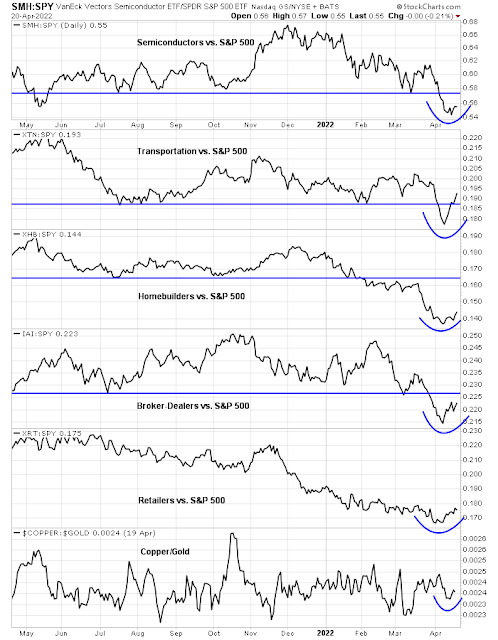

Mid-week market update: Cyclical industries have caught a bid in the last week. That’s not a big surprise as they have been badly clobbered relative to the market. Transportation stocks exhibited impressive strength as they regained relative support turned resistance level. However, the relative performance of all of the other industries was either below relative support or in a relative downtrend (retailers). The cyclically sensitive copper/gold ratio also rebounded, but in the context of a broad sideways pattern (bottom panel).

Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn’t happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower.

With inflationary pressures running hot, the S&P 500 is about -7% from its all-time highs. Credit spreads have widened a little, but stress levels are still low. Expect the Fed to tighten further and which will snuff out any cyclical rebound.

Explaining the rally

In short, the macro backdrop argues for further stock market weakness. The recent market advance can be attributed to a combination of seasonality and negative sentiment.

AAII bullish sentiment collapsed last week and readings fell to levels not seen since the Greek Crisis of 2011. These conditions were confirmed by the latest release of the Investors Intelligence survey, which also saw a similar decline in the bull-bear spread.

While the bull-bear spread retreated to negative, which should be interpreted as a buy signal, the sentiment backdrop appears flimsy beneath the surface. That’s because both bulls and bearish sentiment fell. Just like last week’s AAII survey, bullish sentiment collapsed faster than bearish sentiment. Respondents aren’t becoming actively more bearish, which would be positive for stock prices, they became more uncertain, which does not lead to the same solid contrarian bullish conclusion.

From a top-down macro viewpoint, cyclical sentiment had become excessive bearish. The Atlanta Fed’s GDPNow nowcast of Q1 GDP fell into negative territory in late February, which pulled down the economic growth outlook. It has since rebounded to 1.3%.

Post-Tax Day positive seasonality is providing a temporary tailwind for the bulls.

Exercise caution

Investors should exercise some caution as we progress through Q1 earnings season. Notwithstanding the Netflix disaster, S&P 500 large-cap forecast margins are fine, but S&P 600 small-cap margins appear wobbly.

Meanwhile, equity risk appetite factors are still weak and do not confirm the market rally.

As well, market breadth has been hardly inspiring. With the exception of the S&P 500 Advance-Decline Line, the other versions of A-D Lines are either deteriorating or trading sideways.

The S&P 500 will encounter overhead resistance at its 200 dma at about 4500 and upside potential is limited. Stay defensively positioned.

Former NY Fed President articulated his thoughts on what Fed should do ‘all else being equal ‘. Two items of note about Powell Fed: 1. They are data dependent and 2. They are extremely hawkish at the moment. The latter view should be mostly priced in by the market by now.

The expectations for inflation to remain stubbornly high should also be priced in.

Sentiment is extremely bearish as a result. Who is not bearish in other words?

I think charts are currently reflecting what market has done. Any positive surprise should provide a powerful catalyst for an upside. JMO

Jim Bullard and Bill Dudley. Jimmy and Billy. What can I say?

Some people say that the Stock Market’s obligation is to inflect the maximum pain to its participants. So what will be the maximum pain? – That 03/14/2022 was a major bottom and this was a Fibonacci pull back between 50% to 65%. For chart followers one can draw a bull flag at these levels. A break a above the 200 moving average of 4492 in the S&P decisively will cause a short covering rally that will propel the market higher.

Luckily, I don’t have to deal with these weighty issues. I just go with the flow from day to day.

Adding a second allocation to TLT.

Reopening a position in VT here.

I won’t be adding further to my bond positions (TLT/ TIP/ IEF/ IEI).

On the other hand, I’m also disinclined to day trade the positions. I think current levels will in retrospect be seen as excellent entry points.

Adding a second allocation to VT here.

Maximum pain indeed.

This is the time of day when the ambulances have left and Alice begins sweeping up…

“We’ve had a tsunami of negative news for stocks: crazy high inflation, fed tightening, rising long rates, commodity shortages, war, trade sanctions, covid spikes, etc. Many spec stocks way down but the broader market has mostly held up in the face of it all. Kinda bullish….”

https://twitter.com/lloydblankfein/status/1507462182715465733

ES has been forming a triangle so far. Resistance 4500, support 4385-90, that’s where we are. Would expect us to remain in the triangle until most of the megacaps have reported. I think the market is holding up because it is still expecting positive earnings surprises from the stronger names. I would like to warn though that I spoke to large online business client today and their initial target was 10% growth this year – they have now adjusted that to being happy with only a small loss. But are we already at a stage where we are expecting gloomy news from the likes of AAPL and GOOGL?

What happened with PICK and GDX?

Looks like rising yields hurt gold and higher costs hurt FCX (and by extension other copper miners).

Thanks!!

“The S&P 500 will encounter overhead resistance at its 200 dma at about 4500 and upside potential is limited.”

Spot on!

Bonds are finally doing what they’re supposed to do during market declines.

Here’s my take.

(a) Bond yields (especially those on 20+ year Treasuries) are likely to turn lower from here.

(b) Growth stocks will rally in response – let’s say the next 1-2 months.

(c) China/ emerging markets are bucking the trend today. Thursday’s selloffs in FXI/EEM on above-average volume may have marked the latest round of capitulation in this sector.

I’m comfortable holding a collection of bond funds + VT at this point. Further allocations will require confirmations of (a) through (c).

This may be as contrarian as it gets – but I’m thinking it’s time to go long both stocks and bonds. A great deal of carnage over extended periods has taken place in both sectors.

Hard to be a contrarian on a day like this – but that’s what being a contrarian is all about.

Might we close green? Absolutely.

Opening day trading positions in QQQ/ SPY here.

Retest and undercut of the intraday lows.

Another retest and undercut.

QQQ/ SPY positions opened since March 16 are now underwater.

Adding to QQQ/ SPY here.

Intraday positions in QQQ/ SPY closed end of day. I was completely wrong about a rally into the close. Position sizes were larger than I would like under the circumstances – as my conviction level in a rally was higher than usual – but percentage loss numbers are certainly manageable.

My positions in bond funds sheltered the portfolio to some extent. My largest portfolio allocation is still in cash – which is really the only asset class that survived today’s carnage intact.

Looks like commodities have joined the party.