E ratios, or earnings have to rise.

Since global central bankers are engaged in a tightening cycle, the prospect of falling rates is off the table. In that case, what’s the outlook for earnings?

Excessive optimism

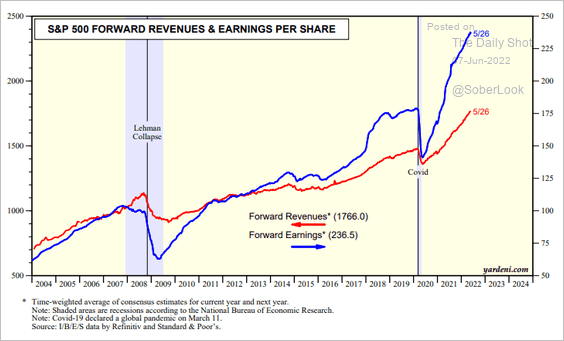

The Daily Shot recently featured an analysis of S&P 500 consensus forward 12-month sales and EPS estimates. While both are rising, the rate of increase in forward EPS is steeper than sales, indicating margin expansion. While top-down strategists are starting to reduce their S&P 500 EPS estimates, bottom-up analysts are still raising. This analysis begs the question of whether Wall Street analysts are being excessively optimistic about the outlook for individual companies.

Ian Hartnett of Absolute Strategy Research pointed out that CEO confidence is plunging. Conditions are consistent with past earnings recessions. JPMorgan CEO Jamie Dimon recently warned about an impending hurricane:

I said there’s storm clouds, they’re big storm clouds, they’re — it’s a hurricane It’s, we — right now it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy or — yes, Sandy or Andrew, or something like that.

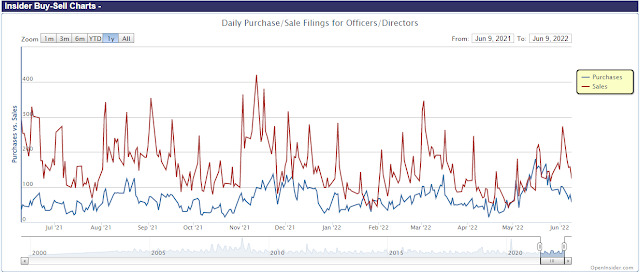

Staying with the storm analogy, there is a silver lining in the dark clouds. Despite the plunge in CEO confidence, insiders stepped up their buying when the S&P 500 tested its May lows. These is a constructive sign from a group of “smart investors” that the outlook isn’t necessarily disastrous.

Main Street turns grumpy

The dour mood is becoming evident on Main Street. An

Economist/YouGov poll found a majority of Republicans and a plurality of Democrats believe the economy is in an economic recession.

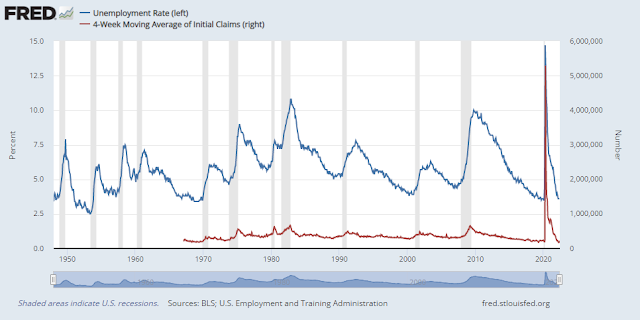

As a reminder, recessions are officially determined by NBER Business Cycle Dating Committee, based on a definition that “emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months”. Even if you use the definition of two consecutive quarters of negative GDP growth, it’s difficult to square the recession view with the unemployment rate at 3.6%, though initial jobless claims have bottomed and begun to rise.

I interpret these conditions to mean that most people don’t know the specific definition of “recession”. They are probably using the term to describe their general feeling about the economy. In particular, inflation is biting into household budgets. The Economist/YouGov poll found that gasoline prices are becoming a problem for most people.

These conditions lend support to the Fed’s determination to maintain a tight monetary policy to fight inflation, especially in the wake of the hot May CPI report. These kinds of survey results can easily spark a wage-price spiral where the Fed loses control of inflationary expectations.

Recession ahead?

With the Fed intent on raising rates to fight inflation, what are the odds of a recession?

From a central banker’s perspective, real M2 money growth had been rising at a 3-4% rate until the COVID Crisis pushed liquidity well above trend. The Fed’s challenge is to return real M2 to trend growth, either hold real M2 growth flat until 2025 or sharply reducq liquidity over the next 12-18 months, which would be highly recessionary.

