The bond market may fare better in the coming year. The Barclays Aggregate Index unusually fell last year and it has never exhibited two consecutive years of negative returns (warning: n=3).

What does this mean for asset prices? Will 2022 be equity bearish and volatile and become Twenty-Twenty Too?

A bond tantrum

The latest source of market angst was sparked by the release of the December FOMC minutes. Further bad news came with the release of December Jobs Report, which had all the signs of full employment that allowed the Fed to raise rates. Even San Francisco President Mary Daly, who is viewed as a dove, believes the economy is nearing full employment and was in favor of raising rates: “I’m of the mind that we might need to, likely will need to, raise interest rates … in order to keep the economy in balance”.

The Treasury market threw a tantrum last week when both the 10 year Treasury yield broke up through resisance and the 30 year Treasury yield surged above its falling channel. In addition, the 2s10s yield curve steepened, indicating that the market expects better economic growth as the Fed “gently” tightens monetary policy. On the other hand, the 5s30s had the opposite gentle flattening reaction to the FOMC minutes.

A similar minor divergence is appearing between the Economic Surprise Index, which is stalling, and the 10-year Treasury yield, which is rising.

I interpret this to mean that investors should fade the bond market’s rising yields. The combination of a hawkish Fed and a loss of economic momentum is a recipe for slower growth and lower rates.

Defensive stocks take the lead

The stock market’s internals are also telling a similar story of caution. An analysis of the changing leadership of different parts of the stock market was highly revealing.

Starting with the defensive sectors, their relative performance is showing signs of emerging leadership. All are forming saucer-shaped relative bottoms against the S&P 500, indicating that the bears are wrestling control of the tape away from the bulls.

The leadership pattern of value and cyclical sectors looks a little better. In particular, the relative performance of financial stocks is the most correlated to the shape of the yield curve, mainly because banks borrow short and lend long. A steepening yield curve, therefore, enhances banking profitability. The other value and cyclical sectors are all exhibiting sideways basing patterns, though there have been some short-term recoveries, such as the one shown by energy stocks.

A more detailed look at the relative performance of cyclically sensitive industries tells a different story. Most have been trading sideways against the market and show no definitive signs of strong leadership.

From a global perspective, even though commodity prices are holding up well, the relative performance of the equity markets of resource producing countries to the MSCI All-Country World Index (ACWI) are all flat to down. This is additional confirmation that cyclical exposure is to be avoided.

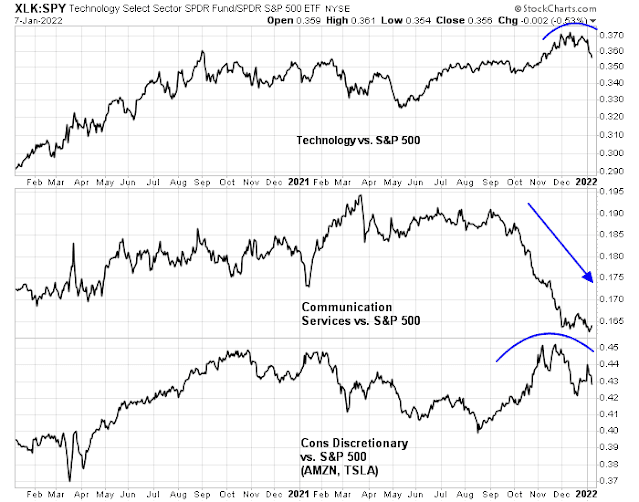

What about growth stocks? They look downright ugly. Growth sectors are either rolling over or in decline on a relative basis.

In short, stock market internals are turning risk-off. This is consistent with a hawkish interpretation of Fed policy. The market is already discounting three quarter-point rate hikes this year and a discussion of quantitative tightening, or a reduction in the size of the Fed’s balance sheet, may not be very far behind.

Investment implications

Here is what this means for investors. Position for slower growth, at least for the first half of 2022. This means:

- A flattening yield curve and long bond duration, or maturity,

- Long USD in response to a hawkish Fed;

- Long defensive sectors of the equity market; and

- Long large-cap growth stocks as duration plays for their interest rate sensitivity.

Equity investors should also brace for greater volatility. The S&P 500 exhibited a drawdown of only -5.2% in 2021, which is well below average. The S&P 500 rose over 10% for the last three consecutive years, which is an unusual condition. Even on those occasions, which saw the market advance in four out of five instances since 1928, the average drawdown in the fourth year was -13.5% and the lowest was -6.8%.

