Mid-week market update: Before the war began, I wrote that investors should Buy to the sound of cannons. Historically, investors have been rewarded by buying sudden geopolitically related downdrafts. The corollary is “sell to the sound of trumpets”, or news of peace.

US equity indices across all market cap bands staged upside breakouts through resistance yesterday and they pulled back today to test the breakout levels.

Is peace at hand? Are the trumpets sounding?

Falling geopolitical risk

The market rallied yesterday on the hopeful news of Russia-Ukraine negotiations. The Ukrainians made a proposal of neutrality under the following conditions:

- Ukraine would be neutral and agree not to join alliances like NATO or have foreign troops on its soil, but would have security guarantees in terms similar to NATO’s Article 5, which states that an attack on any NATO member would be interpreted as an attack on all.

- Russia would not object to Ukraine joining the EU.

- There would be a t5-year consultation period on the status of Crimea and the Donbas breakaway republics.

- The proposals would be subject to ratification by a referendum in Ukraine.

The Russians stated that they would scale back military operations around the cities of Kyiv and Chernihiv. However, a read of Russian media indicated a less constructive view, where the Kremlin downplayed the odds of a breakthrough and featured the profile of s soldier “cleaning up” Mariupol along Chechen comrades.

Left unsaid is the issue of reparations, if any, for the rebuilding of Ukrainian cities. As well, Biden’s recent outbursk, “For God’s sake, this man [Putin] cannot remain in power” will be an impediment to a deal.

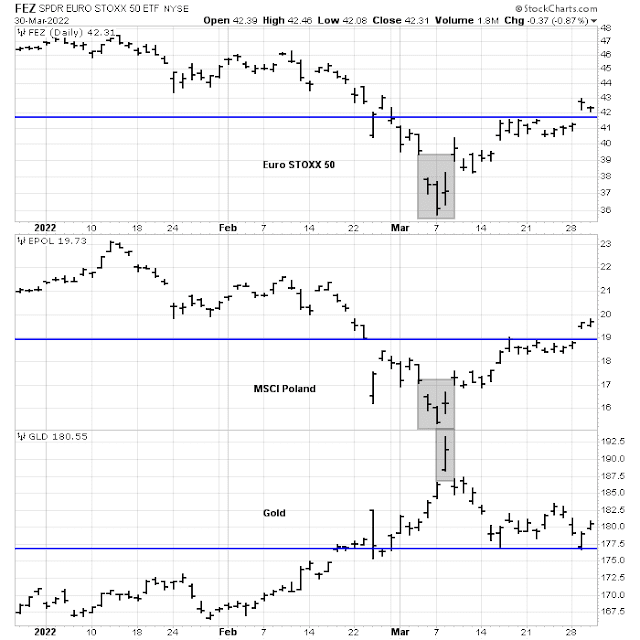

The response to the negotiations news is an instructive window on market psychology. Russia-Ukraine war-sensitive instruments experienced island reversals. The Euro STOXX 500 and MSCI Poland printed bullish reversals, while gold showed a bearish reversal. Equity markets staged upside breakouts through resistance in the manner of US markets, but gold prices did not break support.

I interpret this to mean that geopolitical risk is fading, but could flare up again at any time.

Strong momentum, weak breadth

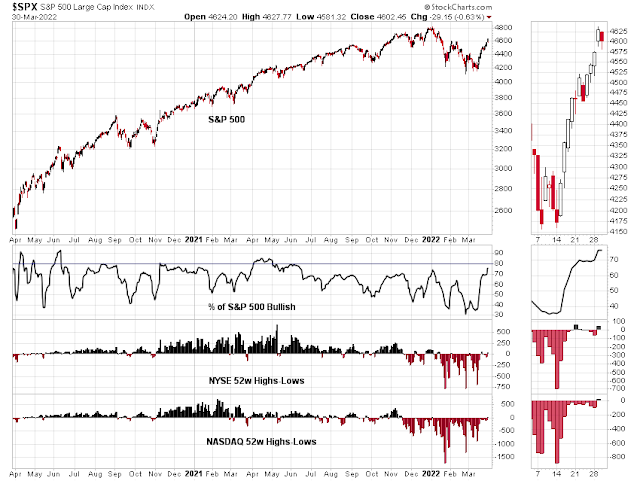

Market internals are characterized by strong price momentum but weak breadth.

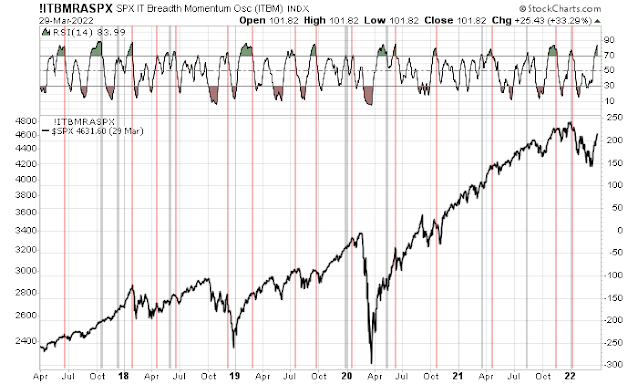

Bullish price momentum has been strong. In the last 10 years, such episodes have carried stock prices higher and, at a minimum, have not topped until the 5-week RSI has become overbought.

