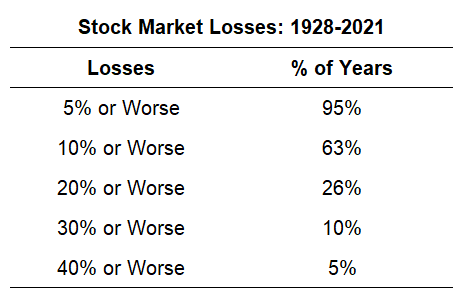

As global markets have been jittery on the prospect of military conflict in Ukraine, Ben Carlson showed a table of the regular nature of US stock market drawdowns, which is a feature of equity risk.

Anyway, it was the Cuban Missile Crisis and there were rumors that Russia had launched rockets and the Dow took a dive near the bell.

I cleaned up my desk and raced to the Moosehead, as animated as only an 18 year-old can be. Jack was already there and as I burst through the door, I shouted: “Jack! Jack, there was a strong rumor that the missiles were flying and I tried to sell the market but failed.”

Jack said “Calm down kid! First buy me a drink and then sit down and listen to me.” I ordered the drink and meekly sat down.

Jack said – “Look kid, if you hear the missiles are flying, you buy them. You don’t sell them.”

“You buy them?” I said, somewhat puzzled.

“Sure you buy them!” said Jack. “Cause if you’re wrong, the trade will never clear. We’ll all be dead.”

That’s a lesson you won’t learn in the Wharton School.

Both Rothchild’s thinking and Cashin’s story are lessons in market psychology and the occasional asymmetric nature of asset returns. With the angst over the FOMC decision out of the way, let’s consider what might happen if war were to actually break out.

A hot war, or stealth war?

The framework of a discussion of a Russia-Ukraine war is based on Russia’s political objectives, the military situation, and NATO’s response, and, most importantly for investors, the economic fallout.

As Russian troops mass on Ukraine’s borders, the biggest unknown is Putin’s political objective in an invasion. Is he aiming for limited military objectives, or does he want to topple the Ukrainian government altogether?

In a limited hot war involving actual hostilities, Russia could take the breakaway and separatist regions of Luhansk and Donbas. A more ambitious plan would be to secure a “land bridge” to the annexed Crimea, which involves seizing territory between the Sea of Azov to the Dnieper River.

Moscow could decide to destabilize the current Ukrainian government using covert operatives to spark another Orange Revolution, this time to install a Russia-friendly regime. If that’s the objective, why mass 125,000 troops on the border? A full hot war could see the siege and fall of Kyiv to Russian forces.

Each plan carries its own risks. A limited incursion would still leave a West-leaning government in Kyiv in power. While Russia is likely to win a full military campaign that ends with the takeover of Ukraine, its losses could be considerable and see soldiers return home in body bags, which should not be popular. If it were to install a Moscow-friendly government in Kyiv, will the government remain stable if Russian troops go home? The Russian Army could be bogged down in a bloody guerilla conflict with no end in sight.

The economic fallout

The West has threatened severe sanctions if Russia were to invade. A recent background press conference by senior US officials outlined the measures being contemplated.

That means the gradualism of the past is out, and this time we’ll start at the top of the escalation ladder and stay there. We’ve made efforts to signal this intention very clearly. And I would say the deepening selloff in Russian markets, its borrowing costs, the value of its currency, market-implied default risk reflect the severity of the economic consequences we can and will impose on the Russian economy in the event of a further invasion.

In addition to financial sanctions, which have immediate and visible effect on the day they’re implemented, we’re also prepared to impose novel export controls that would deal Putin a weak strategic hand over the medium term.

Specifically, the White House is threatening the use of technology export sanctions that crippled Huawei in the past.

In the case of export controls, what we’re talking about are sophisticated technologies that we design and produce that are essential inputs to Russia’s strategic ambitions.

So, you can think of these export controls as trade restrictions in the service of broader U.S. national security interests. We use them to prohibit the export of products from the U.S. to Russia and, potentially, certain foreign-made products that fall under U.S. export regulations.

The nightmare scenario for the West is Russia’s use of natural gas as a weapon. Russian gas exports account for about one-third of the EU’s gas use and the European economy could collapse if the taps were to be turned off. The White House is working with other global gas suppliers to fill the gap.

We’re working with countries and companies around the world to ensure the security of supply and to mitigate against price shocks affecting both the American people and the global economy…

We’ve been working to identify additional volumes of non-Russian natural gas from various areas of the world — from North Africa and the Middle East to Asia and the United States.

Correspondingly, we’re in discussions with major natural gas producers around the globe to understand their capacity and willingness to temporarily surge natural gas output and to allocate these volumes to European buyers.