To be sure, a flattening yield curve is a signal of slower economic growth. In all likelihood, COVID-19 fueled inflation pressures will begin to fade about mid-year, which will allow the Fed to reverse course on monetary tightening. Prepare for a dovish and cyclical pivot in the summer or autumn. This scenario is consistent with the historical mid-term election year pattern of a choppy market for the first nine months, followed by a rally into year-end.

This last week has been the weirdest I have experience. Pure Growth ETF (RPG) fell 12% while Value ETF (VLUE) went up 2% and the Bank ETF (KBWB) within Value went up 7%. All this while the S&P 500 went down 2%.

A 14% difference between Growth and Value over a five day period is weird and the Banks versus Growth of 19% (IN A WEEK) is …… sorry, can’t find a word for it.

Cam’s long term charts above don’t show the last week of relative action.

We all try to build a narrative around things happening. What can be the narrative here. First, as I keep saying, the Fed pumping QE into investment markets means they float up the general market with only shifts from one sector to the other internally. In December, there was a huge shift to Low Vol/Defensive and the general market went up. (BTW defensive Healthcare crashed 5% last week) Now we have a massive shift from Growth to Value and we have a relatively tiny drop in the S&P 500.

The bubble of the ARK dream stocks was already popping (it was $160 in the summer) and maybe we are seeing the crash finally hitting large cap growth names. The bubble popped because it got absurd. The large caps are now falling due to the new interest rate outlook plus their popularity made them somewhat overpriced and hence vulnerable.

The aggressive day traders are not price conscious. If they spot a trade, they jump all in. They remind me of those cowboys that ride those insane bulls in the rodeos.

The last time we had a Value/Bank surge and bond drop as big as this was November 9, 2020 Vaccine Day. The Bank ETF went up 13% that single day and then from the closing price went up a further 39% over the next five months. Is the jump this week in the banks the end or beginning? That’s yours to figure.

People are jumping on the hate ARK trade with SARK as their vehicle. They weren’t there when the easy 160 to 100 drop was happening but the next 15% is a pile on. Will the intensity of this hate trade have a flush out ending sooner that expected? Even Clean Energy (ICLN) went down 8% last week and is down 40% from its summer peak. I suspect it will be loved somewhere in the future again.

So if the Fed QE is floating the entire general market and shifts from one sector to another are the way things happen, it begs the question of ‘What happens when they take QE away?’ I’ll let you guess on that one.

Let me post a positive as we swim in this sea of pandemic and Fed pessimism. I try to keep an open and unbiased, objective view of the world.

The news on Omicron from a few experts is VERY promising. They had seen the Omicron cases crashing in South Africa with far less severity but were cautious about whether this would happen in the developed world with its different demographics. Well, they are seeing the first signs that Omicron might be a flash tidal wave of misery followed by much quicker than expected steep fall leaving the population with boosted, very effective (even for unvaccinated) herd immunity to future Covid.

The test will be the UK where Omicron hit the developed world first. Please readers, post anything you see on this topic. It’s a game changer.

What are the investment market implications. Higher interest rates dues to a more robust economy coming out of this pandemic sooner. Growth stocks, due to high interest rates will lag.

Economically sensitive, Value stocks will do well. Generally, stock markets around the world will do great. Interestingly, counties that try to stop the Covid completely like China will lag because they prolong the shutdowns. Inflation may be a problem as commodity prices surge. It’s not a problem for owners of commodity producers. It’s a wealth builder.

We can all dream and this is mine.

Do stay safe. Let others, the risk takers, get the Omicron and give us herd immunity.

Stunning to read the wish – let others, the risk takers, get omicron, and give us herd immunity. Plenty of people who are boosted are getting omicron. And children who can not get the vaccine? Our 4 year old grandson is dealing with it. And people in developing countries who don’t have access to the vaccine?

We are on these pages so that we can navigate the markets. Not at the expense of others suffering.

good job Cam

Further on the Omicron flash and crash outlook, this would be VERY positive for Biden and the Dems. November could see a big sweep which would be very positive for stock markets due to added fiscal spending and a different view of 2024 possibilities.

I think I have opined before that Omicron could be a blessing in disguise because it will burn itself out more quickly. I look at Worldometers and check the USA new cases, you can see the explosion in numbers. Between Xmas and New Years it was something like 100k to 200k, yesterday was 850k, and at this point, does everyone get tested ? So I am watching for a drop in new cases, when it starts going down big time, get ready for news about it.South Africa #18 on the list seems to be topping, another day or 2 should reveal if it is passing there.

So if we get news that Covid might be over, there will be most likely a market reaction, up or down I don’t know.

