Recession fears have arrived on Main Street. From a statistical perspective, Google searches for “recession” have spiked.

- Will there be a recession?

- If so, how much of the slowdown is in the market?

- When will the recessionary stock market bottom?

Will there be a recession?

Because of the effect on monthly interest payments, as discussed above, I suspect it will be worse. And that would almost certainly have enough impact on the economy next year to put us close to if not in a recession, all by itself.

In the coming months, I still expect to see a substantial decline in permits. Ordinarily that would be a major negative long leading indicator. But actual construction starts are likely to continue to show strength until the near record backlog has been cleared. Since starts are the actual, hard economic activity, this indicates that housing is still going to make a positive to the economy looking out ahead 12 months.

In fairness, this is an amendment to what I wrote yesterday. Then I noted that there was no “pent-up demand” or “demographic tailwind” present anymore. That is true; but the backlog in construction due to supply shortages will delay any actual downturn affecting economic activity.

With what we know now, my most likely scenario (60%) is a mild recession next year, something like the 2001 recession in severity when the unemployment rate rose two percentage points. We could also easily see a 2-handle on unemployment (under 3 percent) sometime this year. I don’t care what hawks say; that would be amazing. (Note, to complete my forecast: 30% on no recession; 10% on a severe one.)

I wrote in my Sahm Rule post that a mild recession next year was my “most likely” (as in at least 50%) forecast. After a restless night of sleep—yes, I have macro nightmares, I deleted it. Chances are not that high.

After the CPI release I downgraded my “mild recession” to 30% chance.

As Keynes famously said, “When the facts change, I change my mind. What do you do, sir?” While there are many moving parts to my economic forecast, my base case calls for a slowdown to begin in either Q4 2022 or Q1 2023. As to whether the economy weakens into outright recession, as defined by two consecutive quarters of negative GDP growth, the jury is out on that.

That said. Fed Chair Jerome Powell reinforced his hawkish views at an IMF hosted discussion with ECB President Christine Lagarde, as reported by the WSJ. First, he affirmed that a half-point rate hike is a done deal at the May FOMC meeting and to expect more half-point moves at subsequent meetings.

“It is appropriate in my view to be moving a little more quickly” to raise interest rates than the Fed has in the recent past, Mr. Powell said Thursday. “I also think there’s something in the idea of front-end-loading” the removal of stimulus, he said.

As for the trade-off between recession and fighting inflation, he gave a nod to trying to engineer a soft landing, but gave a higher priority to its price stability mandate.

The Fed is trying to engineer a so-called soft landing in which it slows growth enough to bring down inflation, but not so aggressively that the economy falls into a recession. “I don’t think you’ll hear anyone at the Fed say that that’s straightforward or easy. It’s going to be very challenging,” Mr. Powell said.

Mr. Powell said the Fed is focused above all else on bringing down inflation. “Economies don’t work without price stability,” he said.

To underline the Fed’s inflation fighting commitment, Powell went on to extol Paul Volcker’s efforts in controlling inflationary expectations.

“Chair Volcker understood that expectations for inflation play a significant role in its persistence,” said Mr. Powell. “He therefore had to fight on two fronts: slaying, as he called it, the ‘inflationary dragon’ and dismantling the public’s belief that elevated inflation was an unfortunate, but immutable, fact of life.”

Mr. Volcker “knew that in order to tame inflation and heal the economy, he had to stay the course,” Mr. Powell said.

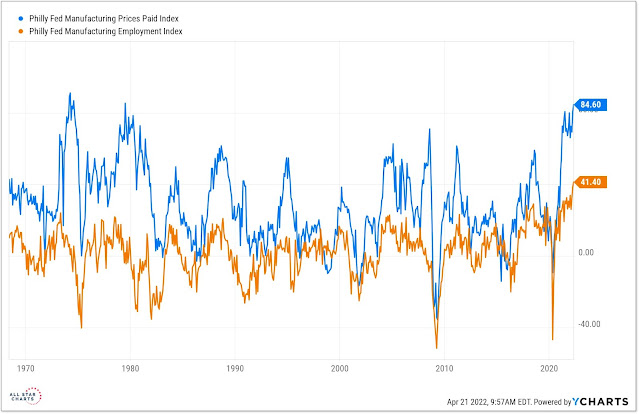

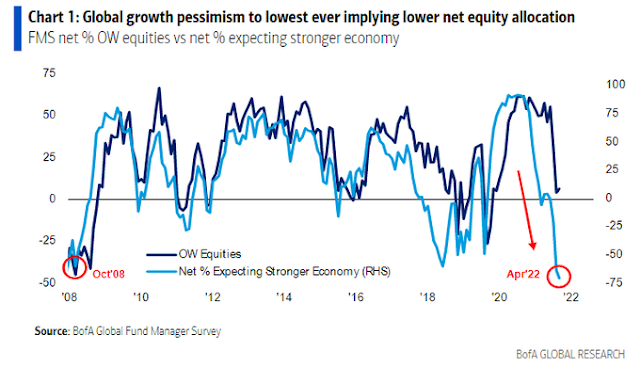

Discounting recession risk

How much recession risk is priced in? I would argue that while recession fears are rising, the market hasn’t fully discounted recession risk at all. The BoA Global Fund Manager Survey showed that while global institutions are all-in on slowdown risk, portfolio positioning can only be described as neutral and not risk-off.