The Economist summarized Europe’s gas supply situation and concluded that Europe has become more energy resilient owing to a number of measures: Changes to contracts that allow the re-export and redirection of gas supplies; the supply of LNG, which saw an armada of LNG carriers redirected to Europe as supplies tightened recently; gas held in storage; and a supply of “cushion gas”, which is an extra supply of gas that regulators demanded to held in storage caverns.

Mr Stoppard [of IHS Markit] helpfully simplifies things. Russian gas exports to Europe currently amount to about 230m cubic metres per day (cm/d). He reckons surplus regasification capacity could make up for about 50m cm/d. Boosting coal and nuclear power, for example by restarting recently mothballed plants or increasing load factors at underutilised ones, could add the equivalent of another 40m cm/d. That still leaves a shortfall of 140m cm/d. He calculates that if weather remains normal then the amount of stored gas (not including cushion gas) would cover the remaining 140m cm/d shortfall for four and a half months. “This is a price crisis more than a physical supply crisis,” he concludes.

In other words, demand can be met from physical supplies, it’s only money.

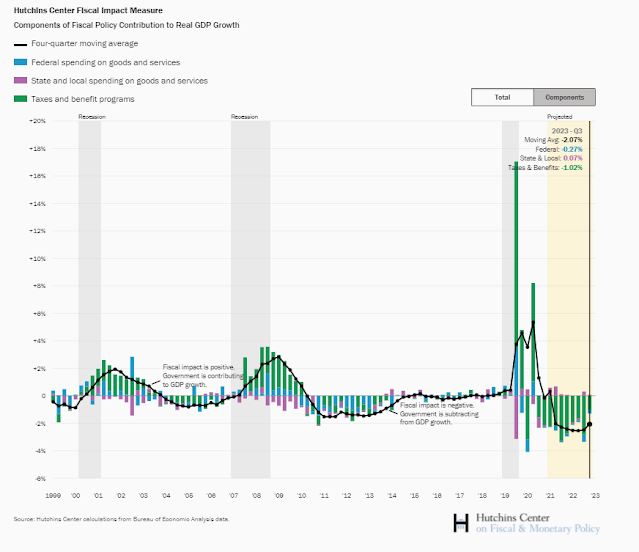

The fiscal put

One of the headwinds to growth in 2022 is the falling fiscal impulse, which has already turned negative. In the US, it appears that Biden’s Build Back Better legislation is collapsing, which Moody’s estimates would subtract 0.75% from GDP growth this year. In addition, the Republicans are likely to regain control of Congress in November, which will put a screeching halt to most of Biden’s spending plans.

In Europe, France and Germany are at loggerheads over the fiscal impulse. France, which took over the rotating EU Presidency, favors fiscal expansion while the new German finance minister is a fiscal hawk. Across the English Channel, the UK raised taxes by about 2% of GDP in 2021. China and Japan are the only major countries that are engaged in any stimulus.

Investment implications

Cam, confused over your last sentence. Could you please clarify. Thanks.

“In all cases, investors and traders should fade the war fears and take advantage of any price weakness to buy risky assets.”

Buy the panic, but that’s only a tactical call.

If we get a full blown war, the fiscal response should hold stock prices up.

If peace breaks out, sell the rally.

Yes Cam, like Gary, I am confused also. In early January you state that investment accounts should start to de-risk. In mid January you emphasize long bond durations, dollar positions, defensive sectors, and large cap quality growth. Last week you go neutral on the trend model. Now you are telling investors to buy the dip? I assume you meant traders for a contra trend oversold rally? (which started Friday, and may be close to over already).

Thanks for your insight.

Mike

Fed’s Kashkari says rate hike ‘pause’ conceivable in spring

https://www.reuters.com/article/usa-fed-kashkari-pause/feds-kashkari-says-rate-hike-pause-conceivable-in-spring-idUSKBN2K21PO

1Q growth looking very soft.

Re the comments above, my take would be that Cam has been expecting a -10% to -20% correction – but not a crash.

We’ve already had a -10% correction – so he was correct in recommending that we de-risk earlier in the month. It’s been a pretty quick decline since then. Could we go down another -10%? Sure. The catalyst for such a decline may be a war with implications for energy supplies and prices. In which case, it’s time to aggressively buy.

As noted elsewhere, last week’s low is unlikely to be the the low for 2022.

I was hoping for more discussion on rates. I am not particularly concerned by a Russian war. It seems unlikely to me, just Putin trolling the Biden Regime. I am wondering how hard to buy the bounce. More discussion tomorrow would be welcomed.

Fed Funds futures are now discounting five rate hikes this year. Also seems a bit unlikely. It’s all a question of when the Fed reverses course. Watch the NFP Friday for some clues.

2s10s is now down to 0.63. So that leaves very little room for rate hikes without inverting the curves. Everyone is watching this number. If it continues to go down I am pretty sure newer batch of front running will drive indices even lower. It is almost like bears are trying to get us into a recession.