This tightening and rate hikes has been so obviously telegraphed that it makes me wonder about what will happen. If so many are talking about decreased liquidity and higher rates, what is a contrarian position? How do corporate buybacks fit in? If the C-suites start to have a FOMO regarding last chance for juicy stock option gains will there be an increase in buybacks? Speculation on my part, I don’t know what regs there are for buybacks, but this talk of decreasing qe and raising rates has been going on for a while.

Since the market looks ahead, what about the USD? Rate hikes ahead, priced in? What happens when the crash this brings about occurs? Rates drop again? So will we see the USD start dropping in anticipation?

I try not to do Elliott waves because they are after the fact fits, like making patterns with legos, but there is a free video on the Dec theorist that shows many charts demonstrating how we are clearly in bubble territory. So unless this time is really different some major reckoning is coming, only when? If you look at the charts showing metrics that are hitting record levels, you can see that sometimes after hitting a new record high they just kept going higher for maybe even years…Markets can stay irrational longer than one can stay solvent…How do you short Tesla? One share at a time lol.

Remember that as individuals we can hide in as much cash as we want, professionals running funds cannot. So they can hide in low vol, bonds , whatever, but when the crash happens everything goes down except short etfs, even gold and so will bitcoin as people sell to cover their losses. Remember in the Dotcom crash, SPY did very well compared to the Nasdaq, but it still dropped over 50%. Cash would have been a better place.

But just about every central bank wants to print, and these days they can do it much more easily than making paper notes, so who knows what will happen.

Maybe we are making a shift from a service economy to one that is based on real assets. The USA was a manufacturing leader after WW2, but eventually we stopped having the trade surpluses and credit surpluses and became debtors, and the economy shifted to service…but to run a service economy you have to spend on the service…kind of like an inverse Ponzi scheme.

So now we have AI, robotics….this will replace many service jobs, as will the metaverse, Taas etc….what will happen to jobs? My job is I am a helicopter money dumpster…I get it and spend it. So what has value? Real assets. Not just precious metals, anything real and useful, copper lithium plywood, whatever.

I like silver over gold, silver is extremely useful, gets used up and is rare…I think at some point Exxon or Chevron will do really well because ESG may be turning them into pariahs, but 5 years from now there will probably be tighter oil supplies and yet many vehicles will still run on oil, but I’m waiting for the big crash before loading up on anything. Just look at what Gold, WPM did in 2008 when the market crashed…it all goes down.

I do hold some Cameco, I’m very nervous and watching credit markets….the uranium story is compelling, and there is disruption in kazakhstan… and eurozone issues about adopting it as green along with energy crisis, so it could really pop, but if there is a crash, uranium dumps…CCJ went to 5 in March 2020, now it is around 23….Uranium is a tiny market, it could go crazy, but the stock can still crash even if uranium prices are stable.

Most of the times tops are a process, but 1929, Nikkei 1989 and nasdaq 2000 were steeple tops…they were all characterized by real excesses, like we have now.

But I have to say, I have been nervous about the market for years, at some point this broken clock will give the right time.

Hello Cam, I don’t mean to try to front run your model, but based on this investment outlook, do you think there is a chance you go to Neutral on the TREND model sometime soon?

Thanks,

Mike M.

I expect that the Trend Model will get downgraded to neutral in the next few weeks.

This is a trend following model and they can’t spot exact tops or bottoms, only trends. It’s a feature, not a bug.

A lot of front running thru algos. A little out of control. When it reverses it will be even more violent. Looks like this year will be going in the sharp cycles and driving people insane. Many will get fatigued and give up.

The current turmoil arises from the memory of 2018 by many. It was a year of rate hikes and QT, culminating in -20% SPX crash in Dec 2018. And then Powell made an about-face. This time he will be more skillful.

Reading the title of the post ‘2022 = Twenty-Twenty, too?’ brought back the memory of steep and rapid decline in the market followed by an equally powerful rally. The post itself is not implying anything close to the spring of 2020. (Rates have gone up dramatically in the first week of the year and may reach 2% in next few weeks, yet markets are orderly.)

One aspect that may become important is slower growth but persistent inflation. Omicron is affecting the business activities and may prolong the inflation well into fall and next year. How do you see the market behavior in that scenario?

What is your thinking about developed markets outside US? 10 year P/E are more reasonable.

https://twitter.com/callum_thomas/status/1479938769809600513?s=21

Non-US valuations are more reasonable, but the companies with dominant business models and growth (read: FANG+) are in the US.

If the global economy pivots to growth, then non-US should outperform. It’s a growth vs. value/cyclical story.

Thanks Cam. Any thoughts on slow growth and high inflation scenario?