Here is the latest update from

New Deal democrat, who monitors the health of the economy with a series of coincident, short-leading, and long-leading indicators. Among the long-leading indicators, which are designed to spot economic weakness a year ahead, four had positive components, two neutral, and eight negative. The score for the short-leading indicators was more balanced at 6-1-7, while the coincident indicator score was 2-5-4.

We have an objectively weak, and weakening, economy. At this point, I would suggest especially watching the consumer coincident indicators – restaurant reservations (one of the first, and easiest things for consumes to cut), and Redbook consumer spending. If these turn significantly negative, then trouble is very close. But I continue to think, based on the timing of the turn in the long leading indicators, that the danger of an outright downturn is next year rather than this.

The outlook for 2023 is extremely wobbly. As the Fed raises rates in order to destroy demand, it’s difficult to see how the economy can sidestep a recession in Q1 or Q2.

Here’s the good news. Investors are often afflicted with recency bias. When they think “recession”, they think either 2008, which was the Great Financial Crisis, or 2020, which was rescued by unprecedented levels of fiscal and monetary stimulus that are unlikely to be repeated.

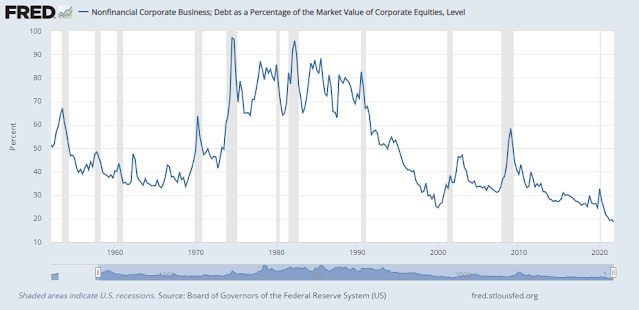

This time is different. The US economy is faced with minimal financial crisis risk. Corporate balance sheets are strong.

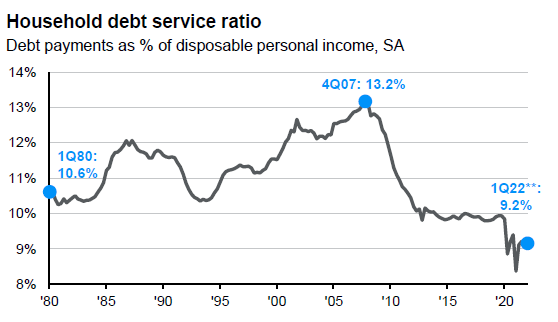

Household debt ratios are also under control.

Instead, the economy is faced with a plain vanilla inventory recession. In the absence of excessive leverage, any slowdown will see greater resilience. A reasonable template would be the post-NASDAQ peak recession. While equity prices cratered because of excess valuation, the rise in the unemployment rate was relatively tame by historical standards.

That doesn’t mean, however, that a financial crisis is off the table. Notwithstanding the usual risk of a currency crisis from a strong USD that sparks either an EM crisis or excessive JPY weakness that sets off a round of competitive currency devaluation in Asia, the risk from the developed economies come from countries with property market bubbles, namely Sweden, Canada, Australia, Norway, and New Zealand (SCANNZ), where housing prices have surged far more than rents and incomes to create affordability problems.

Investment implications

In conclusion, the equity market is currently suffering from a non-recessionary slump. Valuations are slightly above fair value and bottom-up EPS estimates are rising. In order for prices to advance, one of two things need to happen. Either earnings need to continue growing, or the cost of capital, otherwise known as interest rates, need to fall.

Earnings can only grow if the economy avoids a recession, which is a difficult task in light of the Fed’s tightening bias. If the 10-year Treasury yield were to decline, it would be the bond market’s signal of a weakening economy, which is negative for the earnings outlook.

I have made the point before that valuations don’t matter much in a bull market, but define downside risk in a bear market. This is a difficult economic environment for US equity investors. It’s time to consider non-US markets, whose forward P/E ratios are well below the S&P 500, as a way to mitigate downside risk and enhance upside potential when the turn actually arrives.

Just be aware of SCANNZ markets as a source of tail-risk.

Cam,

“A reasonable template would be the post-NASDAQ peak recession”.

Which year are you referring to?

“Just be aware of SCANNZ markets as a source of tail-risk”.

Not sure I full understand the above. These are small markets. Would a fall out of the housing price collapse in these countries have significant impact in non-US equity valuations or global economy??

Thanks.

The recession of 2000-2002.

Remember I am discussing the economic recession, not the stock market.

