Ahead of tomorrow’s FOMC decision, market expectations are turning bearish. Even as the S&P 500 consolidated sideways, defensive sectors are all starting to show signs of life by rallying through relative performance downtrends.

Hawkish fears

The CNBC Fed Survey finds that respondents expect the Fed to double the pace of the taper to $30 billion at its December meeting, which would roughly end the $120 billion in monthly asset purchases by March. The 31 respondents, including economists, strategists and money managers, then see the Fed embarking on a series of rate hikes, with about three forecast in each of the next two years. The funds rate is expected to climb to 1.50% by the end of 2023 from its range near zero today.

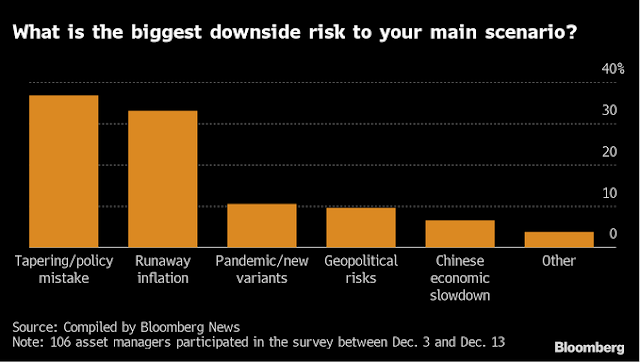

Psychology has turned cautious. A Bloomberg survey found that respondents are more worried about a Fed policy error of over-tightening than inflation.

The BoA Global Fund Manager Survey showed a similar result.

Positioning has turned defensive in response.

Too bearish?

Are expectations too hawkish and psychology too bearish? A quick Twitter poll by Helene Meisler today shows that the bull-bear spread has turned decidedly negative after a bull-bear spread of +15 on her weekend poll.

Fear levels are elevated, as measured by the put/call ratio, even as the S&P 500 is less than 1% from its all-time highs.

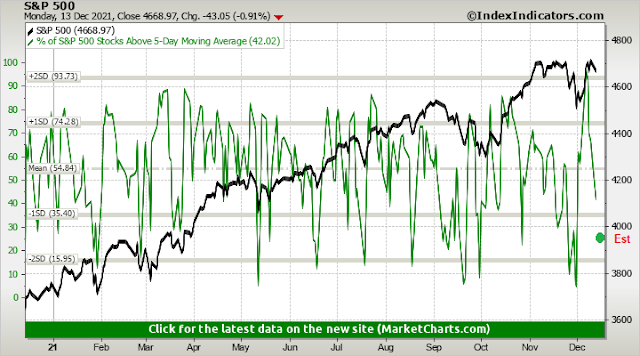

Short-term breadth has come off the boil and it is approaching oversold levels.

This is option expiry week (OpEx) and December OpEx has historically been bullish for stocks. However, the short-term outlook is clouded by the Fed decision wildcard.

In conclusion, major bear markets don’t begin when psychology is this bearish. Recall that when the November CPI print was in line with market expectations last Friday, the S&P 500 rallied to an all-time high. Even if you believe that the bull trend is rolling over, wait for a relief rally before initiating short positions.

Disclosure: Long SPXL

In mid-february Cathy Wood’s ARKK fund topped out together with high growth stocks like Ring Central(RNG). Today, the Nasdaq is being held up by five stocks: AAPL, MSFT, TSLA,NVDA and GOOGL:

https://www.zerohedge.com/markets/goldman-rings-alarm-collapsing-market-breadth-51-all-market-gains-april-are-just-5-stocks

Normally, in the tail end of an extended rally it is the best stocks that see the largest decline. So, I would now watch TSLA which seems to breaking down. It does not have to be a bear market but it can be a significant decline.

Great post!

If I were Jay Powell, I would be more worried about a repeat of Dec 2018 tightening that led to lower markets. Globalization and technology are the two deflationary forces still going on pretty strong through the pace may be decelerating. China will probably become less of a factor in the future but the manufacturing is moving to other low-cost locations that should keep the overall inflation under control.

Inflation should soften next year as supply-chain bottlenecks ease, the demand for goods is replaced with the demand for services, and the auto production resumes. There is still some concern around the housing and the labor costs but other factors should mitigate the rise in these costs.

What if the market crashes and the inflation softens in coming months? Will Powell do a 180 again?

If we consider that the average stock is already in correction, then it’s possible the bear market started in February when sentiment was clearly overheated. In which case we may be nearing the point where the indexes catch up quickly. In other words, the market may have pulled another fast one.

The Israelis are always ahead of the game.

https://www.medrxiv.org/content/10.1101/2021.12.13.21267670v1.full.pdf

Looks like the third vaccination makes all the difference.

That’s great news (for those of us with the booster).

I haven’t seen anything yet about kids. Mine just finished their second dose of Pfizer end of November.

I wouldn’t be surprised to see the market shoot up. We will get comments like “the market had already priced in the news (really? at close to all time highs?)” or ” the market was expecting worse news”. This would be the formula for euphoria and a FOMO charge.

Of course we could get more tree shaking before the next rally. They shouldn’t have those FOMCs lol

But when all is said and done, they will print like mad and do whatever it takes. I fear it will be a bumpy ride