I also highlighted a possible equity valuation shortfall last week (see US equity investors are playing with fire). Based on current consensus S&P 500 EPS estimates and bond yields, the downside valuation risk is -10% to -30%. In the case of a recession, earnings estimates would decline further and raise downside risk, though the fall in earnings would be partly offset by falling yields.

When should you buy?

So where does that leave us? Current data indicates that the economy will experience a slowdown by late Q4 or early Q1, though an outright recession is in doubt. However, the Fed Funds futures market is discounting a very hawkish Fed of a half-point rate hike in May, followed by a three-quarter point hike in June, a half-point hike in July, and moderating to a series of quarter-point hikes.

If the Fed’s actions are remotely near what the market expects, it’s difficult to see how the economy won’t avoid a recession. In that case, let’s assume that a recession begins in Q1 and lasts two quarters. As the stock market looks ahead 6-12 months, expect a market bottom some time in Q3 or Q4. This scenario is also consistent with the mid-term election year seasonal pattern of a market bottom in early October.

I also offer two rough guideposts to a market bottom. The first is insider activity. If the stock market were to weaken further, watch for insider buying (blue line) to overwhelm insider selling (red line). While this is an inexact market timing indicator, it does show periods when this group of “smart investors” believe that the long-term risk-reward of owning stocks is favorable.

Another way of spotting a long-term bottom is to watch when the awareness of a recession is well-known by using the Sahm Rule: “If the unemployment rate—the average of the current month and the prior two—is 0.5 percentage points above its lowest value during the previous twelve months, then we are in a recession.” Add to equity allocations when the Sahm Rule indicates a recession (blue line) and when confirmed by a falling 10-year Treasury yield. Like the insider trading rule, the Sahm Rule buy signal will not spot the exact bottom, but it will indicate low-risk entry points for long-term equity investors.

Neither model has flashed buy signals. In the alternative, if the S&P 500 continues to rise from current levels into late Q3 or early Q4, all bets are off. I will have to revisit my assumptions about a recession, economic slowdown, bear market, and equity valuation risk.

Cam-

Very helpful post at this juncture in the markets thanks!

Are you aware of similar guideposts to low-risk entry points for long-term bond investors?

I had the same question. Feeling like mid summer is the right timing, somewhere after the Fed shows it will follow through on big hikes and before it starts to moderate its message as the effects of its actions starts to show up in the numbers.

This is a bond market crash of unprecedented proportions. I had been cautiously bullish on the bond market for several weeks but I have been wrong.

I have been watching TLT after your write up, and found it drop significantly. Something tells me we are heading to a 1994 style bond market massacre, in coming months.

If I understand today’s post correctly, Cam is in the recession camp. Given that premise, equities will likely fall another 10-30% from the current levels bottoming in Q3/Q4. Market has already fallen roughly 10% so that is 20%-40% from the most recent highs.

What would change this forecast? One can argue that relief on inflation may not be forthcoming till we have a recession(Volcker era).

I think consumer behaviour has started to adjust on the margin. How can one be so cognisant of a forthcoming recession and not get more cautious?

Time will tell but I am not in the recession camp (maybe foolishly so).

I am not in the recession camp. I am still undecided.

The market is discounting an economic slowdown that begins Q4 or Q1. Whether it turns into a full-blown recession, I have no idea.

Thanks Cam!

My reading of the following led me to that understanding:

If the Fed’s actions are remotely near what the market expects, it’s difficult to see how the economy won’t avoid a recession. In that case, let’s assume that a recession begins in Q1 and lasts two quarters.

I stand corrected (and feel better).

If there is a slow down, what are you thinking about further downside for equities and bonds?

Stocks, yes. Bonds should rally if the economy slows into recession (and the yield curve inverts).

Tlt bounced on Thursday although gave back a little yesterday. Could that be the low for long bonds?

https://www.marketwatch.com/story/could-bonds-rally-with-inflation-high-and-the-fed-raising-rates-more-market-timers-are-betting-on-it-11650614841?mod=mark-hulbert

Excerpts:

‘Bond market pessimism has become so extreme that a rally is a distinct possibility.

‘Pessimism about bonds has been at extreme levels for several months now and the market has stubbornly refused to rally. What’s different now is the willingness of a few (though a growing number of) brave advisers to buck the consensus. Rather than falling over themselves proclaiming how awful bonds’ prospects are, more and more bond advisers are beginning to tiptoe in the direction of being less bearish — if not outright bullish.’

