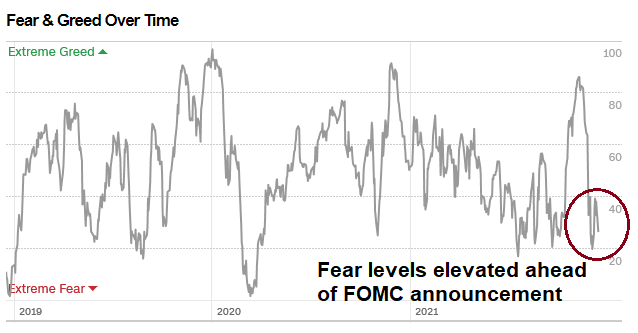

Mid-week market update: I don`t have very much to add beyond yesterday`s commentary (see Hawkish expectations). Ahead of the FOMC announcement as of the Tuesday night close, fear levels were elevated.

The market`s retreat left it oversold or mildly oversold, such as the NYSE McClellan Summation Index (NYSI).

Both the NYSE and NASDAQ McClellan Oscillators (NYMO and NAMO) were approaching oversold readings.

As I pointed out yesterday, anxiety was in the air as the market was discounting a Fed policy error of overtightening. Arguably, the recent pullback is in line with the historical seasonal pattern of mid-December weakness before a year-end rally.

Here comes the oversold bounce. Tactically, I remain cautiously bullish and I will be monitoring the evolution of the market`s internals and psychology as prices rise before pronouncing judgment on the durability of this rally.

Disclosure: Long SPXL

I think we get euphoria, but the bear is getting closer. I would love to be able to hold until after dec31, so yeah I will root for the bull.

Yes Jerome has backed himself into a corner. He may not be able to talk his way out everytime.

From a chart perspective, I would say that if we don’t soon make new highs but rather fall below the December 1 low, the outlook would turn very badly. The rally today is totally ignoring Omicron which is rising exponentially.

Sinopac, the most used vaccine in the world was tested by the University of Hong Kong and it does not protect against Omicron.

WHO warns against dismissing the variant with the idea of its supposed mild effects since its transmissibility is so much greater. Plus we haven’t seen its effects on older populations in the developed world.

We are only weeks away from knowing enough to make a better investment decision about Omicron. If anybody is waiting on selling anything to book a capital gain in 2022, you can do a deep in the money covered call write to January to shift the sell to 2022 and ear some option premium along the way. If you think the coast is clear, just buy back the option and drive on.

Ken

It would help if you would be specific on what call option, strike price, expiration date and buy or sell. Thanks kindly.

A good strategy to push the sale to a later time period. Also, a hedge.

One needs to keep in mind the tax trade off depending on the situation.

I agree. No ATH would be very bad news.

Cup and handle the last month or so puts a target of around 4925

Just a short term observation. In the last 7 years or so, every time we had a S&P 500 gain of 1% or more such as today and we are within 3% of the recent highest highs, and that the 52 week new lows in Nasdaq 100 ($52WLND) increased to 5 or more such as today, the index pulled back for 2 to 10 days generally. The $52WLND closed at 5 today from 2 yesterday. You do not expect a rally to bring higher new lows hence the divergence. The last instance was just 11/29/21.

12/16/2015

08/14/2017

09/11/2017

11/29/2021

12/15/2021

“index pulled back for 2 to 10 days generally”

Please keep us updated. Thanks.

I for one appreciate the beginning of the end to QE and the rate hikes. It’s about time.

(a) Ideally, we’ll reach a point where the return on fixed assets will allow retirees at least an even chance at keeping up with inflation.

(b) QE was necessary prior to the availability of vaccines – then phased out more aggressively as vaccination rates increased.

(c) I recall being contrarian bullish in the summer of 2020 – and probably just as contrarian bearish at this point. There’s a time to buy, and a time to sell. A time to wait for attractive pricing on assets. We’re not obligated to own stocks – most of the world in fact gets by just fine without them.

‘-then SHOULD HAVE BEEN phased out more aggressively as vaccination rates increased.’

What exactly was bullish about today’s Fed decisions? I think they’re basically telling people to get off their behinds and go back to work. Which is ultimately bullish – but only in an environment free of rampant speculation and artificially-elevated valuations.

The Fed did a bullish pivot!

Chairman Powell is trying to thread the needle. Stop adding liquidity to the economy ( $9T balance sheet, ton of cash on corporate balance sheets, consumers have 2-3T of excess savings already) while hoping that many forces in play (Supply chain, Covid, etc) resolve favorably to reduce inflation and inflation expectations. In such a scenario, rate hikes may be at a slower rate to avoid making a policy error.

Researcher Dr. Shabir Madhi from Africa suggests that omicron may not be less virulent than Delta. Booster here I come 🙁

Cam

Did we hit the Zweig breadth thrust signal?

I think we got the wall of worry signal. Hopefully it keeps grinding up and we get the Santa Claus rally. Aside from a cup and handle pattern, since Oct we could be making a rising wedge pattern, with a lower line currently around 4560 which is fairly far off, until it isn’t. For now we are having higher highs and higher lows so the trend is still up.

Tapering is tightening. Do we fight the Federal Reserve? Maybe, this time it is different. I would not count on it. Let us wait and see what happens once the dust settles. The algos push the market in the short term.

As usual I could be wrong. It is not important how often you are right. It is more important how much you make on a trade when you are right.

There is 2 Trillion $s on the sidelines. The Earnings yield on stocks is abut 3.5% higher than ten year treasury. Buy backs add to this whole story. High inflation increases share earnings. Still want to not invest in stocks?

This is following the 2007 top very closely.

Taking a swing at VT here.

The Nasdaq did what a dead cat was supposed to do.

I’m curious to find out if the weakness in tech is going to spread to value/cyclicals, the relative performance of defensive sectors does not bode well for the cyclicals.

Tomorrow Omicron is likely going to be the dominant variant in the UK. Certainly this current wave is going to peak one day, but I fear the virus related news will be far less benign in the coming weeks.

If the narrative is that “each covid wave has been incrementally less impactful for the economony” – take Germany’s Flash PMI today – Services 48.4, Composite 50.0 – UK next. PMIs in the low 50s in the US to follow, SPX ~3900

VT off at the open ~105.3x. Basis was 106.4x. Another trade bites the dust.

They’re rotating out of yesterday’s winners into yesterday’s losers.

Back to Tuesday’s lows. A retest, or a break below?

On December 1 wrote:

First the Junk Bond crapped out.

Second on 11/22 we had one of the biggest day intra -day reversal a very bearish sign.

Third on a day after Thanksgiving which is normally a Bullish Day we had a decline for the records.

Fourth Powell has changed his tune. Now he talks about aggressively tapering.

Marty Zweig said long ago “don’t fight the fed”.

So in my mind the question should be not do you believe in Santa Claus but do you believe Powell?

Sure the market is oversold and due for a rally. The $65,000 question is going further do you by the dip or do you sell the rallies?

If we don’t get the overall trend right it will cause a lot of pain.

Russell 2000 – positive what a surprise for me.

Pretty good bounce off 4600.

Very tricky market with multiple misleading moves. Looks like Santa may arrive around the usual time – or not.

One move in one direction – second in another. Hope next week will be calmer and UP.

That’s about as bearish as it gets.

https://twitter.com/Bob_Wachter/status/1471918426687873026

Be careful out there.