Thanks. Seems like what you are referring to is specific to these smaller countries, that are on the hook for a housing related pull back for a long time coming. The Y2K correction was a generational bust. In the current cycle it appears we are headed to a fairly significant further downside, from what you have written (this is consistent with your earlier message).

Looking at these two charts of U.S. Fed and European ECB rate futures has me expecting a shockingly swift negative impact on economies and stocks. The last two weeks surge to new highs is EXTREMELY negative.

https://refini.tv/3wAky7q

https://refini.tv/3LgDZsz

The stock market is now a dangerous war zone. My advice is this surge in Central Bank rates is like hearing incoming artillery shells. Experienced soldiers dive into a foxhole. The new recruits look around wondering what’s going on. New guys don’t last long.

Lol.

My wife and I were discussing the entire concept of market timing on our way back from dinner last night. I’m a proponent of timing, as I know myself well enough to know that holding through steep declines isn’t my thing.

But here’s the thing. I have always underperformed the market – that’s a price I’m willing to pay for avoiding discomfort. In contrast, my late Dad never once tried to time the market – and departed this world with a portfolio that outperformed mine for >30 years. So I would say that whether one views the market as a war zone is highly dependent on one’s approach to the stock market. The average buy-and-hold investor likely outperforms the AVERAGE market timer – just as the market itself outperforms most actively-managed funds.

I think you are absolutely right RX but few market timers would admit to it! I don’t have the stomach to buy and hold except for a core group of income producing assets. At the first sign of trouble I am out.

That’s why I follow Cam. He’s very transparent AND he outperforms the market.

Also something to do with portfolio size and tax situation and personal style. Tiger funds are very famous in Wall St. They average 16% for the last 20 years but have been down about 50% so far this year. ARK funds are now source of jokes but there is a chance they might be big winners again, like Tiger funds.

Hi Ken, how do you read these 2 charts, do you mind adding a bit colors. It seems the winter will be long? Thank you!

The salient aspect of this market is that if an investor had hedged or shorted and held that small short portion (5 to 10% of portfolio) in the indices for about 8 days whenever the indices are overbot in 2022, they could be up 53% in the shorts as in the following chart, with very little drawdown and more than 90% trades profitable. Not bragging because more than once this trader has been on the wrong side and got burned in the leveraged long position. Not an advice, just an observation – the strategy covered the shorts on Friday.

https://ibi.sandisk.com/action/share/ddc356bb-e58d-4a68-875b-23ac2a9c4e56

The rallies have been relatively tame so far, I would have also expected more short-term pain for the bears, but the case for more downside is simply too obvious. The prudent short-seller should have covered on Friday, that’s what I did as well, this doesn’t mean the market can’t go much lower (it should)

Signs of a more active European role in the Ukraine war (and increased risk of escalation) – Scholz visiting Kiev and Macron mulling some kind of intervention to open up maritime trade routes through the Black Sea.

Indeed risk is rising. Last night I had a report coming in. It is about internal situations in Russia. Instability is brewing, especially in the Ural region. The conclusion is that something like 1918-1920 civil war is not inconceivable if current trajectory is kept on course. None of us subscribers here has witnessed last great war, WW2. Would you like to see another major and very complicated conflict? I don’t want to.

That said, history has proven that a country like Russia will eventually break into pieces. Think, before Russia, there is Ottoman. Multiethnic with conflicting interests and historical complexes. Always remember dS>0 ==> maximum randomness.

My perception is that it is starting to dawn on European leaders that the current sanctions are still not enough and right now everything is playing into Putin’s hands letting this drag on for much longer until the inflationary pressures become more painful for the western world than the sanctions are for Russia.

The Ottoman empire persisted for quite some time and the Europeans had to beat them on the battlefield, colonialism and the rapid expansion of global trade (led by western nations) also played a key role in eventually gaining an economic advantage over the Ottoman empire, we found ways to trade around them. I’m not sure if the same kind of dynamics are in play right now, we are trying to cut them out of global trade, but they seem to tighten their grip on several key ressources while the western world is not expanding global control over those ressources at the same time.

https://mobile.twitter.com/JominiW/status/1535446558484877312

“There is a growing unevenness to support of Ukraine. Britain, Poland, Denmark, Czech Republic, Slovakia, and the Baltic States are the most supportive while Germany, France, Italy, & Hungary voice support but show little by way of their actions.”

“Russia has a hunger plan. Vladimir Putin is preparing to starve much of the developing world as the next stage in his war in Europe.”

https://twitter.com/timothydsnyder/status/1535617894045868033