‘Their bullish arguments fall into four major categories:

Inflation: A growing number of advisers are now referring to “peak inflation.” Earlier this week, in fact, even Fed chairman Jerome Powell acknowledged that the Consumer Price Index’s trailing 12-month rate of change may have peaked with the U.S. Labor Department’s Apr. 12 report — at 8.5%. If inflation does decline, the Federal Reserve would feel less pressure to raise interest rates as aggressively as the market currently expects.

Economy: The odds of a recession have grown in recent weeks. One of many straws in the wind suggesting a recession is the inversion (or near-inversion) of the yield curve. Goldman Sachs now puts the odds of a recession at 35% within the next 24 months. If a recession were to occur, bonds almost certainly would rally.

Technical: When judged according to past rate-hike cycles, interest rates may have already risen enough, according to Joe Kalish, chief global macro strategist at Ned Davis Research. Since March 16, when the Fed began the current rate-tightening cycle, the 10-year Treasury yield TMUBMUSD10Y, 2.895% has risen 75 basis points, or 0.75%. That exceeds the median increase of 61 basis points during the entirety of previous Fed tightening cycles, according to Kalish’s calculations. Technical analysts Mary Anne and Pamela Aden reach the same conclusion through their analysis of interest rates’ long-term trends. They predict that “long-term interest rates are unlikely to rise much further and they’ll soon turn down.”

Sentiment: Though bond-market timers have been incredibly pessimistic for several months now, it’s important to acknowledge their pessimism since it means that when the bond market turns up, the rally will be resting on a solid sentiment foundation. The chart below plots the average recommended bond-market exposure level among a subset of several dozen bond market timers my firm monitors (as measured by the Hulbert Bond Newsletter Sentiment Index, or HBNSI). Notice that the HBNSI has been low for some time now. For a couple of months straight it has remained in, or close to, the bottom decile of the historical distribution—the range that in previous columns I have used to identify excessive bearishness.’

So, if bonds rally, shouldn’t stocks rally as well?

Well, earnings matter too which will likely decline in a recession.

The difficulty in navigating markets is that we have three powerful undercurrents; Inflation-loving stocks up NOW, a powerful Beta-Crash of ridiculously overvalued growth stocks NOW and a LATER recession bear market that will undercut economically sensitive and inflation-hating companies.

It’s impossible to sum up those influences on the general stock market indexes at any given day.

With the Beta-Crash, March 15 was a solid low after a deeply oversold plunge. It is failing and failing badly. Here are two chart examples Internet ETF https://refini.tv/3Kb0qhh and ARKK giving back a 36% rally https://refini.tv/3k2fMsM

My suggestion for finding a bottom of the Beta-Crash is to watch the Anti-Beta ETF BTAL. Here is that chart https://refini.tv/3HsLn1W It is the best performing alternative ETF outside commodities that I track. It’s a big reason my clients are up on the year. I have highlighted it often in the blog.

With the inflation-loving companies and ETFs, I think that trend is early and possibly a new amazing secular trend. Using moving average trendlines to stay with a big trend or get out if it flops is the best way to navigate. Of course some people are gold bugs or oil bugs and could get super rich if things keep skyrocketing just like the early crypto diamond hands folks. But that attitude is for the YOLO crowd with small pots of money not my clients who have real wealth they need for living and not betting.

With the economically sensitive Value and Small Cap stocks that get killed in a recession, I look at this Fed Funds Futures chart https://refini.tv/34V81y4 and see a huge and unprecedented tsunami wave of interest rate hurt hitting the economy not the old-style gradual taking away the punch bowl. That leads me to disregard past relationships and technical indicators. The stock and bond have fallen in corelated fashion like no other time in history and bonds have had the worst start to the year in history. We have Powell worshipping Volker and Volker’s tough love and determination to wring out inflation. That is wonderful long term but comes with a world of hurt before the dawn. My guess is that we will get rallies in the Value/Small Caps until future earnings start to dip and spoil the stability illusion. But the real low in the Recession Bear Market comes when inflation is beaten (or Fed gives up) and the Fed pivots dovishly.

I completely agree with the October low as Cam points out on Presidential politics. Mid-Terms are important but the real prize is the Presidency. The trick is to get the bad stuff like a recession out of the way early so the incumbent party has positive momentum going into the 2024 Presidential Election year. I have studied this cycle deeply and the period from October 9 of the midterm year to January 1, of the election year has ALWAYS been up and usually big. It’s the most consistent winning period in investing. I see the DEMs setting up for this to win in 2024 and for us to profit.

Thanks for the additional perspective Ken, much appreciated as always!

Interesting take. You seem to be telling us that October 2022 would be the low, right before the mid terms. Thanks.

Thank you Ken!

Recent Inflation Surges Have Modestly Affected Long-Term Expectations

https://www.dallasfed.org/research/economics/2022/0405

“The one-year expectation is increasing and has rocketed past the Fed’s 2 percent target in recent months. However, the 5-year, 5-year-forward has remained in a tight range around the 2 percent target since the mid-2000s.”

Note the one-year expectation for inflation rate is slightly above 2% as of Apr 5, 2022.