On the other hand, breadth indicators are unusually weak for a momentum-driven advance. The percentage of S&P 500 bullish on P&F has not reached the 80% level that’s consistent with a “good overbought” rally. Net NYSE and NASDAQ highs-lows have also been weak. Readings finally turned positive yesterday (Tuesday) after a prolonged period of net negatives.

Bloomberg’s Dani Burger highlighted a recent BoA cautionary note based on the divergence between the VIX Index and MOVE Index, which measures bond market implied volatility. The last time this happened, the S&P 500 took a tumble.

In conclusion, stock prices can run higher in the short term as momentum has become dominant, but negative breadth divergences are concerns. If momentum falters, the S&P 500 intermediate-term breadth momentum oscillator should be able to flash a sell signal.

But not yet.

I fervently hope the sound of trumpets comes from Ukraine. That would imply that many commodities would again be available in a reasonable period of time for reconstruction (who pays?) but fossil fuels will still be in a squeeze. Our policy makers need to think more rationally ( why give more money to people to buy something that is in short supply already – eg in California). At best, inflation probably peaks soon and rate of change is negative. This would be equity bullish.

Matter of yield curve inversion (choose the part that fits your narrative best) – it’s not a signal of imminent threat. May be 18 months down the road on an average when it does happen. So, why cash in your chips to stuff them into the proverbial mattress till the all clear trumpet sounds?

I think it’s a trading range market. Cam has been amazing with his calls. That’s my playbook. For now.

Tonight the citizens of Kiev learned what “dramatic reduction of military activity” means, heavy bombardements all night long. Putin has a consistent track record of lies for at least the last 20 years. We have to keep that in mind.

Can we please restrain from political comments here.

There is now a deep level of distrust between Putin-led Russia and European trading partners – the implications for global energy and commodity markets are more than likely to stay, regardless of any kind of ceasefire agreements. As Europeans will be looking to buy energy and other ressources from other sources, this is likely going to have some reverberations in global markets over the coming years. We are also seeing Diesel prices soaring and rising wage demands are also now hitting in Europe, a classic inflationary spiral that is currently accelerating in the EU and may be even sharper than elsewhere because of the more direct Russia impact, government stimulus measures and the lack of action by the ECB.

Hi Jan,

Thank You for comments. I always find them incisive. We are going back to the cold war days. U.S. and its allies on one side and China-Russia block on the other. Countries like India are trying to stay neutral. This will affect commercial trading in numerous ways which have yet to be sorted out. More so, if the US dollar loses its reserve currency status.

Politics and economics are conjoined twins. All policy decisions at the government and world level impact both.

This is true. However there’s a difference between political declarations or demonstrations of political bias, and analysis of how the geopolitical realities affect the economics and the markets.

The comment is in context of the ‘squeeze’ on fossil fuels regardless of who sounds the trumpets. Policy decisions that do not help the supply side are misguided in my world view at this point in time, regardless of political persuasion.

I am critical of poor economic policy prescriptions.

I didn’t have your comment in mind. In fact, I agree with what you’ve written that recent policy decisions will have adverse economic impact.

Reopening a position in FXI.

Reopening a position in EWG.

BABA.

KRE.

Sticking with current positions for now – all of which were opened on morning weakness and sized appropriately.

I suspect a gap down on Friday.

Larry Summers seems to think 400+ basis point increases by the Fed and a mild recession is the most likely outcome over the next 18 months. Interesting interview with Ezra Klein. https://podcasts.apple.com/us/podcast/the-ezra-klein-show/id1548604447?i=1000555567714

Closing most positions early in the premarket session as overnight gains have already exceeded my targets.

FXI +5%

BABA +7%

EWG +1%

Limit sell order in place for KRE.

Modest overall gain, as all position sizes were relatively small.

Eyes on TLT/ IEF/ TIP (changing hands at a new 52-wk low).

Closing KRE here.

Opening a position in TIP.

Opening positions in IEF/ TLT.

Keeping position sizes small.

Taking profits in TLT/ IEF/ TIP.

Wow – really misjudged the move in bonds.

Another ST buying opp heading into today’s close?

Scaling carefully into SMH.

VT.

Reopening BABA.

Opening VTV.

Reopening KRE.

Taking gains on VT.

Taking gains on SOXL and KRE.

BABA off here for a minor loss on my second trade of the day.

Hit-and-run trading’s all I’m comfortable with right now.

Reopening a smaller position in VT.

Closing VT here.

Back to 100% cash.